An entrepreneur in Vilnius reviews the figures for a proposed solar panel factory. The market opportunity is clear, driven by Europe’s push for energy independence and green manufacturing. But the initial capital outlay is substantial, making the project’s financial viability appear challenging on paper.

This is a common scenario for leaders in the solar industry—and one where a powerful variable is often overlooked in preliminary calculations: strategic financing from European Union structural funds.

For projects in member states like Lithuania, these funds are not merely a bonus. They can fundamentally alter the financial structure and profitability of a manufacturing venture. This guide explains how to incorporate EU grants and subsidized loans into a financial model, transforming a promising idea into a bankable project.

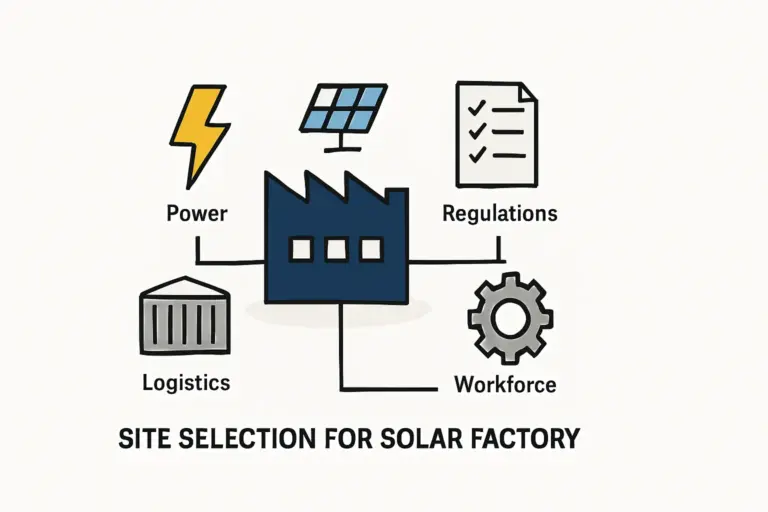

Understanding the Landscape: Why Lithuania and EU Funds Are a Powerful Combination

Establishing a solar manufacturing plant in Lithuania aligns perfectly with both national and EU-level strategic objectives. The country’s National Energy and Climate Plan (NECP) mandates a significant increase in renewable energy capacity, creating strong domestic demand. At the same time, the EU Cohesion Policy has allocated a substantial budget to support this transition.

For the 2021-2027 period, Lithuania has been allocated over €6.7 billion in Cohesion Policy funding with a primary objective of fostering a ‘greener, low-carbon transitioning towards a net-zero carbon economy.’ New solar manufacturing projects are well-positioned to benefit, as they contribute directly to these goals. For an investor, this means access to capital specifically earmarked for such initiatives.

Understanding how to access and model this funding is a critical step in the evaluation process. It elevates the project from a standard commercial venture to a strategic initiative with the backing of public support.

The Two Primary Types of EU Funding for Manufacturing Projects

While various funding instruments exist, most available for a new manufacturing facility fall into two main categories, each with a different impact on the financial model.

Non-Repayable Grants

A grant is a direct capital injection that does not need to be repaid. It is often provided through programmes like the European Regional Development Fund (ERDF) to stimulate economic activity, create jobs, or promote innovation in specific regions.

While highly attractive, grants come with stringent conditions. An applicant might need to commit to creating a certain number of jobs, sourcing materials locally, or achieving specific environmental targets. These obligations are not mere application formalities but binding commitments that influence long-term costs and must be factored into the operational plan.

Subsidized (Low-Interest) Loans

Subsidized loans are offered at interest rates significantly below commercial market rates. They are often facilitated by institutions like the European Investment Bank (EIB) or national promotional banks using frameworks like the InvestEU programme.

The primary advantage of a subsidized loan lies in the reduced cost of capital. Over the typical 10- to 15-year lifetime of a factory loan, even a small reduction in the interest rate can yield substantial savings. This directly improves the project’s cash flow, lowers its break-even point, and increases overall profitability.

Common Pitfalls in Modeling EU Funds (And How to Avoid Them)

Integrating public funding into a financial model requires more nuance than simply adding a line item. Several common mistakes can lead to inaccurate projections and potential cash flow problems.

Mistake 1: Treating a Grant as Day-One Cash

A frequent error is modeling a grant as a single lump-sum payment received at the start of the project. In reality, funds are almost always disbursed in tranches tied to specific, verifiable milestones, such as the completion of the factory building, successful equipment procurement, or the start of production.

Your financial model must reflect this staggered timeline. A detailed cash flow forecast should show these inflows arriving at realistic points in the project schedule to accurately project working capital needs at every stage.

Mistake 2: Ignoring Co-Financing Requirements

EU funding programmes rarely cover 100% of project costs. They operate on a co-financing principle, requiring the applicant to secure a significant portion of the capital from private sources like equity or commercial loans. The financial model must clearly delineate between these funding sources and demonstrate that the private contribution is both secured and sufficient.

Mistake 3: Underestimating Non-Financial Obligations

The reporting, auditing, and compliance requirements associated with EU funds are considerable. While not direct capital costs, they translate into administrative overhead and staff time. A robust business plan must account for these operational expenses to avoid underestimating the true cost of managing the grant or loan.

A Practical Approach to Integrating Funds into Your Financial Model

A structured approach helps ensure your financial projections are both ambitious and realistic.

Step 1: Create Separate Scenarios

The most effective method is to build two primary scenarios in your financial model:

- Base Case: This model shows the project’s financials based solely on private investment and commercial loans. It establishes a baseline for performance.

- Funded Case: This model incorporates the anticipated EU grant and/or subsidized loan.

Comparing these two scenarios provides a clear, quantifiable measure of the funding’s impact on key financial metrics.

Step 2: Modeling a Grant

In your cash flow statement, classify a grant under ‘Financing Activities,’ not ‘Operating Revenue.’ Create separate line items for each expected disbursement tranche and align the timing with your project milestone chart. This approach prevents the grant from artificially inflating revenue projections and provides an accurate picture of operational performance.

Step 3: Modeling a Subsidized Loan

Model this similarly to a standard commercial loan, but with more favorable terms. Create a detailed loan amortization schedule using the lower interest rate and specific repayment conditions of the subsidized loan. The model will then automatically calculate the reduced interest expense, revealing its positive impact on the profit and loss statement and cash flow.

The Strategic Impact: How EU Funding Transforms Project Viability

Correctly modeling these funds reveals their true strategic value. The most immediate effect is the reduced initial capital investment required from the entrepreneur and private investors. This significantly lowers the barrier to entry and de-risks the project.

Beyond the initial investment, the positive effects ripple through all key performance indicators (KPIs). The project’s Internal Rate of Return (IRR) and Net Present Value (NPV) will almost certainly improve, often dramatically. The payback period—the time required to recoup the initial investment—also shortens, making the venture far more attractive to stakeholders.

Based on analyses from J.v.G. turnkey projects, the successful incorporation of such funding can be the deciding factor that moves a project from consideration to implementation.

Frequently Asked Questions (FAQ)

Do I need to have my company established before applying for funds?

Generally, yes. Most funding agencies require a legally registered entity in Lithuania to be the applicant. The application will also require detailed corporate information and financial history, if available.

How long does the application process for EU funds typically take?

The process can be lengthy, often taking six months to over a year from application submission to the first disbursement. This timeline must be factored into the overall project schedule.

Is professional assistance required to apply for these funds?

While not mandatory, it is highly recommended. The application process is complex and document-intensive. Consulting firms specializing in EU funding can significantly increase the chances of success. Their fees can sometimes even be included as an eligible project cost.

Can these funds be used for operational costs or only for capital expenditures?

This depends on the specific funding programme. Most grants and loans are intended for capital expenditures (CAPEX), such as building construction and machinery. However, some programmes may allow a portion to be used for initial operational costs (OPEX), like staff training or raw material sourcing.

Next Steps in Your Planning Process

Before approaching funding bodies, a solid foundation is essential. Your first step is to develop a comprehensive business plan that details the market analysis, technical specifications, operational plan, and financial projections.

Funding applications require a high level of detail and demonstrated competence, making a deep understanding of the process of starting a solar panel factory vital. Educational resources, such as the structured e-learning from pvknowhow.com, can provide a clear framework for this critical planning phase, ensuring your project is well-conceived before you seek investment.