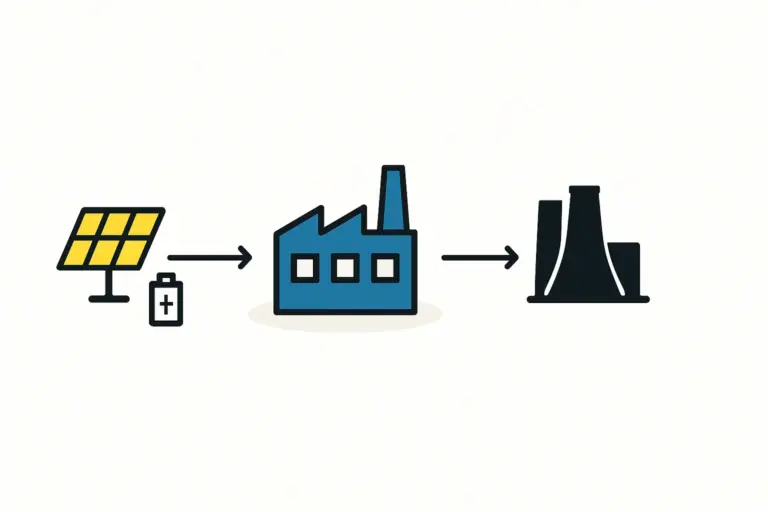

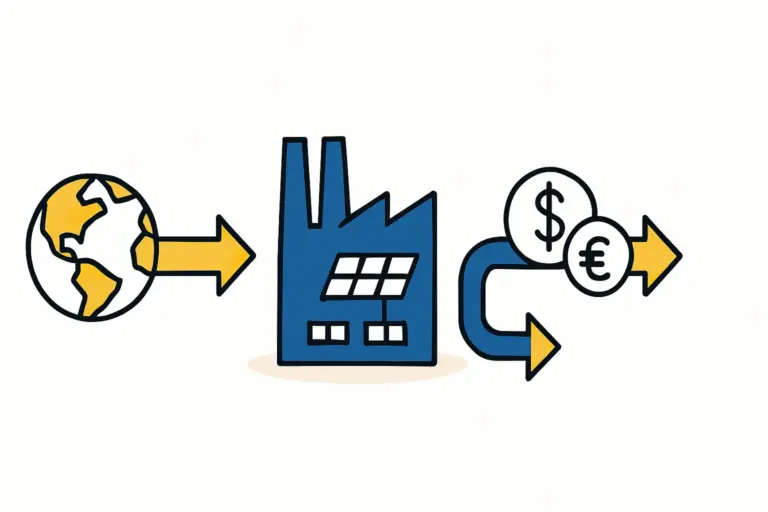

For international investors surveying Africa’s renewable energy landscape, Madagascar presents a compelling case. The island nation’s high solar irradiation and pressing need for energy independence create significant potential.

To turn this potential into a viable manufacturing operation, however, investors must navigate a local regulatory framework that can seem daunting from afar. The key to unlocking these opportunities lies with a single entity: the Economic Development Board of Madagascar (EDBM). This guide outlines how to engage with the EDBM to secure the investment incentives designed to support ventures like solar module manufacturing.

Understanding Madagascar’s Investment Framework

Madagascar’s strategy to attract foreign direct investment is centered on Investment Law No. 2007-036, which created a transparent and favorable environment for businesses. The EDBM was established to implement the law, serving as a ‘one-stop shop’ for investors.

Its main role is to simplify administrative procedures and reduce the bureaucratic burden that often deters new market entrants. For anyone considering a solar factory setup, the EDBM serves as the single point of contact for coordinating with all relevant government ministries, from tax authorities to customs officials.

Key Incentives Available for Solar Manufacturers

The Malagasy government offers powerful incentives to attract investment in strategic sectors like renewable energy manufacturing. These are not abstract promises but tangible financial benefits that can significantly improve a project’s profitability and reduce initial capital expenditure.

Corporate Income Tax (CIT) Holidays

A key incentive is an exemption from Corporate Income Tax. Newly established solar manufacturing companies may be exempt from this tax for five years or more, depending on the scale and nature of the investment. This tax holiday allows a new venture to reinvest its early profits directly into growth and stabilization.

Customs and VAT Exemptions on Equipment

The initial investment for a solar factory is heavily weighted toward capital goods. The Investment Law allows for exemptions from customs duties and Value Added Tax (VAT) on imported machinery, materials, and equipment for the production line. This provision directly lowers the barrier to entry and preserves capital for operations and workforce training.

Status as a ‘Free Zone Company’

Manufacturers planning to export a significant portion of their output (typically over 95%) can acquire ‘Entreprise Franche’ or Free Zone Company status for an even more attractive package. This status includes a 10-year CIT exemption followed by a reduced rate, on top of the customs and VAT exemptions for imported goods. This is particularly relevant for investors aiming to use Madagascar as a manufacturing hub for the wider Southern African Development Community (SADC) or Common Market for Eastern and Southern Africa (COMESA) regions.

The Step-by-Step EDBM Application Process

Engaging the EDBM is a structured process. While it requires diligence, its one-stop-shop design eliminates the need to negotiate with multiple disconnected agencies. Based on experience from J.v.G. Technology turnkey projects, a methodical approach delivers the best results.

Step 1: Company Registration

Before applying for incentives, the business must be legally established in Madagascar. The EDBM facilitates this process, guiding the investor through the steps of creating a local legal entity.

Step 2: Preparation of the Investment File

This is the most critical phase. The investor must compile a comprehensive file that includes:

- A detailed business plan for solar manufacturing, outlining the project’s scope, objectives, and market analysis.

- Financial projections and proof of financing.

- A complete list of the equipment to be imported.

- Technical specifications of the proposed factory and its output.

- Information on job creation and skills transfer plans.

Step 3: Submission to the EDBM

The completed investment file is formally submitted to the EDBM, which then acts as the central coordinator, circulating it to all relevant ministries for review and approval.

Step 4: Review and Approval

The EDBM is mandated to process applications efficiently, usually within a 20 to 30-working-day timeframe. During this period, they may request clarifications or additional documentation.

Step 5: Issuance of the Approval Certificate

Upon successful review, the EDBM issues an ‘Accord d’Agrément’ (Approval Certificate). This official document certifies the company’s eligibility for the requested incentives and is the legal instrument needed to claim them from tax and customs authorities.

Common Challenges and How to Prepare

While the process is streamlined, success depends on preparation. Investors often encounter challenges in a few key areas.

Document Accuracy and Completeness

Any inconsistency or omission in the investment file can cause significant delays. The business plan must be robust, with financial statements that are clear and professionally prepared. It is crucial to ensure every document aligns perfectly with the requirements stipulated by the EDBM.

Demonstrating Project Viability

The EDBM’s role is not just to process paperwork but to approve viable, long-term projects that will benefit the Malagasy economy. The application must convincingly demonstrate the project’s technical feasibility, financial sustainability, and positive local impact. A feasibility study prepared with expert input can be invaluable here.

Navigating Local Context

A strong understanding of the local business environment is a major asset. While the EDBM simplifies official procedures, guidance from advisors with on-the-ground experience can help preempt questions from local authorities, particularly regarding supply chains, logistics, and labor.

Frequently Asked Questions (FAQ)

-

Is there a minimum investment amount to qualify for incentives?

While specific thresholds can vary, eligibility is generally tied to the creation of a new, formal enterprise with a credible business plan rather than a fixed monetary value. The scale of the incentives often corresponds to the size of the investment and the number of jobs created. -

Can a foreign investor own 100% of a company in Madagascar?

Yes, Madagascar’s Investment Law permits 100% foreign ownership of companies in most sectors, including manufacturing. -

What happens after the tax holiday period ends?

After the exemption period, the company becomes subject to the standard Corporate Income Tax rate prevailing at that time, unless it qualifies for a reduced rate under a specific status like the Free Zone Company. -

Is a local partner required for the investment?

No, a local partner is not a legal requirement. However, some investors choose to partner with local entities for their market knowledge and operational expertise.

Your Next Steps in Exploring the Malagasy Solar Market

Madagascar offers a structured and highly attractive incentive program for entrepreneurs ready to enter the solar manufacturing sector. The EDBM provides a clear, centralized pathway to accessing these benefits. However, success depends on meticulous preparation and a deep understanding of what is required to build a viable operation from the ground up.

To ensure the business plan you submit to the EDBM is not only ambitious but also realistic and fundable, your logical next step is to develop a comprehensive understanding of the total investment required for a solar panel factory.