A conventional market analysis of many Pacific Island nations might lead an investor to a swift conclusion: the market is too small, fragmented, and logistically complex for local solar module manufacturing. Viewed through the lens of residential rooftop sales or large-scale commercial projects, this assessment often holds true.

But this perspective overlooks the most significant drivers of solar adoption in the region—ones that are fundamentally strategic, not commercial. The true opportunity lies in supplying projects funded not by private capital, but by national governments and international development partners. These initiatives are focused on two critical objectives: building climate resilience and achieving energy independence. For the entrepreneur who understands this landscape, a local production facility becomes a key piece of national infrastructure, not just another factory.

Conventional Market Size vs. Strategic Demand

For an investor accustomed to mature markets, evaluating an opportunity is a straightforward process of assessing the total addressable market (TAM), analyzing consumer purchasing power, and modeling growth based on commercial and industrial demand. In the Pacific, this approach is often insufficient.

Strategic demand is driven by different factors:

-

National Electrification Goals: Governments are actively working to bring reliable power to remote outer islands and atolls, which are almost entirely dependent on expensive and volatile shipments of diesel fuel.

-

Climate Adaptation Mandates: International bodies like the World Bank and the Asian Development Bank (ADB) are channeling significant funding into the region. The World Bank alone has committed over $2 billion to enhance the resilience of Pacific Island countries. Solar power is a cornerstone of these efforts, ensuring critical infrastructure like hospitals, schools, and communication centers can function during and after extreme weather events.

-

Energy Security: High reliance on imported fossil fuels creates immense economic and strategic vulnerability, where a single disruption in shipping can have severe consequences. Solar energy provides a pathway to greater self-sufficiency.

These are not speculative, consumer-driven markets. They are well-defined, government-tendered, and aid-funded projects that represent a stable and predictable source of demand for the right local supplier.

Key Drivers for Local Solar Module Production

Understanding the needs behind these projects reveals why local manufacturing offers a distinct competitive advantage. The demand is not for the cheapest available module from a global supplier, but for a reliable, long-term solution that supports broader development goals.

Supplying Climate Resilience and Adaptation Projects

Pacific Island nations are on the front lines of climate change. For these countries, solar power is not an environmental luxury; it is a critical tool for survival and adaptation. International climate finance is increasingly directed towards projects that build this resilience.

A local solar module assembly plant can directly supply these initiatives, providing panels for:

-

Emergency Power Systems: Powering cyclone shelters, medical clinics, and desalination plants when the main grid fails.

-

Resilient Communications: Ensuring satellite and radio communication networks remain operational during natural disasters.

-

Sustainable Infrastructure: Integrating solar into the design of new, climate-resilient public buildings and water systems.

Supplying these projects requires more than just delivering a product; it requires a partner who understands the stakes and can provide reliable, long-term support.

Achieving Energy Independence and Rural Electrification

For many remote Pacific communities, electricity is synonymous with diesel generators. According to the International Renewable Energy Agency (IRENA), the levelized cost of electricity (LCOE) from new utility-scale solar PV is now far below that of new fossil fuel-fired power generation, even without financial support. In island settings, where diesel must be shipped over vast distances, the economic case for solar is overwhelming.

A local factory can become the primary supplier for national projects aimed at:

-

Diesel Replacement: Systematically replacing costly, high-maintenance generators with solar and battery storage systems on outer islands.

-

Mini-Grid Development: Establishing independent, resilient power grids for entire communities to foster economic activity and improve quality of life.

-

Powering Productive Use: Enabling local industries like fishing, agriculture, and tourism with reliable, low-cost energy.

Fulfilling Local Content Requirements in Tenders

Government and international aid agency tenders frequently include ‘local content’ requirements. These mandates are designed to ensure that large investments also contribute to local economic development, job creation, and technology transfer.

A foreign module supplier is at a significant disadvantage in these scenarios. A local assembly plant, however, is ideally positioned. It can:

-

Meet Tender Specifications: Directly satisfy procurement rules that favor or mandate locally produced goods.

-

Demonstrate National Commitment: Align the business with the government’s economic development objectives.

-

Build In-Country Capacity: Create a skilled workforce and a local ecosystem of suppliers and technicians.

Developing a solar manufacturing business plan for this environment requires a focus on B2G (Business-to-Government) and institutional sales channels—a different model than the typical commercial enterprise.

The Practical Advantages of a Local Facility

Beyond aligning with strategic demand, a local presence solves fundamental logistical and technical challenges inherent to the Pacific region.

Reduced Logistics Costs and Complexity

Importing solar modules to island nations is expensive and fraught with risk. The panels are fragile, and shipping them across thousands of kilometers of ocean leads to high transportation costs, long lead times, and a significant risk of damage. A local facility that imports raw materials and assembles modules in-country can dramatically simplify the supply chain, reduce these costs, and ensure a faster, more reliable supply for critical projects.

Customization for Tropical and Marine Environments

Modules designed for continental climates often underperform in the hot, humid, and salt-laden air of the Pacific. A local manufacturer can produce panels specifically engineered for these harsh conditions, incorporating features like:

-

Enhanced Salt Mist Resistance: Using materials and seals that can withstand constant exposure to corrosive sea spray.

-

High-Humidity and High-Temperature Performance: Selecting components optimized for tropical climates to ensure longevity and output.

-

Robust Framing: Designing modules that can withstand the high wind loads of cyclones.

This ability to customize creates a superior product that offers a lower total cost of ownership over its lifetime.

Establishing a Feasible Scale of Operation

The goal is not to compete with multi-gigawatt factories in Asia. The strategic opportunity in the Pacific can be captured with a smaller, more agile production facility. Experience from J.v.G. Technology GmbH projects in developing markets shows that a semi-automated turnkey solar manufacturing line with an annual capacity of 20 to 50 MW is often the ideal starting point. This scale is large enough to supply national projects yet nimble enough to adapt to specific technical requirements, creating a sustainable business model without requiring massive capital investment.

Frequently Asked Questions (FAQ)

What kind of investment is required for a small-scale factory?

A 20–50 MW semi-automated assembly line typically requires a lower capital investment than a fully automated gigafactory. The total cost depends on factors like building acquisition, logistics, and local labor costs, but it is well within the range of established entrepreneurs and institutional investors.

How does local assembly differ from full-scale manufacturing?

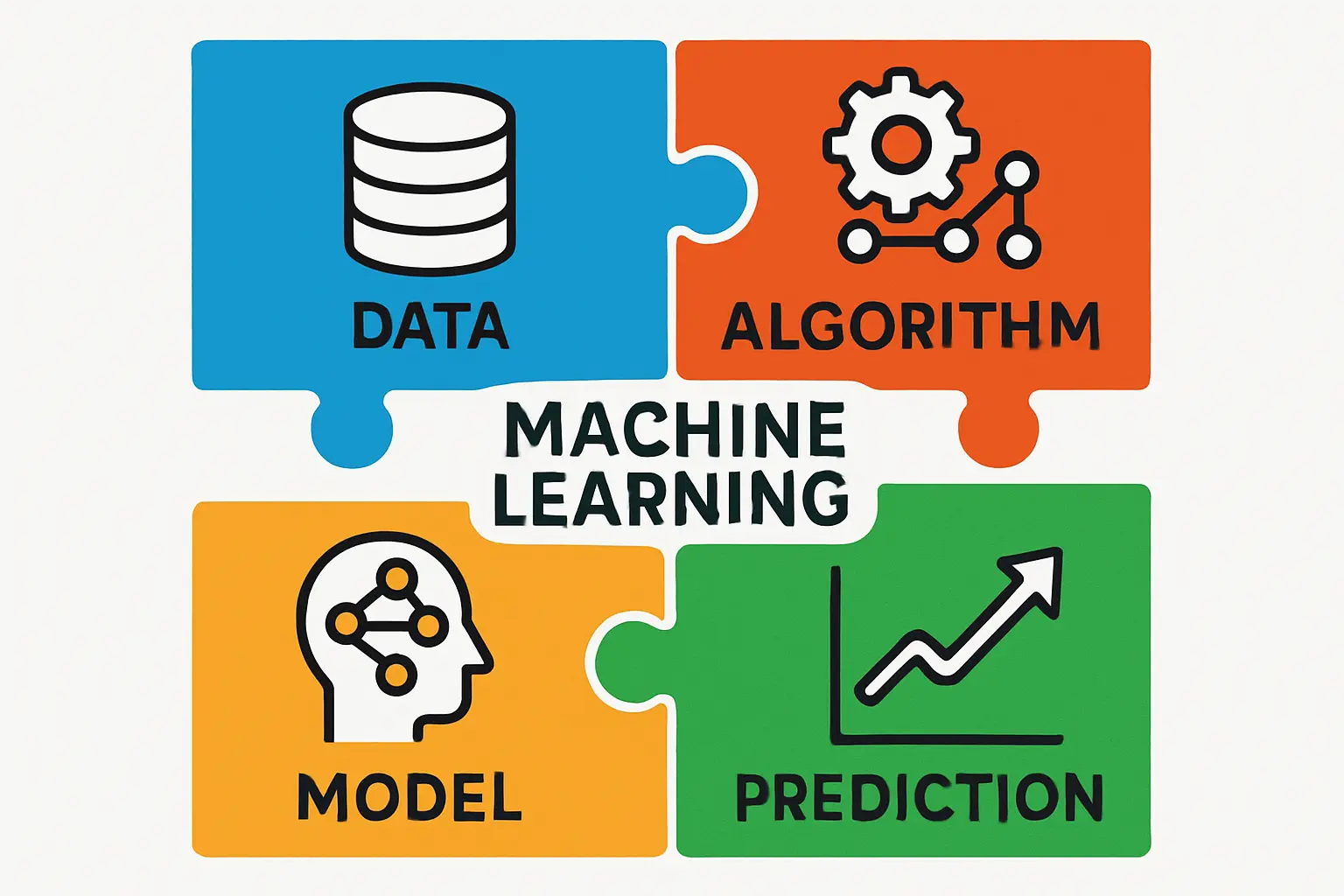

Full-scale manufacturing involves producing every component, from silicon wafers to solar cells. Local assembly, the more common model for new market entry, involves importing pre-made solar cells and other materials to assemble, laminate, and frame the final module in-country. This approach requires significantly less capital and technical complexity.

Are there specific certifications required for these projects?

Yes. Modules must typically meet international standards from bodies like the IEC (International Electrotechnical Commission). A local factory would need to implement a robust quality management system to ensure its products meet the stringent requirements of government and development bank tenders.

How long does it take to set up a production line?

With a structured approach and an experienced technical partner, a 20–50 MW solar module assembly line can be operational in under a year.

Next Steps in Evaluating the Pacific Market

The business case for local solar production in the Pacific is built on a foundation of national strategic priorities, not conventional market metrics. It requires an understanding of energy security, climate resilience, and the mechanics of government and aid-funded procurement.

For investors and entrepreneurs who see this larger picture, the opportunity is significant—a chance to build a profitable enterprise while making a foundational contribution to the sustainable development and long-term resilience of the region. The first step is to move beyond a standard commercial analysis and begin evaluating the specific electrification and climate adaptation plans of individual Pacific nations.