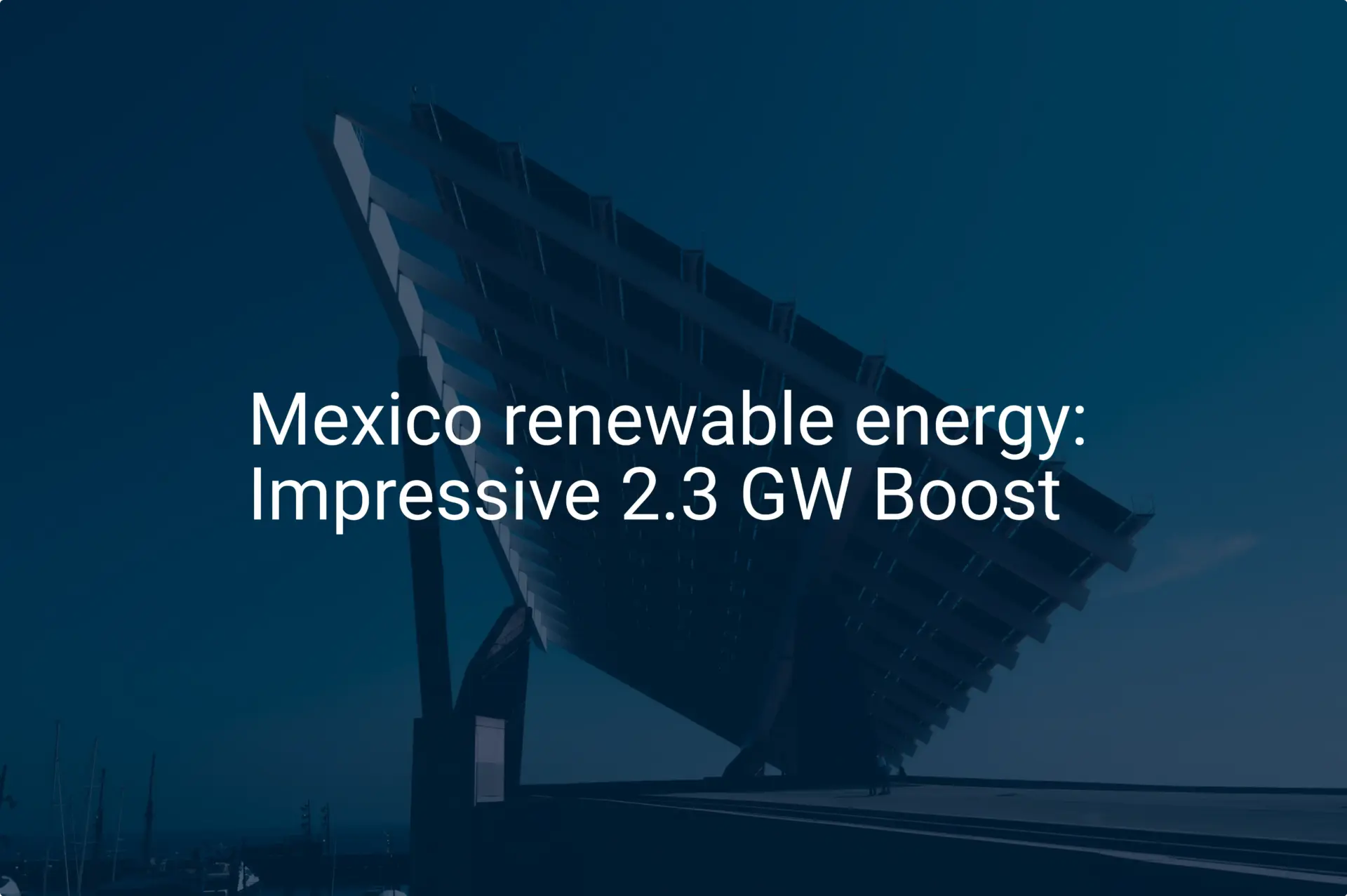

When planning a new solar factory, an entrepreneur’s focus naturally falls on machine specifications, supply chains, and facility requirements. Yet, long-term success often hinges on something less tangible but equally critical: a deep understanding of the local labor environment. In Mexico, a leading destination for advanced manufacturing, the labor framework is comprehensive and pro-employee, with unique obligations that can surprise unprepared investors.

Overlooking mandatory social contributions, profit-sharing, and the structured nature of employee relations can significantly impact financial models and operational timelines. This guide outlines the key components of Mexico’s Federal Labor Law (Ley Federal del Trabajo, or LFT) to help business leaders navigate this complex landscape with confidence.

The Foundation: Understanding Mexico’s Federal Labor Law (LFT)

The LFT is the cornerstone of every employer-employee relationship in Mexico. Unlike the ‘at-will’ employment common in jurisdictions like the United States, the Mexican system provides robust protections for workers. Every aspect of hiring, compensation, working conditions, and termination is regulated.

For investors, the most critical point is that verbal agreements are insufficient. Formal, written contracts are standard practice and essential for defining the terms of employment and protecting the business. Terminating an employee is also a highly structured process requiring ‘just cause,’ which must be thoroughly documented according to specific legal criteria.

Beyond the Salary: The True Cost of Labor

A common budgeting mistake is to calculate labor costs based solely on wages. In Mexico, mandatory social contributions and benefits add a significant percentage—often 30% to 40%—on top of an employee’s base salary. These are not optional; they are federally mandated.

Social Security (IMSS)

The Mexican Social Security Institute (IMSS) administers a comprehensive, mandatory national program for all formal employees. Employer contributions fund a wide array of benefits for workers and their families, including:

- Medical care, hospitalization, and medication

- Disability and life insurance

- Maternity leave and benefits

- Pensions for retirement

These contributions are calculated based on employee salaries and represent a substantial, recurring operational expense that must be factored into any serious financial planning for a solar factory.

Housing Fund (INFONAVIT) and Retirement Savings (SAR)

Alongside IMSS, employers must contribute to two other key funds on behalf of their employees:

- INFONAVIT (National Workers’ Housing Fund Institute): A mandatory 5% payroll contribution that goes into a fund allowing employees to secure mortgages for housing.

- SAR (Retirement Savings System): A mandatory 2% payroll contribution that is deposited into the employee’s individual retirement account.

These non-negotiable contributions form the basic structure of employee compensation and are central to building a compliant and stable operation.

Annual Financial Obligations: Aguinaldo and PTU

Beyond monthly contributions, two major annual financial obligations require careful planning.

Aguinaldo (Christmas Bonus)

The aguinaldo is a legally mandated year-end bonus equivalent to at least 15 days of wages. It must be paid to all employees before December 20th each year.

PTU (Mandatory Employee Profit-Sharing)

Perhaps the most unfamiliar concept for foreign investors is the Participación de los Trabajadores en las Utilidades (PTU). Mexican law requires companies to distribute 10% of their annual pre-tax profits among their employees.

This is not a discretionary bonus but a legal obligation. While this may not be a factor for a new factory in its first year or two of operation, it is an essential component of long-term financial projections that directly impacts the enterprise’s net profitability.

Building Your Workforce: Hiring, Training, and Contracts

A skilled and motivated workforce is the engine of any successful solar module factory. In Mexico, the process of building that team is governed by clear regulations.

Hiring and Contracts

Indefinite-term contracts are the default in Mexico, offering employees maximum job security. Fixed-term or project-based contracts are possible, but they must be legally justified by the temporary nature of the work. Every new hire should sign a detailed contract outlining their role, responsibilities, compensation, and working hours.

Training and Skills Development

The LFT also requires employers to provide workforce training. For a high-tech operation like a solar panel factory, this mandate aligns perfectly with business needs. Proper training ensures high-quality production, operational safety, and adherence to industry standards. Many successful enterprises, particularly those establishing a turnkey solar manufacturing line, satisfy this legal requirement while boosting productivity by integrating skills development programs from day one.

Engaging with Unions

Mexico has a long and established history of unionization in the manufacturing sector. Prominent confederations like the CTM (Confederation of Mexican Workers) and CROC (Revolutionary Confederation of Workers and Peasants) are major players.

Rather than viewing unions as an obstacle, it is wise to take a proactive and transparent approach. Engaging with a legitimate union to establish a Collective Bargaining Agreement (CBA) can create a stable and predictable labor environment. A well-structured CBA defines wages, benefits, and working conditions for all covered employees, reducing the risk of disputes and work stoppages. A factory producing high-quality solar modules relies on precision and consistency, making a stable workforce a true strategic asset.

Special Considerations for Foreign Investors

Many foreign companies operate in Mexico under the IMMEX (Maquiladora) program, which offers significant tax and tariff advantages for export-oriented manufacturing. Crucially, while IMMEX streamlines customs and tax processes, it does not exempt a company from its obligations under the Federal Labor Law. All the regulations discussed here apply fully to IMMEX operations.

Investors should also be aware that minimum wages vary by region in Mexico. While factory wages will typically be well above the legal minimum, this regional variation reflects the diverse economic conditions across the country.

Frequently Asked Questions (FAQ)

-

What is the total ‘loaded’ cost of an employee in Mexico?

As a general rule, investors should budget for mandatory social contributions and benefits adding approximately 30% to 40% on top of an employee’s base salary. This figure does not include the 10% profit-sharing (PTU). -

Is it difficult to terminate an employee for poor performance?

Yes, it can be. The LFT requires employers to prove ‘just cause’ for termination, which involves extensive documentation and a formal process. Implementing clear performance metrics and maintaining detailed records from the start is essential. -

Does my factory have to have a union?

While you are not required to invite a union, employees have the legal right to organize and select representation. Because of this, it is often more strategic to engage proactively with a reputable union to establish a fair and stable Collective Bargaining Agreement. -

How does profit-sharing (PTU) work if my new factory is not yet profitable?

The PTU obligation applies only when the company generates a pre-tax profit. Newly established companies are typically exempt for their first year of operation. However, it must be factored into all financial models for subsequent years.

Conclusion: Planning for Predictable Success

Mexico’s labor laws are detailed and designed to protect the workforce, but they need not be an impediment to success. For international investors, these laws create a predictable and structured environment. By understanding and planning for mandatory contributions, annual bonuses, profit-sharing, and union relations, entrepreneurs can build a strong, stable, and legally compliant operation.

This knowledge is a fundamental part of the larger journey of learning how to start a solar factory. With the right legal advice and a clear grasp of these obligations, a business can establish a thriving solar manufacturing facility that benefits from Mexico’s skilled workforce and strategic location.