Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

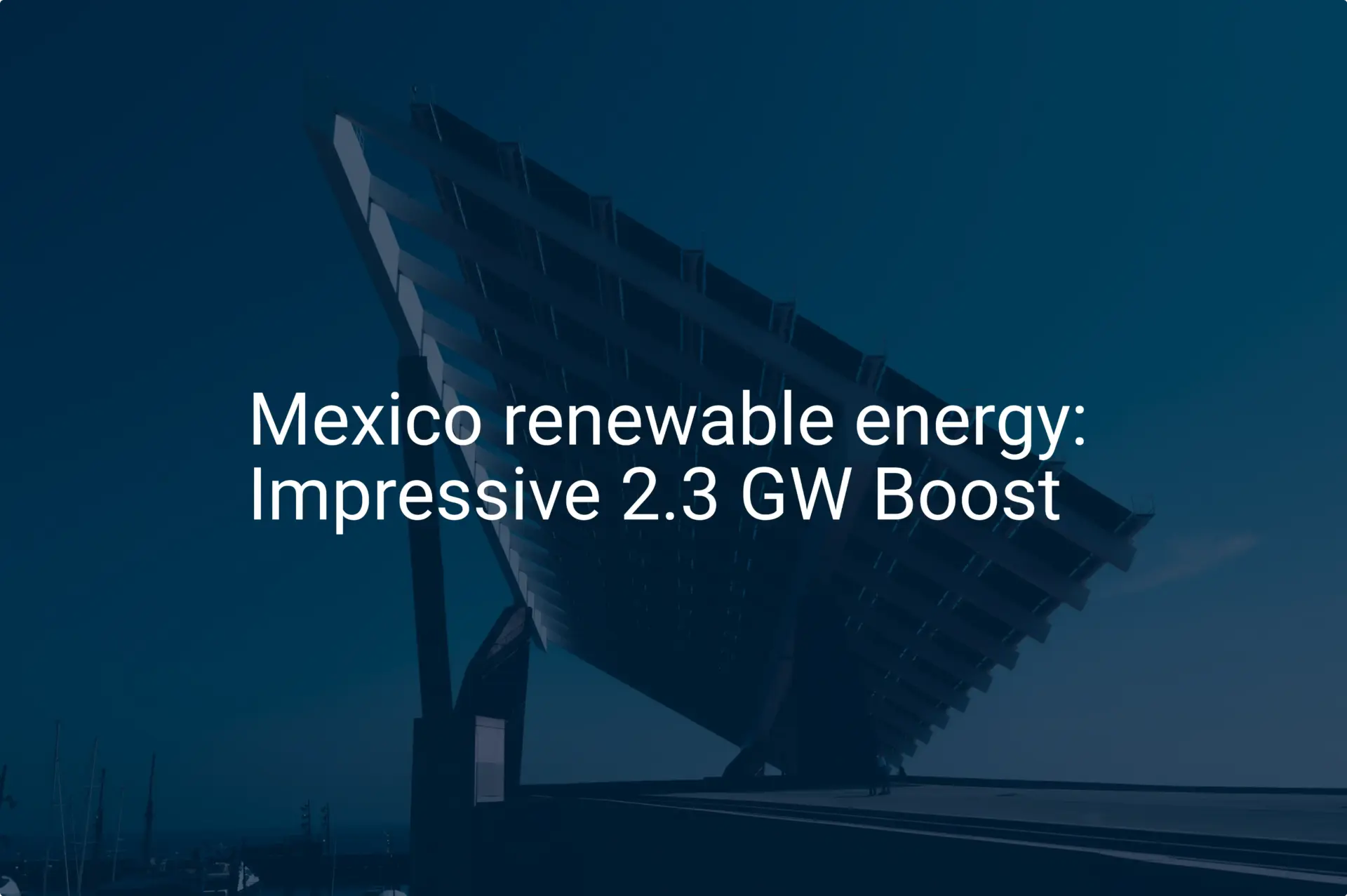

While global supply chains often evoke images of trans-pacific shipping, a powerful convergence of trade policy, geography, and market incentives is creating an unprecedented manufacturing opportunity much closer to the world’s largest solar market. For entrepreneurs and industrial leaders eyeing the solar sector, Monterrey, Mexico, now stands out as a uniquely strategic location to establish a utility-scale solar panel factory aimed at serving the United States.

This blueprint examines the complete strategy for launching a 500 MW automated production facility in Nuevo León, detailing how leveraging the United States-Mexico-Canada Agreement (USMCA) and Monterrey’s industrial strengths can create a significant competitive advantage in supplying large-scale US solar projects.

The Strategic Imperative: Why Monterrey, Why Now?

Establishing a large-scale manufacturing operation always depends on market demand and favorable business conditions. Today, two major forces are aligning to create a unique window of opportunity for solar manufacturing in Mexico.

First, the U.S. Inflation Reduction Act (IRA) has created powerful incentives for solar projects that use domestically-sourced components. This puts immense pressure on developers to find reliable, high-volume suppliers within North America.

Second, the USMCA provides a stable trade framework that, when navigated correctly, allows components made in Mexico to qualify for preferential treatment and directly support the IRA’s domestic content goals.

This confluence of factors transforms a Monterrey-based factory from a mere logistical convenience into a powerful strategic asset. An enterprise here can produce high-quality solar modules in a cost-effective environment, all while providing U.S. clients a secure, nearshored supply chain that helps them maximize government incentives.

Site Selection and Logistics: Monterrey’s Geographic Dividend

Location is a critical factor for any manufacturing business, influencing cost, efficiency, and market access. Monterrey, the capital of Nuevo León, offers a compelling combination of industrial maturity and logistical strength.

Proximity and Infrastructure

Located just 200 kilometers (approx. 125 miles) from the U.S. border, Monterrey is a premier logistics hub with a well-developed network of highways and rail lines. This infrastructure provides direct, efficient access to major markets in Texas and across the United States, drastically reducing shipping times and costs compared to sourcing from Asia. The result is a more responsive and resilient supply chain—a significant commercial advantage for utility-scale projects operating on tight construction schedules.

A Skilled and Stable Workforce

Monterrey boasts a deep pool of skilled labor in engineering, manufacturing, and technical operations. With decades of experience as a center for heavy industry and advanced manufacturing, finding and training qualified personnel for a sophisticated solar panel plant is more streamlined here than in less-developed regions. Labor costs also remain competitive, offering a sustainable operational advantage for a high-volume facility. Based on European turnkey engineering team experience with turnkey projects, a 500 MW plant requires a skilled workforce of 250 to 300—a number Monterrey’s labor market can readily support.

Decoding the USMCA Advantage for Solar Manufacturing

The USMCA is more than a trade agreement; it is a detailed framework governing tariff-free commerce within North America. For solar panel manufacturers, its most critical component is the ‘Rules of Origin.’

To qualify for USMCA benefits, a finished solar panel must meet specific criteria showing that a substantial portion of its value was created within the member countries (U.S., Mexico, or Canada). This requires a careful analysis of the bill of materials (BOM)—from solar cells and glass to junction boxes and frames.

A manufacturing strategy in Monterrey must be designed from the ground up for compliance. This includes:

- Strategic Sourcing: Developing a supply chain that prioritizes North American suppliers for key components.

- Value-Add Transformation: Ensuring the solar panel manufacturing process in the Monterrey facility represents a ‘substantial transformation,’ a key requirement for origin qualification.

- Documentation and Certification: Maintaining meticulous records to prove compliance to customs authorities.

Successfully navigating these requirements allows finished solar modules to enter the U.S. market tariff-free, making them highly competitive for large utility projects seeking to fulfill domestic content requirements.

The Factory Blueprint: Engineering a 500 MW Turnkey Facility

A 500 MW annual capacity is considered utility-scale, demanding a high degree of automation and process control to ensure consistent quality and throughput. The physical plant is a complex, integrated system designed for maximum efficiency.

Facility and Layout

A typical 500 MW production line requires a building of 15,000 to 20,000 square meters (around 160,000 to 215,000 square feet). This space accommodates not just the main production line but also raw material warehousing, finished goods storage, quality control labs, and administrative offices. The layout must be engineered for a logical flow of materials, from the initial glass washing station to the final packaging of completed modules.

Automation and Technology

At this scale, manual processes are minimized. A state-of-the-art turnkey production line incorporates robotics and automated systems for key stages:

- Cell Stringing: High-speed stringer machines automatically solder solar cells together into strings.

- Layup: Robotic arms precisely place the cell matrix, encapsulant, and backsheet onto the solar glass.

- Lamination: Automated laminators use heat and pressure to bond the module layers into a durable, weatherproof unit.

- Testing and Sorting: Electroluminescence (EL) and ‘Sun Simulator’ testers automatically inspect each panel for defects and measure its power output, sorting them by performance class.

This level of automation, a core component of the European EPC implementation model, is essential for achieving the cost-per-watt and quality consistency that utility-scale customers demand.

Investment Profile and Timeline

Launching a 500 MW facility is a significant capital project. A typical investment for a solar factory ranges from $40 to $60 million USD, a budget that covers machinery, facility retrofitting or construction, initial raw material procurement, and operational ramp-up costs.

From initial decision to full-scale production, a well-managed project can be completed in 12 to 18 months. This timeline includes:

- Phase 1 (Months 1-3): Feasibility studies, business plan finalization, and securing financing.

- Phase 2 (Months 4-9): Site acquisition, facility engineering, and procurement of long-lead-time machinery.

- Phase 3 (Months 10-15): Machine installation, commissioning, and workforce training.

- Phase 4 (Months 16-18): Pilot production, quality certification (e.g., IEC, UL), and ramp-up to full capacity.

To help prospective investors navigate this complex process with confidence, pvknowhow.com provides structured guidance, including sample business plans and e-courses.

Comprehensive FAQ for Prospective Investors

Do I need a technical background in photovoltaics to start this business?

No. While technical understanding is helpful, the most critical requirements are business acumen, project management skills, and sufficient capital. A partner like European pv manufacturer provides the necessary technical expertise, from machinery selection and factory layout to process optimization and staff training.

What are the primary risks involved in this venture?

The primary risks are supply chain disruptions for raw materials (particularly solar cells), shifts in international trade policy, and rapid technological changes in module design. A robust business plan mitigates these risks through diversified sourcing strategies, careful USMCA compliance, and a production line designed to adapt to future technologies like TOPCon or HJT cells.

How does a factory in Mexico help a U.S. solar project meet IRA domestic content rules?

The IRA offers a bonus tax credit for projects that meet certain domestic content thresholds. While the final guidance is complex, solar modules assembled in Mexico using a significant proportion of U.S.-made components (like steel frames or polysilicon) can help projects qualify for these valuable incentives. A Monterrey location makes integrating U.S. components into the supply chain far more seamless.

What is the single biggest challenge for a new entrant?

For new entrants, the biggest challenge is often navigating the intersection of manufacturing logistics, international trade law, and solar technology standards. It requires a multidisciplinary approach, which is why a structured, phased implementation plan guided by experienced consultants is essential for success.

Download the 500 MW Monterrey Factory Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.