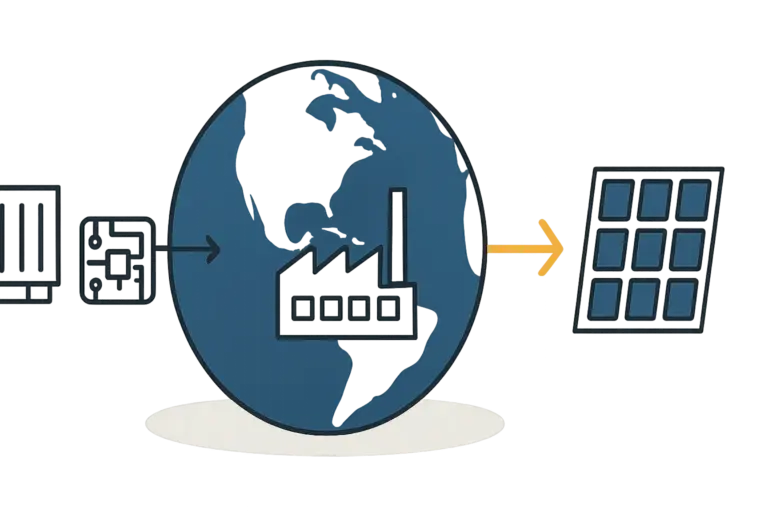

A state-of-the-art solar module factory can have the most advanced production equipment in the world, yet its success is often dictated by something outside its walls: the efficiency of its supply lines.

The most common oversight for new entrepreneurs in this industry is focusing entirely on production technology while underestimating the critical role of logistics. A factory’s profitability, after all, is determined not by its machines but by its ability to move raw materials in and finished goods out reliably and cost-effectively.

This guide provides a strategic overview of logistics for solar module manufacturing. It examines the key ports and border crossings that form the industry’s arteries, using the North American trade corridor as a case study to illustrate the decision-making process for any new venture, anywhere in the world.

Why Logistics is a Cornerstone of Solar Manufacturing Success

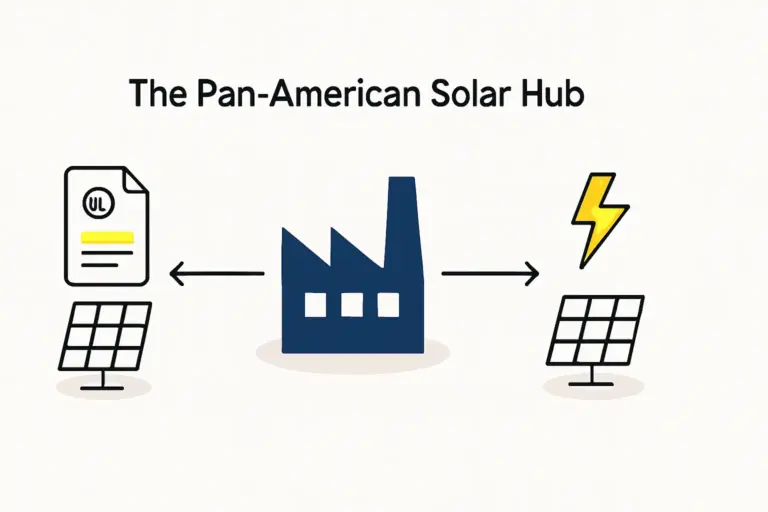

A solar module assembly plant operates on a constant, two-way flow of materials. Inbound logistics cover the import of critical components, while outbound logistics handle the distribution of finished solar panels to customers.

Inbound Supply Chain: Sourcing and transporting raw materials like solar cells, tempered glass, EVA encapsulant, backsheets, and aluminum frames, the majority of which originate in Asia.

Outbound Supply Chain: Shipping palletized, finished solar modules to distributors, project developers, or installation companies, often across international borders.

Managing this flow effectively is a core business function. A delay in a single container of solar cells from Taiwan can halt an entire production line and lead to significant financial losses. Conversely, an inefficient export process can cause missed delivery deadlines and damage a company’s reputation.

Think of a factory as a high-performance engine. The production line is the engine itself, but logistics are the fuel lines and the exhaust system. If either is clogged, restricted, or inefficient, the engine cannot perform at capacity, regardless of how well-engineered it is. Understanding and mastering this flow is a prerequisite for success. For those just beginning, a detailed review of the complete solar module manufacturing process provides essential context for these logistical challenges.

Analyzing Key Logistical Hubs: A North American Case Study

To make these concepts tangible, let’s analyze the strategic trade corridors serving a hypothetical solar module factory in Mexico that plans to serve the large United States market. This example highlights how geographical positioning and infrastructure directly impact operational viability.

The selection of a logistical hub should be based on clear criteria: port capacity (measured in TEUs, or Twenty-foot Equivalent Units), connectivity to rail and road networks, customs processing efficiency, and proximity to major industrial zones.

The Pacific Gateway: Port of Manzanillo, Mexico

For a factory sourcing its primary components from Asia, the Port of Manzanillo is the most logical entry point.

Strategic Role: As Mexico’s busiest container port, handling over 3.3 million TEUs annually, it is the primary gateway for goods from China, South Korea, Taiwan, and Vietnam. This is where most solar cells, backsheets, and junction boxes will arrive.

Advantages: The port has direct, established shipping lanes from Asia, which can reduce ocean transit times. It is also well-connected to Mexico’s industrial heartland via the Ferromex rail network, allowing for efficient inland distribution of raw materials.

Challenges: High volume can lead to congestion. Based on experience from J.v.G. turnkey projects, meticulous documentation and a reliable customs broker are non-negotiable here. A minor error in the bill of lading can result in costly delays.

The Atlantic Gateway: Port of Veracruz, Mexico

While Manzanillo handles Asian trade, the Port of Veracruz on the Gulf of Mexico serves a different but equally important strategic purpose.

Strategic Role: Veracruz is the ideal entry point for specialized manufacturing equipment from Europe, such as high-precision German stringers or laminators. It also serves as a critical export hub for finished modules destined for the US East Coast, Latin America, or even European markets.

Advantages: This gateway provides vital supply chain diversification. In the event of disruptions or congestion at Pacific ports, Veracruz offers an alternative route. Its modernized infrastructure gives shippers efficient access to US Gulf Coast ports like Houston and New Orleans.

Business-Relevant Metric: For a factory in central Mexico, shipping finished modules from Veracruz to a customer in Florida can be up to three days faster and more cost-effective than trucking them overland through Texas.

The Land Bridge: Laredo, USA/Mexico Border Crossing

Once modules are assembled, the primary route to the vast US market is overland. The Laredo port of entry is the most significant commercial land crossing in North America.

Strategic Role: As the destination for nearly 40% of all US-bound Mexican exports, Laredo is the main artery for finished solar modules. Billions of dollars in trade cross this border monthly.

Advantages: This crossing provides direct connections to the US Interstate 35 corridor—a major transportation route running north through the center of the country—and to major rail operators.

Challenges: This is the most critical compliance checkpoint. Shipments must have perfect documentation to clear US Customs, including proof of compliance with regulations like the Uyghur Forced Labor Prevention Act (UFLPA). A client in northern Mexico once faced a 10-day delay on their first major shipment due to a minor paperwork discrepancy, jeopardizing a critical project deadline. This underscores the need for expert planning, especially when navigating the rules associated with solar module certifications required for market access.

Integrating Logistics into Your Factory Siting Decision

The choice of where to build a solar factory cannot be made in a vacuum; it must be directly informed by a thorough logistical analysis. The goal is to optimize the ‘total landed cost’—the sum of the product price plus all transportation, customs, and compliance costs required to get the finished goods to the end customer.

A location with low labor costs might seem attractive, but if it is poorly connected to ports and border crossings, the additional transportation expenses could easily negate any savings. The most successful ventures are situated at the nexus of efficient inbound and outbound supply chains. This strategic analysis is a foundational element of a bankable business plan for a solar factory.

Frequently Asked Questions (FAQ) about Solar Manufacturing Logistics

Q1: How much does international shipping add to the cost of a solar module?

A: This figure varies significantly based on origin, destination, fuel costs, and global freight rate volatility. However, logistics can typically account for 3% to 10% of the final cost of goods sold. Budgeting for this volatility is a key financial planning challenge.

Q2: What is the typical lead time for raw materials shipped from Asia to North America?

A: Standard ocean freight from a major Asian port to a North American West Coast port usually takes three to five weeks. A prudent planner should budget for a total of six to eight weeks from the supplier’s port to the factory floor to account for potential port congestion, customs clearance, and inland transportation.

Q3: Is it better to locate a factory near a port or near the target market?

A: This is a core strategic trade-off. Locating near a port simplifies inbound logistics for raw materials, which reduces lead times and inland freight costs. Positioning the factory near the primary market cuts outbound logistics costs and delivery times for finished goods. The optimal choice depends on a detailed analysis of which part of the supply chain carries the most cost and risk for your business model.

Q4: How does pvknowhow.com assist with logistical planning?

A: J.v.G. Technology GmbH, the company behind pvknowhow.com, assists entrepreneurs by modeling these logistical trade-offs during the initial feasibility and business planning stages. The educational courses on pvknowhow.com are designed to give business leaders the foundational knowledge needed to make these critical strategic decisions.

Conclusion: Your Next Steps in Building a Resilient Supply Chain

Logistics should not be an operational afterthought; it is a strategic pillar of any successful solar manufacturing venture. The location of your factory relative to key ports, railways, and border crossings will have a lasting impact on your production costs, delivery timelines, and overall competitiveness.

By understanding these trade flows and planning for them from day one, an entrepreneur can build a resilient and efficient supply chain that becomes a true competitive advantage. The next step is to explore the specific raw materials required and develop a robust sourcing strategy to feed the production line you envision.