International investors increasingly recognize Mexico’s strategic potential for solar manufacturing, drawn by its proximity to the US market and favorable trade agreements.

A common oversight, however, is to focus solely on federal programs while underestimating the decisive financial and operational advantages offered at the state level. These regional incentives are often what separates a good investment location from a great one, significantly impacting a project’s long-term profitability and success.

This analysis compares the financial incentives, tax breaks, and infrastructure support offered by key industrial states—Nuevo León, Querétaro, and Jalisco—to provide prospective investors with the actionable data needed to make a more informed site selection.

Why Mexico? The Macro View for Solar Investors

Before examining state-specific benefits, it’s worth reviewing the foundational advantages that make Mexico an attractive destination for solar manufacturing. The United States-Mexico-Canada Agreement (USMCA) provides preferential access to the world’s largest solar market, a critical factor for export-oriented factories.

Mexico also has a skilled and cost-effective labor force with extensive experience in advanced manufacturing sectors, including automotive and electronics. This existing industrial ecosystem provides a solid foundation for building a high-quality solar module production line. Mexico’s own growing domestic demand for renewable energy creates a secondary market, offering a degree of insulation from global trade volatility.

Understanding Mexico’s Incentive Structure: Federal vs. State

Mexico has a two-tiered incentive system, and understanding it is key for new investors looking to maximize their advantages.

Federal Incentives: The Baseline

The primary federal program is IMMEX (Maquiladora), which allows foreign manufacturers to import raw materials and machinery duty-free and VAT-free, provided the final product is exported. This program is the cornerstone of Mexico’s manufacturing-for-export model and significantly reduces upfront capital costs. Leveraging these programs effectively begins with understanding the full scope of the investment requirements for a solar module factory.

State-Level Incentives: The Competitive Edge

While federal programs are available nationwide, state governments actively compete for foreign direct investment. They offer a distinct layer of incentives that can include:

- Tax Reductions: Reductions or exemptions on payroll tax, property tax, and other local fees.

- Cash Grants: Direct financial support for training programs or R&D initiatives.

- Infrastructure Support: Government investment in connecting a new facility to utilities, roads, and industrial parks.

- Streamlined Permitting: A ‘soft’ but highly valuable incentive where the state assigns a dedicated contact to expedite bureaucratic processes.

These state-level benefits are where strategic decision-making truly begins.

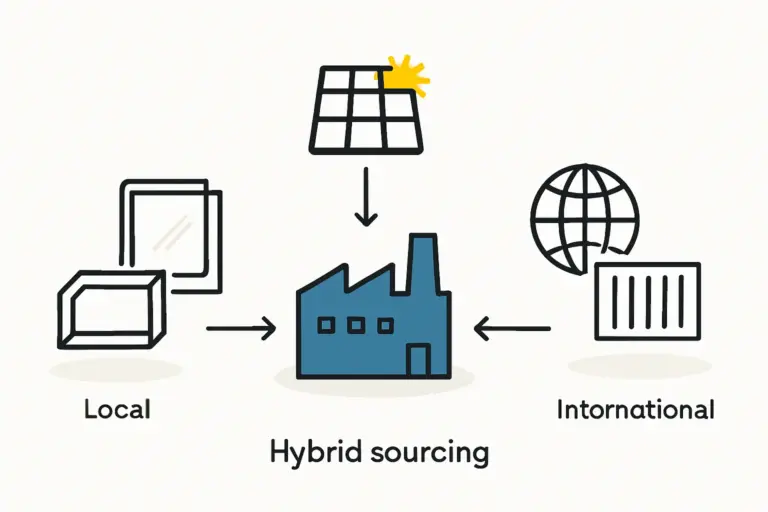

A Comparative Look at Key Industrial States

Choosing the right state depends on a project’s specific priorities, such as proximity to the US border, access to a particular type of talent, or integration into a specific supply chain. This comparison covers three leading contenders.

Nuevo León: The Industrial Powerhouse

Located on the US border, Nuevo León and its capital, Monterrey, form Mexico’s industrial heartland. Its primary advantage is logistics, offering unparalleled overland shipping routes for manufacturers targeting Texas and the wider US market.

Incentive Focus: Nuevo León’s incentives are often geared towards large-scale, technology-intensive projects. This includes significant R&D tax credits and grants for high-tech machinery acquisition.

Strengths: World-class industrial infrastructure, a dense network of suppliers for industrial components, and direct access to US markets.

Considerations: Operational costs, including labor and land, are among the highest in Mexico. The intense competition for skilled labor can also be a factor. Projects here are often larger in scale (e.g., 100-200 MW) to justify the higher operating expenses.

Querétaro: The Aerospace & Logistics Hub

Situated in central Mexico, Querétaro has cultivated a reputation for political stability, safety, and a pro-business government. As a hub for the aerospace and automotive industries, its workforce is highly trained in precision and advanced manufacturing.

Incentive Focus: The state government strongly supports workforce development. It often co-invests with companies to create bespoke training programs at local technical universities, ensuring a supply of qualified line operators and technicians.

Strengths: Excellent central logistics for distributing within Mexico, a stable and highly skilled labor pool, and a very supportive, transparent state administration.

Considerations: While it has excellent national connectivity, it lacks the direct US border access of Nuevo León, which may add a day or two to shipping times.

Jalisco: The Silicon Valley of Mexico

Home to Guadalajara, Jalisco is renowned for its vibrant electronics manufacturing ecosystem. Decades of hosting major international tech companies have created a deep talent pool of engineers and technicians specializing in electronics and automation.

Incentive Focus: Jalisco’s incentives often target technology adoption and innovation. This can include grants for implementing Industry 4.0 solutions and tax breaks for companies that establish local R&D centers.

Strengths: Unmatched access to electronics engineers and software developers, a strong university system, and a well-established supply chain for electronic components. This access to specialized talent can positively influence the factory setup timeline.

Considerations: Its primary port, Manzanillo, is on the Pacific coast, making it ideal for importing materials from Asia but less direct for exporting finished modules to the US East Coast.

Beyond Financials: Critical Factors in Site Selection

Incentive packages are compelling, but they must be weighed against practical realities. Based on J.v.G. Technology’s experience with turnkey factory projects globally, investors should also conduct due diligence in several other key areas.

Infrastructure and Logistics

The reliability of the local power grid is non-negotiable for a 24/7 manufacturing operation. Assessing the quality of an industrial park’s electrical substation is crucial. Similarly, investors must evaluate the quality of road networks connecting to major highways and ports, as transportation bottlenecks can erode profits.

Labor and Talent Pool

While one state may offer a larger tax break, another might provide better access to the specific engineering talent needed to run an automated production line. A successful facility depends on a balanced team of qualified personnel, from operators and maintenance technicians to quality control engineers. Proximity to technical universities and vocational schools is also a key consideration.

Bureaucratic Landscape

Navigating permits and regulations can be a source of significant delays. Some state governments are more adept than others at providing a ‘one-stop-shop’ for investors to streamline this process. The presence of a responsive and efficient state economic development agency can be as valuable as any direct financial incentive.

Frequently Asked Questions (FAQ)

-

What exactly is the IMMEX program?

The IMMEX program, also known as the Maquiladora program, is a federal initiative that allows foreign companies to import raw materials, components, and machinery into Mexico without paying import duties or value-added tax (VAT), on the condition that at least 90% of the finished goods are exported. -

How long does it typically take to secure state-level incentives?

The timeline varies by state and project complexity but generally ranges from 3 to 6 months. It involves submitting a detailed business plan, negotiating with the state’s economic development agency, and formalizing the agreement. Having experienced local representation is critical to this process. -

Are these incentives available to 100% foreign-owned companies?

Yes, Mexico’s foreign investment laws permit 100% foreign ownership in the manufacturing sector. Both federal and state incentives are fully available to foreign-owned entities that establish a legal presence in Mexico. -

Do the incentives cover the import of specialized solar manufacturing machinery?

The federal IMMEX program is the primary mechanism for this. It allows for the temporary, duty-free importation of all machinery and equipment necessary for the manufacturing process. Some states may offer additional tax credits or grants specifically for the acquisition of high-technology equipment.

Conclusion: Making an Informed Decision

The choice among states like Nuevo León, Querétaro, and Jalisco isn’t about which is ‘best,’ but which is the best fit for a specific business model. A manufacturer focused on high-volume exports to the US will likely prioritize the logistical advantages of Nuevo León. In contrast, an investor building a high-tech, automated factory may find the talent pool in Jalisco more suitable, while a company seeking stability and strong government partnership might lean towards Querétaro.

Ultimately, financial incentives are only one piece of the puzzle. A comprehensive feasibility study that evaluates logistics, labor, infrastructure, and the local business climate is the essential next step. This data-driven approach ensures the chosen location provides a sustainable competitive advantage for years to come.