When entrepreneurs consider entering the solar module manufacturing sector, their initial analysis often centers on machinery costs and market demand. But a critical factor that can determine a venture’s long-term viability and profitability is its location.

A strategic geographical choice provides significant competitive advantages, particularly for new players aiming to serve established markets like the European Union. This guide examines one such strategic location: the Republic of Moldova and its specialized Free Economic Zones (FEZs).

The Strategic Imperative: Why Location Matters in Solar Manufacturing

The global solar supply chain has long been dominated by manufacturers in Asia. While this model has driven down costs, it also poses challenges for new entrants targeting European customers. These include extended shipping times, complex logistics, potential import tariffs, and a growing consumer preference for regionally produced goods.

Establishing a manufacturing base closer to the end market—a strategy known as nearshoring—is the clear solution. It reduces logistical friction, enhances supply chain resilience, and helps build a brand associated with regional quality standards. For this strategy, Moldova presents a compelling case.

Understanding Moldova’s Unique Proposition

Situated on the eastern border of the European Union, Moldova offers a unique combination of geographical proximity and economic integration. Its strategic position provides direct land access to EU member states like Romania, as well as access to global shipping lanes via the Black Sea.

This geographical advantage is enhanced by the country’s Association Agreement with the European Union, which includes a Deep and Comprehensive Free Trade Area (DCFTA). This agreement grants Moldovan-produced goods tariff-free access to the entire EU single market, creating a level playing field with producers inside the Union.

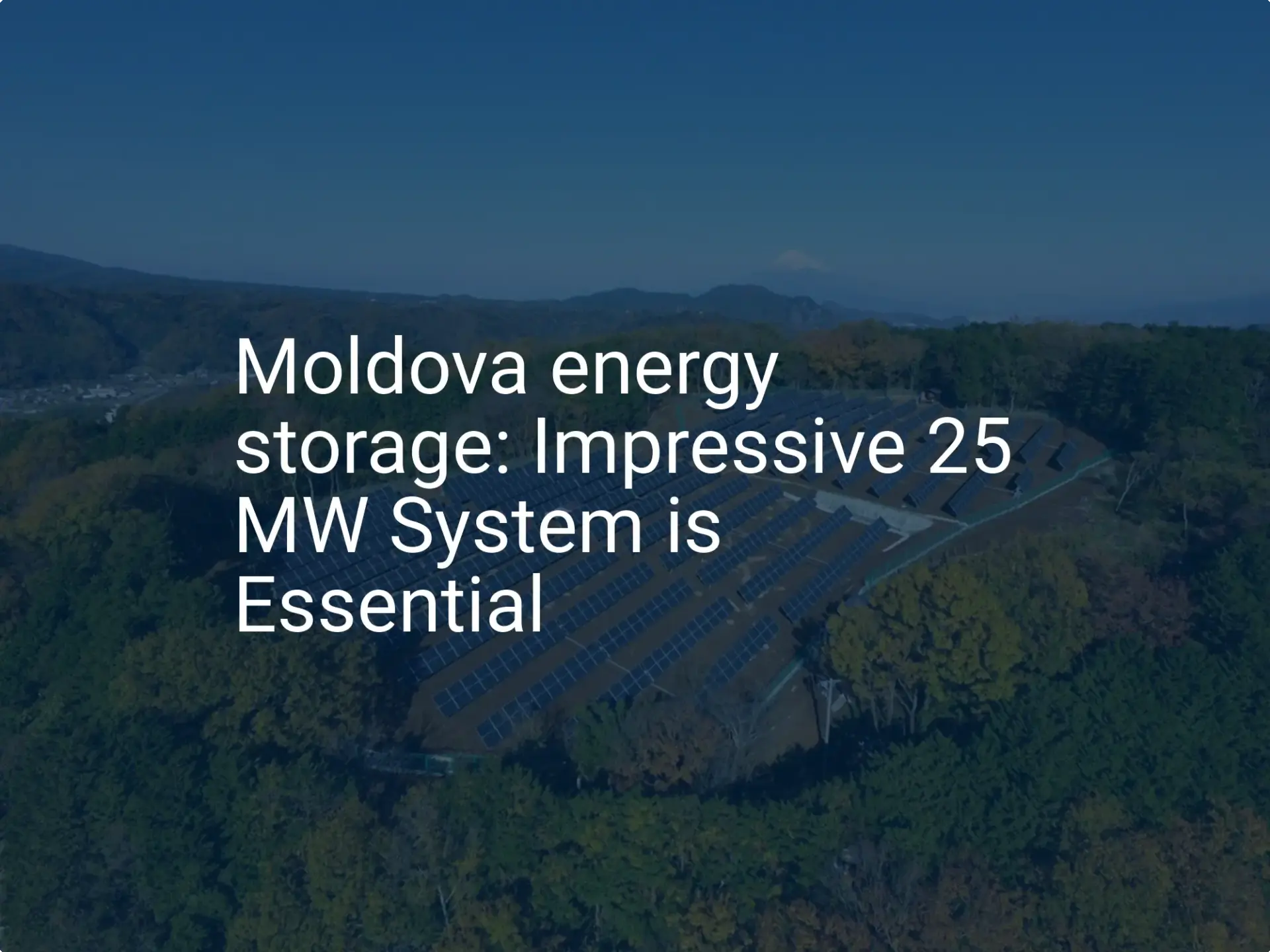

A Deep Dive into Moldova’s Free Economic Zones (FEZs)

To attract foreign investment and stimulate industrial growth, Moldova has established seven Free Economic Zones across the country. These designated areas operate under a special legal and fiscal regime designed to simplify business operations and maximize financial incentives for resident companies.

For an investor planning a solar module assembly facility, the FEZs offer a “plug-and-play” environment. They provide ready access to essential utilities like electricity, natural gas, water, and sewage systems. This significantly reduces the time and capital required for site preparation, allowing management to focus on core operations.

The Financial Advantages: A Breakdown of Tax and Customs Incentives

The financial benefits of operating within a Moldovan FEZ are substantial. The incentive structure is designed to reduce the initial investment burden and improve cash flow—a critical factor during the start-up phase of a manufacturing plant. A comprehensive solar business plan is essential to accurately model these financial benefits.

VAT and Customs Duty Exemptions

Goods and materials imported into an FEZ for production are exempt from Value Added Tax (VAT) and customs duties. This means all necessary machinery, raw materials (like solar cells, glass, and aluminum frames), and components for a turnkey solar module manufacturing line can be imported without incurring the standard 20% VAT. Likewise, finished solar modules exported from the FEZ are also subject to a 0% VAT rate. This creates a substantial and immediate cash flow advantage.

Corporate Income Tax Holidays

The FEZ regime encourages significant investment with generous holidays on corporate income tax. While the standard corporate tax rate in Moldova is 12%, FEZ residents benefit from the following:

- A 3-year full exemption from income tax for investments exceeding USD 1 million.

- A 5-year full exemption from income tax for investments exceeding USD 5 million.

- Following the tax holiday period, resident companies pay only 50% of the standard rate, resulting in an effective income tax of just 6%.

Simplified Administrative Framework

FEZs operate under a “single window” principle for administrative procedures. This centralized system simplifies the process of obtaining permits, licenses, and other necessary authorizations, reducing bureaucratic delays and accelerating the path to operation.

Operational and Market Access Benefits

Beyond direct financial incentives, operating from Moldova offers distinct operational and market advantages.

Skilled Labor at Competitive Costs

Moldova has a well-educated and technically skilled workforce. Its technical universities and vocational schools ensure a steady supply of qualified engineers and technicians, at labor costs that are highly competitive within Europe.

Logistical Efficiency

Proximity to the EU market dramatically reduces shipping times and costs compared to sourcing from Asia. A truck departing from a Moldovan FEZ can reach major markets in Central and Eastern Europe within days, not weeks. This allows for more flexible inventory management and a faster response to customer orders.

The Power of the “Made in Europe” Label

Products manufactured in Moldova can, under the rules of origin established by the DCFTA, qualify for the “Made in Europe” designation. This label resonates strongly with European consumers and project developers, who often associate it with higher quality, stricter environmental standards, and ethical labor practices. It serves as a powerful marketing tool and can unlock access to specific tenders or projects that prioritize European-made components.

A Proven Model: Lessons from Other Industries

The viability of Moldova’s FEZ model is not theoretical. It has been proven by numerous international companies, including a prominent German automotive supplier that has operated successfully within one of the zones for years. Their success demonstrates that the infrastructure, legal framework, and workforce can meet the demanding standards of high-precision global industries, setting a strong precedent for investors in the solar sector.

Frequently Asked Questions (FAQ)

What is the minimum investment required to benefit from the tax incentives?

A full 3-year holiday on corporate income tax is granted for investments of over USD 1 million. The benefit extends to 5 years for investments exceeding USD 5 million.

Is Moldova a stable country for a long-term manufacturing investment?

Moldova’s Association Agreement with the EU signals a clear, long-term commitment to European integration and regulatory alignment. This provides a stable and predictable framework for foreign investors.

How difficult is it to find and train staff for a solar module factory?

The country has a strong industrial heritage and a pool of skilled labor accustomed to manufacturing processes. For specialized roles, the competitive wage environment makes it feasible to invest in targeted training programs.

Can products made in a Moldovan FEZ truly be sold as “Made in Europe”?

Yes. Provided the production processes meet the “rules of origin” criteria set out in the DCFTA, the finished solar modules are considered of Moldovan origin and can be exported to the EU tariff-free, benefiting from the perception and marketability of a European-made product.

Next Steps in Your Evaluation Process

For entrepreneurs and investors exploring solar manufacturing, Moldova’s Free Economic Zones offer a compelling proposition. The combination of direct financial incentives, reduced operational friction, and privileged access to the EU market lays a powerful foundation for a successful venture.

Your next step is to conduct detailed financial modeling to quantify these benefits relative to your specific project scope and investment level. This analysis clarifies the potential return on investment and provides the data needed for an informed strategic decision.