Entrepreneurs exploring new markets often view government regulations as a hurdle, but some strategic locations use their regulatory framework as a powerful accelerator. For those considering entry into the European solar market, Montenegro is a prime example, offering well-defined incentives designed to attract foreign direct investment in key sectors like manufacturing.

Understanding these programs is the first step toward turning a potential investment into a highly competitive, government-supported venture. This overview covers the financial incentives, tax benefits, and strategic advantages available to foreign investors looking to establish a solar module production facility in Montenegro.

Why Montenegro Presents a Unique Opportunity for Solar Investors

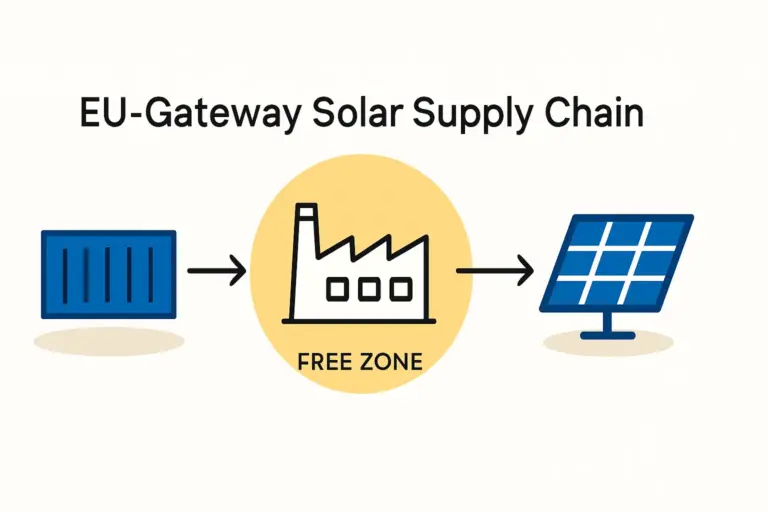

Montenegro’s appeal extends beyond its scenic Adriatic coastline. For industrial investors, the country’s strategic position offers a logistical gateway to the wider European market. Its status as an EU candidate nation also signals long-term regulatory stability and market integration, backed by a government with a clear, welcoming policy towards foreign capital.

This pro-business stance isn’t just rhetoric; it’s codified in law. This ensures foreign investors receive the same legal treatment and operate under the same conditions as domestic businesses. This policy creates a predictable and secure environment for substantial capital projects, such as setting up a solar factory.

Understanding the Core Financial Incentives

The Montenegrin government attracts investment using a combination of a competitive tax system and direct financial grants tied to job creation and capital spending.

The Corporate Tax Environment: A Competitive Edge

A favorable tax structure is fundamental to long-term profitability. Montenegro offers one of the most competitive corporate tax regimes in Europe.

-

Corporate Income Tax: A progressive tax applied at rates of 9% to 15%. For most new manufacturing enterprises, the effective rate will fall at the lower end of this scale, freeing up capital for reinvestment and growth.

-

Value Added Tax (VAT): The standard VAT rate is 21%. However, the export of goods is zero-rated (0% VAT), a critical advantage for a solar module factory planning to serve international markets.

-

Withholding Tax: A low 9% tax applies to dividends, interest, and royalties, simplifying the repatriation of profits.

This structure is straightforward and financially efficient, allowing businesses to forecast costs and returns with greater certainty.

The Decree on Direct Investment Incentives: A Detailed Breakdown

The centerpiece of Montenegro’s FDI strategy is the Decree on Direct Investment Incentives. This program offers non-repayable, direct financial support to investors who create new jobs. The funds are granted per new employee, with amounts varying by the project’s location.

The government categorizes municipalities by their level of development, offering higher incentives for investments in less-developed northern and central regions:

-

Southern Region (Developed): Up to €3,000 per new job created.

-

Central Region (Semi-Developed): Up to €5,000 per new job created.

-

Northern Region (Undeveloped): Up to €7,000 per new job created.

To qualify, projects must meet minimum thresholds for both capital investment and job creation. A manufacturing facility, for instance, typically needs to invest at least €250,000 and create a minimum of 10 new jobs within three years. This clear and accessible threshold is well-suited for starting a small- to medium-sized solar production line.

Special Provisions for Large-Scale, Capital-Intensive Projects

For investors planning more substantial operations, the incentives become even more significant. For projects with a minimum investment of €10 million that create at least 50 new jobs, the government offers direct grants of up to 17% of the total investment value.

This provision is particularly relevant for those planning a fully automated, large-scale turnkey solar panel production line, as the grant can substantially offset the initial capital outlay and shorten the timeline to profitability.

Strategic Assets: Business Zones and Local Support

To further streamline the setup process for industrial projects, Montenegro has established designated Business Zones in several municipalities, including Berane, Kolašin, and Nikšić. Locating a factory within one of these zones often comes with additional benefits:

-

Developed Infrastructure: Access to pre-existing utility connections (power, water, internet) and transport links.

-

Local Incentives: Potential exemptions from local taxes or fees, as determined by the municipality.

-

Administrative Support: A more streamlined process for obtaining permits and licenses.

These zones are designed as ‘plug-and-play’ environments for industrial development, cutting through red tape and allowing management to focus on core business operations.

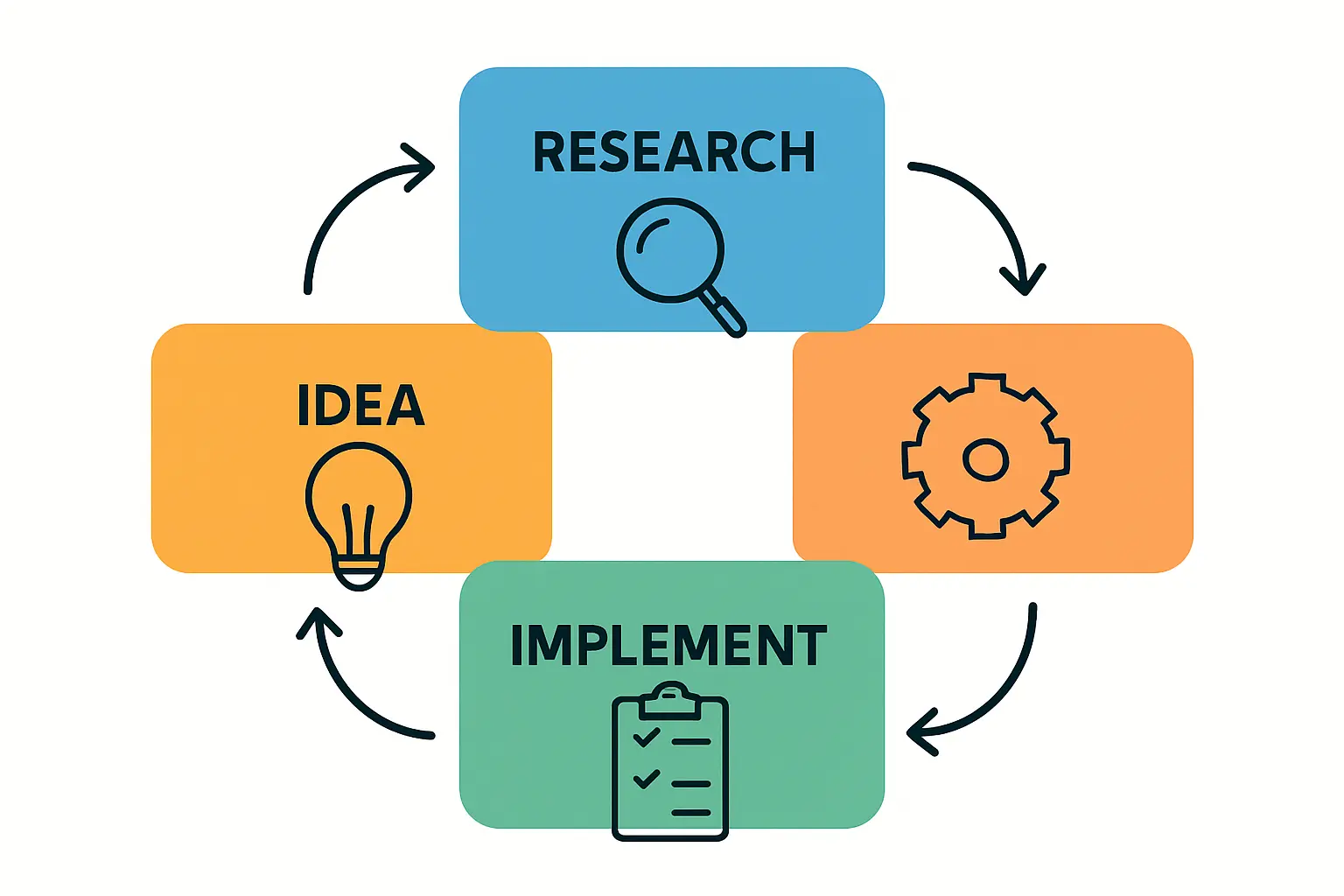

The Practical Path to Securing Incentives

Securing these government incentives is a structured process that begins with a robust application. The cornerstone of that application is a credible, detailed business plan. This document must convincingly outline the project’s financial viability, technical specifications, job creation schedule, and overall contribution to the local economy.

The evaluation process, managed by the Montenegro Investment Agency, is transparent. A successful application depends on realistic financial projections and a clear operational strategy. Creating such a plan requires understanding the full scope of investment requirements for solar manufacturing. Ultimately, a comprehensive business plan for solar panel production is the key to demonstrating the project’s merit to the authorities.

Frequently Asked Questions About Montenegrin Solar Investment

Do foreign investors have the same rights as local investors in Montenegro?

Yes. The Law on Foreign Investment guarantees foreign investors the same rights, obligations, and legal status as domestic investors. This principle of ‘national treatment’ is a cornerstone of the country’s business environment.

What is the minimum investment required to qualify for direct incentives?

For manufacturing projects, the most common threshold is a minimum investment of €250,000 combined with the creation of at least 10 new jobs within a three-year period.

Are these incentives specifically for the solar industry?

The incentives are not exclusive to the solar industry but are available for a range of sectors, including manufacturing, information technology, and tourism. Solar module production fits squarely within the targeted manufacturing category, making it fully eligible.

How does Montenegro’s EU candidacy status impact a long-term investment?

As an official EU candidate country, Montenegro is progressively aligning its laws and standards with those of the European Union. For an investor, this provides a clear trajectory towards full integration into the EU single market, ensuring long-term stability, regulatory predictability, and tariff-free access to one of the world’s largest economic blocs.

Next Steps in Your Evaluation Process

Montenegro offers a compelling and financially attractive framework for establishing a solar module manufacturing presence in Europe. The country’s low-tax environment, direct cash grants for job creation, and stable, pro-business legal system together form a powerful foundation for a successful venture.

For any entrepreneur or company considering this path, the essential next step is to conduct a detailed feasibility study and develop a comprehensive business plan tailored to the Montenegrin incentive programs. A thorough understanding of these opportunities is your foundation for building a competitive and sustainable manufacturing operation.