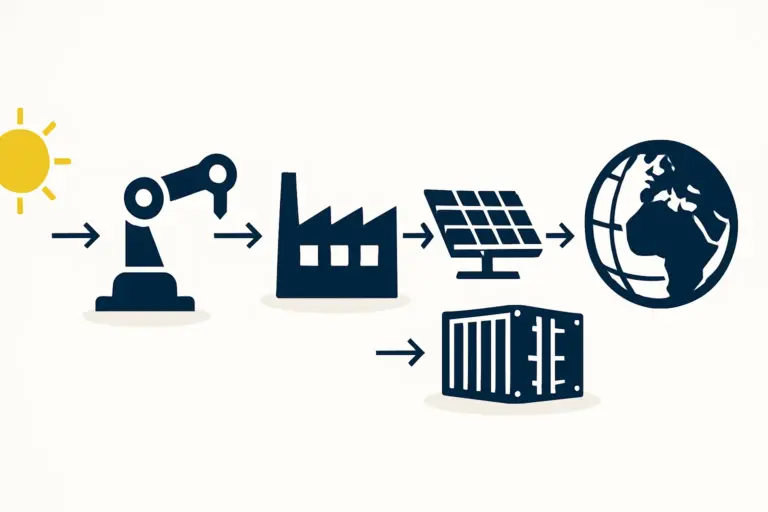

Investors considering a solar panel assembly plant in Morocco are often drawn by the country’s ambitious renewable energy targets and strategic location. The Kingdom’s ‘Green Generation’ plan and the success of projects like the Noor Ouarzazate Solar Complex create a compelling case for local manufacturing. This ambition, however, quickly raises a fundamental question: where will the raw materials come from?

The decision whether to source locally or import key components like glass, encapsulant, and backsheet is one of the most critical financial and operational choices a manufacturer will make. This guide explores Morocco’s current industrial capacity and provides a framework for building a resilient and cost-effective supply chain.

Understanding the Core Components of a Solar Module

Before evaluating sourcing options, it’s essential to understand the primary materials that make up a solar panel. A few key items dominate the Bill of Materials (BOM) for a standard photovoltaic module, significantly influencing its performance, durability, and cost. While a module contains many parts, three non-cell components account for a significant portion of its structure and expense, making a deeper understanding of all solar module components crucial for any prospective manufacturer.

-

Solar Glass: The front layer of the module, protecting the solar cells from the elements while maximizing light transmission.

-

Encapsulant (EVA/POE): A polymer film that bonds the glass, cells, and backsheet together, providing electrical insulation and preventing moisture ingress.

-

Backsheet: The rearmost polymer layer, offering mechanical protection and electrical insulation on the module’s underside.

Collectively, these materials can account for over 60% of the non-cell material costs. The sourcing strategy for these items, therefore, directly impacts the final module price and the plant’s overall profitability.

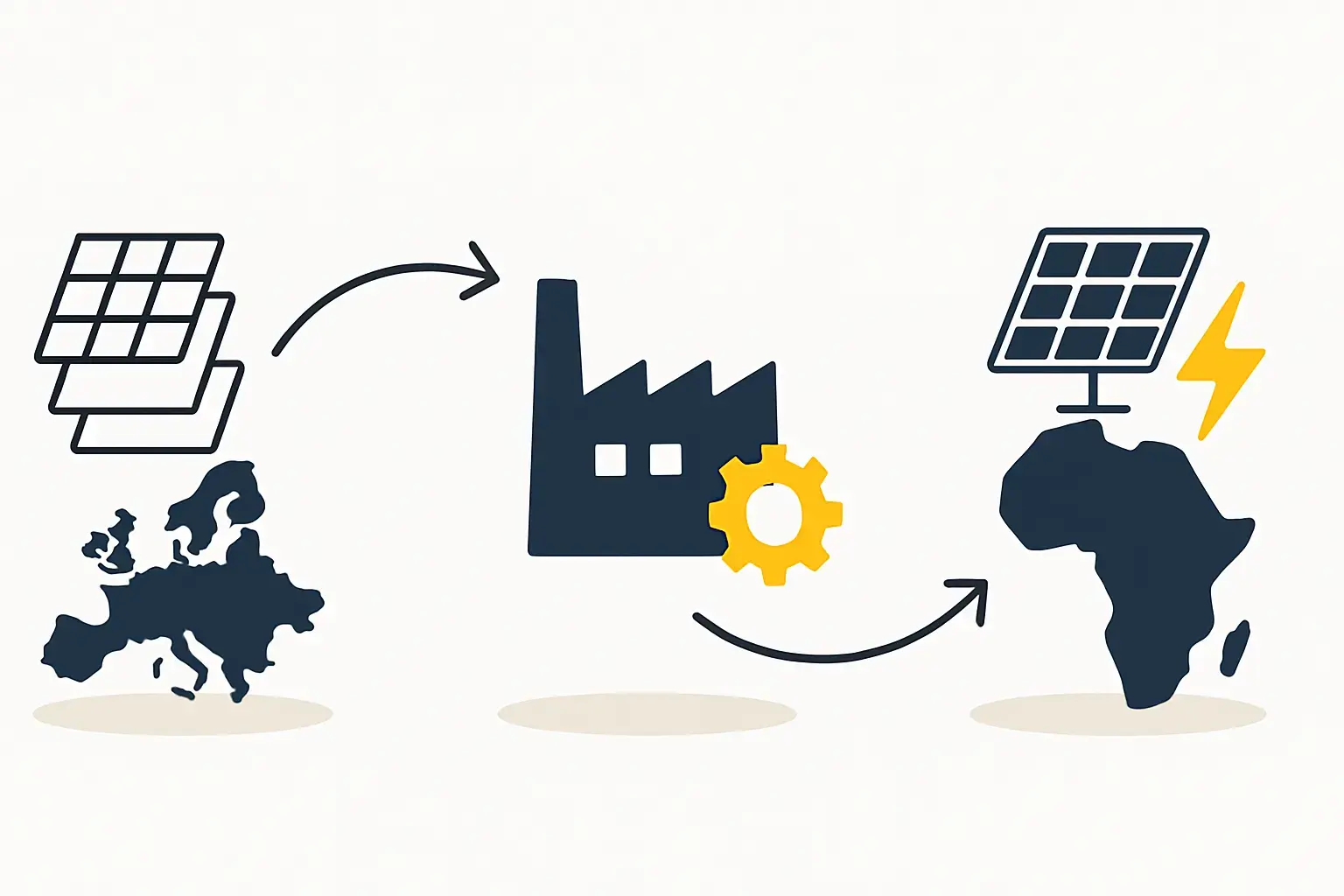

The Moroccan Industrial Landscape: An Assessment for Solar Manufacturing

Morocco has a well-established industrial base, particularly in sectors like automotive manufacturing, aerospace, and agribusiness. The country has demonstrated a clear capacity for producing high-quality goods for export. While this industrial strength provides a promising foundation, the specific requirements of solar manufacturing present unique challenges.

The key question isn’t whether Morocco can produce industrial materials, but whether it currently has the capacity to produce the highly specialized grades required for photovoltaic applications—materials that meet international certification standards such as IEC 61215 and IEC 61730.

Material-by-Material Sourcing Analysis for Morocco

A pragmatic evaluation requires looking at each key component individually, weighing the feasibility of local procurement against the realities of global supply chains.

Solar-Grade Glass: Local Potential with Critical Caveats

At first glance, sourcing glass locally in Morocco seems viable. The country has a modern glass industry, with prominent manufacturers like Induver serving the automotive sector and AGC Glass Europe operating a float glass plant in Kenitra.

However, solar glass differs significantly from architectural or automotive glass. It is defined by three critical characteristics:

-

Low-Iron Content: It must be highly transparent, with minimal iron content to maximize the amount of light reaching the solar cells.

-

Tempering: The glass must be heat-strengthened (tempered) to withstand mechanical stress from wind, snow, and hail.

-

Texturing/Coating: The surface is often patterned or coated with an anti-reflective layer to reduce glare and further improve light absorption.

While local plants possess the core technology for glass manufacturing, producing solar-grade glass at scale requires dedicated production lines and specific expertise. Prospective module manufacturers in Morocco will need to conduct thorough due diligence to determine if local suppliers can meet these exact specifications and provide the necessary quality certifications. Often, this means partnering to co-develop a local supply, which requires significant investment and time. The alternative is to import from established global leaders in solar glass, primarily from China or Europe.

Encapsulant Film (EVA/POE): The Specialized Chemical Challenge

Encapsulant film, typically Ethylene Vinyl Acetate (EVA) or Polyolefin Elastomer (POE), is a highly specialized chemical product. Its production requires advanced polymer extrusion technology and access to a sophisticated chemical industry capable of supplying raw resins of extreme purity.

Currently, there is no significant production of EVA or POE encapsulant film in Morocco or the wider North African region. The global market is dominated by a few large chemical companies in East Asia and Europe. For a new manufacturing plant in Morocco, importing this material is the only practical option. For an investor, the key considerations will be selecting a certified supplier, managing logistics and import duties, and securing a stable supply chain.

Backsheet: The Protective Polymer Barrier

Similar to the encapsulant, the backsheet is a multi-layer polymer laminate designed for extreme durability over a 25- to 30-year lifespan. It must resist UV radiation, humidity, and temperature fluctuations while providing high electrical insulation.

The technology to produce high-performance backsheets is proprietary and concentrated among a small number of international suppliers. Local production in Morocco is not currently established. Therefore, like EVA film, backsheets must be imported. The selection process involves choosing a supplier whose products are certified and listed on the approved vendor lists of major cell and module brands. This ensures the final product will be bankable and accepted in international markets.

A Strategic Framework for Your Sourcing Decision

Based on experience from J.v.G. turnkey projects, the optimal strategy for a new plant in Morocco is often a hybrid model. This involves exploring local potential where it exists (primarily for glass and aluminum frames) while establishing robust international supply chains for specialized chemical components.

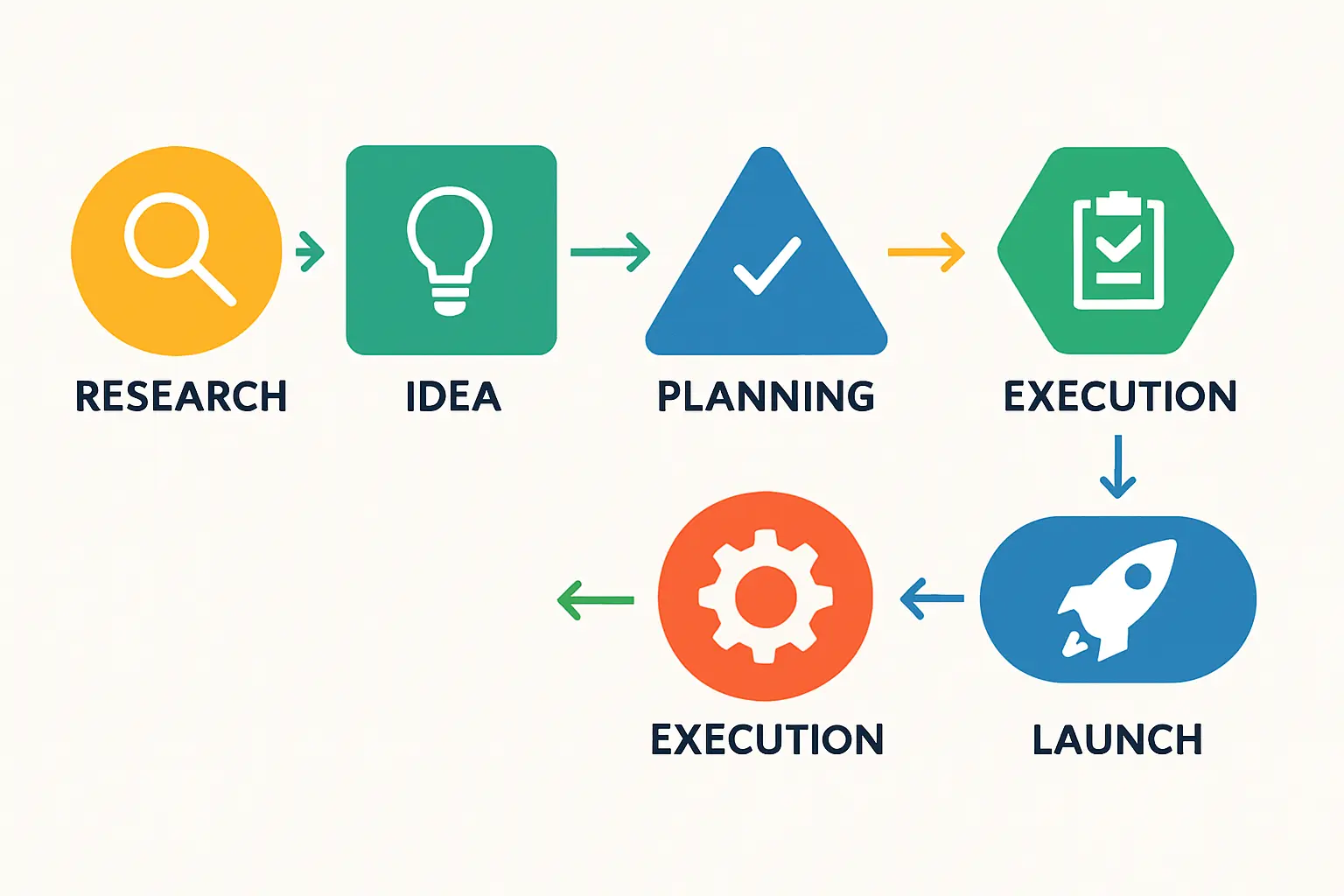

An investor’s decision should be guided by a careful evaluation of the following factors:

-

Cost and Logistics

Compare the landed cost of imported goods (including shipping and tariffs) with potential local prices. This analysis is fundamental to understanding the total solar panel manufacturing plant cost. -

Quality and Certification

All critical materials must be certified to IEC/UL standards. Using uncertified local materials would make it impossible to sell the final module in most markets. -

Supply Chain Resilience

Relying on a single international supplier carries risk. Developing relationships with multiple suppliers or using a local partner for non-specialized items can improve stability. -

Government Incentives

The Moroccan government may offer incentives for local value creation. These can potentially offset higher local costs but must be weighed against quality and bankability requirements.

Frequently Asked Questions (FAQ)

Can standard architectural glass be used for solar panels?

No. Standard glass has high iron content, which blocks a portion of the sunlight and significantly reduces the module’s efficiency. Only specialized, low-iron, patterned solar glass should be used.

How do import duties in Morocco affect material costs?

Import duties are a critical variable in the financial model. Morocco has trade agreements that may reduce tariffs on goods from certain regions (e.g., the EU). A thorough analysis of these duties is essential during the business planning phase.

If I import most materials, is my product still considered ‘Made in Morocco’?

This depends on local ‘rules of origin’ regulations, which typically define the percentage of value that must be added locally. The assembly process itself, which involves a complex solar module manufacturing process, adds significant value and generally qualifies the final product as locally made.

Conclusion: Balancing Ambition with Pragmatism

For an entrepreneur entering the solar manufacturing sector in Morocco, the sourcing strategy must be both ambitious and pragmatic. The potential to cultivate a local supply chain, particularly for solar glass, represents a long-term strategic advantage that aligns with the country’s industrial goals.

In the short to medium term, a successful operation will depend on a well-managed international procurement strategy for critical components like encapsulant and backsheet. The key is to build a diversified supply chain that guarantees quality and bankability while remaining open to local opportunities as the domestic industrial ecosystem matures. Developing this balanced strategy is a foundational step toward building a successful and sustainable solar module factory in Morocco.