The global energy transition offers significant opportunities for investors, but aligning large-scale industrial projects with specific financial principles like Sharia compliance requires careful structuring. This opportunity sits at the convergence of three powerful trends: Morocco’s ambitious renewable energy strategy, the deep pool of capital within the Gulf Cooperation Council (GCC) seeking ethical investments, and the growing demand for localized manufacturing. This convergence creates a unique opening for entrepreneurs to establish a solar module factory that is not only commercially viable but also financially and culturally aligned with a key investor class.

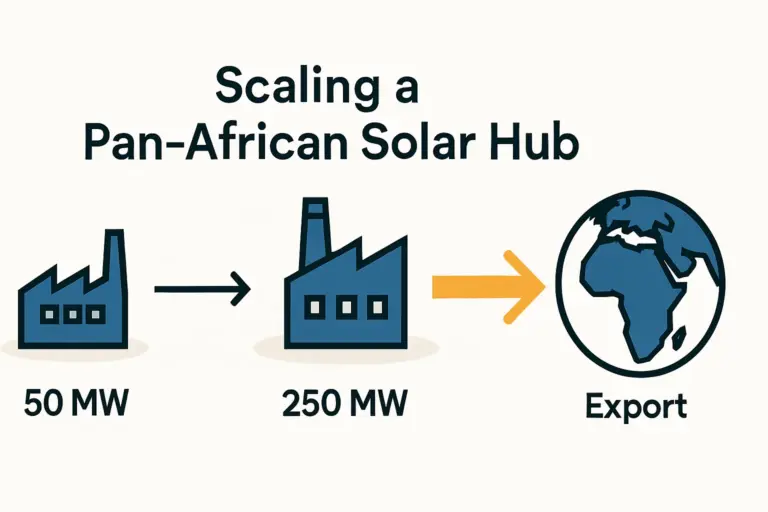

This article lays out a detailed framework for developing a 75 MW solar module factory in Morocco’s Fes-Meknes region, financed through a Sharia-compliant Sukuk structure. It serves as a blueprint for business professionals aiming to enter the solar industry, showing how to attract GCC capital by leveraging proven European technology to de-risk the investment and serve a high-growth domestic market.

The Opportunity: Why Morocco? Why Now?

Morocco has positioned itself as a regional leader in renewable energy, targeting 52% of its electricity generation from renewables by 2030. With electricity demand growing at a steady 4% annually, the country requires substantial new capacity. The Fes-Meknes region, with its strategic infrastructure and industrial focus, is a compelling location for a new manufacturing facility built to meet this demand.

The primary market for a new local manufacturer is not large-scale utility projects, which are often dominated by international players, but the underserved Commercial and Industrial (C&I) sector. Businesses across Morocco are increasingly turning to solar to secure reliable energy and control operational costs, creating a consistent and profitable customer base for locally produced, high-quality solar modules. A local factory can offer faster delivery, better service, and modules specifically adapted to regional conditions like high temperatures and dust, giving it a distinct advantage over imported products.

The Financing Model: Understanding Sukuk for Industrial Projects

Attracting capital from GCC investors requires a financing structure that adheres to Islamic principles. Conventional debt financing, which involves paying interest (riba), is prohibited. The ideal alternative is Sukuk, often called an “Islamic bond.” Rather than representing a debt obligation, a Sukuk gives the investor partial ownership in a tangible, income-generating asset. Returns are not interest payments but a share of the profits generated by that asset.

A solar module factory is an ideal underlying asset for a Sukuk issuance. The building, machinery, and equipment are tangible assets that generate revenue through the sale of solar modules. This structure aligns seamlessly with the Sharia principle of linking financial returns to real economic activity. With the global Sukuk market valued at over $700 billion and growing, it represents a mature, accessible channel for funding well-structured industrial projects. A compelling proposal for this investor base starts with understanding the investment requirements for a solar module factory.

The Business Plan Blueprint: A 75 MW Factory in Fes-Meknes

A successful project hinges on a comprehensive business plan that addresses capital, technology, market strategy, and returns. This blueprint outlines the core components for a 75 MW facility.

Investment and Capital Structure

A 75 MW solar module production facility typically requires a total investment of approximately $25–$30 million. This capital expenditure covers the land, building construction, production machinery, and initial working capital.

Under a Sukuk al-Ijarah structure, one of the most common forms of Sukuk, the mechanism is straightforward:

- A Special Purpose Vehicle (SPV) is created to issue Sukuk certificates to investors.

- The funds raised are used to purchase the factory’s assets (e.g., the turnkey production line).

- The SPV then leases these assets to the factory’s operating company for a predetermined rental fee.

- These rental payments are distributed to the Sukuk holders as their profit share.

This model provides investors with a stable, asset-backed return stream while allowing the operating company full control over the factory’s day-to-day management.

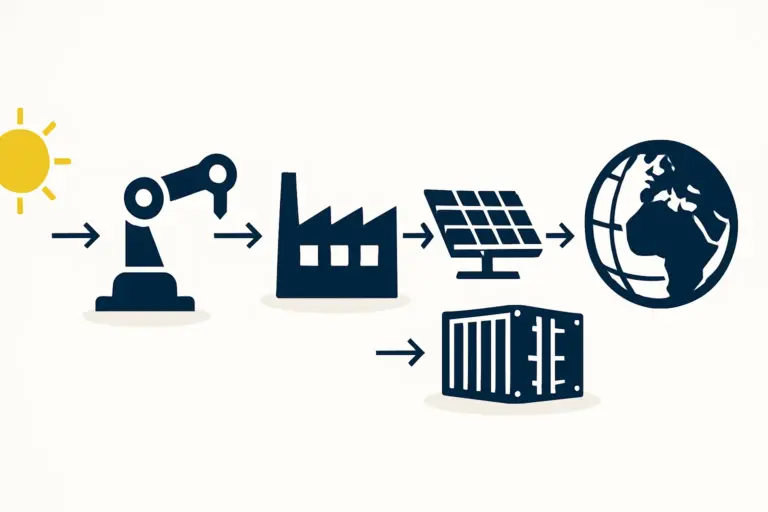

Technology and Operations: The Case for European Turnkey Lines

For new entrants, selecting the right technology is a critical first step in learning how to start a solar panel manufacturing business. A turnkey production line from an established European supplier is the cornerstone of a bankable project. GCC investors and financial institutions prioritize low-risk ventures, making proven technology with performance guarantees, high uptime, and long-term reliability non-negotiable.

Based on experience from J.v.G. turnkey projects, European lines offer superior output quality and lower long-term operational risk—critical factors for securing financing. A typical 75 MW facility would occupy a 5,000-square-meter building and require a workforce of 60 to 80 employees, including technicians, operators, and administrative staff.

Market Focus: Serving Morocco’s C&I Sector

The commercial strategy should center on the Moroccan C&I market. This includes manufacturing plants, agricultural enterprises, shopping centers, and hotels seeking energy independence from an often-unstable grid. By producing modules locally, the factory can avoid the long lead times and logistical complexities of imports, offering a significant competitive edge. Furthermore, the factory can establish a strong brand based on quality and local service, building long-term relationships with a diverse client base.

Projected Returns and Investor Appeal

The financial model must demonstrate clear profitability. The rental income from the Sukuk al-Ijarah structure provides a predictable return for investors. Well-executed projects of this kind typically target an Internal Rate of Return (IRR) in the 15–20% range. For GCC investors, this presents an attractive opportunity that is not only financially sound but also ethically aligned with the economic development and sustainable energy goals of a fellow Islamic nation.

Key Success Factors and Risk Mitigation

While the opportunity is significant, success hinges on meticulous planning and execution. Investors will scrutinize the project’s ability to manage key risks.

Technical Partnership

For entrepreneurs without a deep technical background in photovoltaics, partnering with an experienced engineering consultancy is critical. An expert partner offers guidance throughout the project lifecycle, from initial feasibility studies and equipment selection to factory commissioning and staff training. This significantly de-risks the project and is often a prerequisite for securing investment. pvknowhow.com provides structured e-courses designed to help business professionals navigate this planning phase.

Regulatory Compliance and Certification

The factory’s output must meet both Moroccan standards and international quality benchmarks. Achieving certifications such as IEC 61215 and IEC 61730 from recognized bodies like TÜV is essential for market acceptance. A deep understanding of solar panel quality and certifications is key to ensuring the final product is bankable and trusted by C&I customers and their financiers.

Sharia Governance

To maintain the integrity of the Sukuk financing, a Sharia advisory board or consultant must be appointed. This body will oversee the project’s activities to ensure they remain compliant with Islamic principles at all stages, from the initial asset purchase to sales contracts and profit distribution. This governance provides a crucial layer of assurance for Sharia-conscious investors.

Frequently Asked Questions (FAQ)

What exactly is a Sukuk?

A Sukuk is a Sharia-compliant financial certificate representing a share of ownership in a tangible asset or project. Unlike a conventional bond, it does not represent a debt. Holders receive a share of the profits generated by the underlying asset, not interest.

Why is a turnkey line recommended for new entrants?

A turnkey line is a complete, integrated production solution from a single, experienced supplier. For a new manufacturer, this eliminates the complexity and risk of sourcing machinery from multiple vendors and ensures all components work together seamlessly. It also comes with performance guarantees, training, and support, which is critical for a smooth start-up.

What is the typical timeline to set up a 75 MW factory?

With a well-structured plan and an experienced partner, a 75 MW solar module factory can be fully operational in approximately 12 to 15 months from the final investment decision. This includes building construction, equipment delivery and installation, and staff training.

Do I need a technical background to start this business?

No, a technical background is not a prerequisite. Many successful factory owners come from business, finance, or other industries. The key is to partner with a reputable technical consultancy that can manage the engineering, procurement, and construction aspects of the project, allowing the owner to focus on strategy, finance, and commercial operations.

Why focus on the C&I market instead of large solar farms?

The C&I market offers higher margins, a more diverse customer base, and less competition from large international corporations. It allows a local factory to build a strong brand based on quality and service, fostering stable, long-term growth.

Conclusion and Next Steps

The establishment of a 75 MW solar module factory in Morocco, financed via a Sharia-compliant Sukuk, represents a powerful synthesis of economic opportunity, regional development, and ethical investment principles. By focusing on the high-growth C&I sector and using bankable European technology, entrepreneurs can present a compelling, de-risked proposal to GCC investors.

For those considering this path, the next step is to commission a detailed feasibility study and financial model. A thorough evaluation of technology suppliers and the development of a robust operational plan are also critical milestones on the journey from concept to a fully functioning and profitable enterprise.