Namibia has one of the highest solar irradiation levels in the world, yet it imports over 60% of its electricity from neighbouring countries. This paradox presents a significant strategic opportunity for investors and entrepreneurs.

While the natural resource is abundant, the infrastructure to convert it into reliable power is still developing. For professionals considering entry into the solar industry, this gap between potential and reality makes for a compelling business case.

This analysis examines the market demand for locally manufactured solar modules in Namibia, focusing on the domestic energy sector and export potential to the wider Southern African Development Community (SADC). It provides a framework for understanding the key demand drivers that would support a new solar manufacturing facility.

Understanding Namibia’s Domestic Energy Landscape

Namibia’s energy policy is increasingly focused on achieving self-sufficiency and using its renewable resources. Government initiatives and the practical needs of businesses are laying a solid foundation for local solar module demand. The country’s reliance on imported power is a matter of both cost and energy security—a point of growing concern for policymakers and industry leaders.

Utility-Scale Projects: The Anchor Demand

The national utility, NamPower, is actively pursuing large-scale solar projects to stabilize the grid and reduce its dependency on imports. Through strategic plans and competitive tenders, NamPower has outlined a clear pipeline for new renewable energy generation.

Projects currently in development or planned for the near future represent over 150 MW of new capacity. For a local solar module manufacturer, securing a supply agreement for even one of these utility-scale projects can provide the foundational offtake needed to justify an initial investment. And while formal local content requirements are still evolving, a clear preference for sourcing materials and labour within Namibia gives an in-country producer a distinct advantage.

The Commercial & Industrial (C&I) Sector: A Growing Market

Beyond government-led projects, the most dynamic growth is in the commercial and industrial sector. Businesses across Namibia—from mining operations and large-scale agriculture to manufacturing plants and lodges—are turning to solar to solve two primary problems:

-

Unreliable Grid Supply: Frequent power interruptions disrupt operations and lead to significant financial losses.

-

Rising Electricity Costs: Solar provides a predictable, long-term hedge against volatile electricity tariffs.

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

The C&I market is projected to grow by over 20% annually. Businesses in this segment value reliability and local support. A Namibian-based manufacturer can offer shorter lead times, local technical assistance, and accessible warranty support—powerful differentiators against international competitors. Exploring the [investment requirements for a 20-50 MW solar factory] is a logical first step for investors aiming to serve this expanding market.

The SADC Export Opportunity: Beyond Namibia’s Borders

While the domestic market provides a stable foundation, the larger opportunity lies in using Namibia as a strategic base for exporting to the 16-nation SADC bloc. The region faces a collective energy deficit, driving persistent demand for power solutions. Namibia’s political stability, modern infrastructure, and the strategically located Port of Walvis Bay make it an ideal hub for regional distribution.

Key Target Markets in the SADC Region

Several neighbouring countries present viable export markets, each with unique drivers:

-

Botswana: Like Namibia, Botswana has high solar potential but is heavily reliant on energy imports. Its stable economy and strong trade ties make it a primary export target.

-

Zambia: Facing significant power shortages, Zambia is actively seeking renewable energy solutions to power its crucial mining sector and support its population.

-

South Africa: Despite having its own manufacturing capacity, South Africa’s ongoing energy crisis (load shedding) has sparked an unprecedented demand that domestic production cannot meet alone. A Namibian supplier can offer a nimble and reliable alternative.

Navigating Trade Agreements and Tariffs

Manufacturing within the SADC region offers significant advantages. The SADC Free Trade Area is designed to reduce or eliminate tariffs on goods produced within member states, potentially giving a Namibian-made solar module a cost advantage over imports from Asia or Europe.

Success, however, depends on more than a quality product. It demands a deep understanding of import regulations, logistics, and the necessary [solar factory certifications] needed to access these markets. Building relationships with distributors and project developers in each target country is essential for sustainable export growth.

A Practical Business Case: What This Means for an Investor

Turning market data into a viable business strategy requires a phased approach and a clear understanding of production scale.

Phased Market Entry Strategy

Based on experience from J.v.G. turnkey projects, a logical market entry plan often follows three phases:

-

Secure an Anchor: Focus initial efforts on securing a supply contract for a large domestic project, either a utility-scale plant or a portfolio of C&I installations. This de-risks the investment and proves the production line’s capability.

-

Dominate the Domestic C&I Market: Use the credibility from the anchor project to build a strong reputation within Namibia’s C&I sector, emphasizing local presence and support.

-

Initiate Targeted Exports: Begin exporting to the most accessible and stable neighbouring markets, such as Botswana, before expanding into more complex territories.

Production Capacity Considerations

The initial [production capacity of a solar module factory] should directly reflect the market opportunity. A 50 MW per year facility, for example, is large enough to supply a medium-sized utility project or a significant share of Namibia’s annual C&I demand. This scale is substantial enough to achieve economies of scale while remaining manageable for a new entrant. Starting with a well-defined capacity that aligns with a secured offtake agreement is a critical step toward ensuring financial viability.

Frequently Asked Questions (FAQ)

What are the main risks of establishing a solar factory in this market?

The primary risks include competition from established, high-volume international manufacturers, potential shifts in government policy, and logistical challenges related to importing raw materials. A thorough risk mitigation strategy is a critical part of a successful business plan.

Are there explicit local content requirements in Namibia?

Currently, local content is encouraged but not always strictly mandated with specific percentages. However, the trend across Africa is toward stronger local content requirements. Establishing local production now could therefore create a significant future competitive advantage.

How important is a ‘Made in Namibia’ label?

A local brand can be a powerful asset. It appeals to national pride, simplifies procurement for government and state-owned entities, and assures C&I customers of local after-sales support. This can often justify a slight price premium over imports.

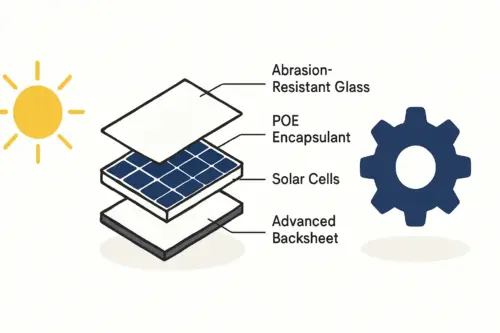

What kind of solar module technology is best for this region?

The climate demands robust and durable technology. Modules designed for high-temperature performance and resistance to dust and arid conditions, such as glass-glass modules or those with highly durable backsheets, are generally preferred.

Conclusion and Next Steps

Namibia offers a compelling, dual-opportunity market for solar module manufacturing. A strong and growing domestic demand provides a stable foundation, while the country’s strategic position serves as a launchpad for accessing the energy-hungry SADC region. For the right investor, this combination presents a unique opportunity to build a resilient and impactful enterprise.

Successfully navigating this path requires meticulous planning. To validate the opportunity, the essential next steps are a thorough feasibility study and a robust business plan. The pvknowhow.com platform provides structured resources, such as a free introductory e-course, to guide you through this complex but rewarding planning phase.