An entrepreneur considering a solar module factory in Namibia is naturally drawn to the country’s immense potential. With over 300 days of sunshine a year, the market driver is clear.

Once the vision takes shape, however, a foundational question arises: where will the raw materials come from? Can a factory rely on local industry, or is an international supply chain necessary?

This question goes beyond logistics—it’s central to the financial viability and product quality of the entire operation. Here, we’ll examine the practical realities of sourcing for a new solar module assembly plant in Namibia, weighing the potential of the local market against the necessity of global imports.

The Anatomy of a Solar Module: Key Raw Materials

Before analyzing supply chains, it helps to understand what constitutes a solar module. A solar panel is not a single item but an assembly of precisely engineered components. These are detailed in the bill of materials (BOM), which forms a core part of any manufacturing plan.

The primary materials required include:

- Solar Glass: A specialized, low-iron, tempered glass with high light transmittance.

- Aluminum Frames: Extruded aluminum profiles that provide structural integrity.

- Encapsulants: Polymer sheets (typically EVA or POE) that laminate the components and protect the solar cells from moisture and impact.

- Backsheet: A multi-layered polymer sheet that acts as the rearmost barrier, providing mechanical protection and electrical insulation.

- Junction Box: An enclosure on the back of the module containing bypass diodes and output cables.

- Solar Cells: The core component that converts sunlight into electricity. These are almost always imported, as cell manufacturing is a distinct and highly capital-intensive industry.

This breakdown is the first step in developing a sourcing strategy, as each component has unique manufacturing requirements that determine its likely origin.

Evaluating Namibia’s Local Sourcing Potential

Namibia possesses significant raw mineral wealth, a fact that can be misleading when assessing its capacity to supply a high-tech manufacturing facility.

The Promise: Raw Mineral Wealth

The country has a well-established mining sector, a cornerstone of its economy. It is a major producer of diamonds, uranium, zinc, and copper. In theory, its copper resources could be used for interconnect ribbons, and potential bauxite deposits could be processed into aluminum for frames.

The Reality: Industrial Processing Gaps

The primary challenge lies in the gap between raw mineral extraction and specialized industrial manufacturing. According to World Bank data, Namibia’s manufacturing sector contributes approximately 11% to its GDP and is largely focused on food processing (meat, fish) and beverages.

This industrial profile reveals several critical gaps for a solar module manufacturer:

- Solar Glass: Producing high-quality solar glass requires specialized furnaces and processing lines not available in the standard glass industry.

- Aluminum Frames: While raw aluminum may be available regionally, the precision extrusion and anodization required for solar frames demand specific industrial capabilities.

- Encapsulants & Backsheets: These are advanced petrochemical products. As Namibia is a net importer of refined chemicals and plastics, local production is not currently feasible.

While the raw materials may exist within the country’s geology, the industrial capacity to convert them into the certified, high-purity components needed for solar modules is limited. For a new enterprise, a local sourcing strategy for major components is simply not a viable starting point.

The Import-Based Strategy: Leveraging Namibia’s Logistical Strengths

Acknowledging the need for imports isn’t a setback; it’s a strategic decision that leverages Namibia’s key logistical strengths. A successful operation depends on establishing reliable, efficient international import channels.

Namibia’s infrastructure is well-suited for this approach. The country has a well-developed road network and, crucially, the deep-water Port of Walvis Bay. This port serves as a strategic gateway not only for Namibia but for neighboring landlocked countries like Botswana, Zambia, and Zimbabwe.

For a solar manufacturer, this makes sourcing components from established global hubs in Asia and Europe a manageable logistical exercise. This approach ensures access to high-quality, certified materials from suppliers with proven track records—essential for producing reliable and bankable solar modules.

Experience from J.v.G. turnkey projects shows that creating a robust import framework is a foundational step for new manufacturers in emerging markets. In fact, setting up a turnkey solar manufacturing line often includes initial assistance in establishing these critical supply relationships.

Financial Implications: The Cost of Sourcing

The decision to import is also driven by financial logic. While sourcing locally might seem cheaper by avoiding shipping costs, the reality is more complex.

- Economies of Scale: Global component suppliers produce millions of units, achieving cost efficiencies that a small, new local producer cannot match.

- Quality & Certification: Established international suppliers provide materials that meet stringent IEC certification standards. Using uncertified local materials would risk the final product’s bankability and could lead to high failure rates.

- Total Cost of Ownership: The slightly higher upfront cost of importing certified materials is often offset by lower defect rates, higher module efficiency, and a longer product lifespan, resulting in a lower total cost per watt produced.

A detailed financial analysis, a critical part of a solar module manufacturing business plan, typically confirms that an import-based model provides greater financial predictability and lower risk.

A Phased Approach: Building a Sustainable Supply Chain

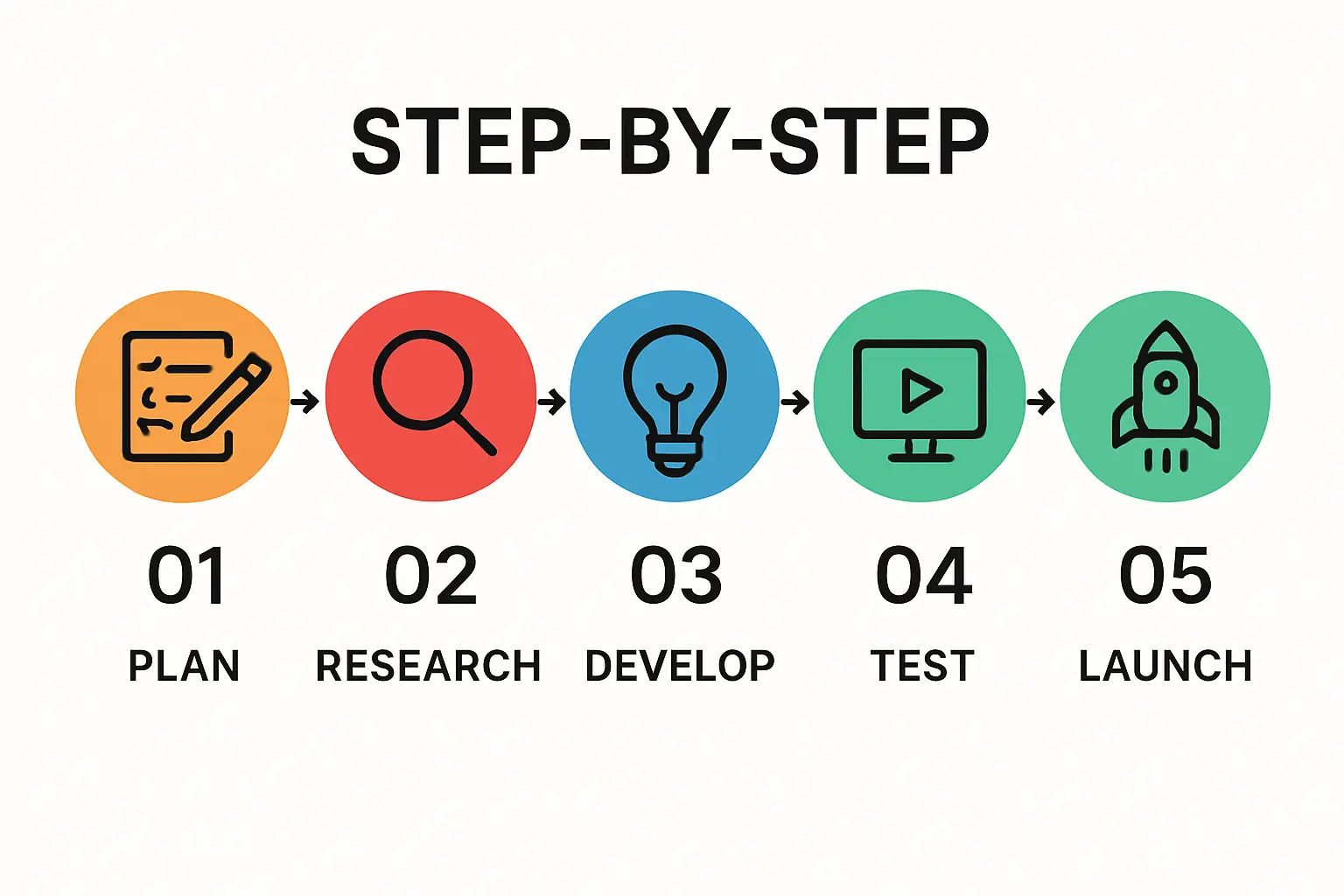

The most pragmatic approach for a new manufacturer in Namibia is a phased strategy that balances global reliability with long-term local potential.

Phase 1: Import-Dominant Foundation

Start by importing 100% of the critical components from certified, pre-qualified international suppliers. This is the fastest and lowest-risk path to beginning production and ensuring the finished modules meet international quality standards. The entire solar panel manufacturing process must be built around these high-quality inputs.

Phase 2: Regional and Local Exploration

Once the factory is operational and generating revenue, the business can begin exploring local or regional sourcing for less critical items. This could include packaging materials (cardboard, plastics) or, eventually, aluminum frames if a local extrusion industry develops to the required specification. Sourcing from within the Southern African Customs Union (SACU), for instance, could become a viable option for certain items over time.

This phased approach allows the business to launch with a high-quality product while keeping an eye on future opportunities to increase local content and support the domestic economy.

Frequently Asked Questions (FAQ)

Q1: Can standard glass from a local supplier be used for solar panels?

A1: No. Solar glass is a highly specialized product. It must be low-iron to maximize light transmission and tempered for strength and safety. Using standard architectural glass would significantly reduce the module’s efficiency and durability and prevent it from passing international certification tests.

Q2: Are solar cells manufactured in Namibia?

A2: Solar cell manufacturing is a separate, highly complex process akin to semiconductor fabrication. It requires immense capital investment and a different set of technical expertise than module assembly. Nearly all new module assembly factories globally, regardless of location, import solar cells from specialized manufacturers.

Q3: How does being a member of the SACU affect sourcing?

A3: Membership in the Southern African Customs Union (SACU) can simplify trade and reduce tariffs when sourcing materials from member countries like South Africa. While South Africa has a more developed industrial base than Namibia, it may not produce all the specialized components needed. For the most critical materials like cells, encapsulants, and backsheets, sourcing from established global leaders remains the standard practice.

Q4: What is the biggest supply chain risk for a new factory in Namibia?

A4: The primary risks are logistical delays (shipping, customs clearance) and currency exchange rate fluctuations. These can be mitigated through careful planning, such as maintaining a buffer stock of critical materials (e.g., 4–6 weeks of production) and using financial instruments to hedge against currency volatility.

Conclusion: From Raw Materials to a Finished Product

For an entrepreneur planning to launch a solar module factory in Namibia, the path forward is clear. The most viable, lowest-risk, and financially sound strategy is to build the business on a foundation of imported, high-quality, certified raw materials. The country’s excellent port and transport infrastructure are key assets that make a global supply chain strategy entirely feasible.

While a long-term goal may be to increase local content, the immediate priority must be producing a world-class product. Recognizing this supply chain reality is a critical step in developing a comprehensive business plan for a successful and sustainable manufacturing operation in one of Africa’s most promising solar markets.