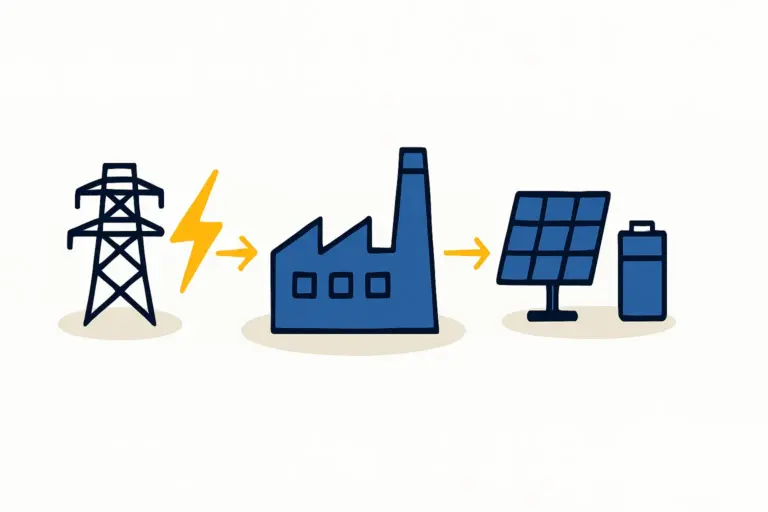

An investor plans to establish a solar module factory in Nepal, a country with immense solar potential. With a solid business plan and financing in the works, a critical question takes center stage: where exactly should the factory be located?

While choosing a plot of land might seem like a simple real estate transaction, for a capital-intensive venture like solar manufacturing, it’s one of the most strategic decisions an entrepreneur can make. The right location can streamline logistics, reduce operational costs, and unlock significant financial incentives, while the wrong one can create persistent operational bottlenecks.

This article lays out a framework for evaluating potential sites in Nepal, focusing specifically on the country’s designated Special Economic Zones (SEZs). We will compare key locations and outline the critical factors that should inform this foundational decision.

The Strategic Importance of Site Selection

The physical location of a manufacturing facility directly influences its long-term viability. This decision extends far beyond the initial land cost, impacting nearly every aspect of the operation:

-

Supply Chain Efficiency: Proximity to international borders and transportation hubs determines the cost and speed of importing raw materials like solar cells, glass, and aluminum frames.

-

Market Access: The ease of transporting finished solar modules to domestic or, more importantly, export markets is a key competitive factor.

-

Operational Costs: The availability and cost of essential utilities like electricity and water, and of the local labor pool, can vary significantly between regions.

-

Regulatory Environment: Operating within a designated economic zone often provides a more favorable regulatory and fiscal framework.

A thorough analysis of these factors is a cornerstone of a successful solar panel manufacturing business plan, as the location underpins all financial projections and operational forecasts.

Understanding Nepal’s Special Economic Zones (SEZs)

To attract foreign investment, promote industrialization, and boost exports, the Government of Nepal established the legal framework for Special Economic Zones through the SEZ Act of 2016 (later amended in 2019).

An SEZ is a geographically designated area with economic laws that are more liberal than those applied domestically. The primary objective of Nepal’s SEZs is to provide a hassle-free, incentive-rich environment for export-oriented industries. For an investor in the solar sector, this is a compelling value proposition.

Key Criteria for Evaluating SEZs for Solar Manufacturing

Assessing a potential SEZ for a solar factory requires a systematic evaluation of several key criteria.

Infrastructure and Utilities

A modern factory cannot function without reliable infrastructure.

-

Power Supply: Consistent, high-quality electricity is non-negotiable for running sensitive manufacturing equipment. Investors should verify the stability of the grid connection within the SEZ and the availability of dedicated feeders.

-

Water and Waste Management: The solar panel manufacturing process requires water for cleaning and cooling. Adequate supply and proper wastewater treatment facilities are essential.

-

Connectivity: High-quality road networks connecting the SEZ to national highways, border crossings, and airports are crucial for the movement of goods and personnel.

Logistics and Supply Chain

As a landlocked country, Nepal’s logistics are heavily dependent on its neighbors, primarily India.

-

Proximity to Borders: An SEZ located near a major border crossing with India significantly reduces transit times and costs for both inbound raw materials and outbound finished products.

-

Customs Facilities: SEZs offer streamlined customs clearance processes, often through a ‘one-stop service’ center. This can drastically reduce the administrative burden and delays commonly associated with cross-border trade.

Labor Availability

Access to a sufficiently large and trainable workforce is another critical factor. The Terai region, where most of Nepal’s SEZs are located, generally has a higher population density, offering a larger labor pool compared to the hill or mountain regions. While specialized technical skills may be limited initially, the availability of a motivated general workforce is a strong starting point.

Government Incentives and Policies

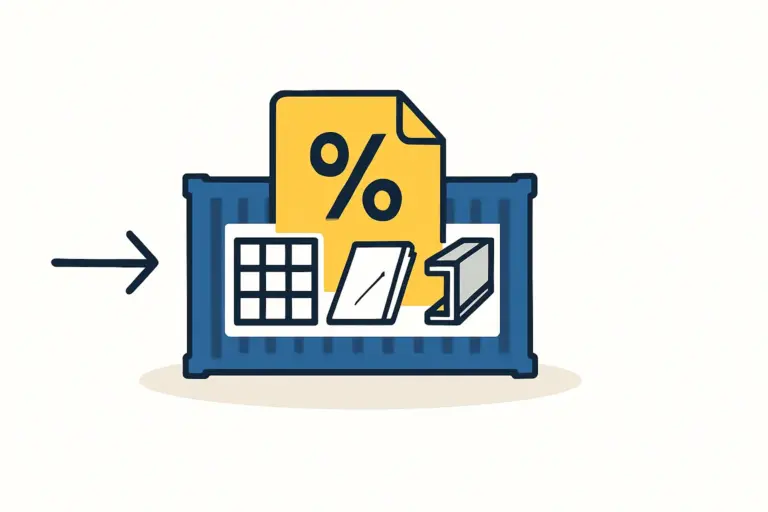

The financial incentives offered within an SEZ are often the most significant advantage. Under the SEZ Act, industries established within these zones are typically entitled to:

-

Tax Holidays: Complete income tax exemptions for a number of years, followed by a partial exemption for a subsequent period.

-

Duty and Tax Exemptions: Exemption from Value Added Tax (VAT), customs duty, and excise duty on the import of raw materials and capital goods, such as solar manufacturing equipment.

-

Simplified Repatriation: A clear and simplified process for repatriating investment profits and dividends.

-

Procedural Ease: A ‘one-stop service’ to handle company registration, permits, and other administrative requirements, intended to reduce bureaucratic friction.

A Comparative Look: Bhairahawa SEZ vs. Simara SEZ

A look at Nepal’s most prominent SEZs through this framework reveals distinct advantages for each, depending on an investor’s specific business model.

Bhairahawa SEZ

The Bhairahawa SEZ was the first to become operational in Nepal and is strategically located in the western Terai region.

-

Location Advantage: Its primary strength is its immediate proximity to the Sunauli-Bhairahawa border, one of the busiest trade points with India. The zone is also adjacent to the Gautam Buddha International Airport, offering air cargo capabilities.

-

Logistics Focus: This location is ideal for a business model that relies heavily on road transport for importing raw materials from India and exporting finished modules to the vast Indian market. Experience from J.v.G. turnkey projects in similar regions confirms that minimizing road transport distance is a major lever for cost control.

-

Best Suited For: Enterprises prioritizing access to the Indian market and supply chain.

Simara SEZ

Located in the central Terai, the Simara SEZ is part of the country’s most significant industrial corridor, stretching from Pathlaiya to Birgunj.

-

Location Advantage: Simara’s key advantage is its proximity to the Birgunj Inland Container Depot (ICD), or ‘dry port’, the main entry point for containerized cargo arriving by sea via Indian ports like Kolkata.

-

Logistics Focus: This makes Simara the superior choice for manufacturers who plan to import the majority of their raw materials or machinery from China or other overseas markets via sea freight. The direct rail link from Indian seaports to the Birgunj ICD is a critical logistical asset.

-

Best Suited For: Enterprises with a global supply chain that relies on sea freight for imports.

Frequently Asked Questions (FAQ)

-

What is the primary advantage of an SEZ over a regular industrial area?

The main advantages are financial incentives, such as multi-year tax holidays and customs duty exemptions on imported machinery and raw materials. Additionally, the ‘one-stop service’ model aims to significantly simplify administrative and regulatory processes. -

Are there restrictions on selling solar modules within Nepal if manufactured in an SEZ?

Yes. SEZs are fundamentally export-oriented. The SEZ Act mandates that industries must export a significant portion of their production (currently set at 60%) to be eligible for the incentives. This requirement is a crucial consideration for any business plan. -

How long does the approval process for an SEZ application typically take?

While the one-stop service is designed to expedite approvals, investors should be prepared for bureaucratic procedures. Timelines can vary, and investors should account for potential administrative delays in the project planning phase. -

Is 100% foreign ownership of a company permitted in a Nepali SEZ?

Yes, the SEZ framework is specifically designed to attract Foreign Direct Investment (FDI), and it allows for 100% foreign ownership of enterprises operating within the zones.

Conclusion: Making the Right Choice

The selection of a manufacturing site in Nepal is not a choice between a ‘good’ and a ‘bad’ location. Instead, it’s about aligning the specific advantages of a location—be it Bhairahawa, Simara, or another emerging zone—with the strategic priorities of your business.

An enterprise focused on exporting to the Indian market will find Bhairahawa’s location compelling. In contrast, a company sourcing materials globally via sea freight will likely benefit more from Simara’s proximity to the Birgunj dry port.

For any serious investor, the next logical step is to move from this general analysis to a detailed feasibility study. This involves on-the-ground assessment, detailed cost-benefit analysis, and engagement with local authorities to validate all assumptions before committing capital. A well-researched site selection decision lays the foundation for a resilient and profitable solar manufacturing operation.