An entrepreneur considering a new venture often looks for a confluence of market demand and strategic support. In New Zealand, the government’s commitment to achieving net-zero emissions by 2050 has created precisely this environment for the clean technology sector. For those exploring how to start a solar panel company, understanding the available financial incentives is not just an advantage but a critical component of strategic planning.

This article outlines the key government-backed investment bodies in New Zealand, aimed at entrepreneurs planning to establish solar module manufacturing operations. It focuses on how to leverage these programmes to secure foundational capital and de-risk the initial stages of development.

The Policy Foundation: Why New Zealand Supports Clean Technology

The primary driver behind New Zealand’s green investment landscape is the Climate Change Response (Zero Carbon) Amendment Act 2019. This legislation codifies the nation’s commitment to reducing greenhouse gas emissions and transitioning to a low-carbon economy.

This policy creates a stable, long-term framework that encourages private investment in sectors aligned with this goal. For a solar manufacturing facility, this means its output directly aligns with national strategic priorities, making it an attractive candidate for the financial instruments designed to accelerate this transition.

Understanding Government-Backed Investment vs. Grants

Understanding the distinction between a government grant and a government-backed investment is essential. While grants are non-repayable funds awarded for specific purposes, investment bodies operate on a commercial basis. They provide capital with the expectation of a financial return, acting as a strategic investment partner rather than a benefactor.

Entities like New Zealand Green Investment Finance (NZGIF) are mandated to invest in commercially viable projects that also deliver significant emissions reductions. They aim to ‘crowd in’ private capital by demonstrating the profitability of green projects, thereby building a self-sustaining market. This approach ensures public funds are recycled into new projects, multiplying their impact over time.

Key Funding Bodies for a Solar Manufacturing Venture

Several key organisations form the backbone of New Zealand’s clean technology funding ecosystem. Prospective solar manufacturers should be familiar with the mandate and offerings of each.

New Zealand Green Investment Finance (NZGIF): The Commercial Catalyst

Established by the government as a green investment bank, NZGIF is a primary source of capital for decarbonisation projects. Its core mission is to accelerate investment in technologies and businesses that lower emissions.

Investment Mandate: NZGIF invests in commercially sound projects that have a demonstrable impact on decarbonisation. This makes local solar manufacturing an ideal fit, as it builds domestic capacity for renewable energy generation.

Business-Relevant Metrics: The organisation typically invests in the range of NZ$2 million to NZ$25 million per transaction. It offers flexible capital solutions—including debt, equity, and hybrid instruments—tailored to a project’s needs. This range is well-suited for the initial investment for solar panel manufacturing required to set up a small to medium-scale production line.

Key Criteria for Applicants:

- Commercial Viability: The project must be based on a sound business model with a clear path to profitability.

- Decarbonisation Impact: The proposal must quantify its expected contribution to reducing New Zealand’s emissions.

- Market Demonstration: The project should ideally pave the way for further private investment in the sector.

Callaghan Innovation: De-Risking Your Technology

Callaghan Innovation, New Zealand’s innovation agency, helps businesses succeed through technology. For a solar manufacturer, its programmes are instrumental in the research and development phase.

R&D Tax Incentive: This programme provides a 15% tax credit on eligible R&D expenditure. For a startup, this can significantly lower the cost of optimising the solar panel manufacturing process or developing modules tailored to local conditions.

Innovation Grants: Programmes such as the Ārohia Innovation Trailblazer Grant support ambitious R&D projects that are new to New Zealand or the world. This can be a pathway for companies looking to introduce advanced module technologies.

Energy Efficiency and Conservation Authority (EECA): Optimising Your Operations

EECA’s mandate is to promote energy efficiency and conservation. Its Government Investment in Decarbonising Industry (GIDI) Fund is particularly relevant.

While the GIDI Fund primarily targets emission reductions from industrial process heat, a solar module factory has energy-intensive stages, such as cell stringing and lamination. A proposal that incorporates high-efficiency, low-emissions equipment for these processes could potentially qualify for co-funding, reducing the facility’s operational costs and carbon footprint from day one.

Preparing a Successful Funding Application

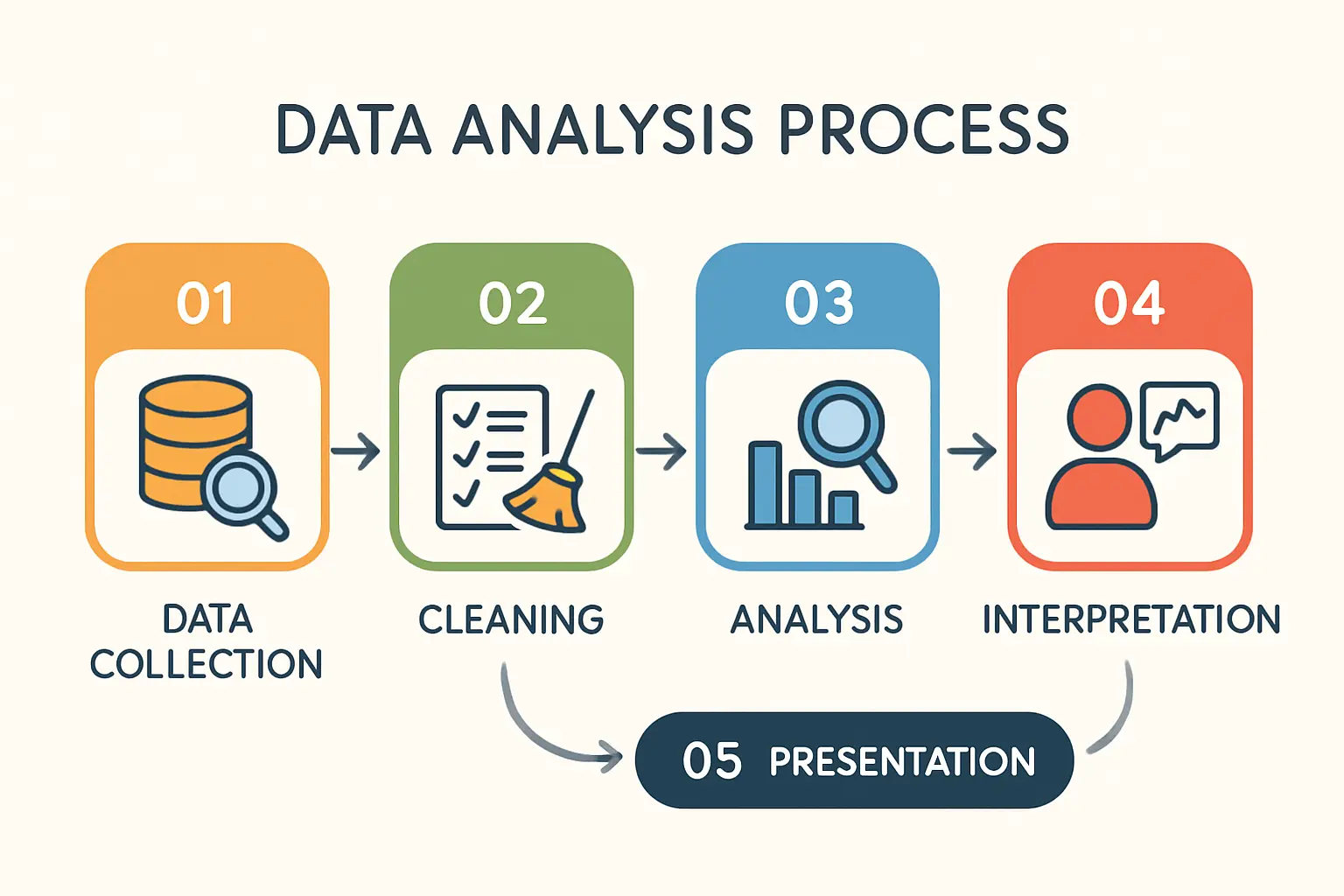

Securing investment from these bodies requires a professional and thorough approach. They are not passive sources of capital; they are sophisticated investors conducting rigorous due diligence.

A compelling application must be backed by a robust solar panel manufacturing business plan. This document should clearly articulate the market opportunity, the technical feasibility of the project, detailed financial projections, and the experience of the management team.

Key elements that reviewers will assess include:

- A Robust Business Case: A clear explanation of the commercial opportunity and competitive landscape.

- Quantifiable Decarbonisation Impact: Specific calculations showing the emissions reductions your project will enable.

- Technical and Commercial Due Diligence: Evidence that the technology is proven and the financial model is sound.

Based on experience from J.v.G. turnkey projects, having a detailed and well-researched plan is the single most important factor in attracting serious investment interest, whether public or private.

The Government’s Role in Building a Local Supply Chain

By providing these financial instruments, the New Zealand government is not just funding individual companies; it is strategically building a domestic supply chain for its clean energy transition. Local manufacturing reduces reliance on international markets, creates skilled jobs, and ensures the economic benefits of the energy transition are retained within New Zealand.

For an entrepreneur, this alignment with national policy provides a powerful tailwind. A project that contributes to energy security and local economic development is more likely to be viewed favourably by government-backed investment bodies.

Frequently Asked Questions (FAQ)

Is this government funding free?

No. Organisations like NZGIF are commercial investors, not grant providers. They provide capital in the form of loans or equity and expect a financial return, similar to a private-sector investment fund.

What is the first step I should take?

The foundational step is to develop a comprehensive business plan. This document is essential for engaging with any potential investor, as it outlines the project’s vision, financial viability, and technical plan.

How long does the application process typically take?

The process can take several months. It involves initial expressions of interest, detailed proposals, and a rigorous due diligence phase where the investor verifies all aspects of your business case.

Do I need a technical background in solar to apply?

While a technical understanding is beneficial, it is not a prerequisite. The key requirement is a credible and well-documented technical plan, often developed with experienced engineering partners or consultants who can provide the necessary expertise.

What investment size is NZGIF interested in?

NZGIF’s typical investment size is between NZ$2 million and NZ$25 million. Projects requiring capital outside this range may still be considered, but this represents their core focus area.

Conclusion: The Path Forward

New Zealand offers a uniquely supportive environment for entrepreneurs aiming to enter the solar manufacturing industry. Through institutions like NZGIF, Callaghan Innovation, and EECA, the government has created clear pathways for securing the capital and technical support needed to launch a successful venture.

However, access to these funds hinges on commercial rigour. Success depends on presenting a professional, well-researched, and financially sound business case that aligns with New Zealand’s long-term decarbonisation goals. For the prepared entrepreneur, this represents a significant opportunity to build a valuable business while contributing to a sustainable future.