For entrepreneurs looking to enter the solar manufacturing sector, evaluating a country’s regulatory framework is as critical as assessing market demand. While many regions offer incentives, some present a compelling, well-structured case for investment. Nicaragua is a standout example, having transformed its energy landscape through deliberate, long-term policy.

This guide explores Nicaragua’s ‘Law for the Promotion of Electricity Generation with Renewable Sources’ (Law No. 532) and its specific implications for investors planning to establish solar module production facilities. It outlines the significant fiscal benefits available and the process for securing them, providing clarity for professionals assessing this strategic opportunity.

Understanding Nicaragua’s Strategic Shift to Renewable Energy

Less than two decades ago, Nicaragua was heavily dependent on fossil fuels, which accounted for over 75% of its electricity generation. Today, the country has achieved a remarkable reversal, with renewables now consistently contributing over 70% to its energy mix. This transformation was not accidental; it was driven by the clear public policy vision behind Law No. 532.

Enacted in 2005 and subsequently refined, this legislation was designed to attract private investment into the renewable energy sector. By establishing a robust framework of tax exemptions and fiscal benefits, it created a stable and predictable environment for investors. The successful implementation of this law is overseen by key government bodies, including the Ministry of Energy and Mines (MEM) and the Ministry of Finance and Public Credit (MHCP), ensuring a structured pathway for new projects.

Key Fiscal Incentives of Law No. 532 for Solar Manufacturers

For an investor, the primary appeal of Law No. 532 is its direct impact on a project’s financial viability. The law provides substantial exemptions that reduce both initial capital expenditure and the long-term tax burden. For a new solar module factory, these benefits are comprehensive.

Exemption from Import Duties (DAI and ISC)

During the pre-investment and construction phases, the law grants a full exemption from customs duties on imports. This includes the general tariff applied to imported goods (DAI) and the selective consumption tax (ISC). This exemption applies directly to all imported machinery and equipment required to set up a production line, as well as the materials and supplies essential for construction. This benefit significantly lowers initial setup costs, a critical factor for any new manufacturing venture.

Value Added Tax (VAT) Exemption

The law provides an exemption from the 15% Value Added Tax (VAT) on local purchases of goods and services during the same pre-investment and construction periods. This benefit complements the import duty exemptions by minimizing costs associated with local sourcing, from construction contractors to material suppliers.

Income Tax (IR) Exemption

Perhaps the most significant long-term benefit is the exemption from Income Tax (IR) payments. New projects approved under Law No. 532 are exempt from paying income tax for up to seven years from the start of commercial operations. This tax holiday allows a new enterprise to reinvest early profits, accelerate growth, and establish a stronger financial footing more quickly.

Municipal Tax Exoneration

The fiscal incentives also extend to the local level. The law provides an exoneration from municipal taxes on any real estate directly associated with the manufacturing project. This reduces ongoing operational overhead and further enhances the financial attractiveness of the investment.

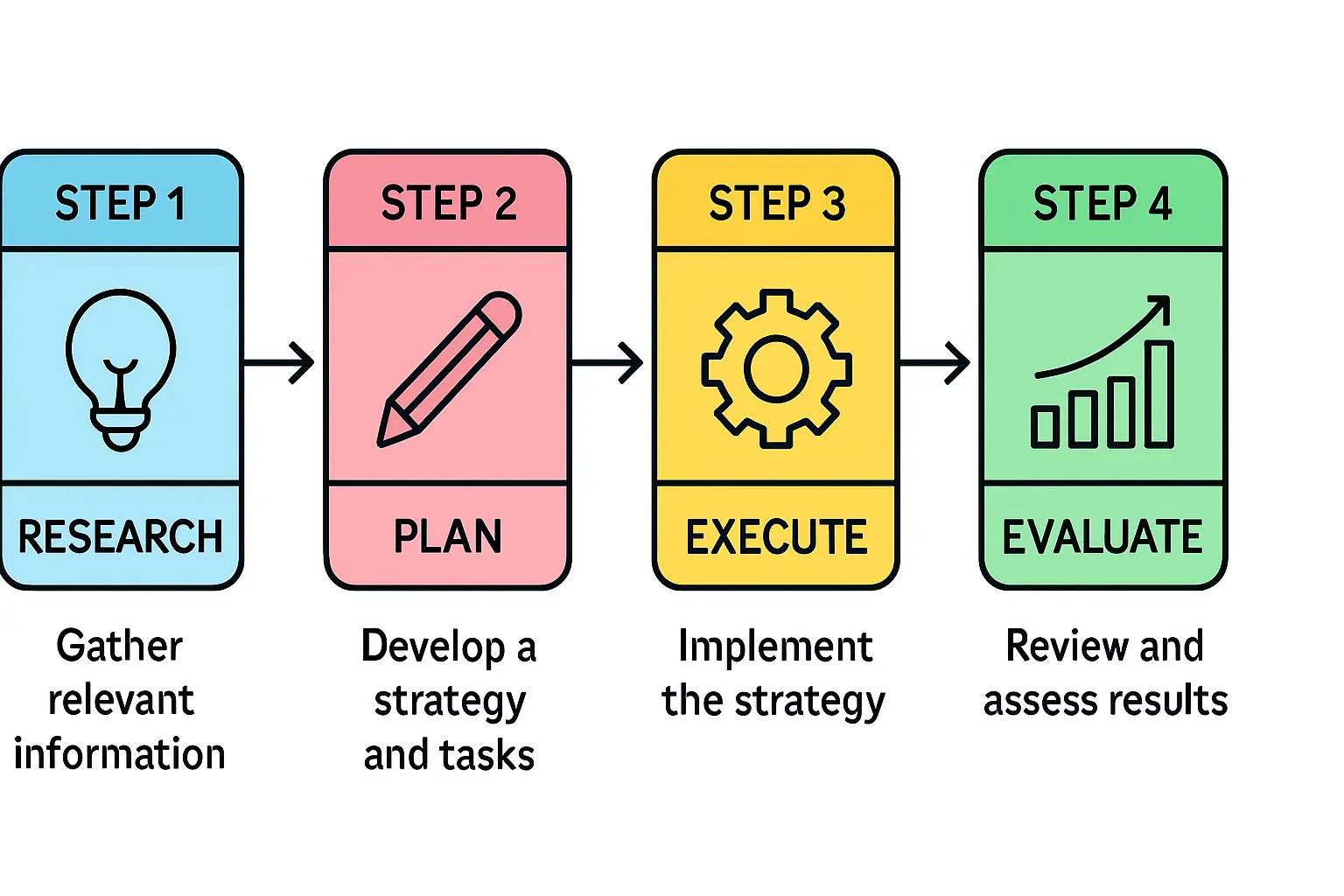

The Process of Securing Eligibility: A Step-by-Step Overview

Nicaragua has established a clear administrative process for investors to access the benefits of Law No. 532. While diligent preparation is required, the pathway is well-defined.

The Role of the Ministry of Energy and Mines (MEM)

The initial application is submitted to the MEM, which is responsible for the technical evaluation of the project, ensuring it aligns with the country’s renewable energy goals. The MEM issues a technical endorsement, or ‘aval,’ which serves as the foundation for the steps that follow.

Approval from the Ministry of Finance and Public Credit (MHCP)

Once the MEM provides its technical approval, the investor presents the project to the MHCP. The MHCP reviews the financial aspects and formally grants the fiscal incentives and tax exemptions detailed in the law. This approval is formalized in a Ministerial Agreement, providing the investor with a legal guarantee of the benefits.

Navigating the ‘Ventanilla Única’ (Single Window for Investment)

To facilitate this process, Nicaragua utilizes a ‘Ventanilla Única de Inversión,’ or Single Window for Investment. Managed by the state investment promotion agency ProNicaragua, this system is designed to centralize and streamline the necessary procedures, reducing bureaucratic hurdles for foreign investors. Navigating these administrative steps is a critical part of the planning process, which is why structured guidance, like that offered through pvknowhow.com’s e-learning courses, can be invaluable for first-time investors.

Beyond the Law: Why Nicaragua Presents a Strategic Opportunity

While the fiscal incentives are compelling, the broader context makes Nicaragua a strategic location for solar manufacturing.

Growing Regional Demand

The country is part of the Central American Electrical Interconnection System (SIEPAC), which provides access to a larger regional market. A manufacturing facility in Nicaragua is well-positioned to supply modules not only to the domestic market but also to neighboring countries expanding their solar capacity.

A Stable and Supportive Regulatory Environment

The longevity and consistent application of Law No. 532 signal a stable and reliable policy environment. This predictability is a key consideration for long-term capital investments. For an entrepreneur, this reduces political risk and provides the confidence needed to establish a solar panel manufacturing plant with a long-term vision.

Frequently Asked Questions (FAQ)

What is the primary purpose of Law No. 532?

Its main goal is to promote private investment in Nicaragua’s renewable energy sector by offering a comprehensive package of fiscal incentives and, in turn, reduce the country’s reliance on fossil fuels.

Do these benefits apply to operational costs after the factory is built?

The most significant benefits, such as exemptions from import duties and VAT, are focused on the pre-investment and construction phases. However, the income tax exemption applies for up to seven years after operations begin, directly benefiting the project’s profitability.

Is this law only for large-scale energy producers?

No. The law explicitly covers not only electricity generation projects but also the manufacturing of equipment used for renewable energy generation, making it directly applicable to investors seeking to establish new solar module factories.

How long does the approval process typically take?

Timelines can vary with the complexity of the project and the completeness of the application. However, the ‘Ventanilla Única’ system is designed to streamline the process and make it as efficient as possible for qualified investors.

A thorough understanding of frameworks like Law No. 532 is the first step toward building a successful and sustainable enterprise in the global solar sector. For investors ready to move from initial research to detailed planning, the logical next step is understanding the investment required for solar panel manufacturing. This knowledge helps create a robust business plan that fully leverages the opportunities available in supportive regulatory environments like Nicaragua’s.