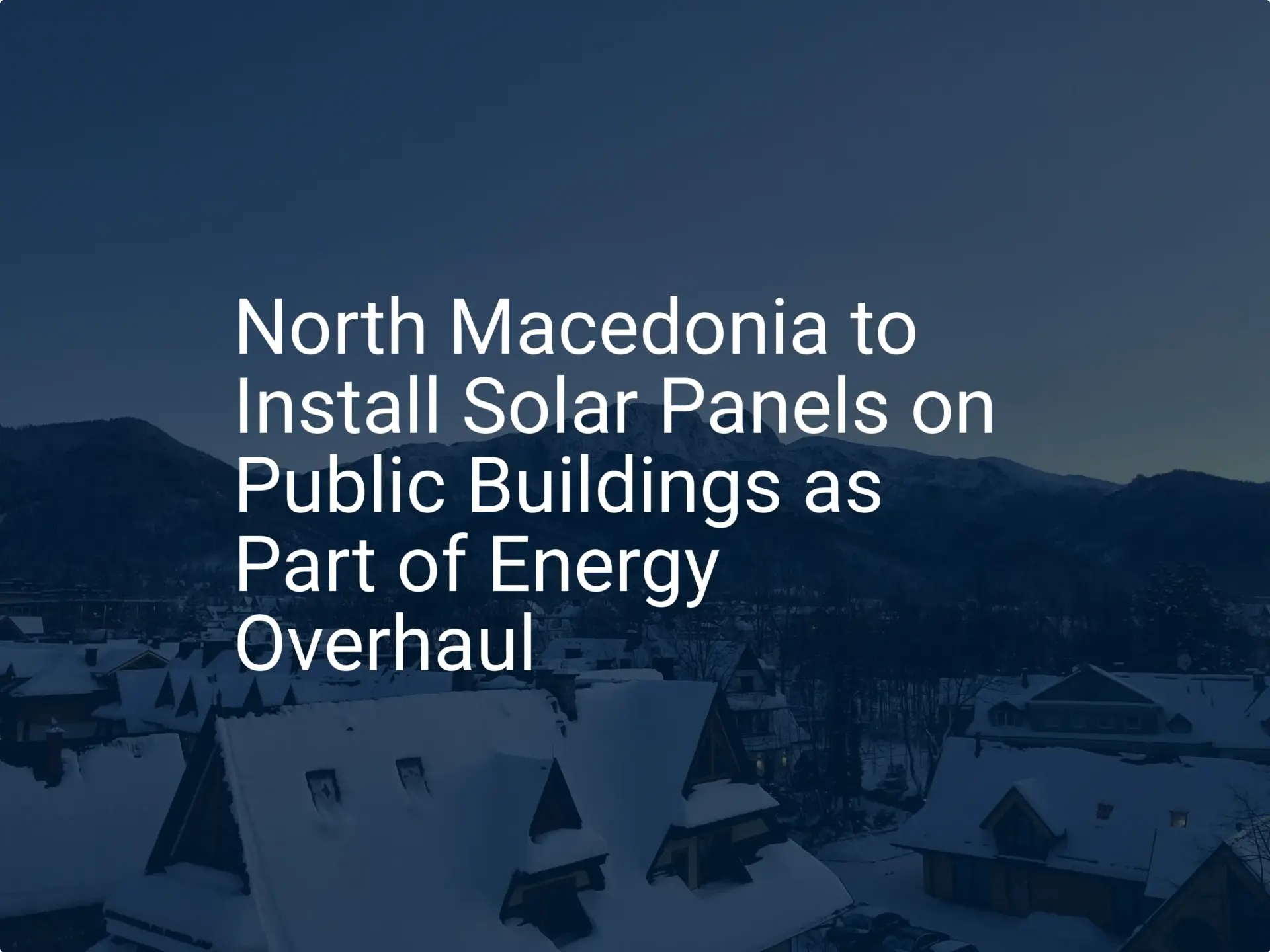

For entrepreneurs entering the solar industry, the choice of location is a critical decision with long-term financial consequences. While factors like market access and labor are vital, government incentives can significantly alter the business case for a new manufacturing facility. An often-overlooked yet highly competitive option is North Macedonia, which has developed a robust framework to attract foreign investment in its Technological Industrial Development Zones (TIDZ).

This guide breaks down the financial and operational advantages offered within these zones, providing a clear, factual analysis for business professionals evaluating locations for a new solar module factory. We will examine the tax exemptions, state aid grants, and cost structures that make North Macedonia a compelling proposition.

The Strategic Advantage of Location: Why North Macedonia?

Situated in the heart of Southeast Europe, North Macedonia offers a unique geographical advantage. Its location provides efficient access to established markets in the European Union and growing markets in the Balkans and the Middle East. For an export-focused manufacturing business, this proximity translates into shorter transport times, reduced logistics costs, and more resilient supply chains.

This central position is complemented by the government’s dedicated efforts to create a favorable business environment, with the TIDZ program serving as the cornerstone of its foreign investment strategy.

Understanding the Technological Industrial Development Zones (TIDZ)

The TIDZ are designated areas within North Macedonia that operate under a unique set of economic regulations. Designed as free economic zones, they provide an attractive package of incentives for companies building production facilities within their boundaries. The primary goal is to stimulate export-oriented manufacturing, technology transfer, and job creation by offering significant financial and administrative benefits to investors.

For a capital-intensive venture like a solar module factory, the benefits of a TIDZ can substantially reduce both initial setup costs and long-term operational expenses.

A Detailed Analysis of TIDZ Financial Incentives

The incentive package is multi-layered, combining long-term tax relief with direct financial support and duty exemptions. This structure is designed to de-risk the initial investment and improve profitability during the critical first decade of operations.

Corporate and Personal Tax Exemptions

One of the most significant advantages is a 10-year tax holiday. Companies operating within a TIDZ are exempt from:

-

Corporate Profit Tax: For the first 10 years of operation, a company pays 0% tax on its profits. This allows for rapid reinvestment of earnings into growth, technology upgrades, or market expansion.

-

Personal Income Tax: Employees working for a company within a TIDZ are also exempt from personal income tax for 10 years. This helps employers offer more competitive net salaries, making it easier to attract and retain talent.

Customs and VAT Relief

For a solar module manufacturer, the cost of importing machinery and raw materials represents a substantial portion of the initial and ongoing investment. The TIDZ framework directly addresses this with:

-

Exemption from Customs Duties: All imported equipment, machinery, spare parts, and raw materials needed for production are free from customs duties.

-

Exemption from Value-Added Tax (VAT): The same imports are also exempt from VAT, significantly improving cash flow, as capital is not tied up in tax payments awaiting reimbursement.

-

Export Duty Exemption: All finished goods exported from the TIDZ are exempt from export duties, making the final products more price-competitive in international markets.

Property and Land Use Fee Waivers

To further reduce setup costs, TIDZ investors are exempt from paying land use and construction permit fees. They also benefit from a direct connection to essential utilities like gas, water, and sewage systems within the zone, simplifying the initial construction and setup phase.

Beyond Tax Breaks: State Aid and Grant Opportunities

In addition to extensive tax and customs relief, the government of North Macedonia offers direct financial support through state aid. This aid is structured to lower the barrier to entry and support the growth of new enterprises.

Capital Investment Grants

Investors can qualify for non-repayable cash grants that cover a significant portion of their initial capital outlay. The state may provide grants of up to 50% on eligible investment costs. Eligible costs typically include the purchase of machinery and equipment and the construction of the production facility. This direct capital injection can dramatically improve a project’s financial viability and return on investment.

Support for Job Creation and Training

Recognizing that a skilled workforce is essential, the government offers further grants tied to employment, which can range from 2,000 to 4,000 euros for each new job created. Additionally, funds are available to support employee training, ensuring the local workforce develops the specific skills required for modern solar module manufacturing.

Operational Cost Advantages: Labor and Energy

Beyond direct incentives, the underlying operational cost structure in North Macedonia provides a sustainable competitive advantage.

-

Labor Costs: With a national minimum wage of approximately 300 euros per month and an average gross salary around 750 euros per month, labor costs are predictable and highly competitive compared to other European locations.

-

Energy Costs: Stable and affordable energy is crucial for manufacturing. The average price of electricity for industrial users in North Macedonia is approximately 0.08 euros per kilowatt-hour, one of the most competitive rates in the region.

A Practical Example: The Turnkey Factory Model in a TIDZ

The benefits of the TIDZ program come to life in real-world projects. For instance, the Brkic Solar Doo facility in TIDZ Shtip was established with support from J.v.G. Technology GmbH. This project leveraged the full spectrum of TIDZ incentives to build a modern manufacturing plant.

By using turnkey solar production lines, the investor was able to streamline the complex process of factory setup while benefiting from the customs and VAT exemptions on all imported machinery. The combination of state aid and a 10-year tax holiday provided a strong financial foundation for the new venture, illustrating how the TIDZ framework can successfully launch a new player in the European solar market.

Frequently Asked Questions (FAQ)

What is the typical duration of these incentive packages?

The key tax exemptions, including the 0% corporate profit tax and 0% personal income tax, are granted for up to 10 years from the start of operations.

Are these incentives available for any business?

The incentives are specifically designed for new investment projects in export-oriented manufacturing that are established within the geographical boundaries of a designated TIDZ.

How does one apply for these state aid grants?

The application process is managed through the Directorate for Technological Industrial Development Zones. It typically requires submitting a detailed business plan that outlines the investment project, job creation targets, and export strategy.

What are the main requirements for setting up a solar module manufacturing plant in a TIDZ?

The primary steps include incorporating a legal entity in North Macedonia, securing a long-term lease for land within a TIDZ, and presenting a viable investment project that meets the criteria for incentives and state aid.

Conclusion

For entrepreneurs and businesses looking to enter the solar manufacturing sector, North Macedonia’s TIDZ program offers a uniquely comprehensive and financially attractive package. The combination of a decade-long tax holiday, exemptions from customs and VAT on critical inputs, and substantial capital grants creates a low-risk, high-potential environment. Complemented by a strategic location and competitive operational costs, this presents a compelling platform for building a successful, export-focused manufacturing enterprise.

Understanding these details is the first step toward choosing a location for your facility. Further exploration of the specific requirements and application processes will provide a complete picture of the opportunity.