For entrepreneurs and established businesses looking to enter the solar manufacturing sector, securing initial capital is often the most significant hurdle. While the market opportunity is clear, navigating the financial landscape to fund a new production facility can be daunting. This is particularly true in emerging European markets like North Macedonia, a country strategically poised for significant growth in renewable energy.

However, a closer look reveals a structured and supportive ecosystem for such ventures. With the right preparation, securing the necessary investment for a solar module factory in North Macedonia is well within reach. This article outlines the primary financing avenues available, from local banking partners to major international development institutions.

The Strategic Context: Why North Macedonia is an Emerging Hub for Solar Manufacturing

North Macedonia’s potential as a solar manufacturing hub stems from supportive government policy, geographical advantages, and economic development initiatives. As a candidate for EU membership and a signatory to the Energy Community Treaty, the country has committed to aligning its energy sector with European standards, creating a stable regulatory framework for renewable energy investments.

This commitment translates into tangible support for green projects, offering investors a favorable business environment with access to local and regional markets. Proximity to the European Union also provides a significant logistical advantage for exporting finished solar modules, making North Macedonia an attractive nearshoring location to supply the continent’s growing demand.

Key Pillars of Project Financing for Solar Module Production

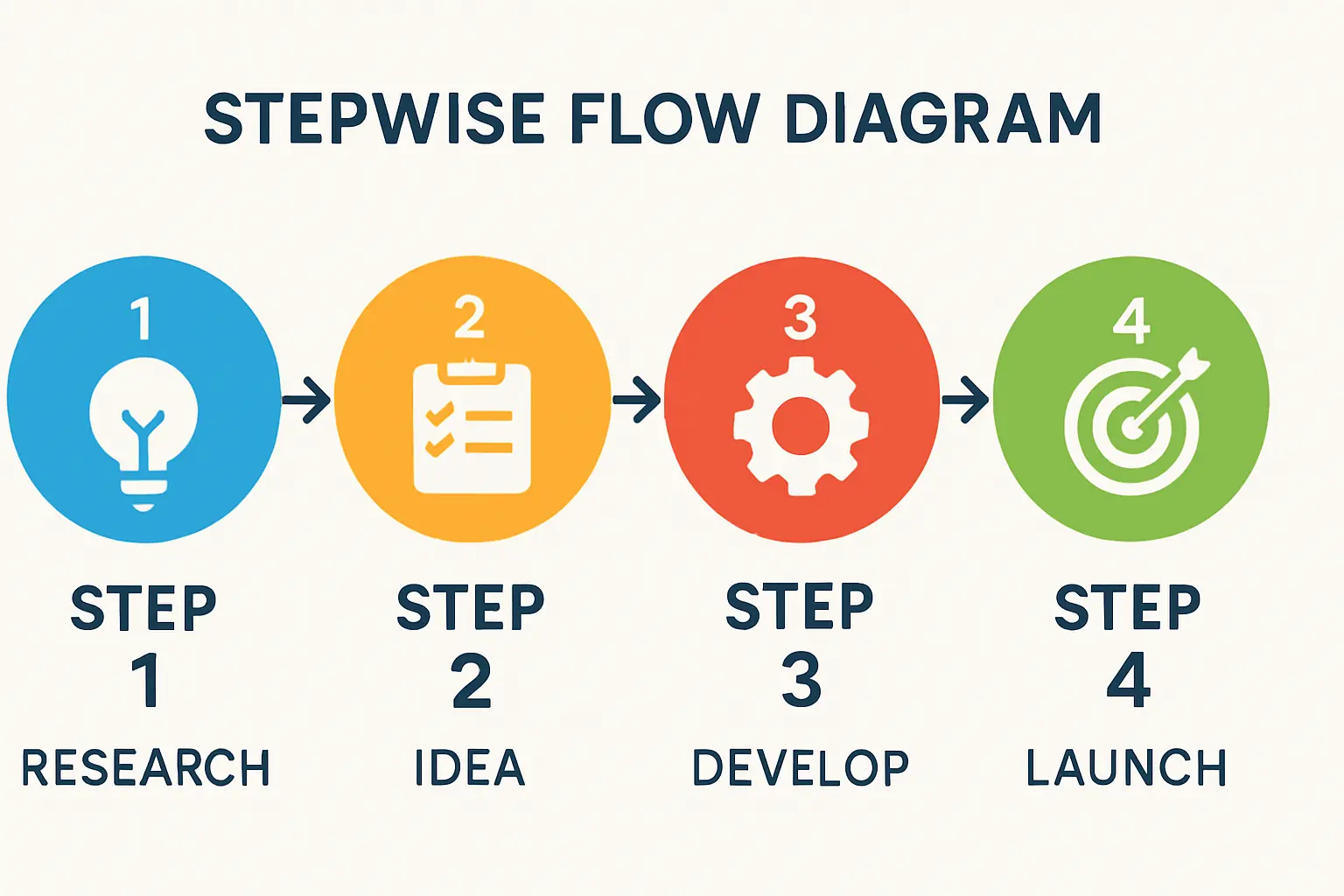

Funding for a new manufacturing plant typically comes from a blend of sources. For a project in North Macedonia, these fall into two main categories: local commercial banks and international development finance institutions (DFIs). Understanding the role and requirements of each is key to building a successful financing strategy.

Tapping into the Local Banking Sector

The commercial banking sector in North Macedonia is well-established and increasingly receptive to financing projects in the green economy. Major institutions have developed frameworks for assessing and funding renewable energy ventures, including manufacturing facilities.

When approaching a local bank, its primary focus will be on the investment’s commercial viability and security. Lenders will typically require:

- A Comprehensive Business Plan: The cornerstone of any application, a well-structured business plan for a solar factory must present detailed financial projections, market analysis, operational plans, and a clear return-on-investment calculation.

- Significant Collateral: Local banks operate on a traditional risk-assessment model, often requiring tangible assets to secure the loan as a prerequisite.

- Demonstrated Management Experience: Lenders will want to see a strong management team with a proven track record, even if it is not directly in the solar industry.

- A Clear Equity Contribution: Banks expect project sponsors to have a significant financial stake in the venture, typically covering a substantial portion of the initial setup costs.

While the requirements are stringent, a strong proposal that aligns with the country’s green energy goals is likely to be considered favorably.

Partnering with International Development Finance Institutions (DFIs)

For larger or strategically important projects, DFIs represent a powerful funding alternative. The most prominent DFI active in North Macedonia and the wider Western Balkans is the European Bank for Reconstruction and Development (EBRD).

The EBRD’s mandate extends beyond pure commercial lending. It aims to foster private-sector development, promote sustainable energy, and facilitate the transition to a green economy. Consequently, its financing criteria consider environmental impact and economic development in addition to financial returns.

Key aspects of working with a DFI like the EBRD include:

- Favorable Lending Terms: DFI loans may offer longer tenors, more flexible repayment schedules, and potentially more competitive interest rates than purely commercial loans.

- Rigorous Due Diligence: The application process is exhaustive. The EBRD conducts a deep-dive analysis of the project’s technical feasibility, environmental and social impact, market potential, and financial structure.

- Technical Assistance: In many cases, DFI financing is bundled with technical cooperation funds that can help project sponsors hire expert consultants. The EBRD’s Western Balkans Green Economy Financing Facility (GEFF) provides such support.

- A ‘Stamp of Approval’: Securing DFI funding lends significant credibility to a project, often making it easier to attract further commercial financing or equity partners.

Experience with J.v.G. turnkey projects shows that the main challenge with DFI financing is not a lack of available capital, but the need for an exceptionally well-prepared project proposal that meets their high standards.

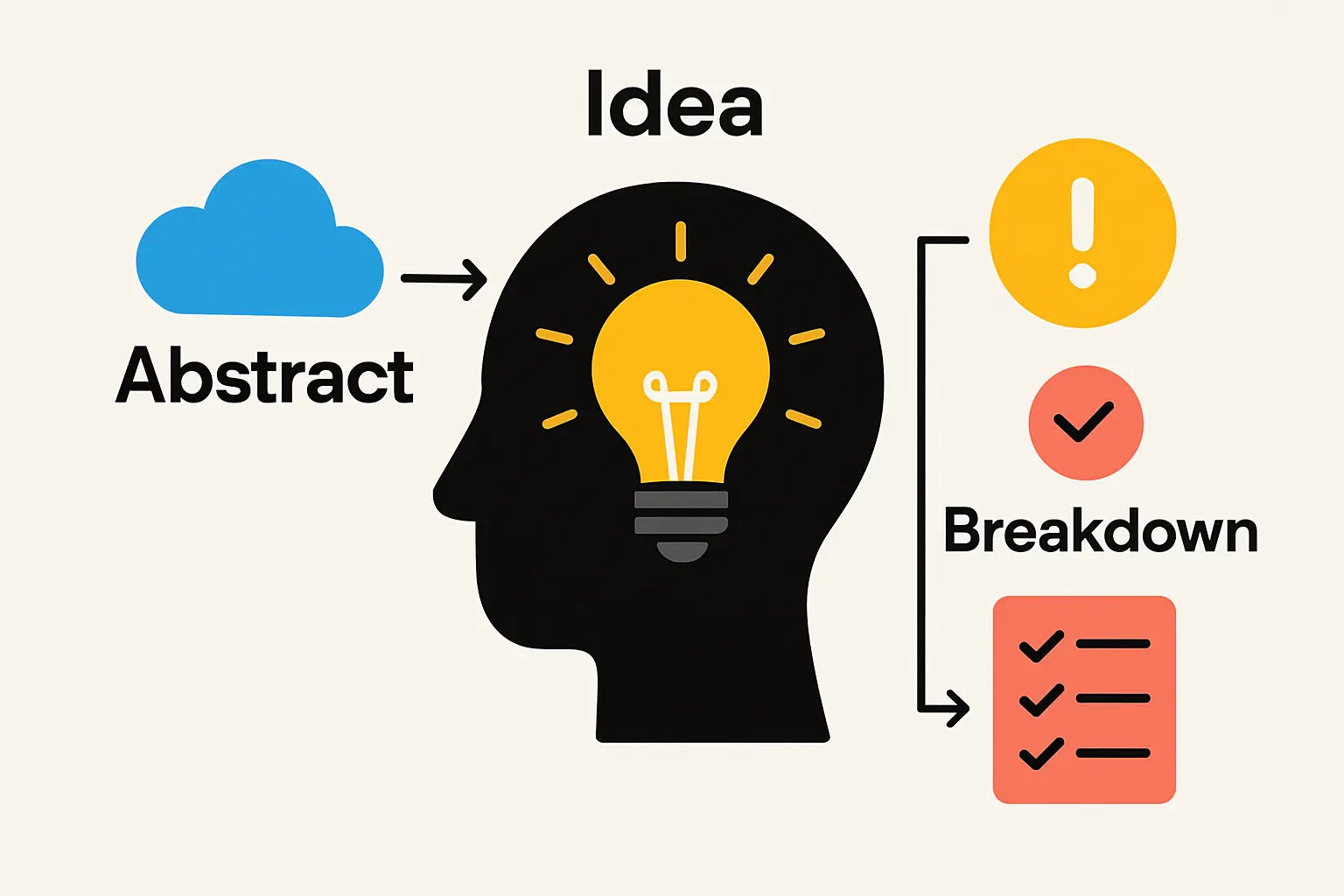

Building a Bankable Case: The Essentials for Securing Capital

Regardless of the chosen funding route, success hinges on the quality and credibility of the project proposal. Investors and lenders need to be convinced not only of the market opportunity but also of the project’s operational and technical soundness.

The Business Plan: Your Financial Blueprint

The business plan is the central document that articulates the entire venture. It must provide clear, data-driven answers to any potential questions from a financier. This includes detailed sections on the choice of solar module manufacturing equipment, raw material sourcing, production costs, and projected revenue streams. A financial model demonstrating profitability and cash flow under various scenarios is non-negotiable.

Technical Partnership and Feasibility

For entrepreneurs entering the solar industry from other sectors, demonstrating technical competence is crucial. Partnering with an experienced engineering or consultancy firm assures lenders that the project is technically viable. This partnership should cover all aspects of implementation, from initial planning and equipment selection to the final factory layout and building requirements.

Offtake Agreements and Market Access

A common concern for financiers is market risk: who will buy the modules once they are produced? Securing letters of intent or pre-purchase agreements (offtake agreements) with potential buyers significantly de-risks the project in the eyes of an investor. This proves existing demand and provides a solid basis for revenue projections.

Frequently Asked Questions (FAQ)

What is the typical initial investment for a 20-50 MW solar module factory?

The investment for a semi-automated line with an annual capacity of 20 to 50 MW typically ranges from 2 million to 5 million EUR. This includes machinery, installation, and initial operational setup, but excludes the cost of the building and land.

How long does it typically take to secure financing in North Macedonia?

The timeline can vary significantly based on the project’s complexity and the financing route. For a well-prepared application to a local commercial bank, the process may take four to six months. For a DFI like the EBRD, the extensive due diligence means a timeline of 9 to 12 months is more realistic.

Is a local partner essential for an international investor?

While not mandatory, a local partner can be highly beneficial. They can be invaluable for navigating administrative procedures, understanding the domestic market, and building relationships with local stakeholders and financial institutions.

What are the main differences between a local bank loan and EBRD financing?

Local banks prioritize collateral and a proven commercial track record, offering a faster but potentially less flexible process. The EBRD places a stronger emphasis on the project’s long-term developmental impact, technical soundness, and adherence to international standards. Its process is longer and more rigorous but can result in more favorable terms and added credibility.

Conclusion: A Structured Approach to Financing Your Entry into Solar Manufacturing

Securing funding for a solar module factory in North Macedonia is a structured process that rewards meticulous preparation. The country offers a supportive environment with access to both motivated local banks and world-class development finance institutions.

Success does not depend on being a solar expert from day one. Instead, it relies on building a robust, credible, and bankable project proposal. This involves creating a detailed business case, securing a reliable technical partner, and demonstrating a clear path to market.

Your logical next step is to develop a detailed financial model within a comprehensive business plan. This foundational work is crucial for enabling productive and confident discussions with potential financial partners in the region.