For any entrepreneur or investor considering the solar manufacturing industry, the choice of location is critical. It influences everything from initial capital outlay to long-term profitability. While many factors are at play, certain governments create highly favorable environments to attract industrial investment. Pakistan, through its network of Special Economic Zones (SEZs), presents a compelling case worth careful examination.

This article explores the specific financial advantages, tax holidays, and infrastructure support available for a solar manufacturing facility in one of Pakistan’s SEZs. It provides a clear framework for understanding how these incentives can significantly de-risk an investment and accelerate the path to profitability for a new solar enterprise.

What is a Special Economic Zone (SEZ)?

At its core, a Special Economic Zone is a geographically defined area where business and trade laws differ from the rest of the country. The primary goal of an SEZ is to increase foreign investment, boost industrialization, and create jobs by offering an attractive package of incentives.

Think of an SEZ as a ‘business-class lounge’ for industrial projects. These zones are designed to remove common obstacles, streamline administrative processes, and provide robust infrastructure, allowing businesses to focus on their core operations. For a capital-intensive project like a solar module factory, the benefits offered within an SEZ can fundamentally alter its financial projections.

Pakistan’s SEZs: A Strategic Overview for Solar Investors

Pakistan has strategically established numerous SEZs across the country, many of which are aligned with the China-Pakistan Economic Corridor (CPEC), a major infrastructure project. For businesses in these zones, this alignment provides enhanced logistics and connectivity. The government’s focus on promoting local manufacturing, particularly in the renewable energy sector, has made these zones especially relevant for solar energy investors.

These zones are not just isolated industrial parks; they are integrated ecosystems designed to support manufacturing and export. Their strategic locations optimize access to transportation networks, ports, and raw material supply chains.

Core Financial Incentives for Solar Module Manufacturing in an SEZ

The financial incentives are the most direct and impactful benefits for a new solar factory. They are designed to reduce the initial investment burden and improve cash flow during the critical early years of operation.

The 10-Year Corporate Tax Holiday

Perhaps the most significant incentive is a complete exemption from corporate income tax for ten years for both the SEZ developer and the businesses operating within it.

For a new solar manufacturing business, this has a profound impact. In the initial years, when the focus is on achieving profitability and reinvesting earnings, a zero percent tax liability frees up substantial capital. This capital can be used for expansion, technology upgrades, or building stronger financial reserves. Experience from turnkey projects shows this tax holiday can dramatically shorten the return-on-investment period.

One-Time Exemption from Customs Duties and Taxes

Setting up a solar module production line requires importing specialized machinery and equipment. Under normal circumstances, these imports would be subject to significant customs duties and other taxes, adding a substantial amount to the initial setup cost.

Enterprises operating within a Pakistani SEZ are granted a one-time exemption from all customs duties and taxes on the import of capital goods. This directly lowers the investment required for solar panel manufacturing. For a medium-sized facility, this exemption can translate into savings of hundreds of thousands, if not millions, of dollars, making the project more financially viable from day one.

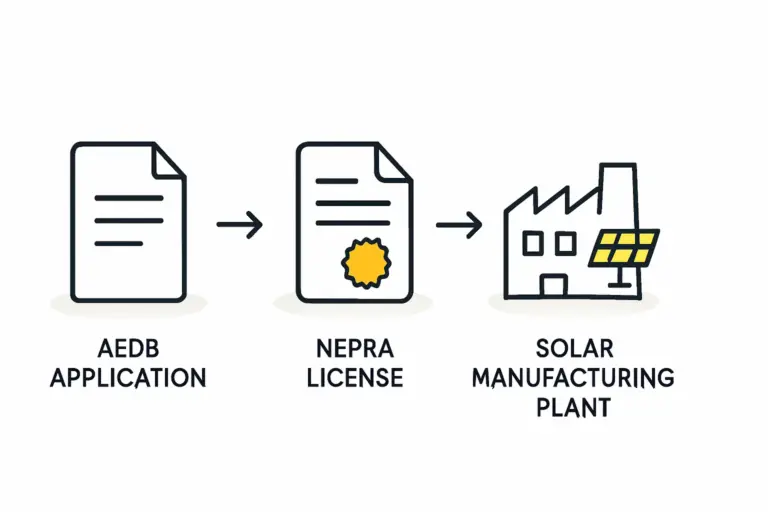

Simplified Business Operations and Infrastructure

Beyond direct financial savings, SEZs are structured to reduce operational friction. A key feature is ‘one-window operations,’ which means an investor has a single point of contact for all necessary permits, licenses, and regulatory approvals. This saves immense time and prevents the bureaucratic delays often encountered when establishing a business in a new country.

Furthermore, SEZs guarantee high-quality infrastructure, including reliable connections to electricity, gas, and water. For a manufacturing process that depends on a stable power supply, this is a critical operational advantage that mitigates a major business risk.

Operational Advantages Beyond Taxation

While the financial incentives are compelling, the operational benefits of locating in a Pakistani SEZ create a sustainable environment for long-term growth.

Strategic Location and Market Access

Pakistan’s geographic position offers a distinct advantage. A factory there is well-positioned to serve the growing domestic market while also enabling exports to neighboring regions, including the Middle East, Central Asia, and Africa. This allows for a diversified market strategy, reducing reliance on a single economy.

A Growing Domestic Market

Pakistan faces a significant energy deficit and has ambitious goals for increasing the share of renewables in its energy mix. Government policies actively encourage the use of solar power for residential, commercial, and industrial applications. This creates a large and rapidly growing domestic market for locally produced solar modules, ensuring a consistent demand base for a new manufacturer.

Labor and Human Resources

Pakistan has a large, youthful population and a growing pool of skilled technicians and engineers, ensuring access to a cost-effective and capable workforce. Understanding the specific team structure for a typical 20–50 MW semi-automated solar factory is a key part of the initial business plan. The availability of local talent simplifies recruitment and training.

Frequently Asked Questions (FAQ)

What is the minimum investment required to qualify for SEZ status?

While there is no fixed universal minimum, the investment must be substantial enough to align with the industrial nature of the SEZ. The application requires a detailed business plan, and approval is based on the project’s viability, job creation potential, and its contribution to the local economy.

Are foreign investors allowed 100% ownership in an SEZ?

Yes, Pakistan’s investment policy allows for 100% foreign ownership in most sectors, including manufacturing within an SEZ. This provides investors with full control over their operations and capital.

How does an SEZ differ from an Export Processing Zone (EPZ)?

While both offer incentives, SEZs generally focus on both domestic market development and exports. EPZs, by contrast, are almost exclusively export-oriented, often requiring that a very high percentage (e.g., 80% or more) of production be exported.

What are the ongoing compliance requirements?

Enterprises in an SEZ must still comply with national labor, environmental, and corporate governance laws. However, the administrative framework within the zone is designed to make compliance more straightforward.

Conclusion: A Strategic Entry Point into Solar Manufacturing

Establishing a solar module factory in a Pakistani Special Economic Zone is more than just a real estate decision; it is a strategic move that leverages a government framework designed for industrial success. The combination of a decade-long tax holiday, duty-free import of machinery, and streamlined administrative support significantly lowers the financial and operational barriers to entry.

For the international investor, this framework transforms a complex undertaking into a structured and more predictable venture. By mitigating key risks and enhancing profitability, Pakistan’s SEZs offer a powerful platform for entering the high-growth solar manufacturing sector. The next logical step is to develop a detailed solar panel manufacturing business plan that models these specific incentives to map out a clear path to success.