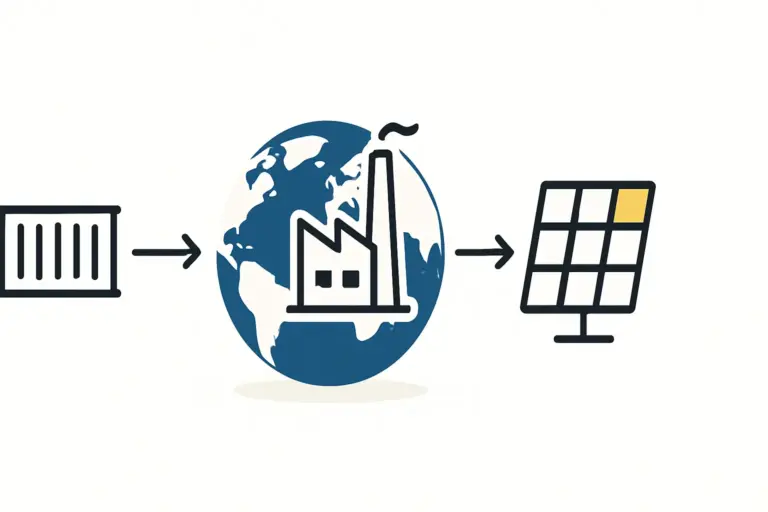

For the international entrepreneur, choosing a location for a new manufacturing facility comes down to logic, stability, and financial advantage. While traditional manufacturing hubs are well-known, a select few countries offer uniquely powerful incentives designed to attract forward-thinking industries. Panama, with its strategic location and robust legal frameworks, presents just such an opportunity, particularly for those entering the renewable energy sector.

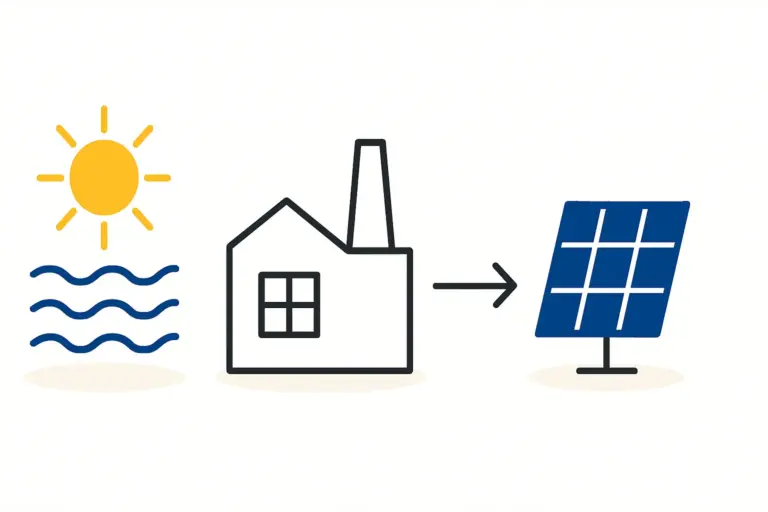

The centerpiece of this opportunity is Law 37 of May 10, 2013. This legislation is not merely a policy document; it is a clear invitation for investment in renewable energy, offering substantial fiscal benefits that directly impact the profitability and viability of a new solar module factory. This guide breaks down these incentives and explains their practical implications for business professionals.

Why Panama? The Strategic Context for Investment

Before diving into the specifics of the law, it helps to understand the business environment in which it operates. Panama’s value proposition extends beyond any single piece of legislation. The country has cultivated a reputation for stability and logistical excellence, built on several key advantages:

-

A Dollarized Economy: Panama uses the U.S. dollar as its official currency, eliminating exchange rate risk for international trade and simplifying financial planning.

-

Political and Economic Stability: The nation has a history of stable governance and consistent economic growth, providing a predictable environment for long-term capital investment.

-

World-Class Logistics: Centered around the Panama Canal, the country is a premier global logistics hub, offering unparalleled access to shipping routes that connect the Atlantic and Pacific. This facilitates the import of raw materials and the export of finished solar modules to markets across the Americas.

These core strengths create an ideal foundation for manufacturing. The government’s incentive programs, like Law 37, are designed to leverage this foundation to attract high-value industries.

Understanding Law 37: The Core of Panama’s Renewable Energy Incentives

Law 37 provides a clear framework for promoting the construction and operation of power plants and manufacturing facilities for renewable energy. For an entrepreneur planning to start a solar panel factory, the law offers several direct and significant financial advantages.

Complete Exemption from Import Taxes

One of the most immediate benefits is the complete exoneration from import taxes. This includes import duties, customs duties, fees, and levies on the equipment, machinery, materials, and spare parts required to build and operate the manufacturing facility.

For a capital-intensive project like a solar factory, these savings are substantial. Key machinery—such as cell stringers, laminators, and solar simulators—makes up a major portion of the initial investment for a solar module factory. Eliminating import duties on these items directly reduces the upfront capital needed to launch the operation, improving the project’s financial metrics from day one.

Income Tax Exemption

Law 37 grants a complete exemption from income tax on profits generated from the manufacturing activity. This exemption is available for up to 10 years, starting from the factory’s commercial start date.

This allows a new enterprise to reinvest its earnings directly into growth, debt repayment, or expansion during its critical early years. A decade without income tax obligations dramatically shortens the payback period on the initial investment and significantly enhances the long-term return on investment (ROI).

Accelerated Depreciation of Assets

In addition to the income tax holiday, the law permits an accelerated depreciation method for tax purposes. This enables a company to write off the value of its assets—machinery and equipment—more quickly than standard accounting rules would allow.

In practice, this reduces taxable income in the years following the initial 10-year exemption period. By accelerating depreciation, a business can lower its tax burden even after the primary tax holiday has concluded, further improving the venture’s financial outlook.

Beyond Law 37: Additional Fiscal and Logistical Advantages

While Law 37 is the cornerstone, Panama offers a multi-layered incentive structure. The country is home to several Special Economic Zones (SEZs), such as the Colón Free Trade Zone and Panama Pacífico, which provide their own sets of benefits that can complement those of Law 37.

Companies operating within these zones often benefit from streamlined customs processes, additional tax incentives, and special labor and migratory regimes. For a solar manufacturer, establishing a facility within an SEZ could further optimize supply chain management and export operations.

The nation’s logistical infrastructure acts as a force multiplier for these financial incentives. With deep-water ports on both the Caribbean and Pacific coasts, a manufacturer in Panama can efficiently source raw materials from Asia and Europe and export finished modules to high-demand markets in North, Central, and South America with reduced shipping times and costs.

The Practical Application: A Business Case

To illustrate the impact of these incentives, consider a hypothetical 50 MW solar module assembly line. A comprehensive solar factory business plan would outline significant capital expenditures for equipment.

Without Law 37, import duties on several million dollars’ worth of machinery could easily add hundreds of thousands of dollars to the initial setup cost. Law 37 eliminates this cost entirely. Over the first decade of operation, the exemption from income tax could save the company millions more, directly boosting retained earnings and enterprise value. This combination of reduced initial cost and enhanced long-term profitability makes a compelling case for choosing Panama as a manufacturing base.

Frequently Asked Questions (FAQ)

What is the official body responsible for administering these incentives?

The National Energy Secretariat of Panama is the primary government entity responsible for processing applications and overseeing the benefits granted under Law 37.

Do these incentives apply to factories of all sizes?

Yes, the incentives are designed to promote the industry as a whole. While large-scale projects will see the greatest absolute financial benefit, the provisions are equally applicable to small and medium-sized manufacturing operations.

Are there any local content or employment requirements?

The legislation focuses primarily on attracting investment and technology. While hiring local labor is a standard and beneficial business practice, Law 37 does not impose stringent or prohibitive local content mandates that might complicate operations for a new entrant.

How does Panama’s legal framework compare to other countries in the region?

Panama’s framework is considered one of the most stable and attractive in Latin America. The use of the U.S. dollar, combined with a clear and long-standing legal commitment to renewable energy, offers a level of predictability that is highly valued by international investors.

A Strategic Hub for Next-Generation Manufacturing

Panama’s Law 37 and its supporting infrastructure offer more than just tax breaks; they represent a clear, long-term strategy to become a central hub for renewable energy manufacturing in the Americas. The blend of significant fiscal incentives, a stable, dollarized economy, and world-class logistical capabilities creates a uniquely advantageous environment.

For entrepreneurs and established companies looking to enter or expand their presence in the solar industry, Panama warrants serious consideration. The legal framework is in place to reduce risk, lower costs, and accelerate profitability, providing a solid foundation for a successful and sustainable manufacturing venture.