For any entrepreneur or investor evaluating new markets, the global solar industry can appear saturated and highly competitive. Entering a developing market often means competing directly with established international giants on price and volume.

However, certain government policies can create unique and powerful entry points for local manufacturing. Peru’s Renewable Energy Resources (RER) auction scheme presents just such an opportunity.

The scheme includes a specific provision—a scoring bonus for using locally manufactured components—that reshapes the competitive landscape. For a new solar module manufacturer, this isn’t just a minor incentive; it is the foundation for building a defensible and profitable business from day one. Understanding how this mechanism works is the key to launching a manufacturing venture designed to capitalize on it.

Understanding Peru’s Renewable Energy Resources (RER) Auctions

Peru’s RER auctions are the primary mechanism the government uses to promote the development of renewable energy projects. Organized by the state, these auctions invite private developers to bid for long-term Power Purchase Agreements (PPAs). Winning bidders secure a contract, typically for 20 years, to sell the electricity they generate to the national grid at a predetermined price.

This 20-year revenue guarantee offers significant stability and bankability for solar project developers. The auctions are intensely competitive, however, with contracts typically awarded to the bidders who offer the lowest energy price. With such a focus on price, any competitive edge becomes critical. This strategy also supports the government’s goal to diversify the country’s energy matrix and ensure a sustainable power supply for its growing economy, which has driven consistent growth in the renewables sector.

The Local Content Advantage: A Game-Changer for Manufacturers

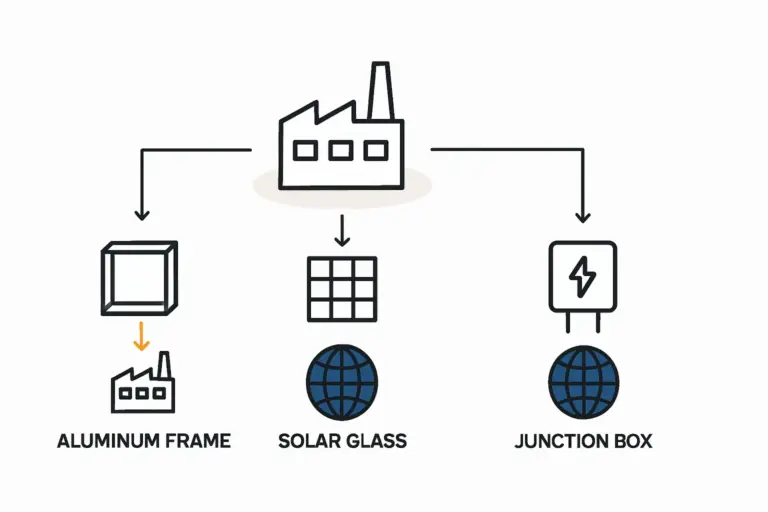

A significant recent development in Peru’s RER scheme was the introduction of Supreme Decree N° 020-2023-EM. This regulation established a scoring bonus for solar projects that incorporate nationally manufactured components, including solar modules.

This is not a direct subsidy but a powerful competitive advantage built into the bid evaluation process. In a hyper-competitive auction where bids are often separated by fractions of a cent, this bonus can be the deciding factor between winning a 20-year PPA and being shut out of the market.

Think of it as receiving extra points on a final exam. Two students might have similar knowledge, but the one with the extra points earns a higher final score. Similarly, two project developers might bid similar prices, but the one using locally produced modules receives a better evaluation score, dramatically increasing its chances of winning the contract.

This mechanism creates a direct and compelling incentive for project developers in Peru to source their solar modules from a local factory. A Peruvian manufacturer is no longer just a supplier; it becomes a strategic partner that offers a decisive advantage in winning bids. Developing a comprehensive solar module manufacturing business plan is the first step to capitalizing on this unique market dynamic.

Strategic Considerations for a New Manufacturing Plant in Peru

Aligning a new venture with the RER auction opportunity requires careful planning around location, capacity, and technology.

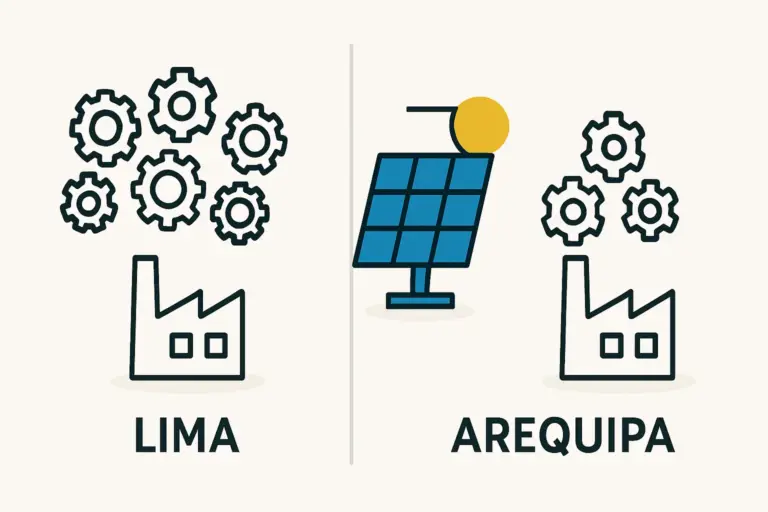

Optimal Geographic Positioning

Peru’s southern regions—particularly Arequipa, Moquegua, and Tacna—boast some of the highest solar irradiation levels in the world, making them prime locations for large-scale solar farms. Establishing a manufacturing facility within this region offers significant logistical advantages, reducing transportation costs and lead times for supplying modules to the country’s largest projects. Proximity also builds stronger relationships with the project developers who need the local content bonus.

Sizing Production for the Market

The scale of a new factory should align with the anticipated demand from the RER auctions. Based on the size of projects typically awarded, a factory with an annual production capacity of 50 to 100 MW represents a logical entry point. This capacity is sufficient to supply one or two significant utility-scale projects per year, making the manufacturer a key player in the national ecosystem. A turnkey solar manufacturing line is often the most efficient pathway to establish this capacity; as J.v.G. turnkey projects demonstrate, a plant can become operational within 9 to 12 months.

Investment and Bankability

The investment required to start a solar panel factory of this scale involves significant capital for machinery, infrastructure, and working capital. However, the built-in demand created by the RER auctions considerably strengthens the investment case. To become a trusted partner for project developers, the factory must produce high-quality, bankable modules. This requires a strong focus on process control and certification. Implementing rigorous solar panel quality control is not optional; it is essential for ensuring that the modules meet the technical and financial standards required by international project financiers.

Frequently Asked Questions (FAQ)

What exactly is an RER auction?

An RER (Recursos Energéticos Renovables) auction is a competitive bidding process managed by the Peruvian government to award long-term contracts for the supply of electricity from renewable sources like solar, wind, and biomass.

Is using locally made modules a requirement to bid in the auctions?

No, it is not mandatory. However, projects that use locally manufactured components receive a scoring bonus during bid evaluation. This provides a significant competitive advantage, making a winning bid far more likely.

What is a typical size for a starter solar factory in Peru?

A strategic starting capacity would be in the 50 to 100 MW per year range. This size is large enough to supply utility-scale projects tendered in the RER auctions without requiring an excessive initial investment.

What are the primary risks associated with this strategy?

The primary risks are regulatory and political. Any change to the Supreme Decree that reduces or eliminates the local content bonus would weaken the business case. Investors must therefore monitor the country’s long-term energy policy and political stability. Standard business risks, such as competition and operational challenges, also exist.

Conclusion and Next Steps

Peru’s RER auction scheme, with its local content bonus, offers a rare and structured market-entry opportunity. It allows a new solar module manufacturer to bypass a purely price-driven commodity market and instead become a high-value strategic partner for project developers. The incentive effectively creates a protected, high-demand niche for in-country producers.

For entrepreneurs and investors, this transforms the challenge of market entry into a clear, actionable strategy. The focus shifts from competing with global giants to serving a defined national demand where the rules are tilted in favor of local production.

Understanding the detailed financial modeling, technical requirements, and certification processes is the next critical step for any serious investor. Seizing this opportunity requires moving from strategy to execution.