An investor considering a new venture often faces a critical decision: should they focus on the immediate, tangible needs of the home market or aim for the broader, more complex opportunities of international trade?

For those looking to enter the solar module manufacturing sector in the Philippines, this question is particularly pressing. The country stands at a crossroads of immense domestic energy demand and significant strategic potential as an export hub for Southeast Asia and beyond.

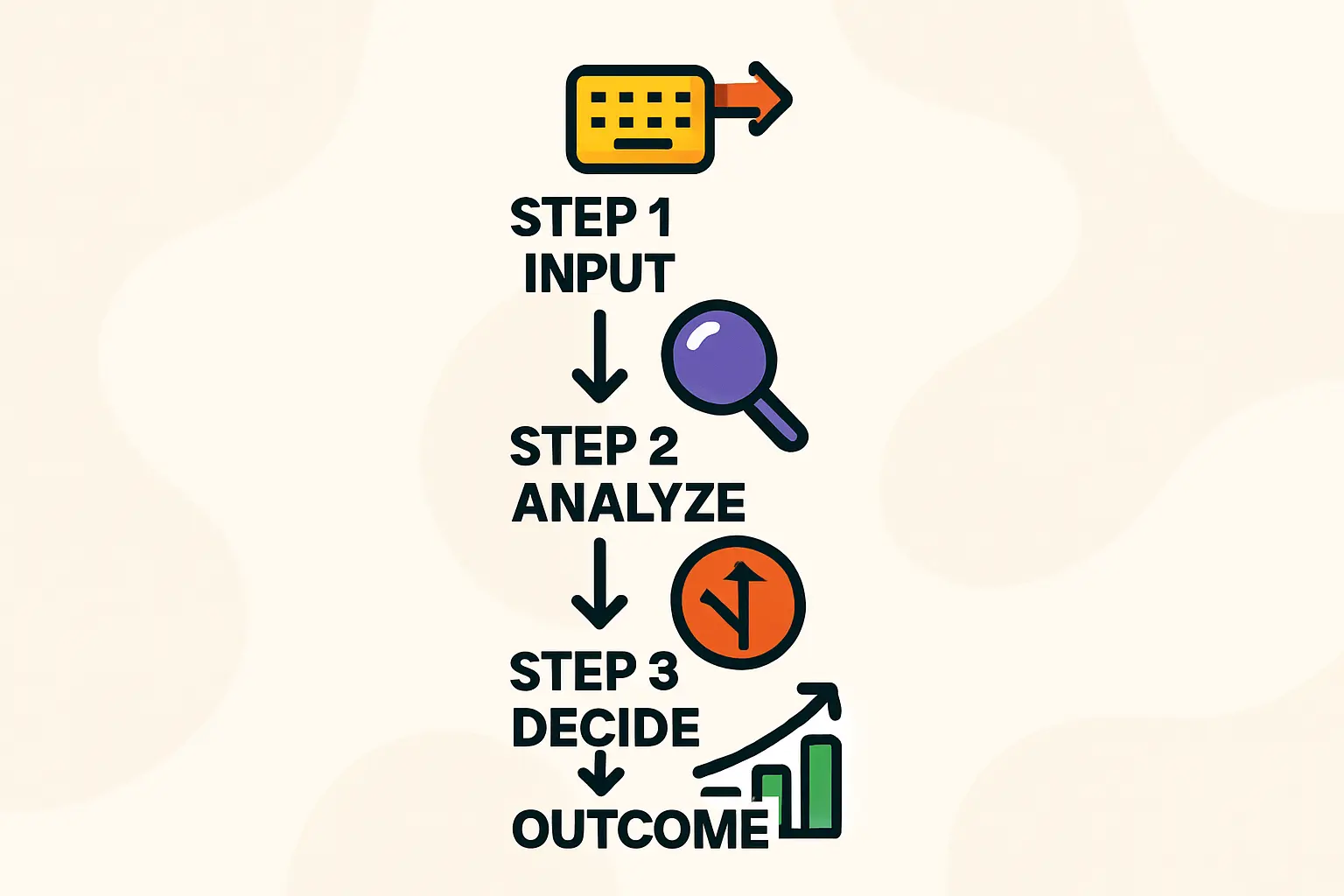

This analysis examines the two primary pathways for a new solar module factory in the Philippines. We contrast the stable, policy-driven local market with the scalable, yet more challenging, export market to provide a framework for strategic decision-making.

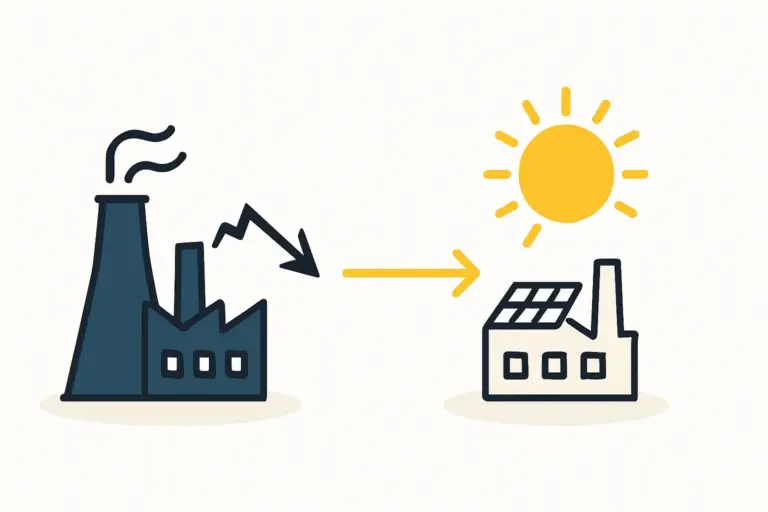

The Domestic Opportunity: Powering a Nation’s Growth

The most compelling case for a domestic focus stems from the Philippine government’s own ambitious energy targets. The National Renewable Energy Program (NREP) 2020-2040 is not merely a policy document; it is a clear roadmap signaling massive, long-term demand for renewable energy infrastructure.

Understanding the Scale of Demand

The NREP outlines a plan to increase the share of renewable energy in the country’s power generation mix to 35% by 2030 and 50% by 2040. To achieve this, the Philippines aims to build approximately 95.2 GW of new renewable energy capacity.

Solar photovoltaics are projected to be the cornerstone of this transition, accounting for an astonishing 43.9 GW of that capacity. To put this figure into perspective, a typical small-to-medium-sized solar module factory might have an annual production capacity of 50-100 MW.

The government’s target creates a sustained, multi-decade demand pipeline that local manufacturers are uniquely positioned to fill. This demand is further supported by policies such as the Renewable Portfolio Standards (RPS), which mandate that distribution utilities source a portion of their energy from eligible renewable resources.

Key Drivers for the Domestic Market:

- Energy Security: Reducing reliance on imported fossil fuels is a national strategic priority.

- High Electricity Costs: The Philippines has some of the highest electricity rates in Southeast Asia, making solar an economically viable alternative for commercial and residential consumers.

- Government Policy: The NREP and RPS create a predictable and regulated demand environment for locally produced modules.

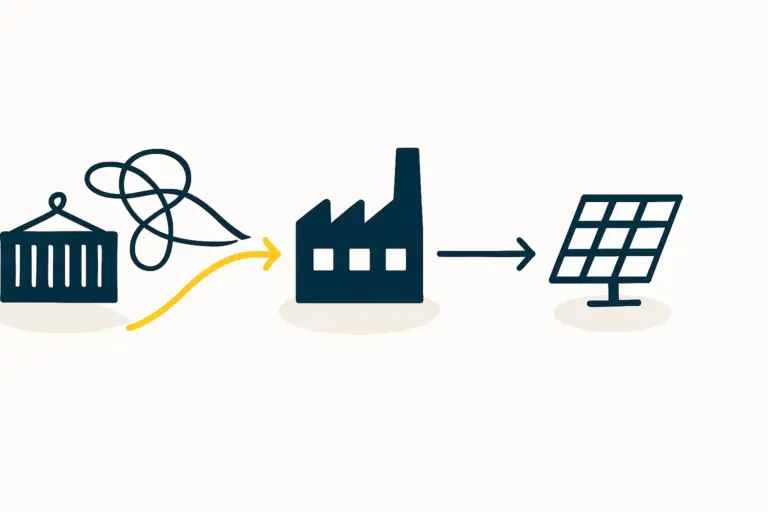

The Export Hub Advantage: A Gateway to Global Markets

While the domestic market offers stability, the Philippines’ geographic and geopolitical position presents a powerful case for an export-oriented strategy. Located at the heart of the Association of Southeast Asian Nations (ASEAN), the country can serve as a strategic production base for one of the world’s fastest-growing economic regions.

The ASEAN region as a whole is pursuing its own energy transition. The ASEAN Plan of Action for Energy Cooperation (APAEC) targets a 23% renewable energy share in the total primary energy supply by 2025. A manufacturing facility in the Philippines is well-placed to supply this burgeoning regional demand, benefiting from regional trade agreements and shorter shipping routes compared to established manufacturing hubs in North Asia.

Beyond ASEAN, manufacturers can target developed markets like the United States and the European Union. As these regions seek to diversify their supply chains and reduce dependence on a single country of origin, the Philippines emerges as an attractive alternative. A ‘Made in the Philippines’ label can carry significant geopolitical advantages, potentially avoiding tariffs and trade barriers affecting other nations.

A Comparative Analysis for Investors

The decision to focus domestically, export, or pursue a hybrid model depends on an investor’s long-term vision, risk tolerance, and operational capabilities. This choice directly influences the initial planning stages of determining how to start a solar panel manufacturing plant.

Domestic Market Focus

Advantages:

- Predictable demand backed by government policy (NREP).

- Lower logistical complexity and costs.

- Direct contribution to national energy independence.

- Simplified regulatory and customs procedures.

Challenges:

- Potential for strong price competition from large-scale importers.

- Market growth is directly tied to the pace of government policy implementation.

- May require building a local brand and distribution network.

Export-Oriented Strategy

Advantages:

- Access to a significantly larger and more diverse total addressable market.

- Potential for higher profit margins in premium markets (US/EU).

- Ability to leverage international trade agreements and geopolitical shifts.

Challenges:

- Higher logistical and shipping costs.

- Meeting stringent international quality certifications (e.g., IEC, UL).

- Exposure to currency exchange rate fluctuations and international trade policy risks.

- Complex sales cycles and international marketing efforts.

Key Considerations for Market Entry

Regardless of the chosen strategy, several fundamental factors require careful consideration. A detailed feasibility study, often part of a comprehensive solar panel manufacturing business plan, is essential to navigate these complexities.