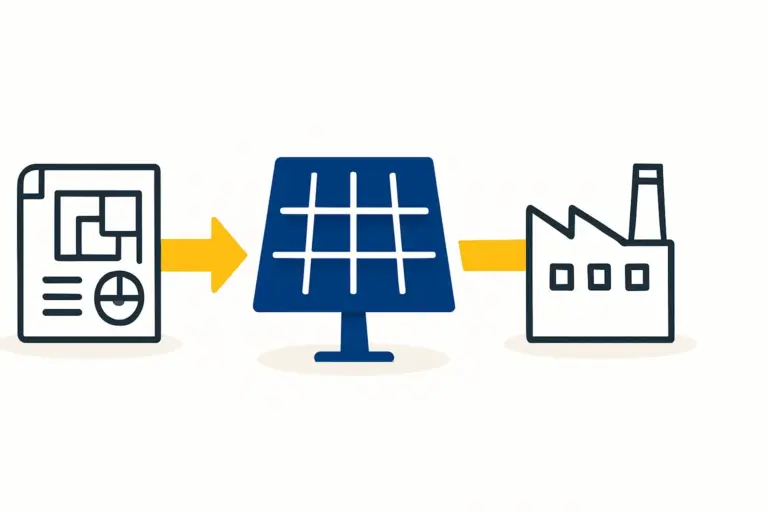

Driven by strong market demand and a solid business plan, many successful entrepreneurs set their sights on expanding into solar module manufacturing.

Yet, even the most robust financial models can be held up by a factor that is often underestimated: the intricate web of national and local regulations. An investor might allocate six months for permits, only to find the process extending over a year due to one overlooked zoning ordinance or a complex environmental clearance.

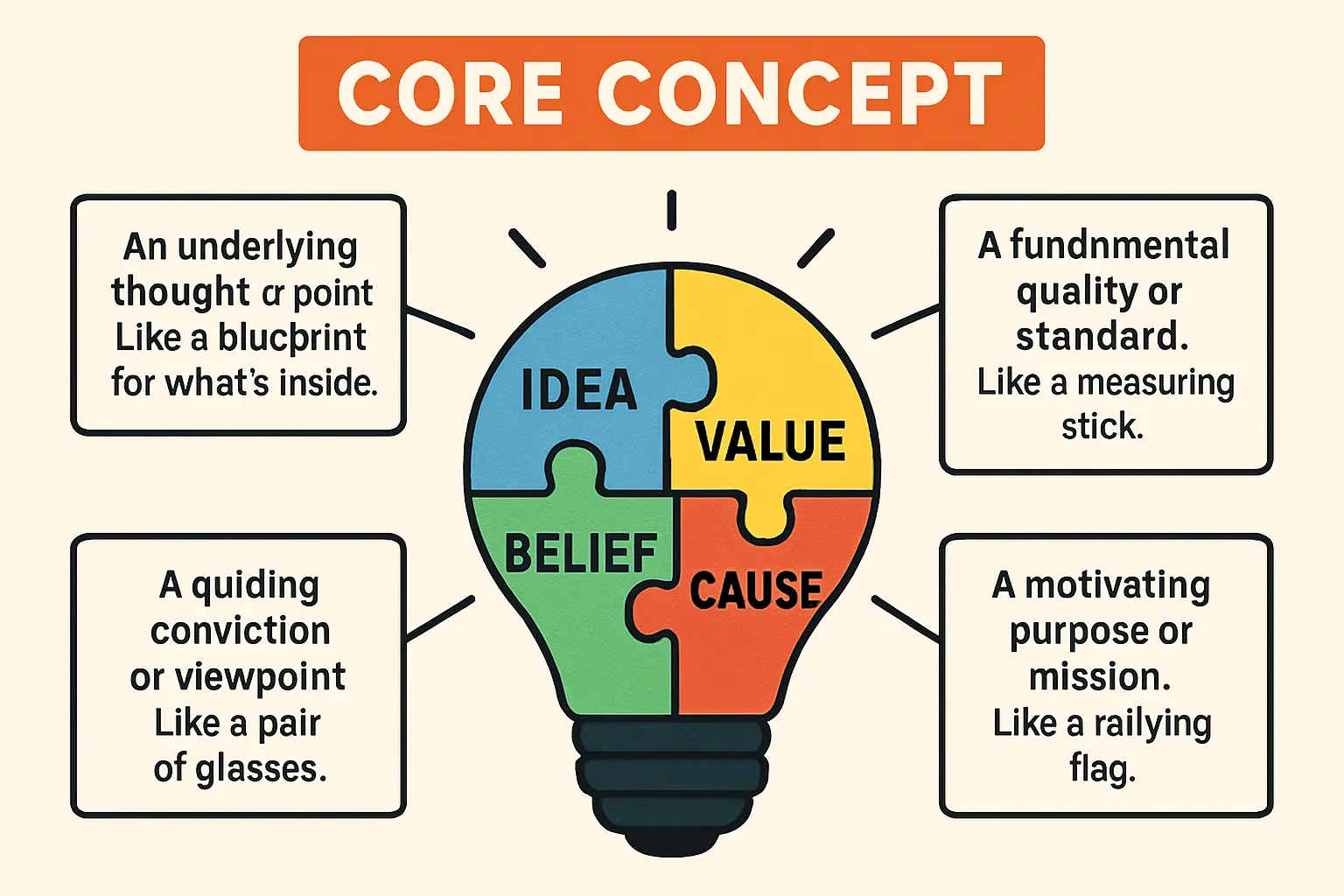

This guide breaks down the regulatory pathway in the Philippines, a country with significant potential and government support for renewable energy. It outlines the key steps—from foundational business registration to securing critical environmental permits—to help business leaders navigate this landscape with foresight and clarity.

The Philippine Regulatory Framework: An Overview

The Philippines actively encourages investment in renewable energy through legislation like the Renewable Energy Act of 2008 (RA 9513), creating a favorable environment for new manufacturing ventures.

However, this national support comes with a multi-layered approval process involving national agencies, local government units (LGUs), and special economic zones. A successful permitting strategy is sequential, with each approval building on the last. Understanding this sequence is essential for creating a realistic project timeline and avoiding costly delays.

Phase 1: Foundational Business Registration

Before any operational or construction permits can be considered, the business entity itself must be legally established and recognized by the Philippine government.

Securities and Exchange Commission (SEC) Registration

For any new corporation, the first official step is registering with the Securities and Exchange Commission (SEC). This process formally creates the legal entity, defining its corporate name, articles of incorporation, and bylaws. It is the bedrock upon which all subsequent licenses and permits are built.

Local Government Unit (LGU) Clearances

While national laws provide the framework, all business is local. Securing permits from the relevant LGU is a critical phase where many projects face their first major test. Key documents include:

-

Zoning Clearance: This document confirms that the proposed factory location is designated for industrial use. Experience from turnkey projects shows that verifying local zoning ordinances before acquiring land is one of the most important due diligence steps. An incorrect classification can lead to months, or even years, of reapplications.

-

Barangay Clearance: This permit from the smallest local government unit, the barangay, confirms the business complies with community standards.

-

Mayor’s Permit / Business Permit: This is the primary LGU license to operate within a specific city or municipality, and it is typically renewed annually.

Bureau of Internal Revenue (BIR) Registration

Once the SEC and LGU registrations are complete, the company must register with the Bureau of Internal Revenue (BIR). This step involves securing a Taxpayer Identification Number (TIN), registering books of accounts, and getting authorization to print official receipts and invoices, ensuring tax compliance from day one.

Phase 2: Strategic Location and Incentives

A factory’s location profoundly impacts its operational efficiency and financial viability. The Philippine government offers powerful incentives through specific agencies and economic zones designed to attract high-value manufacturing.

The PEZA Advantage: Locating in an Economic Zone

The Philippine Economic Zone Authority (PEZA) manages designated economic zones across the country. For export-oriented manufacturers, locating within a PEZA zone offers substantial benefits:

-

Fiscal Incentives: These include income tax holidays for a set number of years.

-

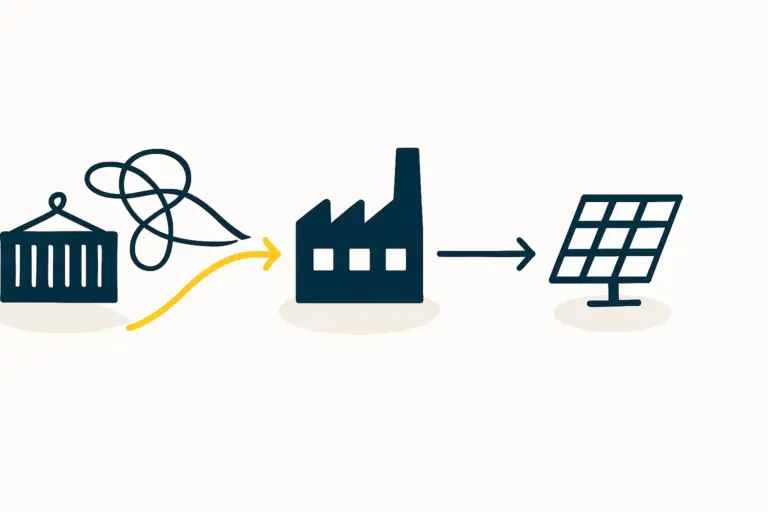

Duty-Free Importation: Capital equipment, spare parts, and raw materials can be imported without tariffs.

-

Simplified Procedures: PEZA provides a ‘one-stop shop’ for managing import/export permits and interacting with other government agencies, greatly reducing the administrative burden.

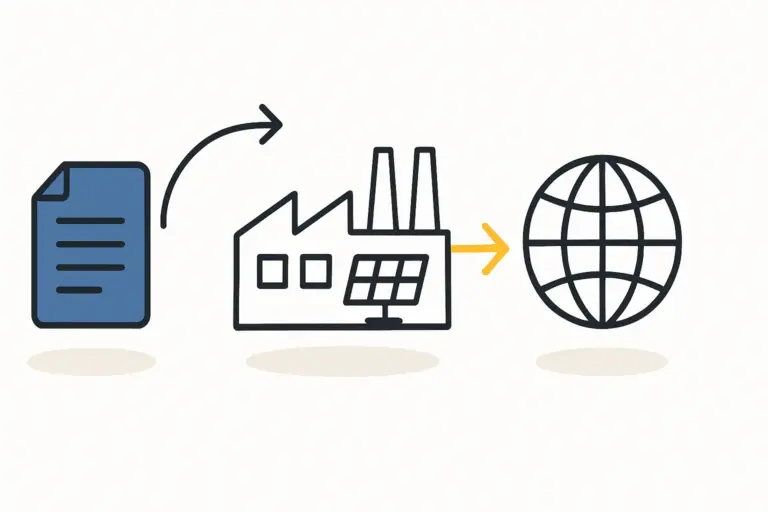

Choosing a PEZA location is a strategic decision that can dramatically improve the financial outlook and simplify the long-term management of a solar factory.

Board of Investments (BOI) Registration

If a company chooses a location outside a PEZA zone, it can still apply for incentives through the Board of Investments (BOI). The BOI maintains an Investment Priorities Plan (IPP) that lists preferred economic activities. The manufacturing of solar cells, modules, and wafers is consistently listed as a priority sector, making projects eligible for incentives similar to those offered by PEZA, including income tax holidays.

Phase 3: The Critical Path – Environmental Compliance

For any industrial facility, environmental permits are non-negotiable. In solar manufacturing, this phase is often the most rigorous and time-consuming part of the entire regulatory process.

Securing the Environmental Compliance Certificate (ECC)

The Department of Environment and Natural Resources (DENR), through its Environmental Management Bureau (EMB), requires an Environmental Compliance Certificate (ECC) before construction or operation can begin. The solar module manufacturing process involves chemicals, industrial water, and waste products—a profile that automatically classifies it as a project with a significant potential environmental impact.

To obtain an ECC, the company must submit an Environmental Impact Statement (EIS), a comprehensive study detailing:

- The project’s potential impact on local air quality, water resources, and land.

- Proposed mitigation measures to manage waste, emissions, and chemical handling.

- A social development plan for the host community.

The ECC process alone can take from 6 to 12 months, involving public consultations and extensive technical reviews. It is often the longest lead-time item in a project’s pre-development schedule.

Other Key Permits

Once the foundational and environmental permits are in place, several other clearances are required. A key step is registering with the Department of Labor and Employment (DOLE) to ensure compliance with occupational safety and health standards for all employees.

Integrating the Process: A Realistic Timeline

A common mistake for new investors is underestimating the cumulative time required for these sequential permits. While simple business registration may take a few weeks, securing a strategic location, navigating LGU approvals, and completing the rigorous ECC application will stretch the timeline considerably.

A realistic timeframe, from initial SEC registration to having all permits in hand to begin construction, is typically 12 to 18 months. This timeline underscores the need for expert guidance and meticulous planning. A comprehensive approach, such as a turnkey solar factory solution, integrates regulatory navigation into the overall project plan from the outset, helping to manage these timelines effectively.

Frequently Asked Questions (FAQ)

What are the main government incentives for setting up a solar factory in the Philippines?

The primary incentives are offered through PEZA and BOI. They typically include multi-year income tax holidays, duty-free importation of capital equipment and raw materials, and simplified customs procedures.

How long should an investor realistically budget for the entire permitting process?

A conservative and realistic timeline is 12 to 18 months. The Environmental Compliance Certificate (ECC) is often the most time-consuming component and should be initiated as early as possible.

Is an environmental permit always necessary for a solar panel factory?

Yes, absolutely. Due to the use of chemicals, solvents, and the generation of industrial waste during the manufacturing process, an ECC from the DENR-EMB is mandatory.

Can a foreign entity have 100% ownership of a solar manufacturing facility?

Generally, yes. Under Philippine law, foreign ownership of export-oriented enterprises located in PEZA zones can be up to 100%. For ventures outside these zones, it is advisable to consult with local legal counsel to confirm the latest regulations.

From Blueprint to Production

Securing the permits to build and operate a solar module factory in the Philippines is a complex but navigable process. The key to success lies in understanding the sequence of requirements, performing thorough due diligence on location, and allocating realistic timelines, particularly for environmental compliance.

By approaching the regulatory landscape with the same strategic focus applied to finance and technology, entrepreneurs can successfully transform a business plan into an operational reality. For those ready to move forward, exploring the detailed investment requirements for a solar module factory is the critical next step in bringing your vision to life.