Imagine your new solar module factory is ready for production: the machinery is installed, the staff is trained, but the first container of critical components is delayed for weeks at a port thousands of miles away. This scenario, a common challenge in recent years, underscores a fundamental truth: a successful manufacturing operation is only as strong as its supply chain.

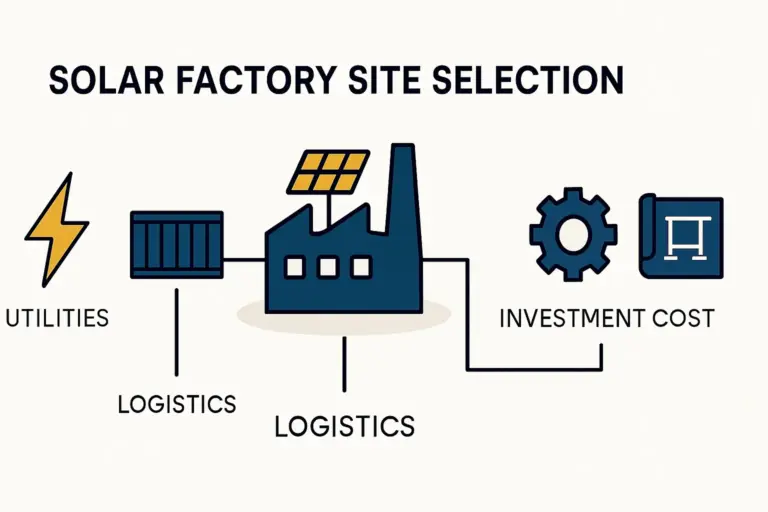

While Asian markets have long been the default for sourcing solar components, a strategic shift is underway. This article explores an increasingly viable alternative: sourcing key materials like solar glass, aluminum frames, and junction boxes from Poland and its neighboring EU countries. It examines this approach by looking at logistics, cost structures, and quality control, providing essential context for entrepreneurs planning to enter the solar manufacturing sector.

The Traditional Approach: Understanding the Asian Supply Chain

For decades, Asia has been the epicenter of solar component manufacturing, offering vast production scale and competitive unit pricing. This has made it the go-to source for most new solar ventures globally. However, this reliance on a single geographic region has also exposed its inherent risks.

Entrepreneurs must account for several factors that impact both timelines and budgets:

-

Extended Lead Times: Standard shipping from Asia to markets in Africa, the Middle East, or the Americas typically takes four to six weeks. This lengthy timeline necessitates larger inventory holdings and reduces operational flexibility.

-

Volatile Logistics Costs: Shipping expenses can be unpredictable, often adding 8% to 12% to the final component price. These costs are subject to global fuel prices, port congestion, and geopolitical events.

-

Supply Chain Disruptions: As the events of 2020 to 2022 demonstrated, global crises can severely disrupt these long-distance supply chains, leading to costly production stoppages. This single point of failure poses a significant risk for any manufacturing business.

A Strategic Alternative: The Rise of Poland and EU Component Manufacturing

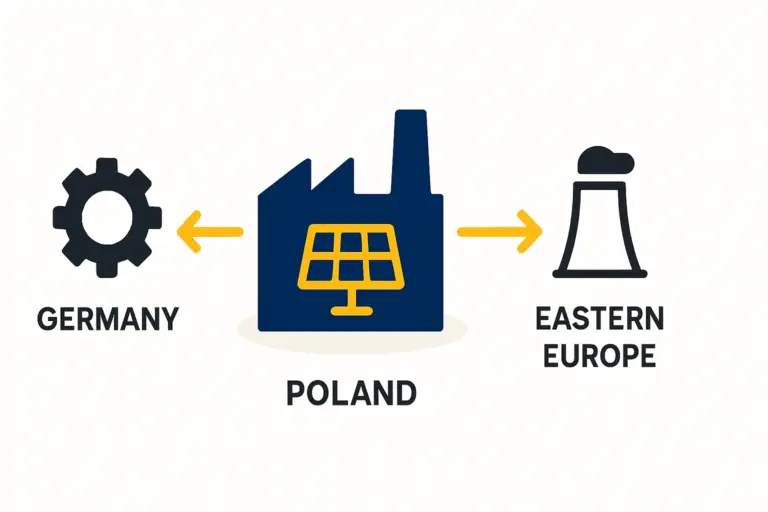

In response to global supply chain vulnerabilities, a robust manufacturing ecosystem has been developing within the European Union, with Poland emerging as a key hub. The country’s solar manufacturing capacity has grown significantly, particularly for essential components like high-transmission solar glass and precision-engineered aluminum frames.

This growth is not happening in isolation. Poland, alongside industrial powerhouses like Germany and the Czech Republic, forms a highly integrated manufacturing cluster. This region benefits from a long history in high-tech sectors such as automotive manufacturing, which has laid a foundation of engineering expertise, advanced automation, and stringent quality protocols. For the solar industry, this translates into a reliable source of high-quality components. This is the core idea behind ‘nearshoring’—reducing distance to mitigate risk.

A Comparative Analysis: Poland/EU vs. Asia

Evaluating sourcing locations requires a direct comparison of key business metrics. The decision extends far beyond the initial price per unit.

Logistics and Lead Times

The most immediate advantage of sourcing from the EU is a drastic reduction in delivery time. Components shipped from Poland can often reach factories in Europe, the Middle East, or North Africa in one to two weeks. This speed translates into significant business benefits:

-

Faster Time-to-Market: Your factory can become operational and generate revenue more quickly.

-

Lower Inventory Costs: Less capital is tied up in stock that is in transit or stored in a warehouse.

-

Greater Agility: The business can respond faster to changes in market demand or product specifications.

Cost Structure: Beyond the Unit Price

While the unit price for a component from Asia may appear lower on paper, a complete financial analysis often tells a different story. Evaluating the Total Cost of Ownership, which includes all direct and indirect expenses, is critical.

An EU-based supply chain alters this calculation. Shipping costs are lower and more stable, import procedures are often simplified, and the risk of costly delays is substantially reduced. Furthermore, emerging regulations like the EU’s Carbon Border Adjustment Mechanism (CBAM) may place future tariffs on goods from regions with less stringent environmental standards, potentially impacting the long-term cost-effectiveness of Asian imports.

Quality and Reliability

EU manufacturers typically operate under strict quality management systems, such as ISO 9001, and their products often carry certifications from reputable bodies like TÜV. This adherence to high standards is not merely a compliance issue; it has a direct impact on your factory’s output and profitability.

-

Reduced Defect Rates: Higher-quality components mean fewer rejections on the production line, leading to less material waste and improved efficiency.

-

Consistent Performance: Uniformity in materials like glass and aluminum frames is crucial for the automated production machinery used in modern factories.

-

Easier Supplier Management: Proximity allows for easier site visits, quality audits, and direct, real-time communication with suppliers to resolve potential issues.

Practical Considerations for Your Solar Factory

The choice of supplier directly influences the entire solar module manufacturing process. A stable supply of high-quality, uniform components allows for a smoother, more predictable production flow and a higher-quality end product.

This strategy is particularly relevant for ventures in emerging markets. For a factory based in North Africa, for example, shipping routes from European ports are significantly shorter and more reliable than those from East Asia. Experience from J.v.G. turnkey projects shows that a diversified supply chain, with a strong regional component, significantly de-risks the initial years of operation and builds a foundation for sustainable growth.

Frequently Asked Questions (FAQ)

Is sourcing from Europe always more expensive?

Not necessarily. While the initial unit cost might be higher, calculating the Total Cost of Ownership—including logistics, import duties, reduced inventory, and lower defect rates—reveals that the European option is often highly competitive and can offer better long-term value.

What specific components can be sourced from Poland?

Poland and the surrounding region have strong manufacturing capabilities for several key solar module components, including solar glass, extruded aluminum frames, junction boxes, and certain types of backsheets and encapsulants.

How does this affect certification for my finished modules?

Using components that are already certified by recognized international bodies (like TÜV) can simplify and expedite the certification process for your final solar modules, a critical step for market access.

Can a small factory mix suppliers from both Asia and Europe?

Yes, and this is often a very prudent strategy. A hybrid approach allows a business to source certain high-volume, standardized components from Asia to manage costs, while relying on European suppliers for more critical or technologically sensitive materials to ensure quality and supply chain resilience.

A clear understanding of your supply chain options is a critical step in planning your solar manufacturing venture. By looking beyond traditional sourcing routes and evaluating the strategic benefits of nearshoring to industrial hubs like Poland, entrepreneurs can build more resilient, efficient, and ultimately more profitable operations. The logical next step is to explore how these components come together in the manufacturing process and the investment required to set up your facility.