When planning a new manufacturing facility, entrepreneurs naturally focus on initial capital expenditure—the cost of land, buildings, and machinery. For a 24/7 solar module production line, however, the single largest and most persistent operational cost is often energy.

An unstable grid or volatile electricity prices can erode profitability far more than any one-time capital expense. This makes analyzing a potential location’s energy landscape a critical step in strategic planning.

Portugal has emerged as an attractive candidate for industrial investment, particularly within the renewable energy sector. Its ambitious green energy policies and favorable climate create a unique environment. This guide examines Portugal’s industrial electricity costs, renewable energy procurement options, and grid stability—all crucial factors for any investor considering the country for a new solar module factory.

The Central Role of Energy in Solar Module Production

A modern solar module factory is a highly automated, energy-intensive operation. Lamination machines, robotic stringers, and climate-controlled curing areas must run continuously to maintain efficiency and quality. A typical 50 MW production line can consume several million kilowatt-hours (kWh) of electricity annually.

This constant demand means that electricity is not just a utility bill; it is a primary raw material. A variance of even a few cents per kWh can translate into hundreds of thousands of Euros in annual operational costs. Understanding the long-term operational expenditure (OPEX) is as important as calculating the initial setup budget.

Portugal’s Industrial Electricity Tariffs in a European Context

Historically, industrial electricity prices in Portugal have been competitive within the European Union. While these prices are subject to market fluctuations, government policies promoting renewable energy have helped stabilize and, in some cases, lower the cost base for industrial consumers.

Compared to other major manufacturing hubs in Europe, Portugal often offers a more favorable tariff structure. This is thanks in part to its high share of electricity generated from renewable sources like wind, solar, and hydro, which have lower marginal costs than fossil fuel power plants.

However, relying solely on standard utility tariffs exposes a business to market volatility. For a 24/7 operation, price predictability is paramount for accurate financial forecasting. This is where alternative procurement strategies become essential.

Securing Long-Term Price Stability with Power Purchase Agreements (PPAs)

A Power Purchase Agreement (PPA) is a long-term contract between an electricity generator and a consumer. In Portugal’s mature renewable energy market, industrial companies are increasingly using PPAs to lock in electricity prices for 10, 15, or even 20 years.

How a PPA Works for a Manufacturer

In a typical PPA, a solar or wind farm developer sells power directly to the factory at a fixed, pre-agreed price. This arrangement offers two key benefits:

-

Cost Predictability: The factory is shielded from volatile wholesale electricity market prices, making long-term financial planning more reliable.

-

Sustainability Credentials: By sourcing energy directly from a renewable project, the factory can authentically claim its operations are powered by green energy—a significant advantage in marketing and corporate social responsibility.

Portugal’s advanced renewable energy sector provides a competitive marketplace for PPAs, with numerous developers offering various contract structures. Experience from J.v.G. turnkey projects has shown that securing a favorable PPA early in the planning process can fundamentally improve the business case for a new factory.

Grid Reliability: The Non-Negotiable Foundation

While competitive energy pricing is attractive, it means little without a stable and reliable electricity grid. The sophisticated machinery required for solar panel production is highly sensitive to power fluctuations, surges, or outages. A single unexpected shutdown can lead to hours of downtime, material waste, and potential equipment damage, directly impacting production targets and profitability.

Portugal’s national grid is generally robust and well-maintained, particularly in established industrial zones. The country has invested heavily in modernizing its infrastructure to accommodate a high influx of variable renewable energy.

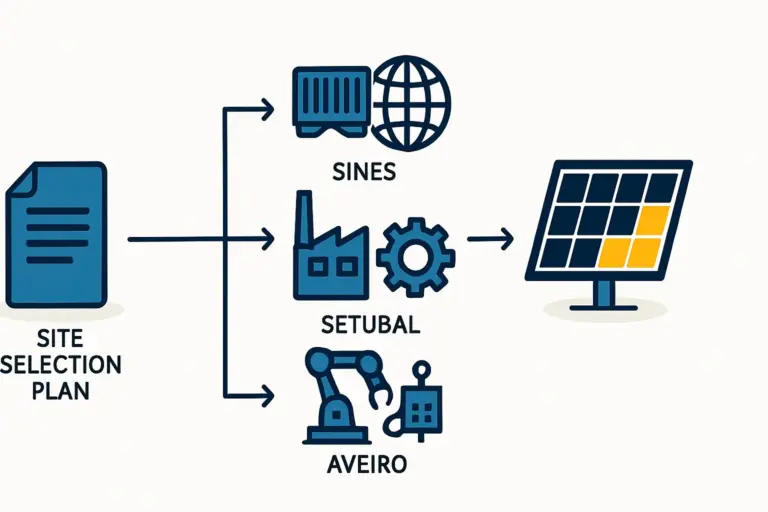

However, grid capacity and stability can vary by region. When evaluating potential sites, especially in more rural areas that may be closer to new renewable energy projects, conducting a thorough grid connection study is crucial. This assessment, typically done with the local distribution system operator, confirms that the grid can handle the factory’s consistent power demand without issue.

A common question from prospective investors is whether a factory in a region with high solar irradiation can become fully self-sufficient. While on-site solar installations can significantly reduce grid dependence, a 24/7 operation will always require a reliable grid connection to ensure uninterrupted power during the night and on cloudy days.

A Strategic Framework for Energy Due Diligence

For any entrepreneur evaluating Portugal as a manufacturing base, we recommend the following energy-related due diligence steps:

-

Analyze Regional Tariffs: Move beyond national averages and investigate the specific industrial tariffs offered by the utility provider in your target regions.

-

Explore the PPA Market: Engage with renewable energy developers to understand available PPA terms, tenors, and pricing. This should be a key part of your overall solar factory investment cost analysis.

-

Commission a Grid Connection Study: Before committing to a site, formally assess the capacity and stability of the local grid connection.

-

Model Energy Costs in Your Business Plan: Use the data gathered to build a detailed 10-year forecast of energy expenditures under different scenarios (e.g., utility tariff vs. PPA). pvknowhow.com provides structured resources to assist with this level of detailed financial modeling.

Frequently Asked Questions

What is a realistic electricity cost per solar module produced?

This varies based on module efficiency, factory automation, and local electricity price. As a general estimate for a modern facility, however, energy costs can range from 1.00 to 2.50 Euros per module. A long-term PPA is one of the most effective tools to keep this cost at the lower end of the range.

Can a solar module factory power itself entirely?

Not for a 24/7 operation. While a large rooftop or ground-mounted solar system can cover a significant portion of the daytime energy demand, a stable grid connection is essential for overnight operations and to ensure 100% uptime, which is critical for profitability.

How does grid instability affect sensitive production machinery?

Equipment like laminators, cell stringers, and testing simulators require precise, uninterrupted power. Voltage drops or ‘brownouts’ can cause machines to halt, leading to production line jams, wasted materials (e.g., half-laminated modules), and potential damage to sensitive electronics.

What is the typical process for securing a PPA in Portugal?

The process generally involves identifying potential renewable energy projects, negotiating key terms (price, duration, volume), conducting legal and technical due diligence, and finalizing a long-form contract. Working with local energy consultants who understand the market and regulatory landscape is highly advisable.

Conclusion: A Balanced Equation of Opportunity and Diligence

Portugal offers a compelling environment for establishing a solar module manufacturing facility, driven by a forward-thinking energy policy and a mature renewables market. The potential to secure low-cost, predictable, and green electricity through PPAs offers a significant competitive advantage.

However, this opportunity must be balanced with rigorous due diligence. A successful investment depends on a detailed analysis of regional grid stability, connection capacity, and the local PPA market. By treating energy as a core strategic element rather than a simple utility, investors can build a resilient and highly profitable manufacturing operation from the ground up.