When planning a new solar module manufacturing venture, the focus naturally falls on production machinery and technology. However, a business plan’s success can be quietly undermined by a factor many entrepreneurs overlook until it is too late: the supply chain.

The logistical complexities, hidden costs, and volatile lead times of sourcing components from distant markets can erode profitability before the first module is even produced. For investors and entrepreneurs eyeing the European market, the Iberian Peninsula in particular presents a significant strategic opportunity.

By tapping into the local supply chain in Spain and Portugal, a new manufacturer can build a more resilient, cost-effective, and efficient operation. This article explores the feasibility of sourcing key solar module components locally, highlighting the practical benefits for a new manufacturing enterprise.

The Strategic Advantage of Local Sourcing

The traditional model of sourcing solar components, primarily from Asia, comes with several well-documented challenges. Lead times can stretch from four to six weeks, tying up significant capital in transit. Furthermore, global shipping is susceptible to disruptions, as recent port congestion and geopolitical instability have shown, which can halt a production line indefinitely.

Sourcing locally within the Iberian Peninsula directly counters these issues:

-

Reduced Shipping Times: Transporting goods from a supplier in Portugal to a factory in Spain, or vice versa, can shrink to just a day or two. This drastically lowers working capital requirements and allows for a more agile, just-in-time inventory system.

-

Lower Logistical Costs: Eliminating transcontinental shipping and associated insurance costs creates direct, substantial savings. This is particularly impactful for bulky and heavy components like solar glass and aluminum frames.

-

Elimination of Import Tariffs: For a factory within the European Union, sourcing from a supplier in Spain or Portugal eliminates import duties and the administrative complexity of customs clearance.

-

Increased Supply Chain Resilience: A local supply chain is insulated from global port closures, international trade disputes, and currency fluctuations against major Asian currencies. This stability is a crucial asset in long-term operational planning.

The European Union’s broader industrial strategy encourages the onshoring of critical manufacturing, further supporting this approach and creating a favorable environment for developing local supply ecosystems.

Key Components for Local Sourcing: An Overview

A standard solar module is assembled from several critical components. While highly specialized items like solar cells are still predominantly manufactured in Asia, three key components present a strong case for local sourcing in the Iberian Peninsula.

Solar Glass: The Foundation of the Module

Solar glass is not ordinary glass. It must have a very low iron content to maximize light transmission and be thermally tempered for strength and durability against environmental factors like hail. It forms the protective top layer of the module.

The Iberian Peninsula has a robust industrial glass manufacturing sector. Companies like Guardian Glass, with major operations in Spain, are world leaders in high-performance coated glass. While their primary focus has not been on mass-producing solar-grade glass, the underlying technical capability and infrastructure are in place. The challenge for a new manufacturer is to engage these suppliers and co-develop a product that meets the specific anti-reflective and transmittance properties required for photovoltaic applications. This represents a significant opportunity.

Aluminum Frames: Providing Structure and Durability

The aluminum frame provides mechanical stability to the module, protecting it during transport and installation while ensuring its rigidity against wind and snow loads.

This is arguably the most promising category for local sourcing. Both Spain and Portugal have well-established aluminum extrusion industries, particularly in regions like the Basque Country. These industries already serve demanding sectors like automotive and construction, and possess the advanced machinery and quality control processes necessary to produce high-precision solar frames. A new manufacturer can tap into this industrial strength by providing exact specifications, securing a reliable and cost-effective supply of frames. Such detailed planning is crucial when setting up your solar panel assembly line.

Junction Boxes and Connectors: The Electrical Interface

The junction box, typically mounted on the rear of the module, is a critical electrical interface. It houses the bypass diodes that protect the module from hotspots and contains the cables and connectors that allow modules to be linked together into an array.

While the Iberian Peninsula has a healthy electronics manufacturing sector, finding a specialized supplier for solar junction boxes at a competitive volume may be more challenging. These are intricate components that must meet stringent international safety and performance standards. However, the opportunity lies in identifying electronics assemblers who can adapt their processes for this specific application. For projects targeting markets in Africa or the Middle East, it’s critical to ensure any potential supplier can specify junction boxes for high ambient temperatures and dust ingress.

Navigating the Supplier Landscape: A Practical Approach

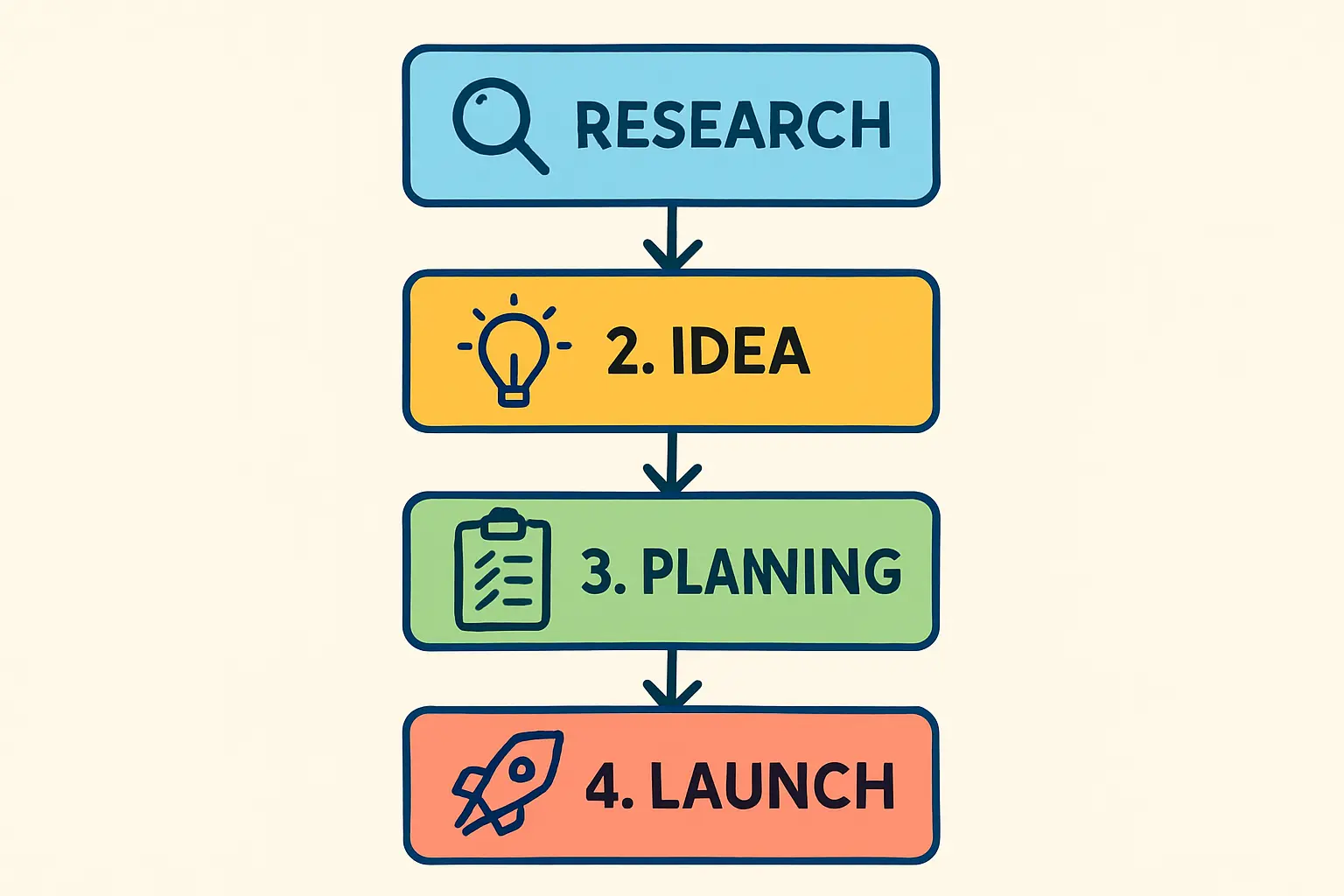

Identifying and vetting potential local suppliers requires a structured, diligent process. This is not merely a search for the lowest price but for a reliable, long-term partner.

A practical approach involves three key stages:

-

Initial Research and Identification: Utilize national industrial directories, engage with trade associations in the glass and aluminum sectors, and attend regional trade fairs to create a longlist of potential suppliers.

-

Technical Due Diligence: Once potential partners are identified, request product samples and technical specification sheets. It is essential to verify their existing quality certifications (e.g., ISO 9001) and inquire about their capability to meet solar-specific standards (e.g., IEC). Verifying these details is crucial, as the quality of these components directly impacts the final product’s bankability and solar panel certifications.

-

On-Site Audits: A factory visit is non-negotiable. An audit assesses the supplier’s production capabilities, quality control protocols, and overall professionalism. Experience from turnkey projects shows that a thorough supplier audit is one of the most critical steps in de-risking the setup of a new manufacturing facility.

The Economic Equation: A Cost-Benefit Analysis

The decision to source locally cannot be based on per-unit price alone. A comprehensive ‘total landed cost’ analysis is required to understand the true economic impact.

-

Importing Scenario (e.g., from Asia): Base Price + Sea Freight + Insurance + Import Tariffs & VAT + Customs Brokerage Fees + Inland Transport + Warehousing Costs for Buffer Stock.

-

Local Sourcing Scenario (Iberian Peninsula): Base Price (potentially 10-15% higher) + Minimal Inland Transport.

Even if the ex-works price from a Spanish or Portuguese supplier is higher, the savings on logistics, tariffs, and reduced inventory holding costs often result in a lower total cost per unit. This detailed cost analysis is a fundamental part of creating a realistic solar panel manufacturing business plan. The financial benefits, combined with the immense strategic value of supply chain security, make a compelling business case.

Frequently Asked Questions (FAQ)

Can I source all my components from Spain and Portugal?

At present, this is unlikely. Critical components like photovoltaic cells are almost exclusively manufactured in Asia. The most effective strategy is a hybrid one: source bulky, high-shipping-cost items like glass and frames locally, while continuing to import specialized electronic components like solar cells from established global leaders.

Are Iberian suppliers competitive on price with Asian manufacturers?

On a direct, per-unit price comparison, they may not be. Their true competitiveness emerges when you analyze the total landed cost. When freight, tariffs, and inventory costs are factored in, local suppliers often become the more economical choice.

What is the main advantage of sourcing from the Iberian Peninsula?

The primary advantage is supply chain resilience. Shorter lead times and insulation from global shipping disruptions provide operational stability, which is a significant competitive advantage in today’s volatile global market.

Do I need a technical background to evaluate these suppliers?

While a technical background is helpful, it is not essential. A structured evaluation framework and a clear set of technical specifications for your components are crucial. This process can be effectively managed with the support of external consultants or partners who specialize in setting up solar manufacturing operations.

Conclusion and Next Steps

The Iberian Peninsula offers a compelling strategic opportunity for new solar module manufacturers to build a more resilient and cost-effective supply chain. The strong industrial base in aluminum extrusion presents an immediate, viable option for sourcing frames. The potential to collaborate with established glass manufacturers offers a clear path to developing a local supply of solar glass.

For the entrepreneur or business professional exploring this venture, the immediate next step is to develop a detailed bill of materials for the planned solar module. With this in hand, a targeted outreach to potential suppliers in Spain and Portugal can begin, transforming a theoretical advantage into a tangible, competitive edge.