For many entrepreneurs in the solar manufacturing sector, the initial capital investment is the most significant hurdle. While the search for a location often centers on production costs and market access, a less obvious but crucial factor is the availability of government and regional financial support. Portugal has quietly emerged as a strategic European base—not just for its geography, but for its robust ecosystem of fiscal incentives and access to substantial EU funding.

This article outlines the key financial instruments available in Portugal for new solar manufacturing projects. It’s designed for business leaders exploring opportunities to establish a production facility, explaining how to leverage these programs to de-risk their investment and accelerate their path to market.

Why Portugal? A Strategic European Hub

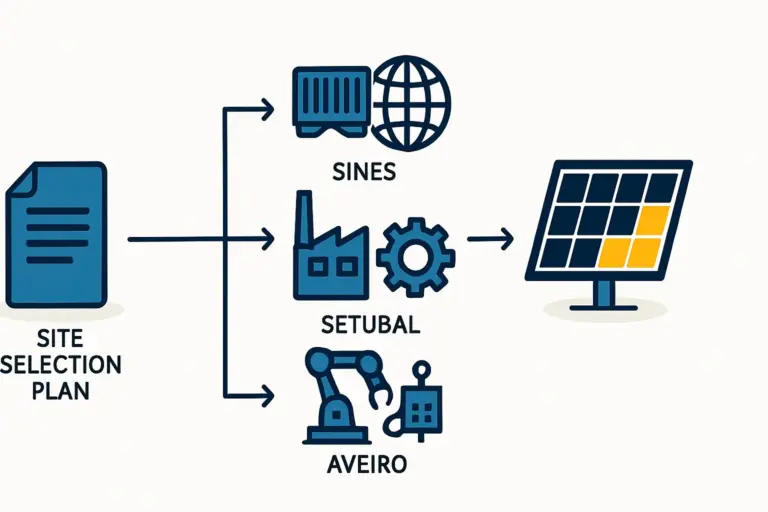

Before diving into the specific financial incentives, it’s worth understanding Portugal’s strategic position. As a member of the European Union, the country offers political stability and access to the European single market. Its ports provide excellent logistical pathways to Africa, the Middle East, and the Americas—a crucial consideration for the target markets of many new solar manufacturers. This unique combination of market access and a supportive government framework makes it a compelling location for a turnkey solar module production line.

The country is also committed to the green transition, which fosters strong domestic demand and a skilled workforce familiar with renewable energy technologies. This alignment between national policy and industrial opportunity creates fertile ground for investment.

Unlocking National Fiscal Incentives

Portugal offers several powerful tax incentives designed to attract investment in strategic sectors like renewable energy manufacturing. Two of the most relevant for a new solar module factory are SIFIDE II and RFAI.

SIFIDE II: Rewarding Research and Development

The Tax Incentive System for Business R&D (SIFIDE II) is designed to encourage innovation. For a solar module manufacturer, this incentive extends beyond fundamental scientific research to include practical, industrial R&D, such as:

- Developing modules with higher efficiency ratings.

- Integrating new materials to improve durability in harsh climates.

- Creating innovative processes to reduce waste or energy consumption during manufacturing.

- Adapting module designs for specific applications, like agrivoltaics or building-integrated photovoltaics (BIPV).

Under SIFIDE II, companies can receive a tax credit of up to 82.5% of their R&D-related expenses. This can significantly lower the effective cost of setting up pilot lines, testing new equipment, or employing specialized engineers, turning a necessary cost center into a substantial financial advantage.

RFAI: Supporting Your Initial Investment in Assets

The Investment Support Tax Regime (RFAI) is more directly focused on the initial capital expenditure required to establish or expand a facility. This incentive provides a corporate income tax credit for investments in tangible fixed assets, which for a solar factory includes essential solar manufacturing equipment like laminators, stringers, and cell testers.

The key benefits of RFAI include:

- Significant Tax Credits: Companies can receive a tax credit of up to 25% of their eligible investments. For a multi-million euro factory setup, this translates into a substantial reduction in the tax burden during the critical early years of operation.

- Broad Eligibility: The incentive applies to new tangible assets, making it perfectly suited for entrepreneurs launching a greenfield project.

While understanding the full investment requirements for a solar factory is the first step, incentives like RFAI directly mitigate that initial financial outlay. J.v.G.’s experience with turnkey projects shows that structuring the investment to maximize eligibility for programs like RFAI is a critical part of the initial planning phase.

Tapping into European Union Funding Streams

Beyond its national programs, Portugal’s membership in the EU provides access to some of the world’s largest pools of capital for green technology projects.

The Recovery and Resilience Plan (RRP): A Historic Opportunity

In response to the economic impact of the pandemic, the EU established the Recovery and Resilience Facility. Portugal’s corresponding national plan (the RRP) has been allocated approximately €16.6 billion in grants and loans to foster a sustainable and resilient economy.

A solar module manufacturing plant aligns perfectly with the RRP’s core objectives of a ‘green transition’ and ‘digital transformation’. Projects that strengthen Europe’s renewable energy supply chain are prime candidates for this funding. The RRP can provide direct grants or favourable loans, substantially reducing the amount of private capital required for a project.

The Innovation Fund and InvestEU Programme

For projects incorporating next-generation technology, the EU Innovation Fund is a key instrument. It focuses on highly innovative, low-carbon technologies and aims to de-risk large-scale projects that can deliver significant emissions reductions. A factory planning to produce innovative panels, such as those using perovskite or other advanced cell technologies, would be a strong candidate.

The InvestEU Programme works differently, providing public guarantees to unlock private investment. For an entrepreneur seeking bank financing, an InvestEU guarantee can make the project more attractive to lenders, resulting in better loan terms and lower financing costs.

Frequently Asked Questions (FAQ)

-

Are these incentives available to companies headquartered outside the EU?

Yes. Foreign investors who establish a legal entity in Portugal can typically access these national and EU-level incentives, provided they meet all eligibility criteria for the specific program. -

Is a local Portuguese partner required to access this funding?

While not always a strict requirement, having a local partner or establishing a Portuguese subsidiary is standard practice. Navigating the administrative and legal systems is considerably more straightforward with a local presence. -

How complex is the application process for these funds?

The complexity varies. National tax incentives like RFAI are relatively straightforward and integrated into the corporate tax system. Applications for large EU grants, such as from the RRP or Innovation Fund, are highly competitive and require a detailed, professionally prepared solar factory business plan and technical proposal. -

What is a realistic timeline for securing funding?

For tax credits, the benefits are realized after the investment is made and profits are generated. For competitive grants, the application and approval process can take anywhere from six to eighteen months. Factoring this timeline into the project plan is crucial.

The Path Forward

The combination of national tax incentives and substantial EU funding makes Portugal a highly attractive location for establishing a solar module manufacturing facility. These programs are not simply minor subsidies; they are powerful financial instruments that can fundamentally improve a project’s business case, reduce risk, and accelerate its timeline.

For entrepreneurs and business leaders, the next step is to move from general awareness to specific analysis. This means thoroughly evaluating how a proposed project aligns with the criteria for each of these funds. With a clear understanding of this financial landscape, an investor can make a well-informed decision and build a more resilient and profitable manufacturing operation from day one.