An investor considering solar module manufacturing in Qatar might initially see a contradiction. As one of the world’s leading exporters of liquefied natural gas (LNG), the nation has access to abundant, cost-effective energy.

That view, however, overlooks the strategic drivers positioning Qatar as a significant emerging market for solar energy and creating distinct opportunities for local producers. The country’s high per capita energy consumption—among the highest globally—is precisely what fuels its demand for diversification and energy security.

This article examines the two primary domestic markets for a solar panel manufacturer in Qatar: large, government-backed utility-scale projects and the rapidly growing industrial self-consumption sector. Understanding the unique characteristics, requirements, and dynamics of each is crucial for developing a successful market entry strategy.

The Two Pillars of Solar Demand in Qatar

While both segments rely on solar photovoltaic (PV) technology, they operate as distinct markets with different customers, sales cycles, and technical requirements. A new manufacturing business must decide whether to focus on one or strategically pursue both.

-

Utility-Scale Tenders: These are large-scale solar farms, often hundreds of megawatts (MW) in size, developed to supply power directly to the national grid. The primary customer is a state entity, and contracts are awarded through a competitive bidding process, or tender.

-

Industrial Self-Consumption: This market consists of private industrial companies—particularly in the LNG, petrochemical, and manufacturing sectors—that install solar systems to generate their own electricity. Their motivation is typically a combination of cost control, price stability, and corporate sustainability goals.

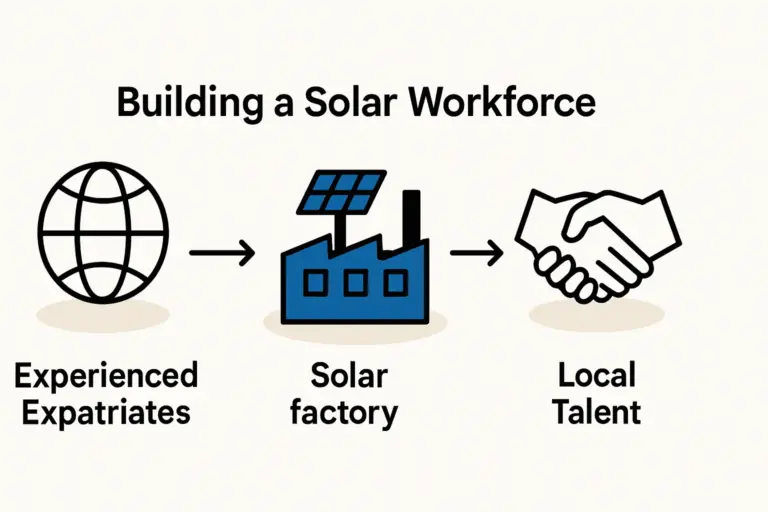

Grasping the nuances of these two pillars is a critical step in defining a viable business model for a solar factory. Experience from J.v.G. turnkey projects shows that aligning production capacity and technology with the target market’s needs from day one is essential for long-term success.

Market Focus 1: Utility-Scale Projects and the National Vision

Qatar’s national solar ambitions are formalized in its National Vision 2030, which targets generating 20% of the country’s electricity from renewables by 2030. This government mandate is the primary driver for the development of large-scale solar farms.

The Tender Process and Key Players

The state-owned utility, Qatar General Electricity & Water Corporation (Kahramaa), acts as the sole buyer (offtaker) of power from these large projects. To procure this energy, Kahramaa issues competitive tenders that invite developers to submit bids to build, own, and operate the solar plants.

A prime example is the 800 MW Al Kharsaa Solar PV Power Plant, a landmark project that showcases the scale of the government’s commitment. Future tenders are already planned for industrial hubs like Mesaieed and Ras Laffan, totaling an additional 875 MW.

Requirements for Manufacturers

To supply modules for these utility-scale projects, a manufacturer must be prepared to meet stringent criteria:

-

High Volume and Standardization: Tenders require hundreds of thousands of identical, high-quality solar panels, meaning a factory’s production line must be optimized for mass output.

-

Cost Competitiveness: The bidding process is intensely price-sensitive. A local manufacturer must compete with major international players, making production efficiency paramount.

-

Bankability and Certification: Developers and their financiers require modules certified to international standards (e.g., IEC) from a bankable brand with a proven track record. A new entrant needs a solid plan to achieve these credentials.

-

Long Sales Cycles: The entire tender process, from announcement to contract award and final module delivery, can take years. This requires significant financial planning and patience.

For a new manufacturer in Qatar, participating in these tenders offers the chance to secure large, predictable orders. However, it also demands significant scale and a focus on cost leadership. Understanding the investment required for a solar module production line is a crucial step before pursuing this path.

Market Focus 2: Industrial Self-Consumption

Beyond government tenders lies a substantial market driven by Qatar’s powerful industrial sector. The production of LNG, chemicals, and steel is incredibly energy-intensive, making electricity a major operational cost and creating a strong business case for self-generation.

Drivers for Industrial Solar Adoption

Companies in industrial cities like Ras Laffan and Mesaieed are increasingly turning to solar for several strategic reasons:

-

Cost Stability and Predictability: While grid electricity is available, solar offers a fixed, predictable energy cost over 25+ years, hedging against future tariff volatility.

-

Decarbonization Goals: Many international companies operating in Qatar, or those exporting to markets like Europe, are under pressure to reduce their products’ carbon footprint. On-site solar is a direct and visible way to achieve this.

-

Operational Resilience: In some cases, a dedicated solar plant can provide a more stable power supply, protecting sensitive industrial processes from grid fluctuations.

-

Evolving Regulations: The government is developing frameworks to support self-consumption, which could further accelerate adoption by allowing companies to sell surplus power back to the grid.

Opportunities for Manufacturers

This market presents a different set of opportunities compared to utility-scale tenders:

-

Direct Customer Relationships: Manufacturers can sell directly to industrial end-users or through specialized installation companies (EPCs), allowing for more direct negotiation and relationship-building.

-

Diverse Project Sizes: Projects range from a few megawatts on a factory roof to larger ground-mounted systems of 50 MW or more on adjacent land.

-

Value-Added Products: Industrial clients may have specific needs, such as modules that perform better in high heat or bifacial panels that increase energy yield. This creates opportunities for specialized, higher-margin products. Exploring different solar panel technologies can reveal which are best suited for this environment.

-

Shorter Sales Cycles: While still a considered purchase, the timeline for a corporate power purchase agreement or direct sale is often significantly shorter than a government tender.

This segment allows a new manufacturer to build a brand based on quality, reliability, and technical expertise, often in closer partnership with the end customer.

Frequently Asked Questions (FAQ)

What is the primary driver for solar in an LNG-rich country like Qatar?

The main drivers are economic diversification under National Vision 2030, the desire for long-term energy security, and meeting national climate commitments. In the industrial sector, the key motivators are cost stability and meeting corporate sustainability targets demanded by global markets.

Is it better for a new manufacturer to target utility-scale or industrial clients first?

This depends on the investor’s strategy and capital. Targeting utility-scale projects requires a large factory focused on cost efficiency to win tenders. Focusing on the industrial market could allow for a smaller initial setup centered on higher-value products and direct sales, potentially offering better margins but requiring a stronger sales and marketing effort.

What role does the government play in the solar market?

The government, through Kahramaa, is the primary driver of the utility-scale market, acting as the sole power purchaser. It also shapes the industrial market by setting the regulatory framework for self-consumption and grid connection.

How does Qatar’s climate affect solar panel requirements?

The high ambient temperatures, intense solar irradiation (averaging 2,140 kWh/m²/year), and dusty conditions are critical factors. Modules must have excellent temperature coefficients to minimize power loss in the heat and durable construction to withstand sand and dust. Local manufacturing offers a distinct advantage by enabling the production of panels specifically optimized for these conditions.

Strategic Considerations for Entering the Qatari Solar Market

Qatar’s solar landscape offers two distinct and compelling markets for a local panel manufacturer. The utility-scale segment is driven by national policy and offers the potential for high-volume, long-term contracts. The industrial self-consumption segment is driven by commercial pragmatism and sustainability goals, offering opportunities for direct sales and higher-margin products.

A prospective investor must weigh these pathways carefully. The choice is not merely about production technology; it shapes the entire business model, from sales strategy and customer relationships to cash flow management and long-term growth.

For any serious entrepreneur, the next logical step is to move from market analysis to operational planning. For a structured approach to this complex process, new investors can explore our comprehensive guide on how to start a solar factory.