Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

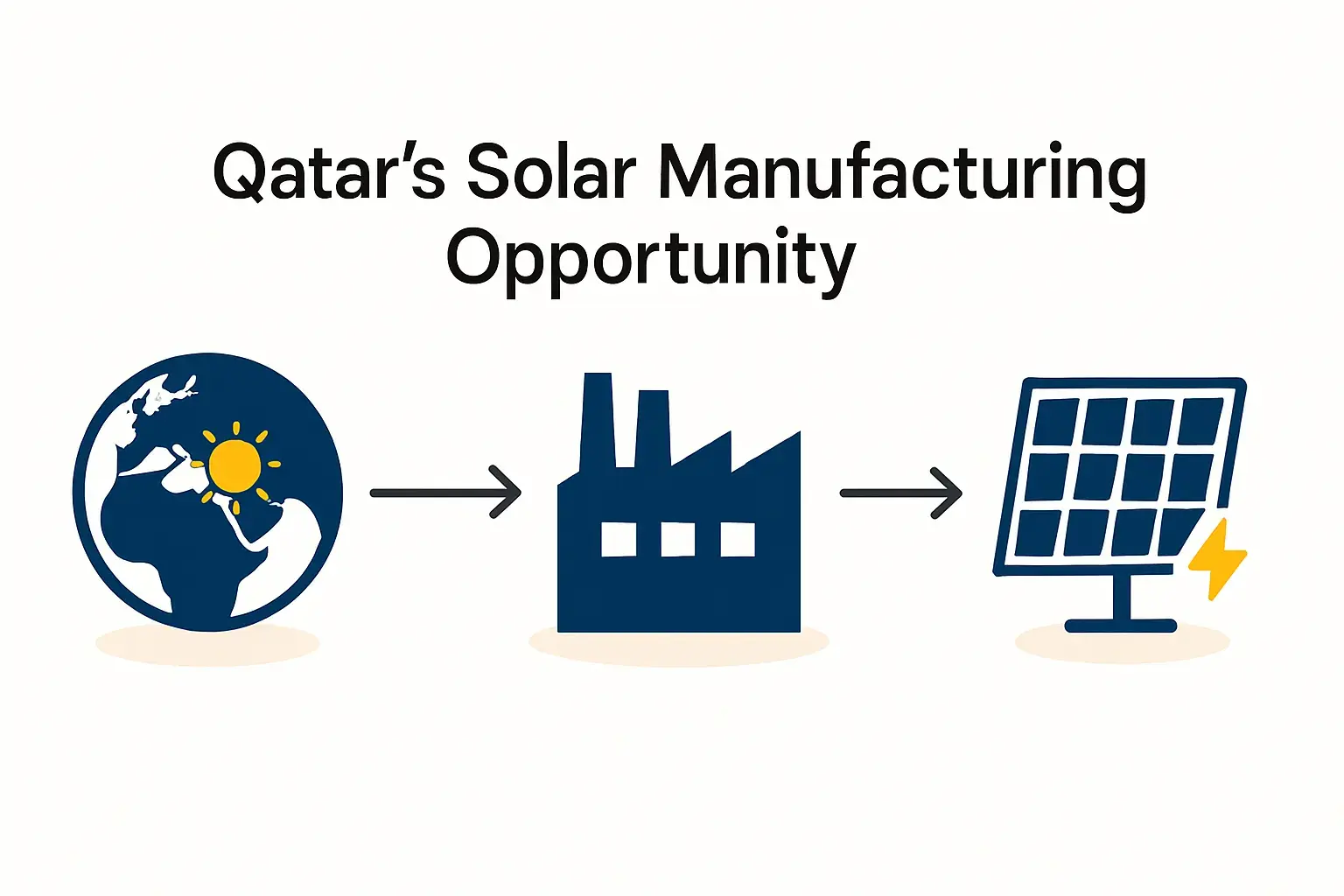

Qatar’s global leadership in the liquefied natural gas (LNG) market is undisputed. The ongoing North Field East (NFE) and North Field South (NFS) projects will cement this position, expanding production capacity to an immense 142 million tonnes per annum (MTPA) by 2030.

While this industrial expansion is monumental, it also creates a colossal demand for energy. Powering this growth presents a strategic inflection point—an opportunity not just to consume energy, but to produce it in a new, sustainable, and sovereign way.

For Qatar’s energy conglomerates, the path from hydrocarbons to photons is no longer a distant vision; it is a clear and commercially viable business imperative. This article outlines the strategic case for vertical integration into solar module manufacturing, transforming a significant operational cost into a cornerstone of national industrial policy and a new, high-tech export revenue stream.

The Inescapable Link: LNG Expansion and National Energy Demand

The scale of Qatar’s LNG expansion requires an energy infrastructure to match. Conservative estimates project the new facilities will need up to 5 GW of dedicated power—a substantial portion of the nation’s current total capacity. Meeting this demand solely with traditional generation would conflict with the foundational pillars of the Qatar National Vision 2030, which prioritizes economic diversification and environmental stewardship.

At the same time, Qatar’s National Climate Change Action Plan has set an ambitious target to install 5 GW of solar capacity by 2035. The successful commissioning of the 800 MW Al Kharsaah Solar PV Power Plant and the development of two IC Solar projects (totaling 875 MW) are significant steps forward.

Yet, these projects currently rely on imported solar modules. This convergence of massive internal energy demand from the LNG sector and ambitious national renewable energy goals creates a powerful, built-in market for locally produced solar technology.

The Strategic Imperative for Domestic Solar Manufacturing

For a nation focused on long-term resilience, the ‘make versus buy’ decision for critical energy components is a matter of strategic importance. Relying on global supply chains for solar modules introduces vulnerabilities, including price volatility, shipping disruptions, and geopolitical risks.

Establishing a domestic manufacturing base presents several key advantages:

- Supply Chain Sovereignty: Local production ensures a stable, predictable supply of solar modules for critical national infrastructure, including the LNG facilities and future utility-scale projects. This insulates the country’s energy transition from external market shocks.

- Economic Diversification: A high-tech manufacturing facility creates a new non-hydrocarbon export industry. It builds a durable economic asset that generates revenue and intellectual property, directly supporting the goals of Vision 2030.

- In-Country Value (ICV): Aligned with the ‘Tawteen’ program, a local factory creates skilled jobs for engineers, technicians, and operators. It also stimulates a local ecosystem of suppliers for components like aluminum frames, glass, and packaging materials.

Blueprint for a 500 MW+ Turnkey Solar Facility

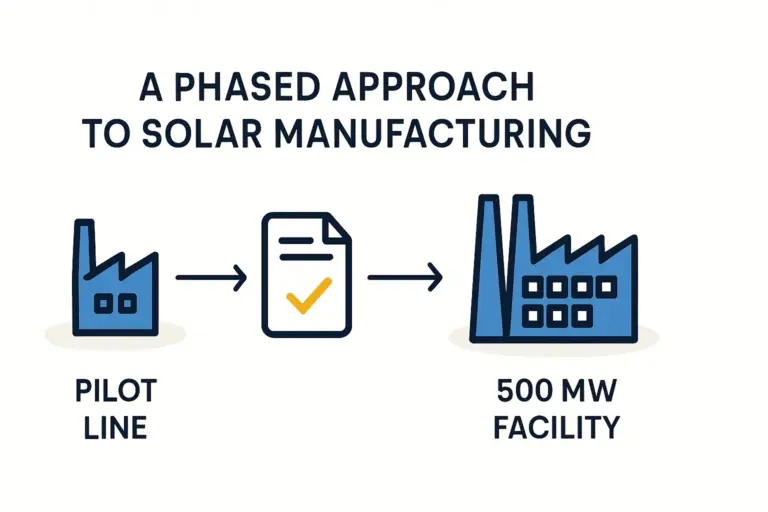

For an organization whose expertise lies in hydrocarbon exploration and processing, entering a new high-tech manufacturing sector may seem daunting. The path, however, is significantly de-risked by a structured, turnkey approach. A modern turnkey solar module production line offers a comprehensive solution, including factory design, machinery procurement and integration, process optimization, quality control systems, and extensive training for the local workforce.

A facility with an annual capacity of 500 MW or more is the ideal scale for this strategic initiative. This size achieves critical economies of scale, making production costs competitive. It is large enough to service a significant portion of the internal demand from the LNG expansion, supply national projects, and establish a strong foundation for exports.

Based on experience gained from European PV manufacturers’ turnkey projects, such a facility can be planned, built, and commissioned within 18 to 24 months. The crucial initial planning phase is best guided by a detailed solar manufacturing business plan that models all technical and financial parameters.

Technology Tailored for the Qatari Climate: The DESERT+ Advantage

Qatar’s environment presents unique challenges for photovoltaic technology. The combination of high solar irradiation, ambient temperatures exceeding 50°C, and abrasive, dust-filled air can cause standard solar panels to degrade quickly and underperform significantly.

To maximize energy yield and ensure a long operational lifespan, specialized modules are essential. The solution lies in advanced DESERT+ technology, engineered specifically for arid, high-temperature climates. These modules incorporate features such as:

- Optimized Cell Technology: Designed for superior performance at high temperatures, minimizing power loss as the module heats up.

- Durable Materials: Use of robust glass-glass construction and specialized encapsulants to withstand sand abrasion and prevent moisture ingress.

- Enhanced Heat Dissipation: Frame and junction box designs that facilitate cooling, improving both performance and longevity.

Investing in a facility capable of producing these specialized modules not only meets Qatar’s own demanding requirements but also creates a unique, high-value product for export to other nations in the GCC and MENA regions facing similar climatic challenges.

Analyzing the Financial Case and Market Opportunity

The business case for a national solar manufacturing champion in Qatar is built on three distinct yet synergistic revenue streams that together ensure its financial viability.

-

Internal Demand (Anchor Offtake): The primary and most secure market is the direct supply of modules to power the LNG expansion. This creates a predictable baseline of demand that de-risks the entire investment from day one.

-

National Demand (Strategic Supplier): The facility would become the premier supplier for Qatar’s ongoing and future utility-scale solar projects, helping the nation meet its 5 GW target with locally manufactured technology.

-

Export Market (Regional Leader): With a proven, high-performance desert-rated product, the facility can position Qatar as a regional hub for advanced solar technology, exporting to neighboring countries with similar climates and energy ambitions.

Frequently Asked Questions (FAQ)

What is the typical investment for a 500 MW solar manufacturing plant?

The investment for a turnkey facility of this scale typically falls within a defined range, depending on the chosen technology, level of automation, and building specifications. A comprehensive feasibility study is the first step toward developing a precise budget.

How many employees are required to operate such a facility?

A 500 MW semi-automated production line generally requires a workforce of approximately 200–250 personnel. This includes skilled engineers, quality control specialists, machine operators, and administrative staff, spread across multiple shifts.

Can a company without prior solar experience successfully run this operation?

Yes. The turnkey model is specifically designed for new market entrants. The process includes comprehensive knowledge transfer, from machinery operation and maintenance to quality assurance protocols (like ISO 9001) and final product certification (e.g., IEC).

What are the primary raw materials, and can they be sourced locally?

The key materials include solar cells, specialized glass, aluminum for frames, encapsulant films (EVA/POE), and backsheets or rear glass. While solar cells are typically imported initially, there is significant potential to localize the supply of glass, aluminum frames, and other components, further enhancing in-country value.

The Path Forward: From Strategic Vision to Operational Reality

The convergence of immense internal energy needs, national diversification mandates, and proven turnkey manufacturing solutions presents a historic opportunity for Qatar’s energy leaders. Establishing a 500 MW+ solar module factory is more than an investment in renewable energy; it is a strategic move to build industrial sovereignty, create a new economic pillar, and secure Qatar’s energy future with locally engineered technology.

The journey begins with a detailed assessment. A comprehensive solar manufacturing business plan provides the essential, data-driven foundation to turn this strategic vision into an operational reality.

Download: Qatar Solar Investment & Strategy Case Study [PDF]

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.