While the initial capital investment for a solar factory often draws the most attention, the ongoing operational expenditure (OpEx) ultimately determines its long-term profitability and sustainability. An investor might secure funding for state-of-the-art machinery, but without a clear, realistic forecast of day-to-day costs, the business model can falter before the first module ships.

This article offers a detailed, illustrative breakdown of operational costs for a mid-sized solar module factory with a capacity of 50–100 MW. Using Romania as a case study allows us to analyze how regional factors like labor rates and energy prices influence the financial viability of a solar manufacturing venture. This model is a foundational guide for entrepreneurs and business leaders evaluating entry into this strategic industry.

Why OpEx is as Critical as Your Initial Investment

In business finance, capital expenditure (CapEx) covers the one-time purchase of major physical assets, such as the machinery and building for your factory. Operational expenditure (OpEx), in contrast, covers the recurring costs of running the business day-to-day.

Think of it this way: CapEx is the cost of building the ship, while OpEx is the cost of the crew, fuel, and supplies needed for the voyage. A magnificent vessel is useless without the resources to operate it. In solar manufacturing, meticulous OpEx management enables competitive module pricing, resilience against market fluctuations, and sustainable profit margins. It is the engine of your factory’s financial health.

A Sample OpEx Breakdown for a Romanian Solar Factory

To create a tangible financial model, let’s consider a factory with an 80 MW annual capacity, operating two shifts, five days a week. Its production line is modern and semi-automated—a common setup for new entrants balancing investment with efficiency. The following figures are illustrative, based on market analysis for Eastern Europe, and will naturally vary depending on specific equipment, supply contracts, and managerial efficiency.

1. Labor Costs: The Human Element

A semi-automated 80 MW line typically requires a workforce of 40 to 60 individuals across two shifts. This includes line operators, quality control technicians, maintenance engineers, logistics staff, and administrative personnel.

Romania offers a significant advantage within the European Union: a skilled and technically educated workforce at a competitive wage level.

- Key Metric: According to recent analyses, the average gross salary for a skilled manufacturing worker in Romania is approximately €1,200–€1,600 per month.

- Estimated Annual Cost: For a staff of 50 employees, the total annual labor cost—including social contributions and taxes—would be in the range of €900,000 to €1.2 million.

This strategic balance of skill and cost makes Romania a compelling location for manufacturing ventures aiming to serve the European market.

2. Energy Consumption: Powering Production

Solar module manufacturing is an energy-intensive process. Key machines like the stringer (which solders cells together), the laminator (which bonds the module layers under heat and vacuum), and the final flash tester consume significant amounts of electricity.

- Key Metric: An 80 MW line consumes approximately 2 to 3 million kWh of electricity annually. Industrial electricity prices in Romania currently range from €0.15 to €0.20 per kWh.

- Estimated Annual Cost: This puts the annual electricity expenditure between €300,000 and €600,000.

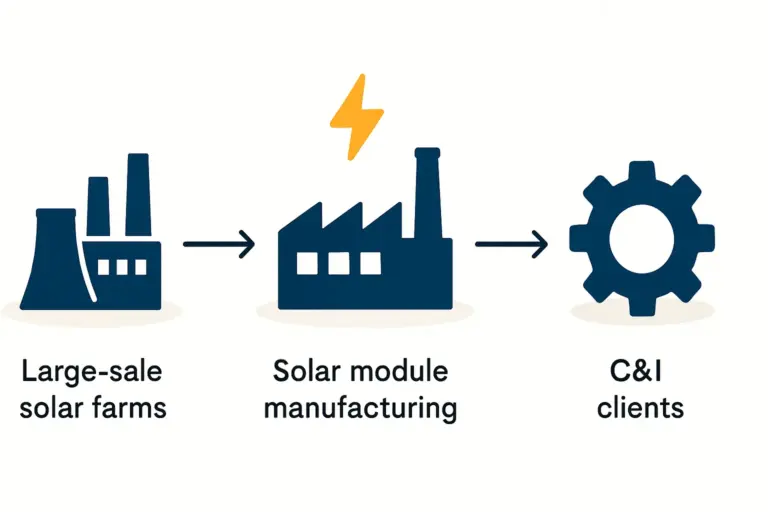

A compelling strategy for new factories, particularly in regions with high solar irradiation, is to install a large-scale PV system on the factory roof. This move not only reduces long-term energy costs but also serves as a powerful demonstration of the product’s value.

3. Raw Materials & Consumables (Bill of Materials – BOM)

While technically part of the Cost of Goods Sold (COGS), procuring and managing the Bill of Materials is a central operational function that accounts for the largest portion of the budget. Efficient supply chain management is therefore non-negotiable for profitability.

The primary materials include:

- Solar cells

- Tempered glass

- EVA or POE encapsulant films

- Backsheets (or a second pane of glass for Glass-Glass modules)

- Aluminum frames

- Junction boxes and cables

A deep understanding of these solar panel components is essential for effective cost management.

- Key Metric: Material costs fluctuate with global commodity markets but typically range from $0.12 to $0.15 per Watt-peak (Wp) produced.

- Estimated Annual Cost: For an 80 MW (80,000,000 Wp) factory, annual raw material expenditure is therefore approximately $9.6 million to $12 million.

Romania’s geographical position—with access to the Port of Constanța on the Black Sea and robust road and rail networks into the EU—offers a logistical advantage for managing both inbound materials and outbound product distribution.

4. Maintenance and Spare Parts

To ensure maximum production uptime and consistent quality, a proactive maintenance schedule is crucial. This budget covers routine service for machines like laminators and stringers, as well as a stock of critical spare parts such as heating elements, vacuum pumps, and soldering tips.

- Industry Benchmark: Experience from J.v.G. turnkey projects shows that budgeting 1–2% of the initial machinery CapEx for annual maintenance is a reliable standard. A preventative schedule, guided by an experienced partner, can reduce costly, unexpected downtime by over 70%.

- Estimated Annual Cost: On a machinery investment of €5 million, the annual maintenance budget would be €50,000 to €100,000.

5. Overheads and Administrative Costs

This category covers all other recurring costs of operating the business.

- Factory Rent or Depreciation: Costs associated with the physical building.

- Insurance: Coverage for the facility, equipment, and liability.

- Certifications & Compliance: Costs for maintaining IEC, ISO, and other required product and quality certifications.

- Logistics: Packaging materials and freight for shipping finished modules.

- Administrative Costs: Software licenses, utilities, office supplies, and salaries for non-production staff.

Though this category can vary widely, it remains a significant factor in the overall OpEx model.

Strategic Implications for an Investor

Analyzing this breakdown reveals several key insights for a prospective factory owner:

-

Focus on Key Levers: While raw materials are the largest cost, their prices are largely dictated by global markets. The most significant operational levers an owner can control are labor efficiency and energy consumption.

-

Location is a Strategic Choice: The example of Romania highlights the competitive advantage a strategic location can provide through a favorable mix of labor costs, logistical access to key markets, and a stable EU regulatory environment.

-

Process Optimization is Key: The difference between profit and loss often comes down to operational efficiency—minimizing material waste, maximizing machine uptime, and optimizing workforce deployment. This is where the initial planning and choice of a turnkey solar manufacturing line can have a lasting impact on long-term OpEx.

These operational costs do not exist in a vacuum. They are directly related to the initial capital investment requirements needed to establish the facility. A higher initial investment in automation, for instance, may lead to lower long-term labor costs.

Frequently Asked Questions (FAQ)

How much working capital is needed to cover the first few months of OpEx?

A common business practice is to secure enough working capital to cover three to six months of total operational expenditures. This buffer ensures the business can manage payroll, purchase raw materials, and cover other costs before generating significant revenue from module sales.

Does a higher level of factory automation reduce OpEx?

Yes, but it involves a trade-off. Higher automation increases the initial CapEx but can significantly reduce long-term labor costs and potentially improve quality consistency. The optimal level of automation depends on local labor rates, capital availability, and production volume goals.

How volatile are the raw material costs?

The costs of key materials, especially solar cells (polysilicon) and glass, can fluctuate based on global supply and demand. Successful factory operators engage in strategic procurement, including long-term supply agreements and dynamic sourcing, to mitigate this volatility.

Can a factory be profitable with these operational costs?

Absolutely. Profitability depends on the balance between OpEx, production efficiency, and the achievable selling price per module. With efficient operations, a factory in a strategic location like Romania can be highly competitive, especially when serving the growing European demand for high-quality, locally manufactured solar modules.

Planning Your Next Steps

Understanding and forecasting operational expenditure is a critical step in de-risking a solar manufacturing investment. A detailed financial model transforms an ambitious idea into a viable business plan. It moves beyond the initial excitement of building a factory to the practical reality of running it profitably.

Proper planning, guided by experienced partners, turns these financial models from theoretical exercises into a predictable and sustainable reality. A structured approach is essential for entrepreneurs embarking on this journey, and the pvknowhow.com platform provides comprehensive resources to help business leaders navigate these complex planning stages with confidence.