Establishing a solar module manufacturing facility in a new market is a significant undertaking. Business plans naturally focus on machinery, supply chains, and market analysis, but one of the most foundational decisions is often underestimated: choosing the right legal entity.

In the Russian Federation, this is not merely a bureaucratic step. It is a strategic decision that will shape your venture’s governance, liability, and ability to attract future investment. For an entrepreneur without a background in Russian corporate law, the options can seem daunting.

This guide offers a straightforward comparison of the two most common legal structures for foreign investors: the Limited Liability Company (OOO) and the Joint-Stock Company (AO). Understanding the nuances of each is the first step toward building a resilient and successful solar manufacturing operation.

The Foundation of Your Venture: Understanding Russian Legal Entities

For most foreign investors in Russia, the choice comes down to two primary forms of legal entity. Both are designed to limit the personal liability of their owners, but they differ significantly in their structure, flexibility, and administrative requirements. The decision between them should be driven by your long-term business strategy, capital structure, and the number of partners involved.

The Limited Liability Company (OOO): The Preferred Choice for Flexibility

The Obschestvo s Ogranichennoy Otvetstvennostyu (OOO) is the most popular form of legal entity in Russia, particularly for small and medium-sized enterprises and wholly-owned subsidiaries of foreign companies. Its popularity stems from its relatively simple governance and operational structure.

What is an OOO?

An OOO is a private company where the capital is divided into ‘participatory interests’ held by its members, known as ‘participants.’ The liability of each participant is limited to the value of their contribution to the company’s charter capital.

Key Characteristics for Solar Investors

-

Liability: As the name implies, the primary advantage is limited liability. The personal assets of participants are protected from business debts—a critical feature when managing the significant investment requirements for a solar factory.

-

Capital Requirements: The legal minimum charter capital is low, currently set at RUB 10,000. While the actual investment for a solar factory will be millions of times higher, this low barrier simplifies the initial registration process.

-

Governance: The OOO’s structure is flexible. While decision-making is straightforward for a single founder, a General Meeting of Participants serves as the highest governing body for multiple participants. Day-to-day management is handled by a General Director appointed by the participants, a lean structure that reduces administrative overhead in the early stages of operation.

-

Transfer of Shares: A crucial distinction lies in the transfer of ownership. Transferring a participatory interest in an OOO is more complex than in an AO. Existing participants typically have a pre-emptive right to purchase the stake being sold, and the process often requires notarization, adding a layer of control but reducing liquidity.

Based on experience from J.v.G. turnkey projects, an OOO is often the most practical starting point for an investor group that is self-funded and does not anticipate bringing in new equity partners in the near term.

The Joint-Stock Company (AO): Structured for Growth and Capital

The Aktsionernoye Obschestvo (AO) is a more formal and regulated business structure. It is the structure of choice for larger businesses or those planning to raise capital from a wide pool of investors. AOs can be non-public (NAO) or public (PAO), though a new venture would almost certainly begin as a non-public entity.

What is an AO?

An AO’s capital is divided into shares, which are registered securities. The owners are ‘shareholders,’ and their ownership is confirmed by an entry in a share register maintained by an independent, licensed registrar. This formality provides investors with a higher level of transparency and security.

Key Characteristics for Solar Investors

-

Liability: Similar to an OOO, shareholders’ liability is limited to the value of their shares.

-

Capital Requirements: The minimum charter capital is also RUB 10,000 for a non-public AO. However, the process of share issuance and registration is more complex and costly than capitalizing an OOO.

-

Governance: AOs have a more rigid, three-tiered governance structure: the General Meeting of Shareholders, a Board of Directors (Supervisory Board), and an executive body (e.g., a General Director). The mandatory Board of Directors adds a formal oversight layer, which can be reassuring for institutional investors.

-

Transfer of Shares: Shares in an AO are freely transferable (unless restricted by the charter) without requiring the consent of other shareholders. This makes it much easier to sell a stake, bring in new investors, or use shares as collateral—a key advantage for a capital-intensive business like solar module manufacturing.

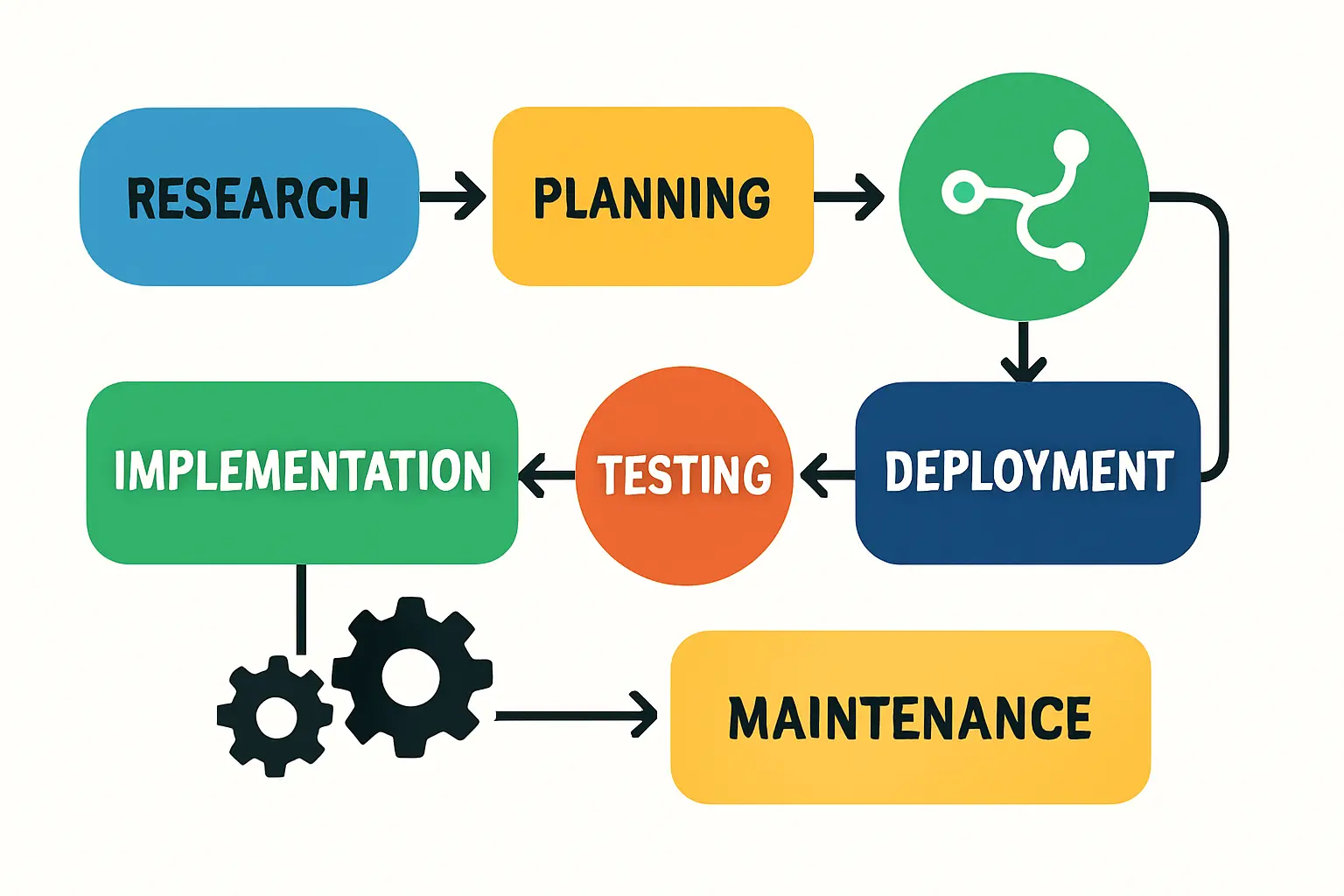

OOO vs. AO: A Strategic Comparison for a Solar Manufacturing Plant

The right choice depends entirely on your business plan. A simple comparison can clarify the decision.

| Feature | Limited Liability Company (OOO) | Joint-Stock Company (AO) |

|---|---|---|

| Best For | Wholly-owned subsidiaries, small founder groups, initial market entry. | Ventures planning to raise external capital, larger partnerships, long-term exit strategies. |

| Ownership | ‘Participants’ holding ‘participatory interests.’ | ‘Shareholders’ holding ‘shares’ (registered securities). |

| Liability | Limited to capital contribution. | Limited to the value of shares held. |

| Governance | Flexible; General Meeting & General Director. | Formal; General Meeting, Board of Directors, & Executive Body. |

| Transfer of Ownership | Complex; pre-emptive rights for other participants, often requires a notary. | Simple; shares are freely transferable via a share registrar. |

| Administrative Burden | Lower; less formal reporting. | Higher; requires an independent share registrar, more formal meetings and disclosures. |

When to Choose an OOO

An OOO is often the ideal structure for the initial phase of setting up a turnkey production line. If your venture is backed by a single parent company or a small, stable group of co-founders who value operational simplicity and control over bringing in new partners, the OOO is a logical and cost-effective choice.

When an AO Might Be a Better Fit

If your strategic plan involves raising capital from venture funds, private equity, or a broad group of angel investors, an AO structure is almost always preferable. The ease of transferring shares and the formal governance structure are what external investors expect to see before committing significant funds.

A past client, an investor group from the Middle East, initially opted for an OOO for its simplicity. However, as they planned for a Phase 2 expansion requiring external capital, they began the process of converting to an AO to facilitate the new investment round.

Critical Considerations Beyond the Basics

Foreign Ownership and Control

In non-strategic sectors like solar panel manufacturing, Russian law permits 100% foreign ownership for both OOO and AO structures. This allows foreign investors full control over their enterprise without requiring a local partner.

Administrative Burden and Costs

Ongoing compliance costs should also be factored into your budget. An AO incurs higher administrative costs from mandatory fees for the independent share registrar and more stringent requirements for corporate record-keeping and shareholder meetings.

The Local Context

This guide provides a high-level overview, but navigating the specifics of corporate registration, tax implications, and ongoing compliance requires professional legal and accounting support on the ground. Understanding these legal frameworks is a critical first step, one that must be aligned with a comprehensive business plan and a clear view of navigating local regulations. pvknowhow.com provides structured guidance on the business and technical aspects of factory planning, which complements the essential advice from your local legal counsel.

Frequently Asked Questions (FAQ)

Can I convert an OOO to an AO later?

Yes, it is legally possible to reorganize an OOO into an AO. However, the process is complex, time-consuming, and involves multiple legal and administrative steps. Choosing the right structure from the outset is often more efficient if your future plans are clear.

What are the typical timeframes for registering an OOO or AO?

The state registration process itself is relatively quick, typically taking 3-5 business days after you submit a complete application package. The preparatory work—drafting the charter, holding foundation meetings, and notarizing documents—can take several additional weeks.

Are there restrictions on the number of owners?

Yes. An OOO cannot have more than 50 participants. If the number exceeds this limit, it must be reorganized into an AO within one year. A non-public AO does not have a formal upper limit but is designed for a defined circle of shareholders.

How does the choice of legal entity affect taxation?

The choice between an OOO and an AO does not directly impact the corporate profits tax rate or VAT. Russia offers several tax regimes, and the optimal choice will depend on your specific business model, revenue forecasts, and operational scale, not on the legal form itself.

Conclusion: Making an Informed Decision

The choice between an OOO and an AO is a foundational one for any foreign investor entering the Russian solar market. The OOO offers simplicity and control, making it ideal for self-funded projects and wholly-owned subsidiaries. The AO provides a more robust and scalable framework, designed for ventures that anticipate raising external capital and require a more formal governance structure.

Your final decision should reflect your long-term vision. By carefully considering your funding strategy, governance preferences, and exit plans, you can select the legal entity that best supports your path to launching a successful solar module factory.