Financing a large-scale industrial project like a solar module factory is a universal challenge. Commercial loans often come with short-term return expectations and high interest rates that can be prohibitive for ventures with long development cycles. For entrepreneurs and corporations looking to establish manufacturing facilities, state-backed development banks offer a strategic, if complex, alternative.

Institutions like Russia’s state development corporation, VEB.RF, act not just as lenders but as partners in national strategic development. Understanding their framework is essential for any business professional considering projects in or connected with the region. This article outlines the process and criteria for securing financing from these key institutions, providing a clear roadmap for applicants.

Understanding the Role of Russian Development Banks

Unlike commercial banks that prioritize short-term profitability, a state development bank’s primary mandate is to facilitate long-term economic growth and technological sovereignty. Their investment decisions are guided by national priorities, such as industrial modernization, infrastructure development, and the promotion of high-technology exports.

VEB.RF, for instance, focuses on projects that commercial banks might deem too large, too complex, or too long-term. They aim to finance transformative ventures that create jobs, introduce new technologies, and enhance the country’s competitive position on the global stage. This means their evaluation process extends far beyond a simple credit risk assessment, involving a deep analysis of a project’s strategic alignment with governmental objectives.

For an entrepreneur planning a solar module factory, this duality presents both an opportunity and a challenge. The opportunity is access to patient, long-term capital; the challenge lies in structuring the project to meet a rigorous set of non-commercial criteria.

Key Eligibility Criteria for Project Financing

Securing a loan from an institution like VEB.RF requires a meticulously prepared proposal that addresses several core criteria, which generally fall into four main categories.

1. Strategic Alignment and National Priorities

The project must demonstrably contribute to Russia’s strategic economic goals. A proposal for a solar module factory, for example, would need to highlight its contribution to:

- Technological Advancement: Introducing or localizing advanced photovoltaic technologies.

- Import Substitution: Reducing reliance on foreign-made solar panels and components.

- Export Potential: A clear strategy for exporting finished modules to international markets.

- Economic Diversification: Supporting the growth of the non-resource-based sector of the economy.

A project that is commercially sound but lacks this strategic dimension is unlikely to be approved.

2. Financial Thresholds and Applicant Contribution

Development banks finance large-scale projects, with total investments considered by VEB.RF typically exceeding several billion rubles (equivalent to tens of millions of US dollars). Furthermore, applicants are expected to provide a significant equity contribution—often in the range of 20–30% of the total project cost, based on past projects. This contribution demonstrates the applicant’s commitment and shares the financial risk. A comprehensive and credible solar module manufacturing business plan is the foundational document for proving financial viability.

3. Technical and Commercial Viability

The bank’s experts conduct extensive due diligence on the project’s technical and market assumptions. This requires:

- A Detailed Technical Plan: A complete specification of the proposed factory, including the machinery, production process, and raw material supply chain. This is where plans for a turnkey solar manufacturing line provide a significant advantage.

- Robust Market Analysis: Evidence of demand for the product, including potential offtake agreements or letters of intent from future customers.

- An Experienced Management Team: Proof that the project will be led by a team with the requisite industrial and managerial experience.

4. Localization and Export Components

A crucial factor is the project’s impact on the domestic economy. Applicants are often required to commit to a certain level of ‘localization,’ which can mean sourcing a percentage of machinery or raw materials from Russian suppliers or creating a specific number of local jobs. At the same time, the project must demonstrate a strong ability to generate foreign currency through exports, a goal supported by the Russian Export Center (REC).

The Application and Due Diligence Process: A Step-by-Step Overview

The journey from initial contact to funding disbursement is a multi-stage process that demands patience and thorough preparation.

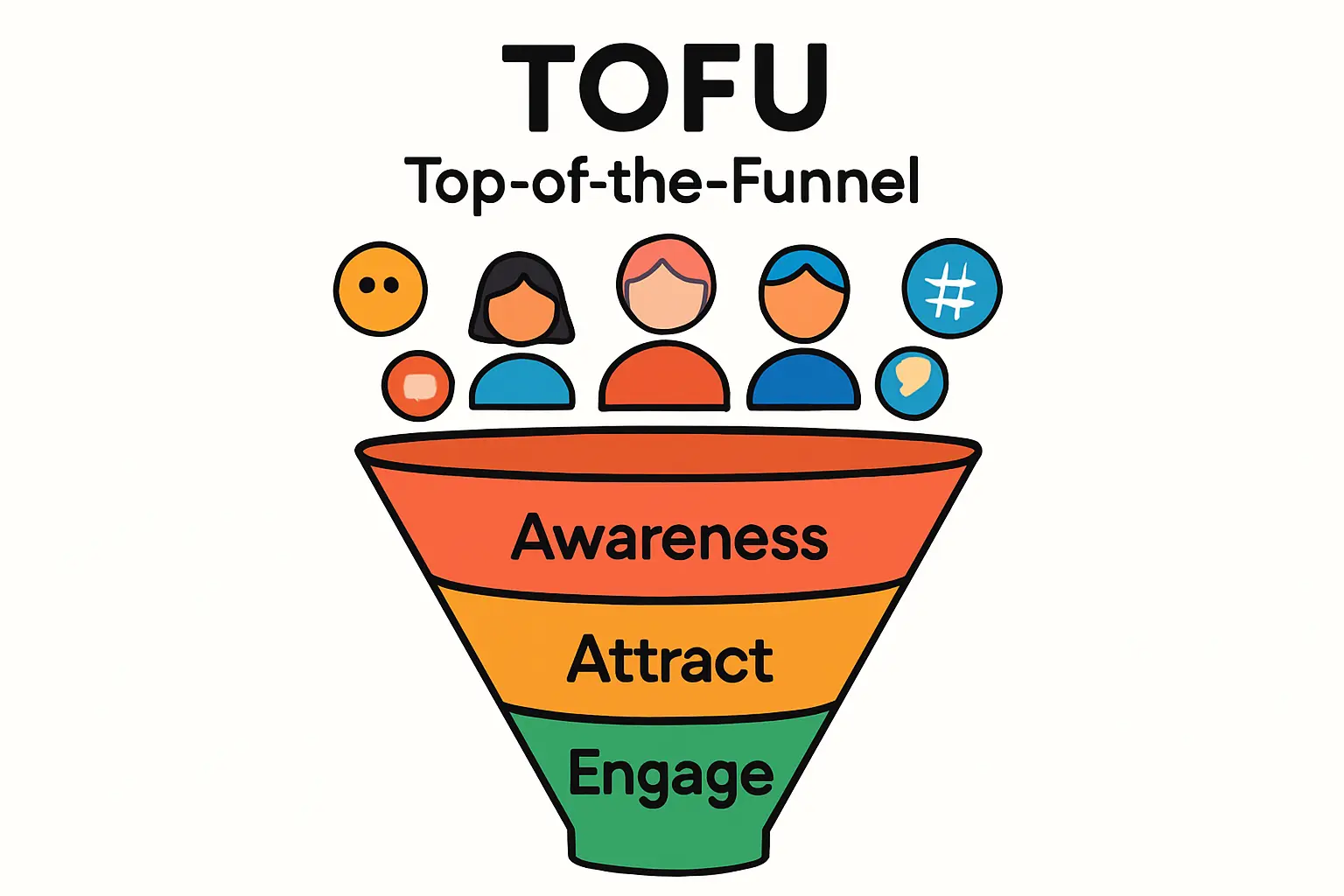

Stage 1: The Preliminary Application

The process typically begins with the submission of a ‘project passport’ or preliminary application. This document provides a high-level overview of the project concept, its strategic rationale, the estimated investment, and the requested financing. If the project aligns with the bank’s mandate, it will be accepted for further review.

Stage 2: In-Depth Due Diligence

This is the most intensive phase. The bank will assign a team of experts to scrutinize every aspect of the proposal. They will validate the financial model, assess the technical specifications, review legal documentation, and independently verify market assumptions. During this stage, applicants must be prepared to answer detailed questions and provide extensive supporting documentation. Having a clear understanding of the full investment requirements for a solar factory is critical here.

Stage 3: Credit Committee Review and Final Approval

Once due diligence is complete, the bank’s project team presents its findings to the credit committee. This committee makes the final decision on whether to approve the loan and on what terms. Success at this stage depends entirely on the quality and thoroughness of the preceding preparation.

Common Pitfalls and How to Prepare for Them

Experience with complex industrial financing projects reveals several common pitfalls that can lead to the rejection of promising applications:

- Inadequate Business Plan: Financial projections that are overly optimistic or unsupported by credible market data.

- Weak Technical Substantiation: A lack of detail on the chosen photovoltaic technology or the equipment supplier’s reliability.

- Failure to Demonstrate Strategic Fit: An inability to clearly articulate how the project helps achieve national economic objectives.

- Underestimating Equity Requirements: The inability to secure the required 20-30% personal capital contribution.

Preparation is the antidote to these risks. Working with technical consultants and financial advisors who understand the requirements of development banks can substantially improve the quality of a submission.

Frequently Asked Questions (FAQ)

What is the typical timeline for securing financing from a Russian development bank?

The process is thorough and can take anywhere from 6 to 18 months from the initial application to the first disbursement of funds, depending on the project’s complexity.

Is this financing available for foreign-owned companies?

Yes, foreign investors can apply for financing, particularly if the project is located within Russia and aligns with strategic priorities like localization and export. The legal structure of the local entity is a key point of discussion during due diligence.

What is the minimum project size VEB.RF will consider?

While there are exceptions, VEB.RF typically focuses on large-scale projects with total investment costs starting from approximately 3 billion rubles (around $30-40 million USD), with many projects being significantly larger.

How does this differ from a commercial bank loan?

Development banks offer longer loan tenors, often have more flexible repayment schedules tied to project cash flows, and may offer lower interest rates. However, their due diligence process is far more comprehensive and includes non-financial criteria.

What role do loan guarantees play?

In some cases, the bank may not provide a direct loan but will offer a guarantee to a commercial bank. This reduces the risk for the commercial lender, enabling them to provide financing on more favorable terms.

Conclusion: Strategic Patience and Meticulous Preparation

Securing project financing from a state-backed development bank is not a simple transaction; it is the formation of a long-term strategic partnership. The process is designed to be rigorous, ensuring that public funds are directed toward projects that offer a substantial and lasting contribution to the national economy.

For the international entrepreneur or business professional, this path requires a deep understanding of the bank’s mandate, a commitment to meticulous preparation, and strategic patience. The reward is access to the kind of patient, foundational capital that can turn an ambitious industrial vision into a reality.