For many entrepreneurs entering the solar industry, the focus is often on technology, market demand, and capital investment. In certain markets, however, a less obvious factor can provide the most significant competitive advantage: government industrial policy.

Rwanda is a prime example where a national strategy, the ‘Made in Rwanda’ policy, has created a uniquely favorable environment for local solar panel manufacturers. This policy directly boosts profitability and market access from day one.

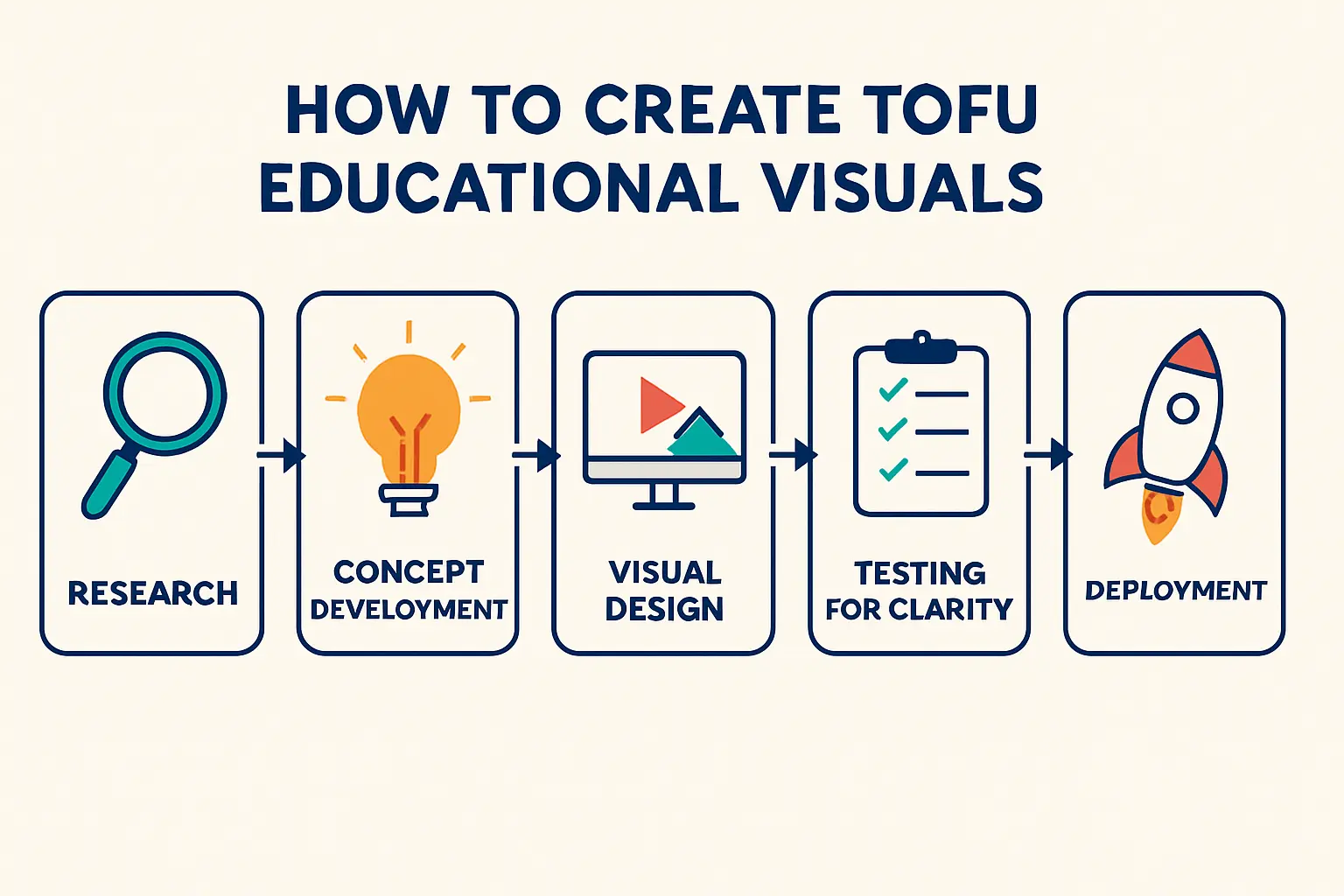

This article examines how this policy framework operates and what it means for an investor planning to build a solar module assembly line in the country.

Understanding the ‘Made in Rwanda’ Initiative

Launched in 2017, the ‘Made in Rwanda’ (MiR) policy is a comprehensive strategy designed to bolster domestic production, reduce the country’s trade deficit, and improve the quality of locally produced goods. More than a promotional campaign, it is a set of legal and financial mechanisms that actively favor local producers over importers.

For an entrepreneur in the solar sector, this means the government has already created a protected market space for those willing to invest in local manufacturing. The core idea is to shift the country from being a net importer of finished goods like solar panels to a nation with its own industrial capacity. This shift creates clear opportunities for new businesses that align with this national vision.

The Core Advantage: Preferential Treatment in Public Tenders

Perhaps the most powerful component of the MiR policy for a solar panel manufacturer is the provision within Rwanda’s Public Procurement Law. This law grants a price preference of up to 15% for locally manufactured goods in government tenders.

How does this work in practice? Imagine a large-scale government tender for a rural electrification project requiring thousands of solar modules.

An international company bids to supply imported panels at a price of $200 per panel.

Your Rwandan factory, producing certified ‘Made in Rwanda’ panels, submits a bid at $220 per panel.

Despite your bid being 10% higher, the procurement authority is required to award the contract to your local factory. The 15% preference allows your locally produced goods to be more expensive yet still win the bid. This creates a substantial and durable competitive advantage, effectively insulating a local manufacturer from direct price competition with high-volume international importers.

Given that government agencies, NGOs, and large-scale development projects are the primary buyers of solar modules in many African nations, this preference is a decisive factor in securing foundational contracts and maintaining factory output.

Key Financial Incentives for Solar Manufacturers

Beyond preferential market access, the Rwandan government offers a range of financial incentives through the Rwanda Development Board (RDB) to reduce the cost of entry and operations—a crucial advantage in the capital-intensive field of solar manufacturing.

VAT Exemptions on Equipment and Materials

Registered investors in priority sectors, including energy and manufacturing, are eligible for a 0% Value Added Tax (VAT) rate on imported machinery, equipment, and raw materials. This incentive directly lowers the initial capital expenditure needed to start a solar panel production business. The cost of essential equipment, from stringers and laminators to testing units, is significantly reduced, improving the project’s financial viability from the outset.

Favorable Corporate Income Tax (CIT) Rates

While the standard CIT rate is 30%, registered investors can benefit from a reduced rate of 15%. For larger-scale projects or international companies establishing a significant presence, further incentives may be available, including potential 0% rates for strategic investments. This directly boosts the long-term profitability and return on investment for the factory.

The Role of the Rwanda Development Board (RDB)

For foreign investors, navigating bureaucracy can be a major challenge. The RDB acts as a centralized, one-stop shop for all aspects of business registration, licensing, and incentive applications. This streamlined process reduces administrative burdens and shortens the timeline from initial planning to full-scale production.

Building a Business Case: Why This Matters for a New Investor

The combination of these policies fundamentally changes the risk-and-reward calculation for setting up a solar factory in Rwanda. An investor is not just building a manufacturing plant; they are creating a strategic asset with government-backed advantages.

-

De-risked Market Entry: The 15% price preference guarantees a competitive edge in a crucial market segment.

-

Lowered Capital Costs: VAT exemptions on machinery directly reduce the initial investment required, making the project more accessible.

-

Improved Profitability: Lower corporate income tax rates enhance the financial returns over the life of the investment.

Based on experience from J.v.G. turnkey projects, aligning factory planning with local industrial policy from day one is a critical success factor. Understanding these regulations is fundamental to structuring the business correctly and creating a more accurate forecast of financial performance.

Frequently Asked Questions (FAQ)

What is the minimum scale for a factory to benefit from these policies?

The ‘Made in Rwanda’ incentives are generally not tied to a specific factory size. A small-scale semi-automated line of 20-50 MW annual capacity can qualify, provided it is officially registered as a local manufacturer and its products meet the criteria. The key is formal registration and local value addition.

How complex is the process of registering for these incentives?

The Rwanda Development Board (RDB) is specifically designed to simplify this process. While documentation and a clear business plan are required, the RDB provides guidance and a streamlined path for investors to secure an Investment Certificate, which is the gateway to these benefits.

Are these benefits only for Rwandan citizens, or for foreign investors too?

These incentives are available to both local and foreign investors. The policy’s goal is to encourage investment and production within Rwanda, regardless of the investor’s nationality.

Besides government tenders, what is the private market for solar panels in Rwanda?

While public procurement is a major driver, a growing private market exists for commercial and industrial (C&I) installations, solar home systems for off-grid households, and agricultural applications like solar water pumps. A local factory is well-positioned to serve these markets with faster delivery times and simplified logistics.

What about quality control and certification for ‘Made in Rwanda’ panels?

To qualify for tenders and build a strong market reputation, locally made panels must meet quality standards. A new factory must plan for IEC or equivalent certifications. Leveraging the ‘Made in Rwanda’ brand effectively also demands a robust quality management system, making an understanding of the solar panel certification process a crucial step in the planning phase.

Next Steps in Your Evaluation

Rwanda’s ‘Made in Rwanda’ policy offers a clear and compelling case for establishing local solar module manufacturing. The framework creates a rare opportunity to enter a market with structural advantages that mitigate risk and enhance profitability.

The next logical step for any serious investor is to develop a detailed feasibility study and business plan that quantifies these benefits. This involves projecting operational costs, understanding technical requirements, and modeling revenue based on the price preference in public tenders. With proper planning, this policy framework can transform a standard manufacturing project into a highly strategic and successful long-term investment.