Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

For a large industrial conglomerate in Saudi Arabia, energy is not just a utility—it is a critical input and a significant operational cost. As the Kingdom diversifies its economy under Vision 2030, industrial electricity prices are gradually increasing, and reliance on the centralized grid can create operational risks.

A successful group operating multiple manufacturing facilities might face a cumulative energy demand of 250 MW or more over the next five years. This presents a strategic challenge: how to secure a stable, cost-effective energy supply for decades to come?

The conventional answer is to procure energy or solar modules from third-party suppliers. However, a more strategic approach is emerging for large-scale energy users: vertical integration through in-house solar module manufacturing. This article outlines the investment case for establishing a 50 MW-per-year solar module factory dedicated to private industrial use, transforming a recurring cost into a long-term strategic asset.

The Strategic Imperative: Why Industrial Groups Are Turning to In-House Solar Production

The decision to manufacture solar modules in-house extends beyond simple cost savings. It is a strategic move to de-risk operations, align with national economic goals, and gain a competitive advantage in an evolving industrial landscape.

Mitigating Rising Energy Costs

In recent years, the industrial electricity tariff in Saudi Arabia has risen from approximately $0.048/kWh to $0.053/kWh. While still competitive globally, this trend signals a future of increasing energy expenditure. For an industrial group, this translates into unpredictable operational costs (OPEX) that directly impact profitability.

By investing in a dedicated module factory, the group shifts this unpredictable OPEX to a controlled capital expenditure (CAPEX). The electricity generated by the self-produced modules has a fixed, predictable cost over the 25-plus-year lifespan of the solar installations, effectively hedging against future tariff hikes.

Ensuring Energy Independence and Operational Stability

Industrial processes rely on an uninterrupted power supply. Grid instability or planned outages can halt production, leading to significant financial losses. A private solar power supply, often paired with energy storage solutions, offers a high degree of energy independence.

This stability ensures that critical operations can continue without interruption, safeguarding production targets and supply chain commitments. Such stability is particularly relevant in regions where new industrial zones are being developed and grid infrastructure is still maturing.

Aligning with National Policy and Local Content Requirements

Saudi Arabia’s Vision 2030 sets an ambitious target of generating 58.7 GW of its electricity from renewable sources by 2030. Projects like the $500 billion NEOM giga-project underscore this commitment. The government’s Local Content policy actively incentivizes companies that contribute to the domestic industrial ecosystem.

Establishing a local solar module factory aligns perfectly with these national priorities. Such a move demonstrates a commitment to the Kingdom’s economic diversification, enhances the group’s corporate standing, and may unlock preferential treatment or incentives tied to local manufacturing initiatives.

Investment Profile: A 50 MW Turnkey Factory for Private Industrial Use

To meet a 250 MW demand over five years, a 50 MW annual production capacity is a logical and scalable starting point. This scale is sufficient to meaningfully address the group’s energy needs without requiring the vast resources of a gigafactory designed for export.

Capital Investment (CAPEX) Breakdown

The total investment for a 50 MW production facility depends on the level of automation and the quality of the equipment. A realistic budget for a high-quality, semi-automated line typically falls within a specific range, a topic explored in a detailed analysis of solar panel manufacturing plant cost. Key components of this investment include:

- Production Equipment: Forming the core of the investment, this includes essential solar panel manufacturing machines such as cell stringers, layup stations, laminators, and testers.

- Building and Infrastructure: A suitable factory floor of approximately 3,000–5,000 square meters is necessary, including a climate-controlled, cleanroom-standard area for the lamination process.

- Initial Raw Materials: Commencing production requires a starting inventory of materials like solar cells, glass, encapsulant (EVA), and backsheets.

- Technology Transfer and Training: A crucial component of a turnkey solution is the comprehensive training of local staff and the transfer of production know-how from experienced engineers.

Operational Considerations (OPEX)

Once operational, the factory’s primary running costs will include:

- Labor: A semi-automated 50 MW line can typically be run effectively with a team of 50 to 70 employees, including operators, technicians, and administrative staff.

- Raw Materials: The ongoing procurement of components represents the largest operational expense.

- Utilities: These costs include the electricity required to run the factory itself, along with water and other services.

The Financial Case: Payback Period and Long-Term Value

The viability of this investment is measured not just by its initial cost, but by its long-term financial returns and strategic value.

Calculating the Levelized Cost of Energy (LCOE)

The most accurate way to assess the financial benefit is by calculating the Levelized Cost of Energy (LCOE). In simple terms, LCOE represents the average cost to produce one kilowatt-hour (kWh) of electricity over the entire lifetime of the solar power plants built with your own modules.

The resulting LCOE, derived from a one-time capital investment, can then be compared directly to the cost of purchasing electricity from the grid. In a high-irradiation environment like Saudi Arabia (over 2,200 kWh/m² annually), the LCOE from self-produced modules is often significantly lower than the industrial grid tariff, creating immediate and ongoing savings.

Estimated Payback Period

Based on the savings generated by displacing grid electricity costs, the typical payback period for the initial factory investment is between five and seven years. After this period, the factory generates electricity at a minimal cost for the remainder of the solar plant’s 25+ year life, creating pure financial gain and a formidable competitive advantage.

Beyond Payback: Strategic Asset Creation

The value of the factory extends far beyond its payback period. It becomes a permanent strategic asset that:

- Provides a hedge against energy market volatility.

- Can be expanded to serve other local industries or contribute to future giga-projects.

- Significantly enhances the group’s Environmental, Social, and Governance (ESG) credentials.

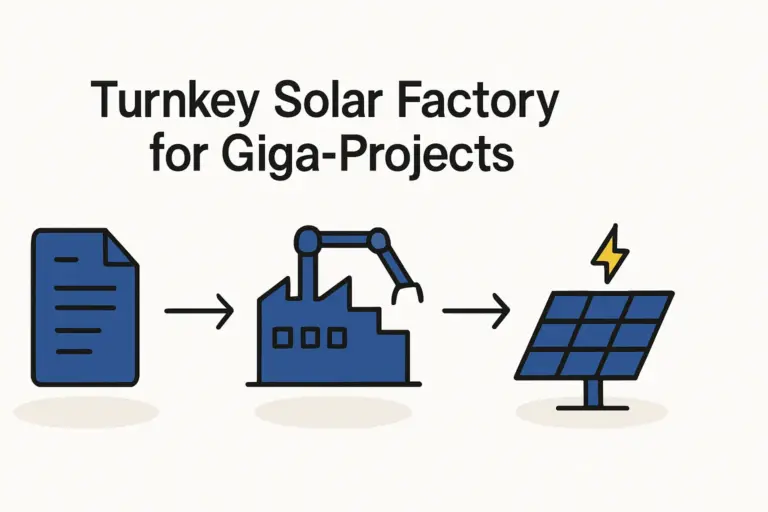

The Execution Plan: From Decision to Production in Under 12 Months

For a business professional without a background in photovoltaics, the prospect of building a factory can seem daunting. However, with a structured project plan and an experienced partner, the process is clear and manageable. A turnkey solar manufacturing line solution, such as those provided by European PV manufacturers, is designed to guide investors through every stage.

Phase 1: Feasibility and Planning (Months 1-3)

This initial phase involves developing a detailed business plan, performing financial modeling, selecting a suitable site, and finalizing the technical specifications for the factory.

Phase 2: Procurement and Site Preparation (Months 4-6)

Once the decision is made, the long-lead-time production equipment is ordered. Simultaneously, the factory building is prepared to meet the required specifications for the solar panel manufacturing process, including foundations, utilities, and cleanroom areas.

Phase 3: Installation and Commissioning (Months 7-9)

The machinery arrives on-site and is installed by a team of experienced engineers. This phase includes the commissioning of all equipment and the intensive training of the local operational team.

Phase 4: Ramp-Up and Certification (Months 10-12)

The factory begins initial production runs, gradually increasing output to its target capacity. During this period, sample modules are sent for third-party certification (e.g., by TÜV) to ensure they meet international quality and safety standards.

Frequently Asked Questions (FAQ) for Industrial Investors

Why not just buy solar modules from the market?

While purchasing modules is a viable option for smaller projects, an industrial group with multi-megawatt demand gains several key advantages from manufacturing in-house:

- Cost Control: Direct control over manufacturing costs eliminates supplier markups.

- Supply Chain Security: In-house production avoids market shortages or price volatility.

- Technology Customization: The ability to produce modules specifically designed for the local environment.

- Strategic Alignment: Fulfills Local Content objectives and creates a valuable corporate asset.

What makes modules for the desert different?

Standard solar modules lose efficiency in the extreme heat common in Saudi Arabia. The accumulation of dust and sand (soiling) also poses a challenge, significantly reducing energy output. Specialized ‘desert’ modules, such asan established European industrial solutions provider’s DESERT+ series, are engineered to overcome these challenges with features like:

- Advanced cell technology that performs better at high temperatures.

- Highly durable backsheets and encapsulants that resist degradation from heat and UV radiation.

- Special anti-soiling coatings on the glass to reduce the adhesion of dust and simplify cleaning.

Do we need a large team of engineers to run the factory?

No. A modern, semi-automated 50 MW turnkey line is designed for operational efficiency. The core requirement is a well-trained team of operators managed by a small group of process engineers and a plant manager. The initial intensive training provided by the turnkey partner ensures the local team is fully equipped to manage day-to-day operations and quality control.

How does this project fit into the broader context of starting a new venture?

This investment case provides a specific scenario for an established industrial group. For any entrepreneur or investor considering this sector, it is essential to understand the complete picture of how to start a solar panel manufacturing business. This process involves market analysis, detailed financial planning, and technology selection, which form the foundation of a successful venture.

Next Steps in Your Evaluation Process

For a Saudi industrial group, establishing a private-use solar module factory is a powerful strategic move. This strategy directly addresses the core business challenges of rising energy costs and operational stability while aligning with the ambitious goals of Vision 2030.

The journey from concept to a fully operational facility is a structured process, not an insurmountable technical hurdle. With the right guidance, a complex project can be broken down into manageable phases. For leadership teams seriously considering this path, the next logical step is to develop a detailed financial model and business plan tailored to their specific energy needs and corporate objectives. To support this detailed planning phase, we offer further resources, including sample business plans and in-depth courses to guide your next steps.

Download the Saudi Arabia 50 MW Solar Factory Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.