Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

For generations, successful family offices in the Kingdom of Saudi Arabia have excelled at identifying and capitalizing on foundational economic shifts. Today, another such shift is underway: Vision 2030 is not merely a policy document but a fundamental restructuring of the national economy with renewable energy at its core.

This creates a unique opportunity for strategic capital to move from traditional holdings into high-growth industrial sectors.

However, for a non-technical investor, the prospect of establishing a solar module factory can seem overwhelmingly complex. The key is to approach it not as a technical challenge, but as a structured business project. With the right execution partner, a family office can enter this lucrative market efficiently, mitigating risks while aligning perfectly with national strategic goals. This article outlines a blueprint for such an investment, focusing on a 100 MW turnkey facility.

The Unprecedented Market Opportunity in Saudi Arabia

The case for investing in solar manufacturing isn’t speculative; it’s grounded in clearly defined national objectives and compelling market dynamics. Several powerful drivers are converging to create a protected, high-demand environment for locally produced solar modules.

Vision 2030 and National Energy Targets

The Kingdom’s strategic framework targets 58.7 GW of renewable energy capacity by 2030, with solar photovoltaic (PV) technology as the cornerstone of this ambition. This government-led demand creates a predictable, long-term market for solar components. At the same time, giga-projects like NEOM, with its planned green hydrogen facility, will require solar capacity on a scale that current regional supply chains cannot meet.

The Power of Local Content Requirements (ICV)

To ensure this economic transformation benefits the nation directly, the government has implemented In-Country Value (ICV) policies. These programs often mandate that government and state-affiliated projects source a significant portion of their materials locally, typically requiring a minimum of 40% local content.

This policy effectively creates a premium market for manufacturers within the Kingdom. A locally assembled solar module has a significant competitive advantage in large-scale public tenders, insulating domestic producers from direct competition with international mass-producers.

Natural Geographical Advantage

Saudi Arabia possesses one of the highest solar irradiance levels in the world, averaging over 2,200 kilowatt-hours per square meter annually. This natural resource makes solar power generation exceptionally efficient and economically attractive, further fueling demand for high-quality solar modules built to withstand local climate conditions.

From Investment Thesis to Operational Reality: The Turnkey Partner Model

The primary barrier for a family office is not a lack of capital, but the absence of in-house technical and operational expertise in PV manufacturing. This is where a single, experienced execution partner is critical. The turnkey model transfers project execution risk from the investor to the specialist partner.

A firm such as an EU-based photovoltaic manufacturing solution partner, with decades of experience setting up solar factories globally, acts as the sole point of responsibility, consolidating all phases of a complex project under one accountable entity.

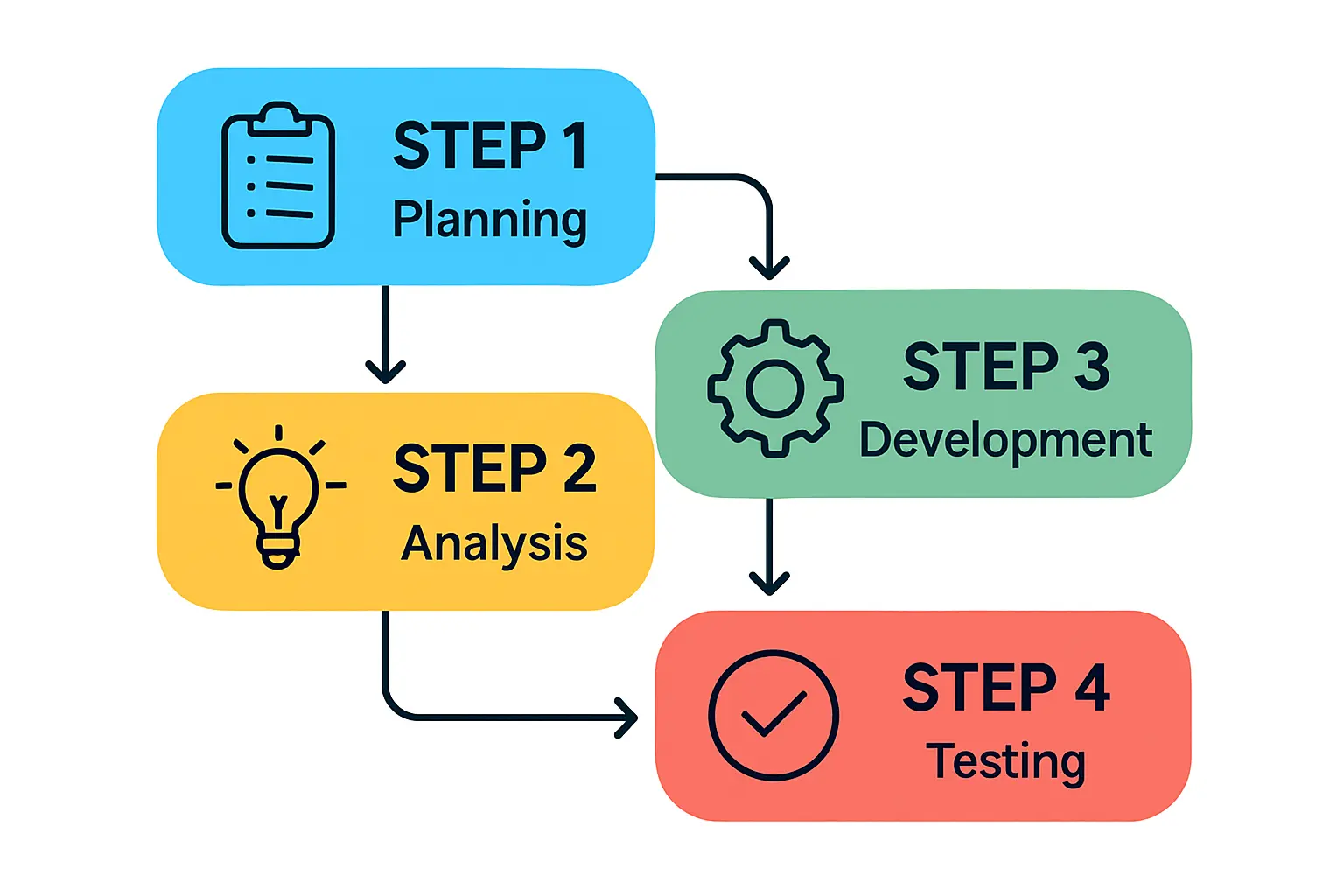

Phase 1: The Feasibility and De-Risking Stage

Before any significant capital is committed, a thorough feasibility study is conducted. This foundational stage validates the business case. It includes:

-

Financial Modeling: Detailed analysis of capital expenditure, operational costs, revenue projections, and ROI under various market scenarios.

-

Technology Selection: Identifying the most suitable module technology (e.g., PERC, TOPCon) for the target market and local climate.

-

Site Analysis: Evaluating potential locations based on logistics, utility access, and labor availability.

-

Supply Chain Strategy: Mapping out a reliable procurement plan for the bill of materials (BOM), balancing international sourcing with local ICV objectives.

Phase 2: Engineering, Procurement, and Construction (EPC)

Once the project is greenlit, the turnkey partner manages the entire implementation. A well-defined turnkey solar manufacturing line project includes:

-

Detailed Engineering: Designing the optimal solar module factory layout and integrating all machinery and control systems.

-

Equipment Procurement: Sourcing, vetting, and acquiring all production machinery from reliable global suppliers.

-

Installation and Commissioning: Managing the physical installation, calibration, and testing of the entire production line until it meets specified performance targets.

Phase 3: Operational Handover and Continued Support

The project extends beyond the moment the machines are switched on. The final, critical phase involves empowering the investor’s local team to run the facility profitably.

This includes comprehensive staff training on machine operation and quality control, establishing standard operating procedures (SOPs), and guiding the facility through its initial production ramp-up. gained from European PV manufacturers’ turnkey projects shows that this hands-on support is crucial for achieving nameplate capacity and product certification efficiently.

A Financial and Operational Framework for a 100 MW Facility

To make this blueprint more tangible, consider the typical parameters for a 100 MW per year solar module assembly plant.

Investment Profile: While a complete financial overview is part of the feasibility study, a preliminary understanding of the investment requirements includes capital for machinery, building retrofitting or construction, and initial working capital for raw materials. The 100 MW scale strikes a balance between significant market presence and manageable initial investment.

Operational Footprint:

-

Facility Size: Typically requires 5,000 to 7,000 square meters of industrial space.

-

Labor: A semi-automated 100 MW line can be operated by approximately 80-100 employees across shifts, including management, engineering, and production staff.

-

Technology: Modern lines are highly automated, particularly in critical processes like cell stringing and lamination, ensuring consistent quality and high throughput.

Strategic Positioning: A 100 MW facility is large enough to bid for utility-scale projects while remaining agile enough to serve the commercial and industrial rooftop market. By securing necessary certifications (like IEC), the modules can be positioned as premium, locally-made products that meet both international standards and national ICV requirements.

Frequently Asked Questions for the First-Time Investor

- Do we need a technical background to own and operate a solar factory?

No. The investor’s role is strategic oversight and business management. A turnkey partner handles the technical execution from design to operational stability. Your local management team, trained by the partner, will handle day-to-day operations.

- What is a realistic timeline from the initial decision to full production?

For a 100 MW turnkey project, a typical timeline is 10 to 14 months. This includes the feasibility study, equipment procurement (which often has the longest lead time), installation, and commissioning.

- How is product quality and international certification ensured?

Quality is integral to the process. It starts with selecting proven machine technology and establishing stringent quality control checkpoints throughout the production line. The turnkey partner guides the facility through the process of obtaining essential international certifications (e.g., IEC 61215, IEC 61730), which are necessary for bankability and market access.

- What are the primary operational challenges after the factory is running?

The main ongoing challenges are supply chain management—ensuring a steady, cost-effective flow of raw materials—and consistent quality control. A strong relationship with the turnkey partner can provide ongoing support in optimizing these areas and troubleshooting any production issues that may arise.

Next Steps on Your Investment Journey

Entering the solar manufacturing sector is a significant strategic move, aligning capital with the Kingdom of Saudi Arabia’s clear and ambitious direction. It represents an opportunity to build a lasting industrial asset that contributes to the national economy while generating strong returns.

For a family office, the key to success is mitigating execution risk by engaging an experienced partner. By leveraging a turnkey model, the investor can focus on high-level strategy, confident that the technical and operational complexities are managed by seasoned experts.

The logical next step is to explore the specific requirements of such a venture by understanding the detailed phases of planning and implementation.

Download: Saudi Family Office Solar Manufacturing Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.