Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

For nations pursuing ambitious economic development, the gap between strategic goals and practical implementation can be a formidable challenge. Senegal’s ‘Plan Sénégal Émergent’ (PSE) offers a clear roadmap for industrialization and energy independence, but achieving these aims requires overcoming a critical dependency on imported solar modules.

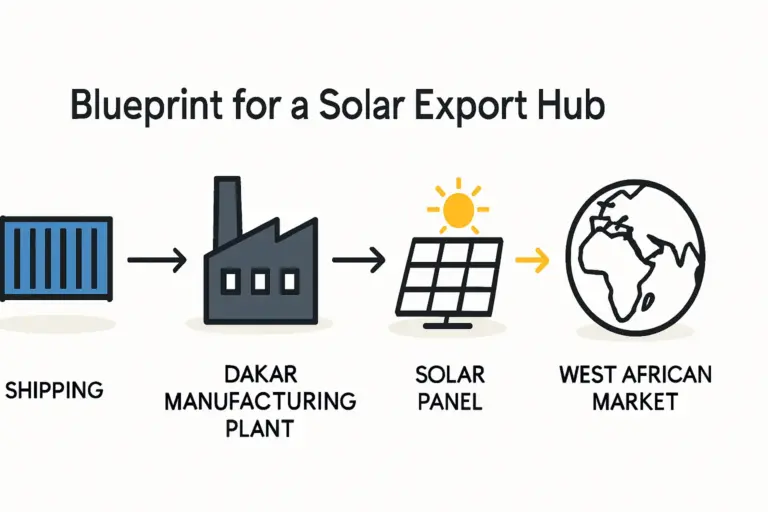

While the sun provides abundant energy, the technology to capture it is often sourced from abroad, creating logistical hurdles and draining capital. This dependency presents a clear opportunity for local manufacturing. A domestic solar module manufacturing plant can create skilled jobs, stabilize the supply chain for national energy projects, and position Senegal as a technological leader in West Africa.

This article outlines a structured Public-Private Partnership (PPP) model designed to make this vision a reality by aligning government objectives with the requirements of private capital.

Understanding the Public-Private Partnership (PPP) Model for Industrial Projects

A Public-Private Partnership is a cooperative arrangement between a government entity and a private-sector company to finance, build, and operate projects like public transportation networks, power plants, or industrial facilities. This model is particularly effective for large-scale infrastructure development in emerging markets.

The core principle is to harness the unique strengths of each partner. The public sector provides the strategic mandate, regulatory support, and long-term stability, while the private sector brings capital, operational efficiency, and technical expertise.

However, a common point of failure in such ventures is the ‘trust and alignment gap.’ Private investors are often wary of political risks and bureaucratic complexities, while government bodies may lack the specialized technical and financial expertise to structure a bankable project. Closing this gap is the key to success.

Aligning National Goals with Investor Interests in Senegal

A successful PPP in solar manufacturing requires clearly defining the objectives and contributions of each party from the outset.

The Government’s Position (Public Partner)

For the Senegalese government, a local solar factory is a strategic national asset. It directly supports the PSE by fostering industrial capacity and moving the country toward energy sovereignty.

Key Government Contributions:

- Land and Infrastructure: Providing a suitable, zoned site with access to essential utilities.

- Fiscal Incentives: Offering tax advantages or customs duty exemptions on imported manufacturing equipment.

- Market Guarantees: Committing to offtake agreements or Power Purchase Agreements (PPAs) for projects that use locally produced modules, creating a predictable domestic market.

- Regulatory Support: Streamlining permitting and licensing to ensure a smooth project timeline.

These contributions de-risk the project for the private partner, creating a stable and attractive investment environment.

The Investor’s Position (Private Partner)

The private investor, whether a local entrepreneur or an international fund, focuses on financial viability and security. The primary objective is to achieve a predictable return on investment within an acceptable risk profile.

Primary Investor Concerns:

- Political and Regulatory Risk: The fear that changes in government policy could negatively affect the project’s profitability.

- Market Uncertainty: Questions surrounding the long-term demand for the factory’s output.

- Technical and Operational Feasibility: Ensuring the factory can be built on time and operated efficiently to produce high-quality products.

The investor provides the capital needed to procure a turnkey solar production line and fund initial operations. Their participation hinges on the government’s ability to mitigate these risks.

The Structuring Partner: Bridging the Gap for a Bankable Project

The disconnect between the government’s strategic vision and the investor’s financial requirements is where many potential projects fail. This makes the role of an experienced structuring partner essential.

This partner acts as a trusted, neutral advisor who understands the perspectives of both sides. With decades of experience in solar technology and international project development, the partner has a proven track record in this role. The structuring partner’s responsibility is to architect a deal that is secure, transparent, and mutually beneficial.

This process involves:

- Developing a comprehensive business plan that satisfies the due diligence requirements of private investors and financiers.

- Structuring the legal and financial framework of the partnership to protect the interests of all parties.

- Translating government policy goals into bankable commercial terms that provide investors with the necessary security and clarity on their expected returns.

This expert guidance transforms a promising idea into a concrete, investable project.

The Technology and Execution Partner: Delivering the Physical Asset

Once the partnership agreement is in place, the project moves from a financial concept to a physical reality. This requires a technology and execution partner with proven engineering expertise—an EPC (Engineering, Procurement, and Construction) contractor.

As a German engineering firm founded in the 1990s, the EU-based photovoltaic manufacturing solutions partner specializes in delivering complete turnkey solar factories. In this PPP model, the European PV manufacturers’s role includes:

- Engineering: Designing the factory layout for optimal workflow and efficiency.

- Procurement: Sourcing and supplying all necessary machinery for the entire solar panel production process.

- Construction & Commissioning: Overseeing equipment installation and bringing the factory online.

- Training: Providing comprehensive training for the local workforce to ensure high-quality production and smooth operations from day one.

This end-to-end management guarantees that the physical asset delivered matches the specifications of the business plan.

Why Technology Matters: The DESERT+ Advantage for Senegal

In a climate like Senegal’s—characterized by high ambient temperatures, intense solar irradiation, and seasonal dust—the choice of solar module technology is fundamental to the project’s long-term success. Standard solar panels can suffer from accelerated degradation and significant performance losses in such conditions.

The proposed PPP model is built around premier EU provider‘s proprietary DESERT+ technology. The manufacturing line is engineered to produce DESERT solar panels, which are specifically designed for hot and arid climates.

Key Benefits of DESERT+ Technology:

- Enhanced Durability: Built to withstand extreme heat and temperature fluctuations, ensuring a longer operational lifespan.

- Superior Performance: Delivers higher energy yields in high-temperature environments compared to conventional modules.

- Increased Bankability: The reliability and higher output of these modules strengthen the project’s financial projections, directly improving the investor’s return.

By integrating the right technology from the start, the factory can produce a premium product perfectly suited for its primary market, giving it a distinct competitive advantage.

Frequently Asked Questions (FAQ)

What is the typical investment size for such a project?

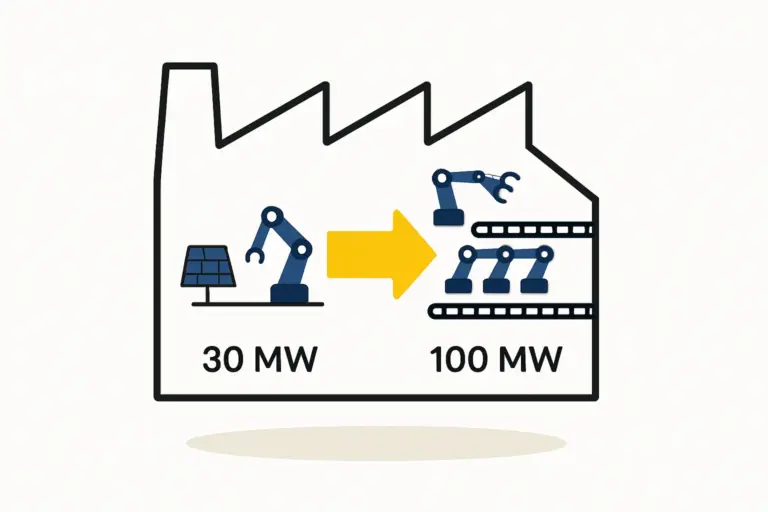

A small to medium-sized solar factory, with an annual capacity of 20 MW to 50 MW, typically requires an initial investment in the range of several million euros. The exact amount depends on the chosen capacity, level of automation, and building specifications.

How long does it take to get a factory operational?

With a structured turnkey approach, a solar manufacturing plant can be operational in under 12 months from the finalization of the partnership agreement. This timeline includes factory planning, equipment delivery, installation, and commissioning.

What is the government’s role after the factory is built?

The government’s primary ongoing role is to honor the terms of the PPP agreement, particularly any offtake or PPA commitments. It also continues to provide a stable regulatory environment that supports the growth of the domestic renewable energy sector.

Can this model be applied in other countries?

Yes. This four-part framework—combining a motivated public partner, a committed private investor, an expert structuring advisor, and a reliable technology provider—is a robust and adaptable model that can be customized for other nations pursuing industrial and energy development goals.

Establishing a solar manufacturing facility in Senegal through a Public-Private Partnership is more than an industrial project; it is a strategic step toward economic sovereignty. This model provides a clear, de-risked, and proven pathway to bring together government ambition, private capital, and world-class technology. For public officials and private investors ready to build this future, understanding the foundational elements of factory planning is the logical next step.

Download the Senegal Solar PPP Framework Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.