Establishing a solar module factory in a market like Seychelles represents a compelling business case. The nation’s goal of achieving 100% renewable energy by 2050 and its heavy reliance on expensive imported fossil fuels create significant demand.

However, the very geography that makes Seychelles a paradise also poses a complex financial challenge: the high cost of logistics in an island economy. A standard financial model designed for a factory in mainland Europe or Asia will likely fail here. The success of such a venture hinges on a detailed, localized financial plan that accurately weighs high operational costs against substantial government support. This article lays out a framework for building such a model and calculating a realistic return on investment.

The Seychelles Opportunity: Beyond the Postcard Image

To understand the financial viability of a solar factory in Seychelles, one must first appreciate the unique economic landscape. Several key factors characterize the nation’s energy sector:

-

High Energy Costs: With over 90% of its primary energy derived from imported fossil fuels, Seychelles faces some of the highest electricity tariffs in the region. This creates a powerful incentive for businesses and residents to adopt solar energy.

-

Strong Government Mandate: The government’s clear policy for a transition to 100% renewable energy provides long-term stability and signals strong support for the sector.

-

Robust Market Demand: The tourism sector, with its numerous hotels and resorts, represents a significant source of demand for locally produced solar modules. Commercial and residential markets are also expanding rapidly as consumers seek to lower their energy bills.

While these factors create fertile ground for investment, they are only one side of the ledger. The other is dominated by the operational realities of an island nation.

Deconstructing the Financial Model for an Island Nation

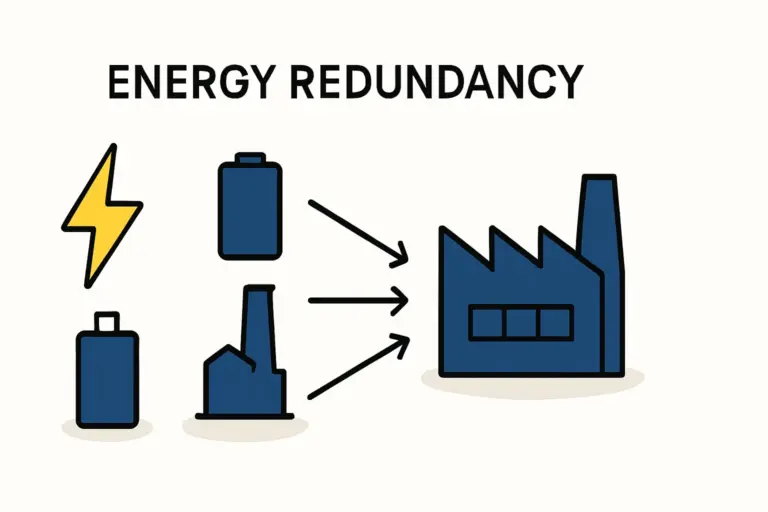

A standard business plan is like a vehicle designed for a smooth highway. For the unique terrain of an island economy, a more robust, specialized approach is required. The financial model must be adapted to account for variables that are far more pronounced than in other markets. A successful projection requires a granular analysis of three core areas: logistics, local operations, and government incentives.

Factoring in Elevated Logistics and Import Costs

For any manufacturing project, the initial capital expenditure (CapEx) for equipment is a primary consideration. In an island nation, however, the cost of simply getting that equipment to the site can be substantial. A thorough financial model must account for:

-

Sea Freight and Insurance: The cost of shipping containers from manufacturing hubs in Asia or Europe to Port Victoria.

-

Port Handling and Demurrage: Fees for unloading, storage, and potential delays at the port.

-

Inland Transportation: The final leg of the journey from the port to the factory site.

-

Import Duties: While many renewable energy goods are exempt, any non-exempt auxiliary equipment or materials will be subject to duties.

These logistical costs can represent a significantly larger percentage of the total initial investment for a solar module factory compared to a mainland project. For example, data from similar remote projects suggests logistics might account for 15–20% of equipment costs, whereas a project in Germany might see that figure closer to 5–8%.

Incorporating Local Operational Expenditures (OpEx)

Once the factory is operational, ongoing expenses (OpEx) will also reflect the island setting. Budgeting for these accurately is crucial for avoiding future cash flow problems. Key considerations include:

-

Skilled Labor: While local labor is available, specialized technical and engineering talent may need to be imported, commanding higher salaries and benefits.

-

Land and Real Estate: Commercial and industrial property can be expensive due to limited availability.

-

Utilities: The same high electricity costs that drive demand for solar will also be a significant expense for the factory itself—at least until it can utilize its own production.

-

Raw Material Inventory: To mitigate shipping delays, a larger-than-normal inventory of raw materials (glass, cells, frames) may be necessary, which ties up working capital.

Experience from J.v.G. turnkey projects shows that underestimating local OpEx is a common and costly pitfall for new investors in island markets.

The Counterbalance: Government Incentives and Support

The key counterweight in this financial puzzle is the government’s use of powerful incentives to offset these high costs. These are not minor benefits but structural advantages that must be built directly into the financial model.

Key incentives in Seychelles include:

-

VAT and Customs Duty Exemptions: Complete exemption on the importation of certified renewable energy equipment, dramatically reducing the initial CapEx.

-

Business Tax Concessions: Favorable tax rates and accelerated depreciation allowances for businesses in the renewable energy sector, increasing net profit.

-

Low-Interest Financing: Access to programs like the Seychelles Energy Efficiency and Renewable Energy Programme (SEEREP), which provides preferential loans that can significantly lower the cost of capital.

A comprehensive business plan for solar manufacturing must accurately model these variables to present a realistic forecast to investors and financial institutions. By directly reducing costs and increasing profitability, these incentives shorten the payback period.

Calculating a Realistic Return on Investment (ROI)

With all variables accounted for, the Return on Investment can be calculated. The formula remains simple:

ROI (%) = (Net Profit / Total Investment) x 100

The integrity of the inputs, however, is what ultimately matters.

-

Total Investment: This must be the fully loaded cost, including all equipment, shipping, duties (if any), installation, and initial working capital.

-

Net Profit: This is the annual profit after accounting for all operational expenses and applying the benefits of tax concessions.

While industry reports suggest payback periods of 4–6 years for solar PV projects in Seychelles, this is attainable only when the financial model accurately reflects both the higher costs and the significant government support. A miscalculation on either side of the equation can render the projection useless.

A Structured Approach to Project Viability

The viability of a solar module factory in Seychelles is ultimately a study in balance. The logistical hurdles and high operational costs are real, but so are the strong market demand and substantial government incentives designed to foster investment. Success depends not on ignoring the challenges but on quantifying them precisely within a sophisticated financial model.

Guidance from experienced consultants can be invaluable in navigating these complexities, particularly when setting up a turnkey solar manufacturing line in a new market. Their experience provides the data points needed to transform assumptions into reliable financial projections.

Frequently Asked Questions (FAQ)

What is the biggest financial mistake investors make in island markets?

The most common error is underestimating the ‘fully loaded’ cost of logistics and local operational expenses. A standard spreadsheet template will not capture the nuances of shipping, port fees, and the higher cost of skilled labor and materials in a remote location.

How do government incentives impact the payback period?

They can shorten it significantly. Customs duty exemptions lower the initial investment required, while tax concessions increase the annual net profit. Both factors directly contribute to a faster return on the initial capital outlay.

Is a smaller-scale factory (e.g., 20–50 MW) viable in Seychelles?

Yes, a smaller-scale operation can be an excellent entry strategy. It allows an investor to match production capacity with local demand, reducing the initial investment and minimizing market risk. This approach enables the business to establish a footprint before potentially scaling up.

Do I need a local partner to succeed in Seychelles?

While not mandatory, a local partner can provide invaluable knowledge of domestic regulations, labor market dynamics, and logistical pathways. Their involvement can help mitigate risks and accelerate the setup process.

Conclusion and Next Steps

Establishing a solar factory in Seychelles is a high-potential venture for the well-prepared investor. Financial success is not a matter of chance, but of diligence. It requires moving beyond generic templates to build a financial model that truthfully reflects the unique economic ecosystem of an island nation.

For those seriously considering such a venture, the next logical step is to develop a detailed feasibility study and preliminary business plan. This process forces a disciplined examination of every cost and revenue variable, laying the foundation for a resilient and profitable enterprise.