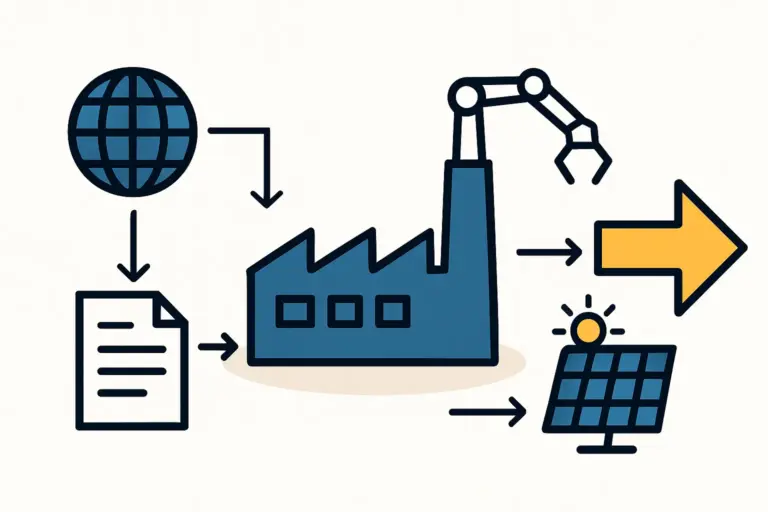

Entrepreneurs entering the solar industry often see a solar module as a standardized global commodity. The assumption is that a panel that performs well in Germany or California will perform equally well in Malaysia or Nigeria. This assumption, however, can be a costly miscalculation.

In tropical regions, where high heat and relentless humidity are constant, standard solar modules can degrade at an alarming rate. This rapid degradation jeopardizes the financial viability of entire solar projects.

This challenge creates a distinct and growing business opportunity: establishing specialized manufacturing focused on producing modules engineered to thrive in these demanding climates. This article examines the business case for locating such a factory in Singapore to serve the rapidly expanding markets of Southeast Asia and beyond.

The Hidden Threat: How Humidity Undermines Solar Panel Performance

Standard solar modules are typically tested and optimized for the temperate climates of Europe and North America. But the conditions in tropical zones, which routinely exceed 80-90% relative humidity with sustained high temperatures, create a hostile environment for conventional module components.

Two primary degradation mechanisms are accelerated under these conditions:

-

Potential Induced Degradation (PID): This effect occurs when a voltage difference exists between the solar cells and the module frame, especially in the presence of moisture. Humidity allows electrical current to ‘leak’ from the cells, which can lead to a catastrophic power loss of up to 30% within the first few years of operation.

-

Component Hydrolysis: The materials used in a standard module, particularly the EVA (ethylene vinyl acetate) encapsulant and the polymer backsheet, are susceptible to breaking down when exposed to constant moisture and heat. This can lead to delamination, corrosion, and electrical insulation failure.

For a solar farm developer or investor, this rapid degradation means a project will fail to deliver its projected energy output and financial returns. For a module manufacturer, it creates a market gap for a more durable, climate-appropriate product.

The Engineering Solution: Building a Module for the Tropics

Addressing the challenges of high-humidity environments requires a fundamental shift in module design and material selection. Instead of minimizing initial cost, the focus shifts to maximizing long-term energy yield and durability.

The most effective solution is to adopt a Glass-Glass (GG) module construction.

Glass-Foil vs. Glass-Glass Construction

A standard module typically uses a ‘glass-foil’ structure, with a single pane of glass at the front and a polymer backsheet at the rear. While cost-effective, the polymer backsheet is the component most vulnerable to moisture ingress.

A Glass-Glass module replaces the polymer backsheet with a second pane of glass. This creates a hermetically sealed enclosure for the solar cells, providing superior protection against humidity.

Key advantages of Glass-Glass modules in tropical climates include:

-

Exceptional Moisture Barrier: Glass is impermeable to water vapor, virtually eliminating the risk of hydrolysis and dramatically reducing PID.

-

Enhanced Mechanical Stability: The rigid structure provides better protection against physical stress and microcracks.

-

Longer Lifespan: Manufacturers of GG modules often offer 30-year performance warranties, compared to the 25-year standard for glass-foil, reflecting their superior durability.

To further enhance resilience, manufacturers often use POE (polyolefin elastomer) as an encapsulant instead of EVA. POE has a much lower water vapor transmission rate, adding another layer of protection for the solar cells. This level of technical specification is central to any successful manufacturing operation targeting tropical markets.

Why Singapore is the Ideal Production Hub

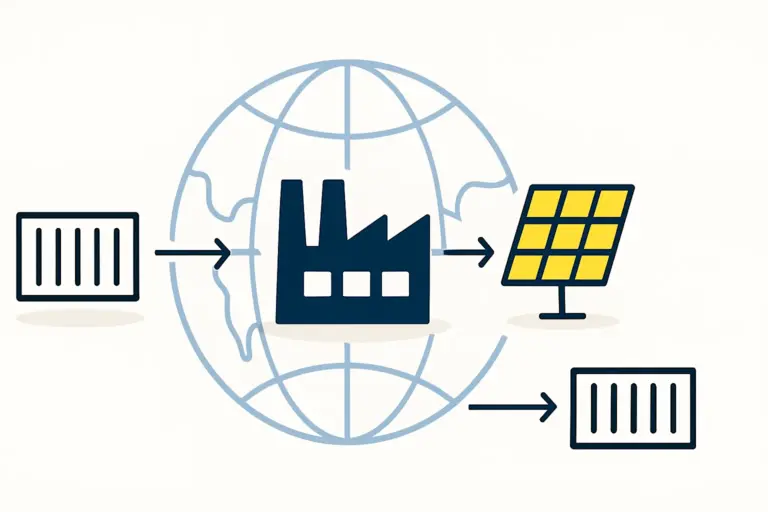

While these specialized modules can be produced anywhere, establishing a factory in Singapore provides a unique strategic advantage for serving the Southeast Asian market. The city-state offers a powerful combination of logistical prowess, technical infrastructure, and business stability.

Unrivaled Logistical Access

Singapore is home to one of the world’s busiest and most efficient container ports. For a manufacturer, this offers a significant competitive edge. Raw materials can be sourced globally and imported efficiently, while finished modules can be shipped to key regional markets like Indonesia, Malaysia, Thailand, the Philippines, and Vietnam with minimal lead times and reduced transportation costs. This proximity is critical for serving a region where solar energy demand is escalating.

A Hub of Technical Excellence and Innovation

Singapore has cultivated a world-class high-tech manufacturing ecosystem. This provides access to:

-

A Highly Skilled Workforce: The availability of experienced engineers and technicians is essential for operating and maintaining the sophisticated, automated equipment in a modern solar panel production line.

-

Advanced Research & Development: Institutions like the Solar Energy Research Institute of Singapore (SERIS) are at the forefront of photovoltaic technology. Proximity to such centers of innovation facilitates collaboration and helps a manufacturer stay current with the latest technological advancements.

A Secure and Stable Investment Climate

For any significant capital investment, stability is paramount. Singapore offers an internationally recognized legal framework, strong protection for intellectual property, and a transparent, pro-business regulatory environment. This reduces political and financial risk, making it an attractive destination for foreign entrepreneurs and institutional investors planning long-term projects.

The Business Case: Investment, Cost, and Long-Term Value

The Southeast Asian solar market is poised for explosive growth, driven by government policies, falling technology costs, and increasing energy demand. A manufacturer based in Singapore is perfectly positioned to capture this opportunity by offering a premium product that directly addresses the region’s primary technical challenge.

Although the initial capital expenditure for a Glass-Glass module production line may be slightly higher—a 50 MW turnkey line can require an investment of approximately €5–7 million—the business model is built on value, not volume.

-

Premium Product, Premium Pricing: High-durability modules command a higher price point, as they offer a lower Levelized Cost of Energy (LCOE) for the end-user over the project’s lifetime.

-

Brand Reputation: By solving a critical problem for solar project developers, a manufacturer can quickly build a reputation for quality and reliability, fostering strong customer loyalty.

-

Reduced Warranty Claims: The superior durability of GG modules leads to fewer field failures and warranty claims, protecting the manufacturer’s bottom line and reputation.

J.v.G. Technology GmbH’s experience in setting up turnkey factories shows that a well-planned facility in a strategic location like Singapore can become profitable by focusing on this high-value market niche.

Frequently Asked Questions (FAQ)

What is the main cause of solar panel failure in humid climates?

The primary causes are Potential Induced Degradation (PID) and the hydrolysis of materials like the backsheet and EVA encapsulant. Both are accelerated by the combination of high humidity and high temperatures, leading to significant power loss and physical degradation.

Are Glass-Glass modules significantly more expensive to produce?

The production cost is marginally higher due to the second pane of glass and the potential use of a POE encapsulant. However, this increased cost is justified by the vast improvement in durability and lifespan. This allows the product to be sold at a premium, as the long-term value for the end customer is substantially greater.

Is Singapore the only viable location for such a factory?

While other locations in Southeast Asia could be considered, Singapore’s unique combination of a world-class logistics hub, a highly skilled workforce, a stable legal framework, and a strong R&D ecosystem makes it a particularly powerful and de-risked choice for a high-tech manufacturing investment.

How long does it take to set up a specialized manufacturing line?

With a structured approach and experienced partners, a turnkey solar module factory can be planned, built, and commissioned in under 12 months. Platforms like pvknowhow.com provide structured e-courses and guidance to help entrepreneurs navigate this process efficiently.

Conclusion: A Strategic Approach to a Niche Market

The global solar market is not monolithic. Regional climatic conditions create specific technical challenges that open up strategic business opportunities. Manufacturing high-humidity-resistant modules is a prime example of a niche where specialized engineering creates superior value.

By combining this targeted product strategy with the logistical and technological advantages of a Singaporean manufacturing base, an entrepreneur can build a defensible and highly reputable business. This approach moves beyond competing on price alone, instead establishing a brand synonymous with quality, durability, and long-term performance in the world’s fastest-growing solar markets.