At first glance, Singapore may seem an unconventional choice for a manufacturing facility. With its high land and labor costs, many entrepreneurs might look to neighboring countries for their solar module production.

Yet this perspective overlooks a unique combination of strategic advantages, government support, and operational efficiencies that makes Singapore a compelling and profitable base for a solar factory.

A successful venture here hinges on a precise and realistic financial model—one that accounts for the distinct local cost structure while leveraging the nation’s strengths. This article outlines the key financial variables an investor must consider when developing a business plan for a solar module factory in Singapore, and it shows how to transform perceived disadvantages into a competitive edge.

The Strategic Rationale: Why Singapore for Solar Manufacturing?

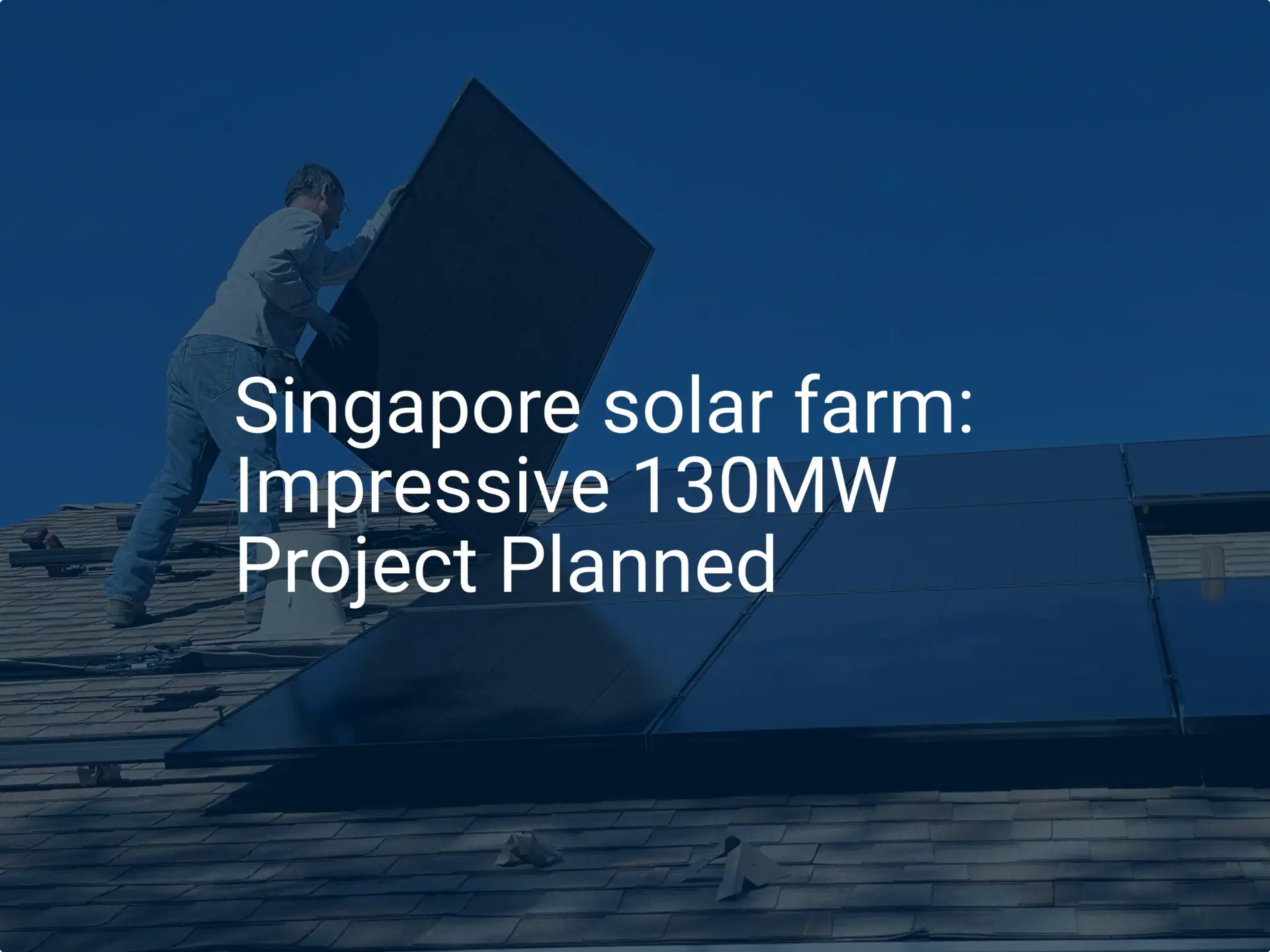

Before examining specific costs, it’s important to understand the strategic context. The Singaporean government is actively fostering a green economy through initiatives like the Singapore Green Plan 2030, which targets at least 2 gigawatt-peak (GWp) of solar energy deployment by 2030. This policy creates stable, government-backed local demand and signals strong support for the renewables sector.

Singapore’s unparalleled political stability, robust legal framework, and world-class infrastructure also create a low-risk environment for significant capital investment. For businesses focused on exporting to the booming ASEAN market, the country offers a logistical and financial hub that is second to none.

Deconstructing Capital Expenditures (CAPEX)

The initial investment in a solar factory, or CAPEX, is driven primarily by machinery and facility setup. While these costs are broadly similar globally, the Singaporean context places a strong emphasis on automation.

The primary components of CAPEX include:

-

Production Equipment: This is the core machinery, from cell stringers and laminators to framing machines and testers. Given Singapore’s high labor costs, investing in a highly automated turnkey solar production line is not a luxury but a strategic necessity for long-term cost competitiveness.

-

Facility Fit-Out: Whether leasing a standard factory building or constructing a purpose-built facility on leased land, the project requires significant investment in cleanroom environments, electrical systems, compressed air, and other critical infrastructure.

-

Initial Raw Material Inventory: Procuring the initial stock of solar cells, glass, backsheets, EVA films, and aluminum frames requires a substantial upfront investment.

Based on experience from J.v.G. turnkey projects, a well-planned, automated production line can significantly reduce the number of operators required per shift, directly impacting the operational cost structure.

Navigating Operational Expenditures (OPEX): Singapore’s Unique Variables

Operational expenditures are where a Singapore-based financial model differs most from other locations. Accurately forecasting these recurring costs is critical for determining a project’s viability.

Industrial Land and Facilities: The JTC Factor

Most industrial land in Singapore is managed by JTC Corporation, a statutory board. Businesses typically lease land or factory buildings from JTC, making this arrangement a key variable for any financial model.

-

Land Rent: Rates for industrial land can range from S$23 to S$28 per square meter per annum. For a typical 5,000 m² facility, this translates to an annual lease cost of S$115,000 to S$140,000.

-

Lease Terms: Leases are typically long-term (e.g., 20-30 years), providing stability for planning but also representing a significant long-term commitment.

These costs are predictable and transparent, allowing for precise inclusion in a financial forecast.

Utility Costs: Managing High Electricity Tariffs

Solar module manufacturing is an energy-intensive process, particularly during lamination and cell testing. Singapore’s electricity tariffs, regulated by the Energy Market Authority (EMA), are among the highest in Southeast Asia, often hovering around S$0.30 per kilowatt-hour (kWh).

This high cost makes operational efficiency a top priority. When selecting machinery, an investor should prioritize equipment with lower energy consumption. Implementing energy management systems within the factory can also yield substantial long-term savings and improve the project’s overall profitability.

Labor and Automation: A Strategic Balancing Act

Singapore’s highly skilled workforce comes at a premium. A skilled manufacturing technician can command a monthly salary of S$4,000 to S$6,000. For a factory running multiple shifts, labor can quickly become one of the largest operational expenses.

This is where that initial CAPEX investment in automation pays dividends. A factory designed for high automation can operate with a leaner team of highly qualified supervisors and technicians, rather than a large number of line operators. This strategy not only controls costs but also improves production consistency and quality.

Supply Chain and Logistics: Leveraging a Global Hub

While Singapore must import nearly all raw materials—such as polysilicon, solar glass, and aluminum frames—its status as a global logistics hub turns this into an advantage.

The Port of Singapore is one of the most efficient in the world. This efficiency translates into lower shipping costs, reduced lead times, and greater supply chain reliability when importing materials. Crucially, this same logistical prowess makes exporting finished solar modules to regional markets like Malaysia, Indonesia, and Vietnam fast and cost-effective.

Revenue Projections and ROI: The Role of Government Incentives

A financial model that considers only high operational costs would be incomplete. The Singaporean government, through its Economic Development Board (EDB), offers a range of powerful incentives to attract high-value manufacturing.

Key schemes include:

-

Pioneer Certificate Status: Provides a corporate tax exemption for five to fifteen years for companies bringing new and innovative activities to Singapore.

-

Development and Expansion Incentive (DEI): Offers a reduced corporate tax rate of 5% or 10% on qualifying profits.

With these incentives factored in, the return on investment (ROI) profile changes dramatically. The tax savings can effectively offset the higher operational costs, making a Singapore-based factory highly competitive, particularly when serving premium regional markets that value ‘Made in Singapore’ quality and reliability.

Building a Resilient Financial Model

Success in Singapore’s solar manufacturing sector depends on a financial model that is both realistic and strategic. It must account for high OPEX while fully leveraging the benefits of automation, logistical efficiency, and powerful government incentives.

A comprehensive solar panel manufacturing business plan is an essential tool for synthesizing these variables. It allows an entrepreneur to run scenarios, understand cash flow implications, and present a compelling case to investors and government agencies. This detailed planning is the foundation for building a profitable and sustainable enterprise.

Frequently Asked Questions (FAQ)

What is a typical initial investment for a small-scale factory in Singapore?

For a 50-100 MW automated factory, initial capital expenditure for machinery, facility fit-out, and initial inventory can range from US$5 million to US$10 million. This figure depends heavily on the level of automation and the specific technology chosen.

How do Singapore’s high labor costs affect profitability?

High labor costs directly impact profitability if not managed strategically. The solution is to invest more heavily in automation during the CAPEX phase. This reduces the number of staff required per megawatt of output, lowering long-term OPEX and making the business model resilient.

Are there specific materials required for solar panel manufacturing that are difficult to source in Singapore?

While Singapore does not produce raw materials like polysilicon or solar glass, its world-class port and logistics infrastructure make sourcing them straightforward. Reputable global suppliers have well-established shipping routes to Singapore, ensuring a reliable supply chain for all components required for solar panel manufacturing.

How long does it typically take for a solar factory in Singapore to become profitable?

Profitability timelines depend on factors like production capacity, operational efficiency, and market demand. With effective use of government tax incentives like the Pioneer Certificate, a well-managed factory can potentially reach operational profitability within two to three years, with a full return on investment projected within five to seven years.

Conclusion: The Path Forward for Your Singapore Solar Venture

Establishing a solar module factory in Singapore is a venture of precision and strategy. The financial model must balance some of the world’s highest operational costs with unparalleled efficiency, stability, and government support.

For the right investor—one who prioritizes automation, quality, and long-term strategic positioning—Singapore offers a unique platform to build a leading solar manufacturing business that can effectively serve the entire Southeast Asian region. The complexity of this undertaking should not be a deterrent. With expert guidance and meticulous planning, entrepreneurs can navigate the financial landscape to build a robust, profitable, and enduring enterprise.