Choosing a location for a new manufacturing plant is one of the most consequential decisions an investor will make. While the ‘right’ location might seem to be the one with the best infrastructure, in a country like Slovakia with significant regional economic variations, a deeper analysis reveals a more nuanced picture. The optimal choice is rarely the most obvious; it demands a strategic balance of logistics, labor, and local incentives.

This article offers a comparative analysis of industrial zones in Eastern and Western Slovakia for prospective solar module manufacturers. It explores the critical factors that shape site selection, offering a framework for making an informed investment decision in this strategic Central European location.

Slovakia: A Central European Manufacturing Hub

Slovakia’s position as a manufacturing powerhouse is well-established. As a member of the European Union and the Eurozone, it offers a stable political and economic environment. The country’s industrial production, which saw a 5.7% year-on-year increase in early 2024, is heavily dominated by the automotive sector.

This heritage has cultivated a highly skilled workforce proficient in automated production, quality control, and sophisticated supply chain management. These skills are directly transferable to the high-tech assembly required for a turnkey solar module production line. For foreign investors, this translates into a familiar and reliable industrial ecosystem. However, the country’s economic landscape is not uniform, with a significant divide separating the highly developed western regions from the developing eastern regions.

The Geographic Divide: Industrial Density in West vs. East

Slovakia has over 80 designated industrial parks, but their distribution is heavily skewed toward the western part of the country. The regions around the capital, Bratislava, and major industrial cities like Nitra, Trnava, and Žilina host a dense concentration of multinational manufacturing operations.

This concentration stems from historical development and superior logistical connections to major European Union markets, such as Germany, Austria, and the Czech Republic. In contrast, Eastern Slovakia, while actively developing, has a less dense industrial landscape. This disparity presents each region with a distinct set of advantages and disadvantages that must be carefully weighed during the site selection process.

Key Decision Factors for Site Selection

An investor’s decision should rest on a methodical evaluation of several core business factors. The ideal location ultimately depends on the project’s specific business model and strategic priorities.

Labor Availability and Cost

One of the most significant differences between the two regions lies in the labor market. Western Slovakia, particularly the Bratislava region, has very low unemployment and, consequently, higher labor costs. Due to the high concentration of existing industry, competition for skilled workers is intense.

In contrast, Eastern Slovakia (e.g., the Prešov and Košice regions) has historically higher unemployment rates. This offers two key advantages for a new employer:

- A larger pool of available labor, reducing recruitment challenges.

- Significantly lower wage expectations, which can substantially impact long-term operational costs.

The difference in average gross monthly wages is a clear indicator of this disparity. For a manufacturing operation that requires a substantial workforce, the potential for long-term savings on payroll in the East can be a compelling financial argument.

Infrastructure and Logistics

Western Slovakia holds a clear logistical advantage. The region is well-integrated into the European motorway network, with the D1 and D2 highways providing direct routes to Vienna, Budapest, and Prague. Proximity to Vienna International Airport and the Port of Bratislava on the Danube River also offers excellent options for international freight.

Eastern Slovakia’s infrastructure is still developing, though significant progress is underway to extend the D1 motorway and connect Košice with the rest of the country. While logistical routes to Western Europe are longer, the East offers strategic proximity to markets in Poland, Hungary, and Ukraine. For companies targeting these markets, an eastern location could prove more efficient.

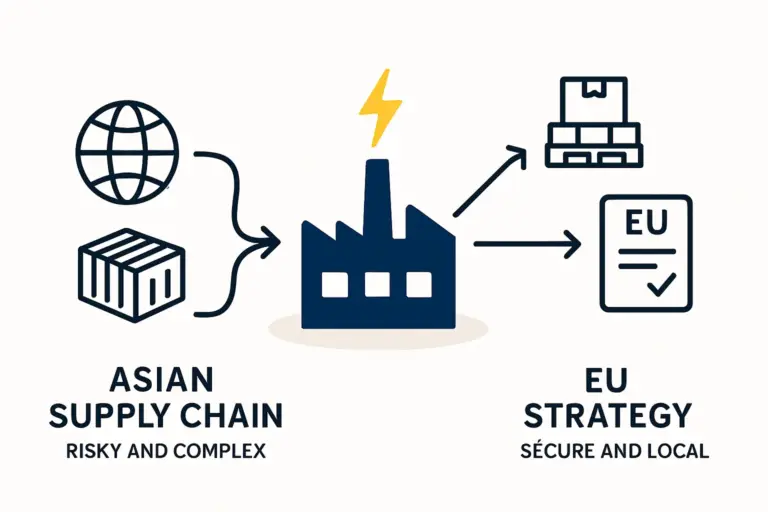

Government Incentives and Investment Aid

To counterbalance the logistical advantages of the West, the Slovak government offers substantial investment incentives. This framework is explicitly designed to encourage development in the eastern regions.

Under Slovak and EU regulations, the maximum intensity of regional investment aid is directly tied to the GDP per capita of a given region. This means a project in Eastern Slovakia is eligible for a much higher percentage of aid on its eligible costs (such as land, buildings, and machinery) compared to an identical project in the Bratislava region. This difference can amount to several million euros for a typical solar factory, directly reducing capital expenditure and lowering overall investment costs.

Land and Operational Costs

Consistent with other economic factors, the cost of industrial land and general operational expenses are considerably lower in Eastern Slovakia. The lower demand compared to the prime industrial real estate in the West results in more competitive pricing for purchasing or leasing land within industrial parks. This further reduces the initial investment required to secure a suitable site.

A Practical Application: Insights from a J.v.G. Project

The trade-offs between East and West become clearer with a real-world example. One J.v.G. client, after a detailed site selection analysis, ultimately chose the Kechnec industrial park near Košice in Eastern Slovakia.

While a western location offered simpler logistics for shipping finished modules to Germany, the financial modeling proved decisive. The combination of substantially lower long-term labor costs, a significant government investment aid package unique to the eastern region, and lower land acquisition costs created a far more compelling business case that outweighed the logistical complexities.

The savings on operational expenditures and the reduction in initial capital outlay provided a faster path to profitability and a more resilient financial structure. This decision highlights a crucial principle: the ‘best’ location is the one that best aligns with the company’s financial and strategic goals, not necessarily the one with the most developed infrastructure.

Frequently Asked Questions (FAQ)

-

Why is the automotive industry’s presence in Slovakia relevant for solar manufacturing?

The automotive industry has created a deep talent pool with experience in high-volume, automated production, lean manufacturing principles, and stringent quality control systems (e.g., ISO 9001). These skills are directly transferable to solar module assembly, which requires similar precision and process discipline. -

Are there language barriers for foreign investors in Slovakia?

While Slovak is the official language, English is widely spoken in the business community, particularly among management-level and technically skilled professionals. Navigating administrative processes may require local support, but conducting business operations in English is standard practice. -

How long does it typically take to get a factory operational after selecting a site?

Assuming a site is chosen within an established industrial park with ready-to-build plots, a new solar module factory can typically become operational within 9 to 12 months. This timeline covers building construction, equipment installation, commissioning, and staff training. -

What is the primary advantage of choosing a site within a designated industrial park?

The main advantage is readiness. Industrial parks offer plots with pre-approved zoning for industrial use, established utility connections (electricity, gas, water), and existing road access. This dramatically simplifies and accelerates the setup process compared to developing a greenfield site.

Conclusion: A Strategic Choice, Not an Obvious One

The decision between locating a solar module factory in Eastern or Western Slovakia is a classic business case of balancing competing factors. Western Slovakia offers world-class logistics and a mature industrial ecosystem, but at a premium cost for labor and land. Eastern Slovakia presents a compelling financial alternative with lower operational costs and significant government incentives, albeit with logistical considerations that require careful planning.

For the international investor, the key is to conduct a thorough analysis that models the long-term financial impact of each factor. As demonstrated by real-world projects, the less obvious choice can often be the more profitable one. A successful investment begins not with securing a piece of land, but with a clear understanding of the strategic trade-offs that will define the business’s success for years to come.