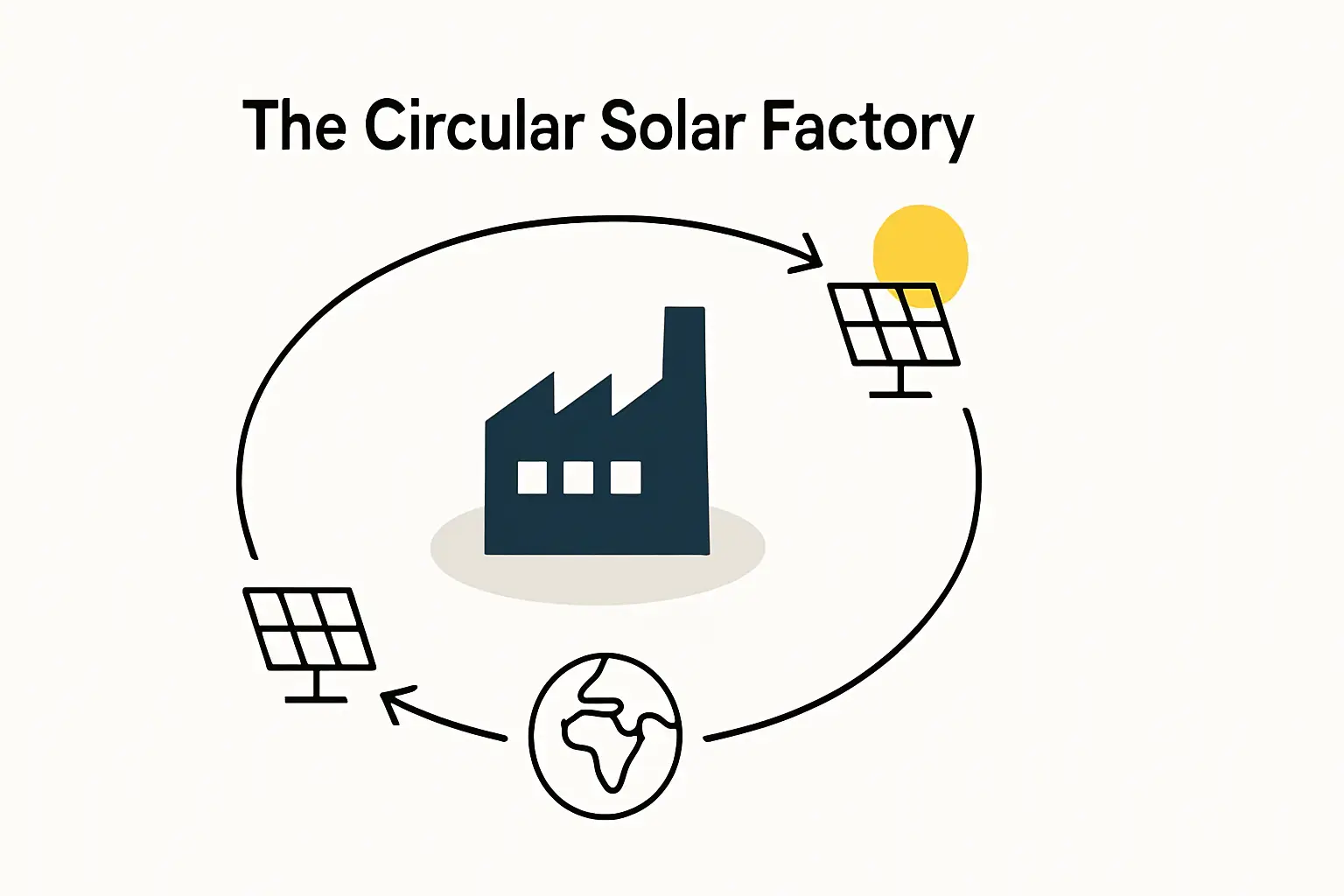

For many entrepreneurs in South Africa, establishing a solar module manufacturing plant is a compelling prospect. It addresses a critical national need, aligns with global sustainability goals, and represents a significant industrial opportunity.

However, the path from concept to a fully operational facility is often blocked by one formidable barrier: securing substantial upfront capital. Development Finance Institutions (DFIs) like the Development Bank of Southern Africa (DBSA) and the Industrial Development Corporation (IDC) were created to bridge this gap. But they aren’t conventional lenders. They are strategic partners, mandated to foster national development, who evaluate investment proposals with rigorous economic, social, and technical scrutiny. This guide lays out a framework for building an investment case that not only meets but exceeds the expectations of these critical funding partners.

The South African Imperative: Why Local Solar Manufacturing is a National Priority

To secure DFI funding, an investor must first demonstrate a deep understanding of the national context. The investment case for a solar factory in South Africa is not built on market opportunity alone; it is founded on the country’s urgent need for energy security and industrial localization.

South Africa faces a structural energy deficit. The national utility, Eskom, has struggled to meet demand, resulting in persistent load shedding that costs the economy billions of Rands. Projections indicate that the country needs to add between 4 and 6 gigawatts of new power generation capacity annually for the next decade to close this gap and support economic growth.

In response, the government has established clear policy frameworks. The Renewable Independent Power Producer Procurement Programme (REIPPPP) and the Integrated Resource Plan (IRP 2019) explicitly prioritize renewable energy. The Just Energy Transition Investment Plan (JET-IP) also earmarks significant funds for scaling up clean energy infrastructure.

A crucial component of these initiatives is the emphasis on localization. Government policies, including the ‘Designation for local production’ of solar PV modules, aim to ensure that this energy transition also builds domestic industrial capacity, creates sustainable jobs, and reduces reliance on imports. A 2022 study by the South African-Tsinghua University Initiative for Economic Development (SA-TIED) confirmed that local content requirements can significantly boost employment and economic value. This is the national context in which DFIs operate and the imperative they are meant to address.

Understanding the DFI Mandate: What the DBSA and IDC Look For

DFIs are mission-driven investors. While they require a project to be commercially viable, their primary evaluation criteria extend to its broader developmental impact. A successful application must demonstrate alignment with their core mandates:

Industrial Development

The project must contribute to building South Africa’s manufacturing base. A proposal for assembling imported components is less attractive than one detailing a plan for a full production line with a roadmap for increasing local content over time.

Job Creation

Quantifiable, high-quality job creation is a key metric. The proposal should detail the number of direct and indirect jobs—from technicians and engineers to logistics and administrative staff—the factory will support.

Economic Transformation

DFIs prioritize projects that advance Broad-Based Black Economic Empowerment (B-BBEE) objectives, promote skills development, and create economic opportunities in underserved communities.

Sustainability and Resilience

The project must be environmentally sustainable and contribute to the country’s climate goals. It should also demonstrate how it enhances national resilience by securing a local supply chain for critical energy components.

A proposal that frames a solar factory solely as a financial investment will likely fail. One that frames it as a cornerstone of national energy independence and industrial policy is positioned for success.

Building a Bankable Investment Case: A Step-by-Step Framework

With a clear understanding of the DFI mandate, the next step is to construct a bankable project proposal. This proposal must be built on four critical pillars of evidence.

Step 1: The Feasibility Study and Market Analysis

DFIs require proof of demand. Your investment case must include a rigorous market analysis identifying a clear route to market for your modules. This means including letters of intent or memoranda of understanding from downstream partners, such as large-scale solar farm developers, commercial and industrial installers, and residential solar providers. A detailed off-take strategy is non-negotiable and forms the basis of a comprehensive business plan.

Step 2: Robust Financial Projections

The financial model is the heart of the proposal. It must be detailed, transparent, and based on defensible assumptions. This involves more than just revenue forecasts; it requires a granular breakdown of capital expenditures (CAPEX) for buildings and equipment, as well as operational expenditures (OPEX) covering raw materials, labor, and utilities. The financial modeling must demonstrate a clear path to profitability and a sustainable internal rate of return (IRR) that can withstand market fluctuations.

Step 3: Technical Validation and De-Risking

DFIs are financiers, not solar engineers. They need assurance that the proposed factory is technically sound, capable of producing high-quality modules, and will operate efficiently for decades. This is where the choice of a technical partner becomes a crucial factor in de-risking the project.

A DFI will scrutinize the proposed technology, the plant layout, the bill of materials, and the quality control processes. Presenting a plan backed by a globally recognized engineering partner with a proven track record is essential. For instance, a proposal based on a German-engineered turnkey solar module manufacturing line provides immediate credibility. This approach assures the DFI that the facility will be built to international standards using reliable solar manufacturing equipment.

This engineering partner plays a vital role during the DFI’s technical due diligence process, answering detailed questions and validating every aspect of the operational plan.

Step 4: The Partnership and Governance Structure

Finally, DFIs invest in people and partnerships as much as they invest in projects. They need to see a strong, experienced management team and a governance structure that inspires confidence. A critical way to de-risk the investment is to demonstrate long-term commitment from credible partners.

For example, a project backed not only by an engineering firm like J.v.G. Technology GmbH but also by its founding family (the Thoma family), which has a multi-generational legacy in German industry, presents a powerful case. This structure signals more than just technical expertise; it signifies financial stability, a long-term vision, and patient capital from a partner with a vested interest in the project’s success. This combination of entrepreneurial drive, engineering excellence, and stable family backing is precisely the formula that gives a DFI the confidence to commit capital.

A Proven Model: The J.v.G. and Thoma Family Approach to De-Risking

The challenge of securing DFI funding ultimately comes down to mitigating risk. Experience from J.v.G. Technology’s turnkey projects shows that a successful approach integrates the four pillars into a single, cohesive narrative. A local entrepreneur provides the vision and market access. A German engineering partner provides the technical bankability and operational excellence. A stable family-office backer provides the financial credibility and long-term perspective.

This tripartite structure directly addresses a DFI’s primary concerns. It proves market demand, validates financial projections, removes technical uncertainty, and establishes a trustworthy governance framework. It transforms a high-potential but high-risk venture into a bankable, development-focused industrial project.

Frequently Asked Questions (FAQ) for Aspiring Solar Manufacturers

What is the typical investment size DFIs look for?

DFIs typically engage with large-scale industrial projects. For a 20 MW to 50 MW semi-automated solar module factory, the initial capital expenditure for machinery and setup can range from $2 million to $5 million USD. DFIs are well-positioned to finance projects of this magnitude, provided the investment case is sound.

How long does the DFI funding application process take?

The process is thorough and can take anywhere from six to 18 months. It involves multiple stages, from an initial expression of interest to detailed due diligence and final credit approval. Patience and meticulous preparation are essential.

Do I need a technical background to apply?

No, an entrepreneur does not need to be a photovoltaic expert. However, the project must have a credible, experienced technical partner. The DFI’s confidence will rest on the demonstrated expertise of the engineering firm responsible for designing, commissioning, and supporting the plant. The educational resources at pvknowhow.com are designed to help business professionals navigate this technical landscape.

What are the key local content requirements in South Africa?

The Department of Trade, Industry and Competition (DTIC) has designated solar PV modules for local production, setting thresholds for local content. Meeting and exceeding these thresholds is a significant advantage in a DFI application, as it directly aligns with the goal of industrialization and job creation.

Conclusion: Your Next Steps in Building a DFI-Ready Project

Securing funding from a Development Finance Institution is a challenge, but it is an achievable goal for entrepreneurs committed to building South Africa’s solar manufacturing capacity. Success does not depend on a single factor but on the methodical construction of a de-risked investment case.

The path forward involves validating the market opportunity, creating transparent and robust financial models, and, most critically, building a partnership that provides unquestionable technical and financial credibility. By aligning a project with national development goals and presenting it through a framework of proven engineering and stable governance, an entrepreneur can transform a powerful vision into a bankable reality.