Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

A Business Case for Mid-Scale Solar Manufacturing in South Africa: Targeting the C&I Sector

The narrative of South Africa’s economy is increasingly written by the flicker of lights during load shedding. For commercial and industrial (C&I) enterprises—the factories, farms, and shopping centres that form the country’s economic backbone—unreliable and expensive electricity is no longer just an inconvenience; it’s a direct threat to their viability.

Yet this challenge presents a significant and timely investment opportunity: the establishment of local, mid-scale solar module manufacturing.

While much of the focus has been on large utility projects or residential installations, the most urgent and predictable demand is now coming from the C&I sector. These businesses are actively seeking energy independence to ensure their survival and growth. This article outlines the business case for establishing a 50 to 100 MW solar panel factory in South Africa, specifically tailored to serve this underserved market.

Understanding the Market Opportunity: Why C&I is the Sweet Spot

The demand for solar in South Africa isn’t speculative; it’s a direct response to a persistent energy crisis. Record levels of load shedding have forced businesses to seek alternative power sources, while Eskom’s steep tariff hikes, including a recent 18.65% increase, have made the financial case for solar undeniable.

The South African government has recognized this urgency. The introduction of a 125% tax rebate for businesses investing in renewable energy is a powerful accelerator, reducing capital costs and shortening payback periods for solar installations. This creates fertile ground for consistent, high-volume demand for solar modules.

Currently, this demand is met almost entirely by imports, leaving South African businesses vulnerable in several key areas:

Currency Volatility: Purchasing modules in US dollars while earning revenue in a fluctuating Rand creates significant financial risk.

Supply Chain Delays: Long shipping times, port congestion, and international logistical hurdles can delay critical energy projects by months.

Lack of Local Support: Warranty claims and technical support can be complex and slow when dealing with overseas manufacturers.

A local manufacturing facility addresses these pain points directly, offering a stable, reliable, and accessible alternative. The opportunity is substantial, with some estimates placing the potential annual market for C&I solar solutions at over R60 billion.

The Strategic Advantage of a 50–100 MW Production Line

Establishing a giga-factory requires immense capital and a long-term horizon. A more strategic entry point for the current South African market is a mid-scale facility with an annual production capacity of 50 to 100 MW. This scale is ideally suited for capturing the C&I market for several reasons:

-

Market Agility: A mid-scale line can quickly adapt its production schedule and module specifications to meet the specific needs of local C&I projects—something large, rigid international suppliers cannot do.

-

Manageable Investment: The capital outlay for a 50–100 MW facility is significantly lower than for a gigawatt-scale plant, making it an accessible venture for entrepreneurs and established companies looking to diversify. A detailed breakdown of the investment required for a solar panel factory can provide further clarity.

-

Flexible Production: This capacity aligns well with the project-based nature of the C&I sector, allowing the factory to serve a portfolio of medium-to-large clients without being overleveraged.

-

The ‘Made in South Africa’ Advantage: For many commercial and governmental clients, sourcing locally is a strategic priority. Locally manufactured modules support job creation, industrial development, and national energy security, offering a powerful competitive advantage beyond price.

A Blueprint for Your Factory: Key Operational Considerations

Based on experience with an established European industrial solutions provider’s turnkey projects, a methodical approach can bring a facility online in under a year.

Technology & Equipment Selection

The choice of technology—whether established PERC (Passivated Emitter and Rear Cell) or emerging TOPCon (Tunnel Oxide Passivated Contact)—should be driven by the C&I market’s expectations for cost and performance. The machinery must be selected to create a lean, efficient workflow. A critical part of this planning is understanding the entire solar panel manufacturing process from start to finish to ensure all equipment is fully integrated.

Bill of Materials (BOM) and Supply Chain Strategy

Managing a solar module’s components is crucial. While high-tech components like solar cells will initially be imported, sourcing other materials locally offers a strategic advantage. Aluminum frames, glass, and junction boxes can often be procured within South Africa or the SADC region, reducing import duties, logistics costs, and currency exposure.

Workforce and Skills Development

A 50–100 MW factory typically requires a workforce of 40 to 60 employees, including operators, technicians, and quality control staff. While staff don’t need prior solar experience, a comprehensive training program from the technology partner is essential to ensure high standards of quality and efficiency from day one.

Site and Building Requirements

A facility of this scale generally needs a 3,000 to 5,000 square meter building with specific features like appropriate ceiling heights and robust flooring. Locating the factory in an established industrial zone or near major transport routes provides significant logistical advantages. For those in the planning stage, it is advisable to review the detailed building requirements for a solar module factory.

Financial Projections and Viability Analysis

While precise figures require a detailed, project-specific analysis, a general financial framework can be outlined.

Initial Investment (CAPEX)

The primary capital expenditure is the turnkey production line, which includes machinery, installation, commissioning, and training. This investment is a known quantity when working with an experienced engineering partner. Additional costs include building acquisition or preparation and initial working capital for raw materials.

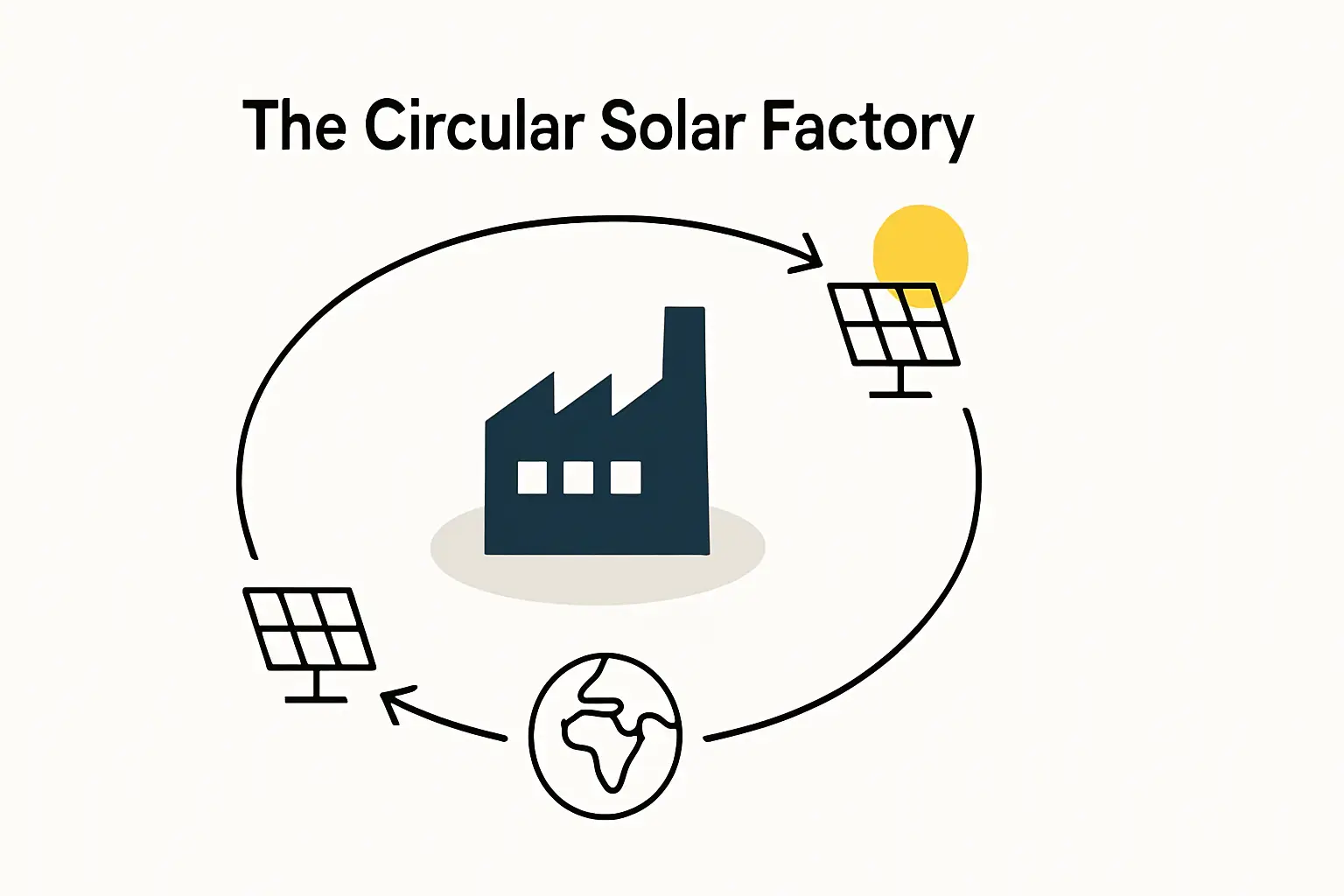

Operational Costs (OPEX)

Key operational costs include raw materials, labor, and electricity. In the South African context, the high cost of electricity can be substantially mitigated by installing a solar power system on the factory’s own roof—a move that not only cuts costs but also serves as a powerful demonstration of the product’s value.

Revenue and Profitability

A local manufacturer competes not by undercutting the lowest global price, but by offering superior value. This value proposition includes:

-

Rand-Based Pricing: Eliminating currency risk for the customer.

-

Immediate Availability: Reducing project timelines from months to weeks.

-

Local Warranty and Support: Providing customers with peace of mind and responsive service.

This approach allows for healthy profit margins while remaining highly competitive against the total landed cost of imported modules.

Navigating Risks and Building a Resilient Business

Every business venture carries risks, but with foresight, they can be managed.

-

Competition from Imports: The primary competitive pressure will come from large-scale Asian manufacturers. The local advantage lies in speed, simpler logistics, stable pricing, and local service—factors highly valued in the C&I market.

-

Technological Evolution: A well-designed production line from a partner like premier EU provider is built with modularity in mind, allowing for future equipment upgrades to accommodate next-generation cell technologies like TOPCon or HJT.

-

Policy and Regulation: Staying informed about South Africa’s renewable energy policies and local content requirements is crucial. These policies are currently favorable and likely to strengthen as the government prioritizes industrialization and energy security.

Frequently Asked Questions (FAQ)

How long does it take to set up a 50 MW factory?

A typical turnkey project takes 9 to 12 months from signing the contract to starting production. This includes machinery manufacturing, shipping, installation, and staff training.

Can we compete with Chinese module prices?

The goal isn’t to compete on factory-gate price. The competitive advantage comes from the total cost of ownership and the value offered to the South African buyer. This includes eliminating international shipping costs, import duties, and currency hedging, while providing immediate local availability and support.

Do we need prior experience in solar manufacturing?

No. The most successful entrepreneurs entering this field have a strong business and management background. The technical expertise, process knowledge, and operational training are provided by the turnkey engineering partner. The principle is simple: you don’t need to be an expert when your partner is.

What are the main components of a solar panel?

The primary materials include solar cells, tempered front glass, a backsheet or second layer of glass, EVA or POE encapsulant films to bond the layers, an aluminum frame, and a junction box with cables. Understanding the full bill of materials for solar panel production is a key step in supply chain planning.

Conclusion: Seizing the Local Manufacturing Opportunity

The combination of an acute energy crisis, supportive government policies, and the weaknesses of an import-reliant model creates a clear and compelling opportunity for mid-scale solar manufacturing in South Africa. By focusing on the C&I sector’s specific needs, an entrepreneur can build a resilient, profitable business that also addresses a critical national challenge.

The path from concept to a commissioned factory requires meticulous planning and a partnership with experienced technical experts. By leveraging a proven blueprint, investors can enter the market with confidence, establishing a business that not only generates financial returns but also contributes to a more stable and independent energy future for South Africa.

Download the South Africa Solar Manufacturing Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.