Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

Case Study: A Turnkey Solar Factory for South Africa’s Agricultural Sector

South Africa’s agricultural sector, a cornerstone of its economy, faces a persistent threat to its operations: inconsistent power. The country’s ongoing energy crisis, characterized by scheduled power outages known as load shedding, directly impacts farm productivity, from irrigation cycles to cold storage and processing.

For an industry that provides 5.3% of the nation’s employment, this instability is more than an inconvenience; it is a direct challenge to food security and economic stability.

This scenario, however, also presents a significant investment opportunity. The challenge of energy insecurity can be met with a strategic, localized solution: a solar module factory tailored to the unique needs of the agricultural industry. This analysis outlines the business case for such a venture, viewing it as a turnkey project designed for entrepreneurs and investors from outside the solar industry.

The Strategic Intersection of Energy and Agriculture

The agricultural sector is a substantial energy consumer, accounting for approximately 5% of South Africa’s total electricity usage. This power is essential for critical operations:

- Irrigation: Pumping water is energy-intensive and time-sensitive. Disruptions can compromise crop yields.

- Processing and Milling: Post-harvest activities often require continuous power to maintain quality and meet production targets.

- Climate Control and Cold Storage: Storing produce at correct temperatures is vital for reducing spoilage and maintaining value, a process severely hampered by power cuts.

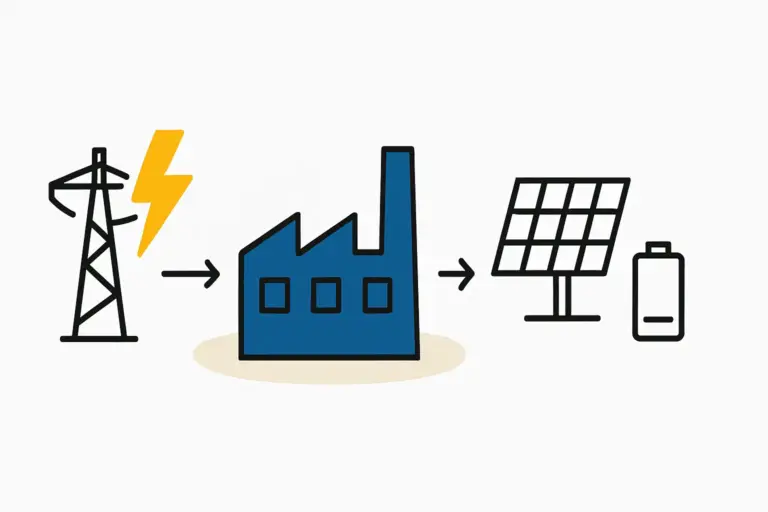

For modern farming, a reliable energy supply is not a luxury but a fundamental requirement. Solar power offers a direct, on-site solution that decouples agricultural operations from the vulnerabilities of the national grid.

The demand is clear. For an investor, the question is how to meet it most effectively. While importing solar modules is one option, local manufacturing presents a more robust and strategic business model.

The Business Case for Localized Solar Module Production

A domestic solar module factory offers distinct advantages over relying on imports. It builds supply chain resilience, creates local employment, and allows for the production of modules specifically designed for agricultural applications—such as those optimized for water pumps or off-grid storage systems.

For an investor without a technical background in photovoltaics, the concept of building a factory can seem daunting. This is where a turnkey solar module factory model becomes invaluable. This comprehensive solution covers everything from factory design and machinery procurement to staff training and process optimization.

An experienced technical partner, such as an experienced European turnkey engineering team, manages the complexities, allowing the investor to focus on business strategy and market development.

Analyzing the Investment and Financial Model

A successful venture begins with a clear view of the financial landscape. The initial investment and operational costs for a medium-scale factory are significant, but strong market drivers and government incentives support its revenue potential.

A key factor driving demand is Section 12B of South Africa’s Income Tax Act. This provision offers a remarkable 125% tax deduction for businesses on the cost of renewable energy assets. For the factory’s end customers—the farmers and agricultural businesses—this incentive dramatically shortens the payback period for investing in a solar installation, making the purchase of locally produced modules highly attractive.

The factory’s revenue model can be diversified across several channels:

- Direct Sales: Supplying large commercial farms and agricultural cooperatives.

- Distribution Partnerships: Collaborating with established agricultural equipment suppliers.

- Project Development: Engaging in larger-scale rural electrification or mini-grid projects.

This multi-channel approach de-risks the investment and builds a broad market presence.

Navigating the Regulatory and Policy Landscape

Any major industrial investment must naturally align with national policy. South Africa’s government has cultivated a supportive environment for renewable energy projects. Initiatives like the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) and the Just Energy Transition Investment Plan (JET IP) signal strong, long-term government commitment to shifting the country’s energy mix.

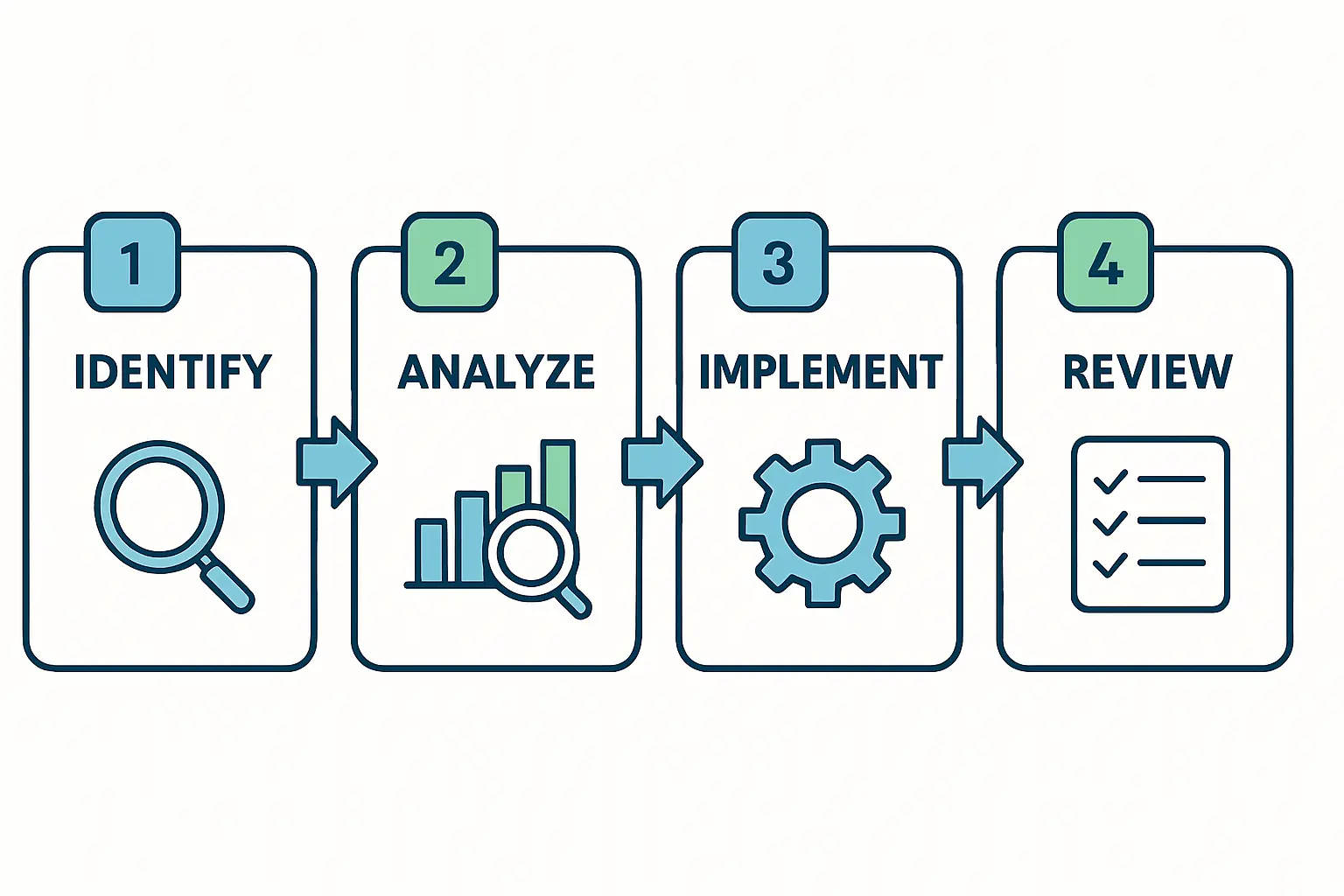

An investor does not need to be an expert in this regulatory environment, but the factory’s output must comply with all necessary certifications. Meeting local and international standards is non-negotiable for market acceptance and long-term success. Guidance from experienced engineering partners is crucial in this phase to ensure all products meet quality and safety benchmarks.

Frequently Asked Questions (FAQ)

What is the typical investment range for such a factory?

The investment depends on the target production capacity. A small to medium-scale facility (20-50 MW annual capacity) designed for a niche market like agriculture typically requires a different capital structure than a large-scale commodity plant. A detailed business plan is necessary to establish precise figures.

How does this model compete with imported solar panels?

A local factory competes on several fronts: bypassing import logistics and tariffs, offering customized products for specific applications (e.g., irrigation pumps), providing faster local support, and capitalizing on the ‘proudly South African’ sentiment. Proximity to the customer is a significant advantage.

What are the primary risks involved in this venture?

As with any industrial project, risks include potential construction delays, supply chain issues for raw materials, and shifts in market demand. A turnkey approach with an experienced partner mitigates technical and operational risks, while the strong underlying demand from the energy-strained agricultural sector helps mitigate market risk.

What level of technical expertise is required from the investor?

The turnkey model is specifically designed for business professionals and entrepreneurs who possess commercial and strategic acumen but not necessarily a deep engineering background. The technical partner, such as an established European industrial solutions provider, offers the necessary expertise for plant design, commissioning, and operational ramp-up.

A Model for Sustainable Industrial Growth

Establishing a solar factory to serve South Africa’s agricultural sector is more than a sound investment. It represents a strategic response to national challenges, creating a virtuous cycle of value. It enhances energy security for a vital industry, promotes food security, stimulates local economic development, and aligns with national energy transition goals.

This case study shows how a focused, well-planned manufacturing venture, guided by expert technical partners, can transform a systemic problem into a powerful engine for industrial growth and national resilience.

Download the South Africa Agricultural Solar Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.