Entering a new market with a significant industrial project, such as a solar module factory, presents a unique set of opportunities and challenges. In a frontier market like South Sudan—a nation with vast solar potential yet one of the lowest electricity access rates in the world—these dynamics are even more pronounced.

With only 1% of the population connected to a fragile national grid and electricity in Juba costing as much as $0.41/kWh, reliance on expensive diesel generators is widespread. This creates a compelling business case for local solar manufacturing.

However, technical feasibility and financial modeling are only part of the picture. The most critical factor for sustainable success often proves to be a robust and well-structured local partnership. For foreign investors and entrepreneurs, navigating the local business, legal, and cultural landscape without a trusted partner is a high-risk endeavor. This article explores the strategic importance of such partnerships and provides a framework for structuring them effectively.

The Strategic Imperative for Local Partnerships

In many emerging markets, government policy explicitly requires local participation in key industries. While South Sudan’s legal framework, including the Investment Promotion Act of 2009, is still developing and its implementation can be inconsistent, a strong, often unwritten, preference for business models involving local entities persists. A partnership is not just a strategic advantage; it is frequently a prerequisite for operational success.

A strong local partner provides indispensable value by:

-

Navigating the Regulatory Environment: The legal system in South Sudan is a complex mix of statutory law and customary law. A local partner with established relationships and a deep understanding of bureaucratic processes is essential for securing licenses, permits, and land use rights.

-

Aligning with National Objectives: The government has ambitious goals, such as increasing national electricity access to 25% of the population. A joint venture that contributes directly to this national development strategy is more likely to receive government support.

-

Building a Social License to Operate: A foreign-owned entity can be perceived with skepticism. Partnering with a respected local business or individual builds community trust, facilitates local hiring, and helps manage stakeholder relations.

Common Partnership Models for Market Entry

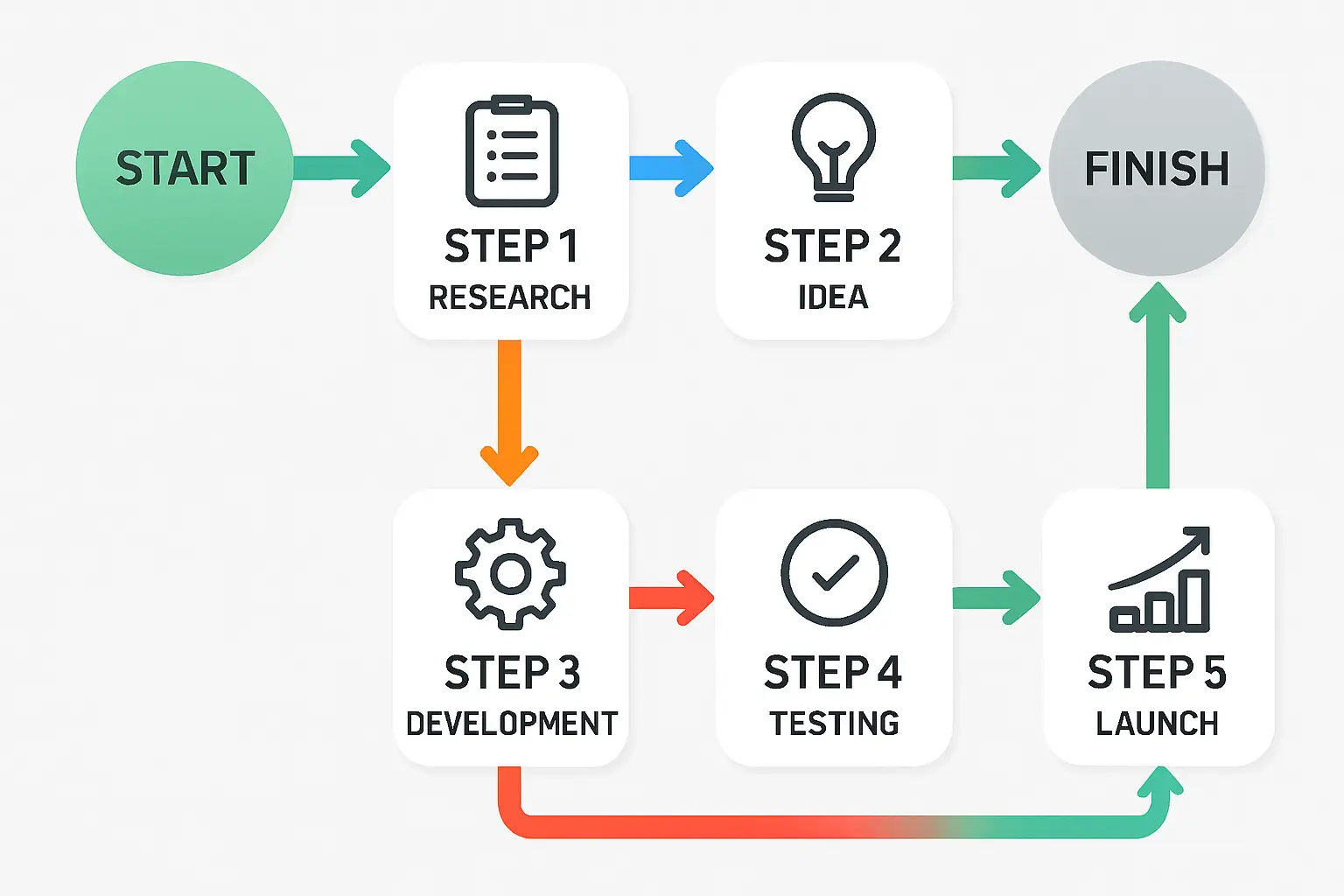

The structure of a partnership can vary significantly based on the foreign enterprise’s level of investment, risk tolerance, and long-term objectives. Three common models are worth considering.

The Joint Venture (JV) Model

A Joint Venture is a formal business arrangement where two or more parties pool their resources for a specific task. For solar manufacturing, this usually means a foreign technical partner and a local business entity creating a new, legally distinct company.

This is often the most effective model for a full-scale manufacturing plant. The foreign partner typically contributes capital, machinery, technical expertise, and operational know-how for the solar panel manufacturing process. In turn, the local partner provides land, market knowledge, government relations, and labor management.

A notable example of this model in the energy sector is the Ezra Power project, a joint venture between a local conglomerate and a foreign technical partner to build a 20 MW solar plant near Juba. This project demonstrates the viability and acceptance of the JV structure for significant energy projects in the country.

The Local Agent or Distributor Model

For businesses not yet ready to commit to a full manufacturing facility, this model offers a lower-risk entry point. The foreign company appoints a local agent or distributor to import and sell its solar components. While this does not involve local manufacturing, it allows the foreign entity to test the market, build a brand presence, and establish a relationship that could later evolve into a more integrated partnership.

The Technical Service Agreement

Under this arrangement, a local entity owns the manufacturing facility, while the foreign company provides critical services under a long-term contract. These services can include factory planning, equipment sourcing and commissioning, staff training, quality control, and ongoing operational support.

This model reduces the foreign partner’s capital exposure while allowing them to generate revenue from their technical expertise. Experience from turnkey projects shows this can be an effective way to transfer knowledge and build local industrial capacity.

Key Considerations in Structuring Your Partnership Agreement

Once a suitable partner and model have been identified, the partnership agreement becomes the venture’s foundational document. It must be meticulously drafted to ensure clarity, manage expectations, and provide mechanisms for resolving disputes.

Legal and Regulatory Compliance

The agreement must comply with South Sudanese law. Engaging competent local legal counsel to draft and review all documentation is crucial. Key clauses that require careful definition include:

-

Ownership and Equity Stakes: A clear definition of the ownership percentage for each partner.

-

Profit and Loss Distribution: The formula and schedule for sharing financial outcomes.

-

Governance and Management: The structure of the board of directors, appointment of key management personnel, and decision-making authority.

-

Dispute Resolution: A pre-agreed mechanism (e.g., arbitration in a neutral jurisdiction) to handle disagreements efficiently.

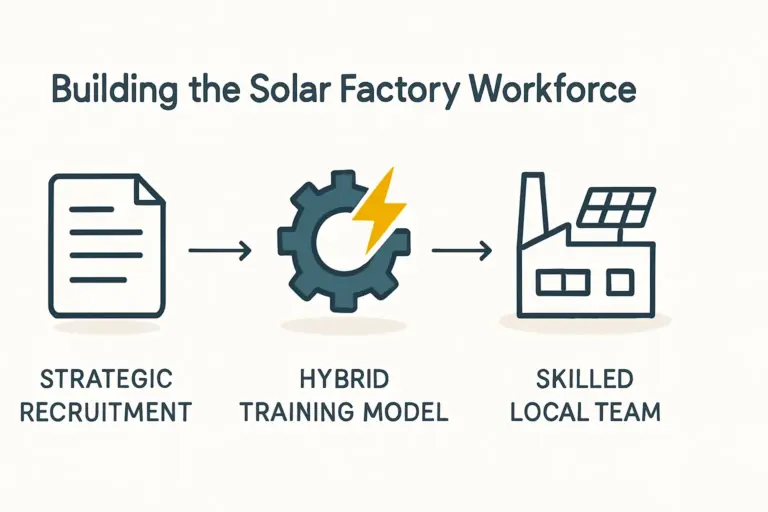

Defining Roles and Responsibilities

The agreement must explicitly detail each party’s contributions and ongoing responsibilities to prevent future misunderstandings. A clear division of labor leverages the core competencies of each partner.

The foreign partner’s role typically includes technology transfer, procuring specialized machinery, quality assurance protocols, and training the local workforce to international standards.

The local partner, in turn, usually handles securing land and building permits, managing government and community relations, navigating customs for imported equipment, and overseeing local staffing and logistics.

Aligning with National and International Stakeholders

A well-structured partnership can unlock access to financing from development finance institutions (DFIs). Organizations like the World Bank and the African Development Bank (AfDB) are actively funding renewable energy projects in South Sudan.

These institutions prioritize projects with strong local ownership, transparent governance, and a clear developmental impact, making a robust JV structure highly attractive for funding applications.

Frequently Asked Questions (FAQ)

What is the typical ownership split in a joint venture in South Sudan?

There is no fixed rule. While a preference for majority local ownership often exists, the final split is negotiable and depends on the respective contributions of capital, technology, and in-kind resources from each partner.

How long does it take to register a new company and begin operations?

The timeline can be unpredictable due to bureaucratic hurdles. Having an experienced and well-connected local partner is the single most important factor in navigating and potentially expediting this process, which can range from several months to over a year.

Are there specific government incentives for solar manufacturing?

The Investment Promotion Act of 2009 outlines a framework for investment incentives, but these are not always automatically applied. Specific incentives, such as tax holidays or duty-free import of machinery, often need to be negotiated directly with the relevant government ministries—another area where a local partner’s influence is critical.

How does the solar panel manufacturing cost in a frontier market compare to established markets?

Initial capital expenditure for setting up a factory may be higher due to logistics and supply chain challenges. However, operational costs can be competitive, and the high local cost of alternative energy (like diesel at over $0.40/kWh) creates a very favorable pricing environment for locally produced solar modules.

Conclusion and Next Steps

The opportunity to establish a solar manufacturing facility in South Sudan is significant, driven by an urgent need for reliable, affordable electricity. However, success depends not just on technology and financial planning but on a strategic, legally robust local partnership.

By carefully selecting a partner, choosing the right operational model, and drafting a comprehensive agreement, an entrepreneur can mitigate many risks associated with this frontier market. A successful joint venture does more than create a profitable business; it contributes to national development, builds local capacity, and provides a sustainable energy solution for a nation poised for growth.

For any serious investor, the next step is to develop a comprehensive business plan. This document is essential for detailed factory planning, equipment selection, and financial modeling, serving as the foundation for engaging potential partners and securing financing.