For an international entrepreneur, evaluating new markets involves balancing immense opportunity with perceived risk. Consider South Sudan: a nation with one of the lowest electricity access rates globally, yet possessing abundant solar irradiation.

The government’s goal of attracting foreign direct investment has yielded a compelling, and often overlooked, legal framework designed to mitigate financial risk and encourage industrial development.

This framework, the Investment Promotion Act of 2009, is a detailed blueprint offering specific financial incentives that can fundamentally alter the business case for establishing a solar module manufacturing facility. This article examines the Act’s key provisions, translating them into tangible financial benefits for prospective solar investors.

Understanding the Strategic Context: Why South Sudan?

To appreciate the significance of the Investment Promotion Act requires understanding the national context. South Sudan is actively working to diversify its economy and build foundational industries, and energy is central to this effort. The government has identified manufacturing, particularly in strategic sectors like renewable energy, as a priority for achieving sustainable economic growth.

The Investment Promotion Act of 2009 was enacted as the primary vehicle for attracting foreign capital and expertise. It establishes the South Sudan Investment Authority (SSIA) and provides a clear, legally-binding set of guarantees and incentives for investors who align with the nation’s development goals.

For an entrepreneur in the solar sector, this means a venture is not just a commercial enterprise but a strategic contribution to national development—a status reflected in the powerful incentives on offer.

Key Financial Incentives Under the Investment Promotion Act

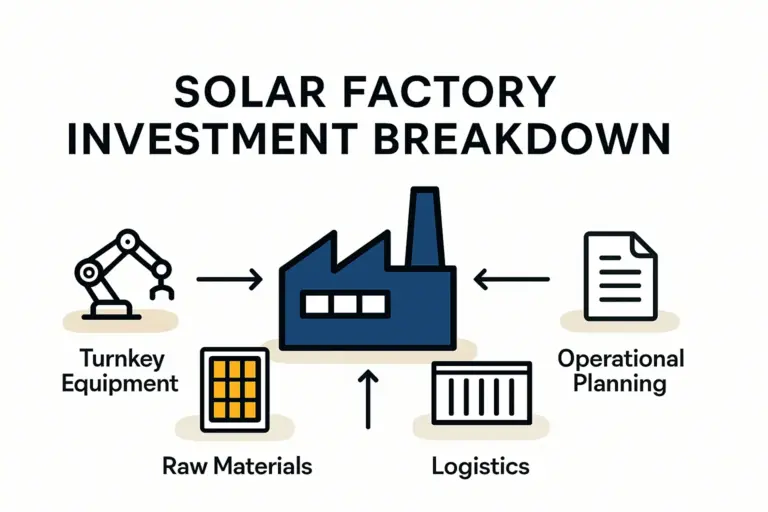

The Act outlines several financial tools designed to improve the viability of new industrial projects and reduce their initial financial burden. For a solar module factory, these benefits apply directly to the most capital-intensive phases of the business.

Tax Holidays and Concessions

Among the most significant incentives are the provisions for tax holidays. Approved investment projects, especially those in priority sectors like energy and manufacturing, may be granted a concession on profit tax for a period of five to ten years.

For a new solar manufacturing business, this incentive is crucial to early-stage financial health. The initial years of operation are typically focused on achieving profitability while managing debt service and reinvesting in operations. A multi-year exemption from profit tax allows the business to retain a much higher portion of its earnings, accelerating its path to a positive return on investment and strengthening its balance sheet.

Customs Duty Exemptions

The initial setup of a solar factory requires importing a substantial amount of machinery, equipment, and specialized raw materials. The Investment Promotion Act allows for customs duty exemptions on all capital equipment, machinery, and spare parts required for the approved project.

This provision directly reduces the initial capital outlay, specifically the solar panel manufacturing plant cost. By eliminating import taxes on essential hardware like laminators, stringers, and cell testers, the Act considerably lowers the barrier to entry, making the project more financially accessible and improving its capital efficiency from day one.

Capital Allowances and Depreciation

Beyond the initial tax holidays, the Act provides for generous capital allowances. This allows an investor to deduct the value of depreciating assets (such as machinery and buildings) from their taxable income over a specified period.

This mechanism allows a business to ‘write off’ the cost of its capital investments more quickly. This accounting practice reduces the taxable profit figure in the years following the tax holiday, effectively lowering the tax burden and improving post-tax cash flow—a critical tool for managing the financial lifecycle of a capital-intensive manufacturing asset.

Unrestricted Remittance of Profits

A primary concern for any foreign investor is the ability to repatriate capital and profits. The Act explicitly guarantees foreign investors the right to transfer profits, dividends, and principal and interest payments on foreign loans out of the country in a freely convertible currency.

This legal guarantee, administered through the Bank of South Sudan, provides essential security and addresses a key element of political and financial risk.

Navigating the Application Process

Securing these incentives requires a formal application and approval process managed by the South Sudan Investment Authority (SSIA). While requirements are specific to each project, the process generally follows a clear sequence:

-

Project Proposal: The investor submits a detailed project proposal. This document must be comprehensive, outlining the technical, financial, and operational aspects of the proposed solar factory. A well-structured business plan for solar panel manufacturing is the foundation of this step.

-

Application for Investment Certificate: A formal application is submitted to the SSIA. This includes the business plan, certificates of incorporation, and evidence of financial capacity.

-

Due Diligence and Review: The SSIA reviews the application to ensure it aligns with national development priorities and meets the criteria outlined in the Act.

-

Issuance of Investment Certificate: Upon approval, the SSIA issues an Investment Certificate. This legal document officially grants the project the incentives and protections specified under the Investment Promotion Act.

Practical Considerations for the Solar Entrepreneur

The incentives in the Investment Promotion Act are more than theoretical advantages—they have a direct, positive impact on the financial modeling of a solar manufacturing venture.

- Reduced Upfront Capital: Duty exemptions on machinery directly lower the initial investment required.

- Faster Path to Profitability: Tax holidays ensure that any profits generated in the critical early years are retained for reinvestment, growth, or debt reduction.

- Improved Long-Term Returns: Accelerated depreciation and capital allowances reduce the tax burden over the project’s lifespan, enhancing the overall return on investment.

- Mitigated Risk: Guarantees on profit repatriation provide a clear and secure exit strategy for capital, addressing a fundamental investor concern.

Based on experience from J.v.G. turnkey projects in emerging markets, leveraging such legal frameworks is a critical component of successful project planning. It transforms a standard business plan into one that is optimized for the local investment climate.

Frequently Asked Questions

What qualifies as a ‘priority sector’ under the Act?

Priority sectors are typically those that contribute to economic diversification, job creation, and infrastructure development. Energy, agriculture, physical infrastructure, and manufacturing are explicitly mentioned, and a solar module factory aligns perfectly with these goals.

Are these incentives guaranteed once an Investment Certificate is issued?

Yes, the Investment Certificate is a legally binding document. It represents a contract between the investor and the Government of South Sudan, guaranteeing the specified incentives for the duration of the project, provided the investor complies with the terms of the agreement and the laws of the country.

What are the primary risks of investing in South Sudan?

Like any frontier market, investing in South Sudan involves risks related to political stability, infrastructure gaps, and currency fluctuations. The Investment Promotion Act is specifically designed to mitigate the financial and regulatory aspects of these risks. A thorough feasibility study should include a comprehensive risk assessment and mitigation strategy.

How long does the approval process with the SSIA typically take?

While timelines can vary, the SSIA is mandated to facilitate investment. A complete and well-prepared application significantly expedites the process. Investors should plan for a multi-month process of engagement, due diligence, and final approval.

A Calculated Opportunity

Establishing a manufacturing facility in an emerging market requires careful analysis. South Sudan’s Investment Promotion Act of 2009 provides a strong, investor-friendly legal framework that significantly enhances the financial attractiveness of a solar manufacturing project.

By systematically reducing upfront costs, improving early-stage profitability, and guaranteeing capital mobility, the Act creates a calculated opportunity for visionary entrepreneurs. For those in the solar sector, it transforms South Sudan from a frontier market into a strategic investment destination with legally defined advantages.