An entrepreneur considering a solar module factory in Sri Lanka might focus first on production—the machines, the building, the staff. But the venture’s viability hinges on a more fundamental question: who will buy the finished solar modules? In Sri Lanka, the answer lies in the policies of the Ceylon Electricity Board (CEB), the state-run utility.

Understanding this regulatory framework isn’t just an academic exercise—it’s the foundation of a successful business case. This guide breaks down the key tariff structures driving local demand for solar panels, offering essential context for any investor evaluating the Sri Lankan market.

The Engine of Demand: Government Policy and the CEB

The main driver for rooftop solar adoption in Sri Lanka is the government’s ‘Soorya Bala Sangramaya’ (Battle for Solar Energy) program. Implemented by the CEB and the Lanka Electricity Company (LECO), this initiative encourages private investment in renewable energy from homeowners and businesses alike.

For a local module manufacturer, this program is the primary source of domestic demand. Its policies create the financial incentive for electricity consumers to install solar power systems, which in turn generates a market for locally produced modules. Success hinges on a clear understanding of the three main compensation schemes available to solar system owners.

Key Compensation Schemes Explained

The CEB offers three distinct models for compensating owners of rooftop solar systems. Each model appeals to a different type of customer, and its attractiveness depends on the specific tariff rates in effect.

1. Net Metering

The simplest of the three schemes, Net Metering allows a consumer to offset their electricity consumption with their solar generation.

How it Works: During the day, excess electricity generated by the solar panels is exported to the national grid and recorded as a credit. At night or during periods of low generation, the consumer draws power from the grid, depleting these credits.

Financial Implication: Consumers are only billed for their ‘net’ consumption—the difference between the electricity they imported from the grid and the electricity they exported. No cash payments are made for excess generation; credits are typically carried forward for a limited time.

Target Customer: This scheme is most attractive for consumers with high daytime electricity usage, as it directly reduces a major operational cost.

2. Net Accounting (Also known as Net Plus)

Net Accounting introduces a direct revenue component, transforming a solar system from a simple cost-saving device into an income-generating asset.

How it Works: As with Net Metering, consumers use their solar-generated electricity first. However, any excess energy exported to the grid is purchased by the utility (CEB/LECO) at a specified feed-in tariff, while consumers pay the standard retail rate for all electricity they import from the grid.

Financial Implication: The consumer receives a monthly payment for all surplus energy supplied to the grid. This creates a predictable revenue stream, making the initial investment in a solar system more financially appealing.

3. Net Plus Plus (Feed-in Tariff Model)

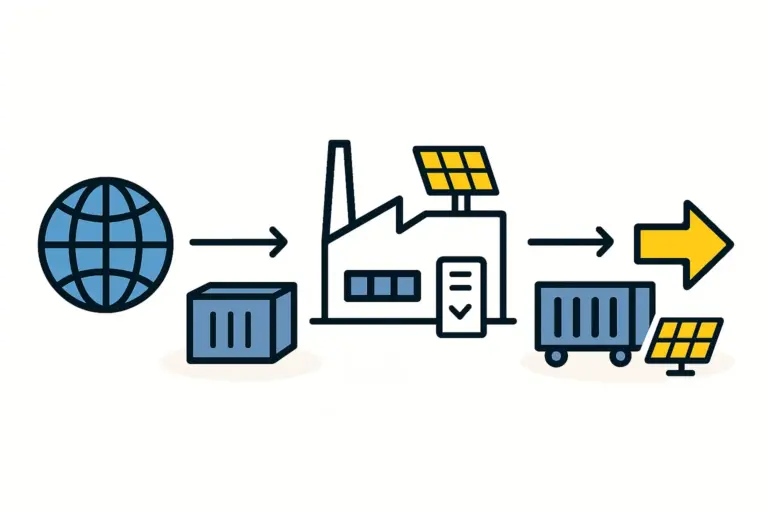

This model decouples electricity generation from consumption, positioning the solar system purely as an investment.

How it Works: All electricity generated by the solar system is sold directly to the grid at a contracted feed-in tariff. The property owner then buys all the electricity needed for their own operations from the utility at the standard rate.

Financial Implication: This provides the most straightforward investment case. The owner has a long-term contract (often 20 years) to sell power at a fixed rate, ensuring a stable and predictable return on investment.

How Tariffs Shape a Manufacturer’s Business Plan

The specific tariff rates offered under these schemes directly influence the type and volume of solar modules in demand. For a prospective manufacturer, analyzing these policies is critical to forecasting market size and profitability.

For example, a high and stable tariff under the Net Accounting or Net Plus Plus schemes encourages businesses to install the largest solar system possible to maximize their revenue, directly increasing demand for solar modules. Conversely, if tariffs are low or perceived as unstable, potential buyers may delay their investment, impacting a manufacturer’s sales pipeline.

Entrepreneurs entering this market often find that their customers’ projects are bankable only with a favorable CEB tariff. A stable, well-defined tariff structure is just as essential as securing the initial investment required for a solar factory. Experience from turnkey projects shows that a clear policy environment gives end-customers the confidence to invest, which in turn underpins the entire local supply chain.

Beyond the Tariffs: Practical Market Considerations

While the tariff structure is central, a manufacturer must also consider other local factors when planning an operation.

-

Grid Capacity: In some regions of Sri Lanka, the local grid has limited capacity to absorb new solar generation. This can create bottlenecks and delay project approvals, affecting demand in those areas and underscoring the need for a robust local sales and distribution strategy.

-

Policy Stability: Changes in government or regulatory priorities can lead to adjustments in tariff rates or program rules. Investors must monitor the policy landscape closely. A local manufacturing presence can sometimes offer an advantage by demonstrating long-term commitment to the market.

-

Quality and Certification: To be eligible for connection to the CEB grid and qualify for these tariffs, solar modules must meet specific international and local quality standards. For any new manufacturer, achieving the necessary approvals through the required solar module certification process is a critical and non-negotiable step.

Frequently Asked Questions

Do these policies apply to large-scale, ground-mounted solar farms?

These three schemes primarily target rooftop installations on residential, commercial, and industrial buildings. Large-scale solar farms are typically developed through a separate process, often involving competitive tenders issued by the government for Power Purchase Agreements (PPAs).

As a module manufacturer, do I interact directly with the CEB?

Generally, no. A manufacturer sells products to solar installation companies, project developers, or distributors. These are the partners who manage interconnection agreements and tariff applications with the CEB on behalf of the end-customer.

How often do the tariff rates change?

Tariff rates are subject to periodic review by the Public Utilities Commission of Sri Lanka (PUCSL) and the CEB. While a contract, once signed, typically fixes the rate for its duration (e.g., 20 years), the rate offered to new projects can change. This makes timing and policy awareness crucial.

Conclusion: A Market Defined by Policy

The domestic market for solar modules in Sri Lanka is not driven by consumer choice alone but is actively shaped and incentivized by government policy. The CEB’s tariff structures create the financial case for homeowners and businesses to invest in solar, which in turn generates the demand a local manufacturer serves.

For an entrepreneur planning to enter this market, a thorough feasibility study that includes deep regulatory analysis is fundamental. Understanding these policies allows an investor to forecast demand, identify the most promising customer segments, and build a resilient business model tailored to the realities of the Sri Lankan energy sector. Resources like the structured e-courses at pvknowhow.com can provide a comprehensive foundation for this critical planning phase.