Entrepreneurs scouting a new venture often look for a confluence of opportunity: favorable government policies, a strategic geographic location, and growing market demand. Suriname, a CARICOM member and a gateway to both Caribbean and South American markets, presents a compelling opportunity for solar module manufacturing.

The success of such an enterprise, however, rests not on market access alone, but on a robust and cost-effective supply chain. For any business professional entering this industry, sourcing raw materials—from solar glass to aluminum frames—is one of the first and most critical hurdles.

This guide explores the two primary strategies for a factory in Suriname: leveraging regional suppliers versus integrating into established global logistics chains. Understanding these trade-offs is essential for building a resilient and profitable operation.

The Strategic Importance of Raw Material Sourcing

A solar module is assembled from several key components. The ability to consistently and promptly procure these materials at a competitive price dictates production uptime, final module cost, and overall quality. A failure in just one part of the supply chain can halt the entire production line, leading to significant financial consequences.

The primary materials required for standard solar module assembly include:

- High-transmission, tempered solar glass

- Aluminum frames

- EVA (Ethylene Vinyl Acetate) encapsulant films

- Polymer backsheets

- Solar cells

- Junction boxes with diodes and cables

The sourcing strategy for these items will directly influence the investment requirements for a 20-50 MW solar factory and is a cornerstone of any bankable business plan.

The Two Primary Sourcing Models for a Suriname Factory

An investor in Suriname must weigh the logistical and financial implications of two distinct approaches to the supply chain. Each model presents unique advantages and challenges that must align with the business’s long-term objectives.

Model 1: The Regional Approach – Leveraging CARICOM and South America

This strategy prioritizes sourcing materials from countries within the Caribbean Community (CARICOM) and neighboring South American nations like Brazil or Colombia. The primary appeal is geographic proximity and potential trade advantages.

Potential Advantages:

- Reduced Lead Times: Shipping from Trinidad and Tobago or Brazil can take days or weeks, compared to the month-plus transit times from Asia. This allows for more agile inventory management.

- Lower Freight Costs: For bulky and heavy materials like glass and aluminum frames, shorter shipping distances can result in substantial savings on logistics.

- Trade Agreement Benefits: Sourcing from CARICOM member states may provide preferential tariff treatment under the Caribbean Single Market and Economy (CSME), reducing import duties on certain goods.

- Simplified Communication: Operating within similar time zones and regional business cultures can facilitate smoother negotiations and supplier management.

Significant Challenges:

- Limited Supplier Base: The biggest challenge is the availability of specialized, high-quality solar components. While aluminum extruders and glass manufacturers may exist regionally, finding suppliers that produce to the precise specifications required for solar modules (e.g., solar-grade, low-iron patterned glass) can be difficult.

- Higher Unit Costs: Regional suppliers may not have the vast economies of scale seen in major Asian manufacturing hubs. This can lead to a higher price per unit for components like EVA, backsheets, and especially solar cells.

- Quality and Certification Hurdles: Established global suppliers have years of experience and a portfolio of international certifications (e.g., IEC, UL). Vetting and ensuring consistent quality from newer or less specialized regional suppliers requires a rigorous incoming quality control process.

Experience from J.v.G. turnkey projects shows that a common challenge for new manufacturers is underestimating the technical specifications of seemingly simple components. An aluminum frame for a solar panel, for instance, requires specific alloys and anodization thickness to withstand decades of environmental exposure.

Model 2: The Global Approach – Tapping into Established Supply Chains

This model—the conventional approach for most solar manufacturers worldwide—involves sourcing components from established, high-volume manufacturing centers, predominantly in China, Southeast Asia, and Europe.

Potential Advantages:

- Economies of Scale: Access to the world’s largest and most efficient suppliers results in highly competitive unit costs, particularly for solar cells and glass.

- Vast Supplier Choice: An investor can choose from dozens of vetted, certified suppliers for every component, creating competition that drives down prices and enhances negotiation power.

- Proven Quality and Reliability: Major global suppliers have well-established quality management systems, and their products are used by leading module brands, offering a high degree of confidence.

Significant Challenges:

- Extended Lead Times: Ocean freight from Asia to Paramaribo, Suriname’s main port, can take 45 to 60 days. This necessitates holding a larger, more expensive inventory buffer to avoid production stoppages.

- Complex Logistics: Managing international shipping, customs clearance in Suriname, and potential port congestion requires dedicated logistics expertise. Any disruption, from global shipping crises to local administrative delays, can have an outsized impact.

- Currency and Geopolitical Risks: Transactions are typically conducted in US dollars or euros, exposing the business to currency fluctuations. Reliance on a single geographic region for critical supplies also creates vulnerability to geopolitical tensions or trade policy shifts.

A Hybrid Strategy: The Balanced Approach for Optimal Performance

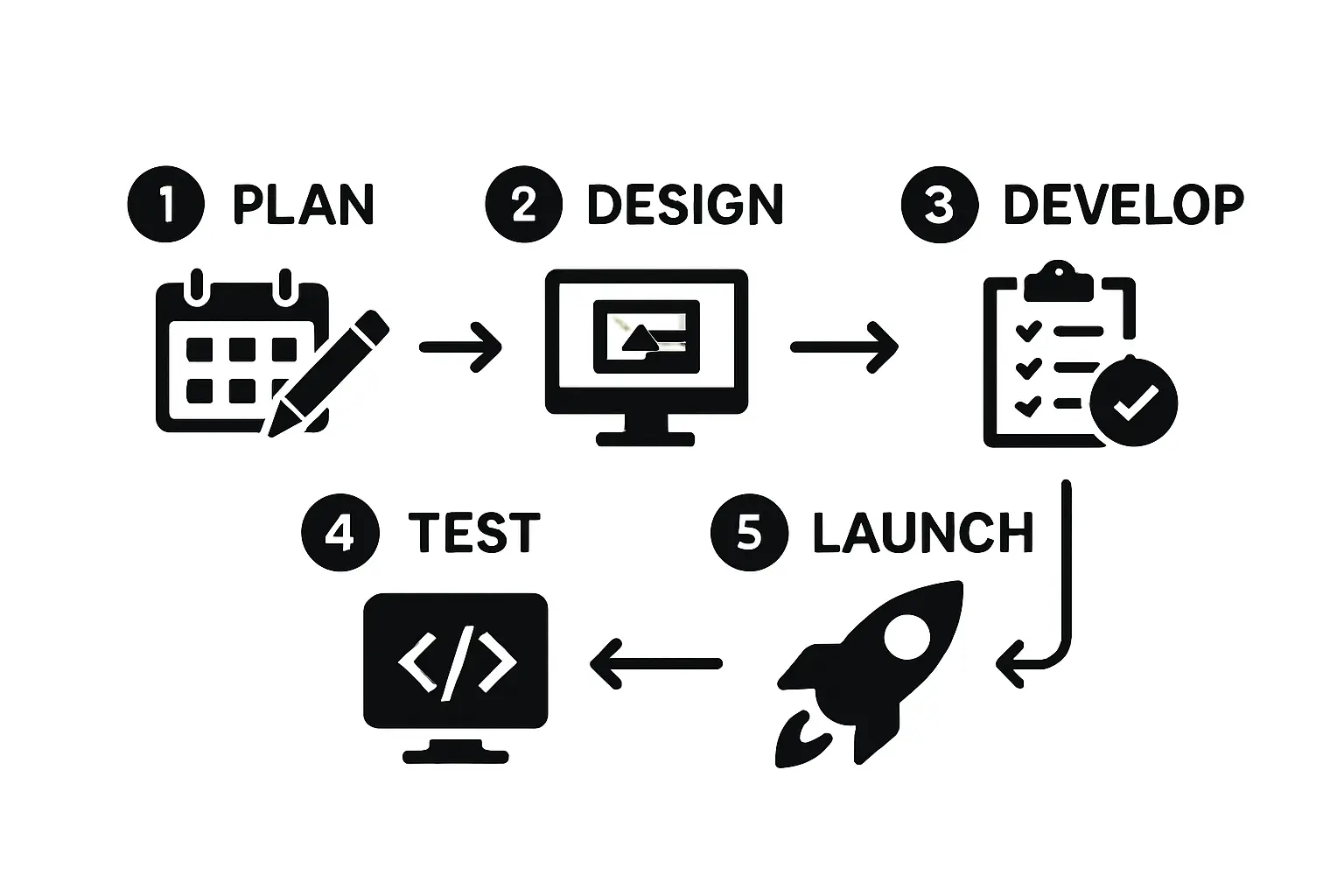

For a solar factory in Suriname, the most resilient and economically sound strategy is rarely a purely regional or global one, but rather a carefully constructed hybrid. This approach aims to capture the benefits of both models while mitigating their respective weaknesses.

A typical hybrid model could look like this:

- Globally Sourced Core Technology: High-tech and price-sensitive components like solar cells, specialized solar glass, and encapsulants are sourced from top-tier international suppliers to ensure quality and cost-competitiveness.

- Regionally Sourced Bulk Materials: Heavier, more standardized materials are sourced from the nearest competent supplier. This could include aluminum frames from an extruder in Brazil or Trinidad and packaging materials (cardboard, wooden pallets) from local or regional sources to minimize freight costs.

While this balanced approach requires a more sophisticated procurement strategy, it provides a powerful competitive advantage. It secures the most critical, high-value components from the world’s best sources while leveraging regional proximity to reduce costs on bulk items. This is a key element in designing an efficient solar module factory layout and operational plan.

Frequently Asked Questions (FAQ)

-

Are there any local suppliers for solar components within Suriname?

Suriname’s domestic industrial base for specialized solar components is still developing. While basic materials like sand for glass or bauxite for aluminum exist, the processing facilities to create solar-grade products are generally not established. The focus should be on regional (CARICOM, South America) or global suppliers. -

How do CARICOM trade agreements affect import duties for solar materials?

Goods originating from a CARICOM member state may qualify for duty-free entry into Suriname. However, strict ‘rules of origin’ apply, meaning the product must be wholly produced or have undergone substantial transformation within the region. An investor must verify that a potential supplier’s product meets these criteria to benefit from the tariff reduction. -

What is a typical lead time for materials from China to Suriname?

Including production time (2–4 weeks) and ocean freight (6–8 weeks), a business should plan for a total lead time of 8 to 12 weeks from placing an order to receiving the goods. This timeframe underscores the need for careful planning and sufficient working capital to manage inventory. -

How much buffer inventory should a factory in Suriname hold?

For globally sourced materials with long lead times, maintaining a buffer stock of 2 to 3 months’ worth of production is a prudent measure to ensure operational continuity. For regionally sourced items with shorter lead times, a 1-month buffer may be sufficient.

Conclusion and Next Steps

Establishing a solar module factory in Suriname is a viable and strategic venture, but its success hinges on a well-designed supply chain. A purely regional strategy may face quality and availability constraints, while a purely global one introduces significant logistical risks and capital requirements for inventory.

The optimal path, therefore, is a hybrid strategy that leverages global economies of scale for core components and regional proximity for bulk materials. This nuanced approach balances cost, quality, and operational resilience.

Developing this detailed logistics and procurement plan is a fundamental part of creating a business plan that will attract investment and ensure long-term viability. For entrepreneurs beginning this journey, understanding these foundational concepts is the first step. The structured modules within the pvknowhow.com e-course offer a comprehensive framework to guide this critical planning stage.