While the global solar industry is often defined by massive factories producing millions of standardized panels, a significant and growing opportunity exists in specialized manufacturing. For entrepreneurs and investors exploring solar manufacturing, competing on volume with established giants is a daunting prospect. A more strategic approach is to identify and serve niche markets that demand tailored, high-value products.

This article explores two such powerful niches: Building-Integrated Photovoltaics (BIPV) and Alpine Solar modules. Understanding the distinct business case and technical requirements for each reveals a viable path to establishing a profitable, defensible position in the solar manufacturing landscape.

Beyond Standard Production: Defining Niche Solar Markets

The vast majority of solar modules are designed for utility-scale solar farms or standard residential rooftops. This is a commodity market, where success is driven by economies of scale and incremental cost reductions.

Specialized production, by contrast, focuses on creating products for specific applications where standard modules are unsuitable. This strategy shifts the competitive focus from price per watt to value per project, allowing for higher margins and stronger customer relationships. Success here isn’t about being the biggest, but about being the best solution for a particular problem.

Opportunity 1: Building-Integrated Photovoltaics (BIPV)

Building-Integrated Photovoltaics represent a fundamental shift in how we view solar technology—from an addition on a building to an integral part of it.

What is BIPV?

BIPV products are multifunctional, serving as part of the building envelope (such as the roof, facade, or windows) while also generating electricity. Instead of mounting separate solar panels onto a roof, a BIPV solution might be the roof itself—composed of solar tiles—or a glass facade with semi-transparent solar windows.

This integration offers superior aesthetics, transforming passive building surfaces into active energy generators.

The Market Drivers for BIPV

The business case for BIPV is compelling and supported by powerful market trends. Research indicates the global BIPV market was valued at USD 19.82 billion in 2022 and is projected to expand to USD 108.38 billion by 2032, growing at a compound annual growth rate (CAGR) of 18.5%.

Several factors are fueling this growth:

-

Government Regulations: Policies like the European Union’s Energy Performance of Buildings Directive (EPBD) mandate that new buildings be nearly zero-emission, creating regulatory demand for solutions like BIPV.

-

Architectural Appeal: Architects and property developers increasingly specify BIPV for its seamless, modern aesthetic, which avoids the visual disruption of conventional panels.

-

Urban Land Constraints: In dense urban environments, large areas for solar farms are unavailable. BIPV utilizes the vast surface area of buildings, turning skyscrapers and commercial centers into power plants.

Manufacturing Considerations for BIPV

Producing BIPV modules is fundamentally different from standard manufacturing, requiring a focus on customization over mass production. Key considerations include:

-

Flexibility: The production line must handle various sizes, shapes, colors, and levels of transparency.

-

Materials: BIPV may use specialized colored glass, unique encapsulants, or different structural backings to meet building codes and design specifications.

-

Integration: The final product must meet the standards of both the electronics and construction industries, demanding a deep understanding of building material properties.

The manufacturing process must be adapted to accommodate these custom requirements, which calls for a higher level of engineering and quality control.

Opportunity 2: Alpine Solar Modules

High-altitude environments present both a unique challenge and a remarkable opportunity for solar energy. Modules designed for these conditions, often called Alpine Solar modules, are engineered to thrive where standard panels would falter.

What are Alpine Solar Modules?

These highly durable solar modules are designed to withstand the harsh conditions of mountainous regions: heavy snow loads, high winds, and extreme temperature fluctuations. Built for resilience, they are optimized for the unique atmospheric conditions found at high altitudes.

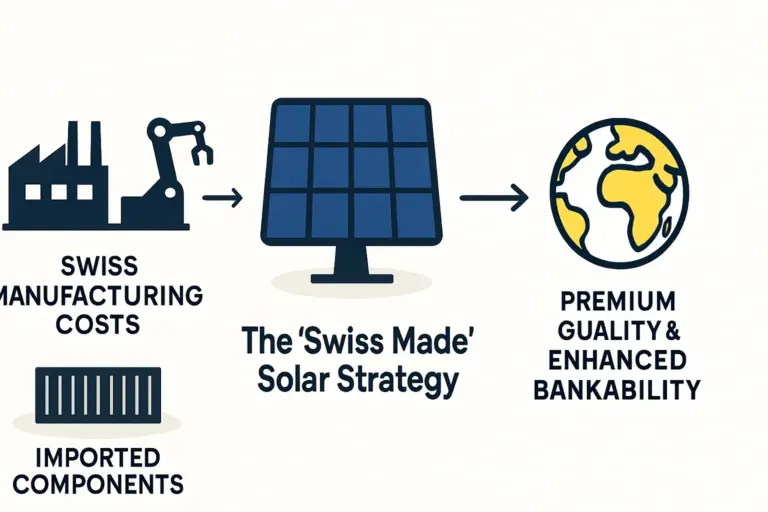

The Business Case for Alpine Solar

The rationale for Alpine Solar is rooted in physics and regional energy strategies. Countries like Switzerland, with ambitious renewable energy goals (aiming for 34 TWh from solar by 2050), are investing heavily in high-altitude solar projects.

The advantages are significant:

-

Higher Irradiance: High altitudes have less atmospheric haze and cloud cover, resulting in stronger, more consistent sunlight.

-

The Albedo Effect: Snow-covered ground reflects sunlight—a phenomenon known as the albedo effect. This reflected light can be captured by the rear side of bifacial solar panels, boosting their energy yield by up to 30% in winter months when energy demand is highest.

-

Temperature Efficiency: Solar panels operate more efficiently in cold temperatures. The consistently low temperatures at high altitudes lead to higher power output compared to the same panels in a hotter climate.

Manufacturing Considerations for Alpine Modules

Manufacturing modules for alpine deployment requires a focus on durability and performance optimization.

-

Mechanical Strength: The modules must be certified to withstand extreme mechanical loads, often exceeding 5400 Pa, to handle the weight of heavy snowpack. This typically requires thicker glass and reinforced frames.

-

Bifacial Technology: The use of bifacial cells is essential to capitalize on the albedo effect.

-

Durability: All components, from the junction box to the cables and connectors, must be rated for extreme cold and high UV exposure.

From Standard to Specialized: What Changes in the Factory?

Transitioning from a concept to a functional factory for specialized modules involves a strategic shift in mindset and equipment. While the core lamination and testing principles remain, the emphasis moves from high throughput to high flexibility.

A manufacturer might need a more adaptable stringer machine that can handle different cell sizes or a laminator that can accommodate non-standard module dimensions. The overall cost of a solar panel manufacturing plant may not be drastically different from a small-scale standard line, but the investment is geared toward value-add capabilities rather than pure volume.

Based on experience from J.v.G. Technology GmbH turnkey projects, a successful specialized production line must be designed for versatility from day one. This allows the business to pivot between different custom products as market demands evolve.

Frequently Asked Questions (FAQ)

Is the market for specialized modules large enough for a new business?

Yes. While smaller than the commodity market, niche segments like BIPV are growing at a much faster rate. They offer an opportunity for new entrants to establish a strong brand based on quality and innovation, rather than competing on price with large-scale producers.

Are the manufacturing equipment requirements completely different?

Not completely, but modifications are necessary. A factory will still require core equipment like a stringer, lay-up station, laminator, and tester. However, these machines must be selected for their flexibility in handling different materials, sizes, and cell technologies, rather than for maximum speed with a single product type.

Do BIPV and Alpine modules require special certifications?

Absolutely. In addition to standard solar certifications (like IEC 61215 and IEC 61730), BIPV modules must often comply with local building codes related to fire safety, structural integrity, and weatherproofing. Alpine modules require certification for high mechanical loads (snow and wind) and must demonstrate performance in specific environmental conditions.

Can a single factory produce both standard and specialized modules?

While possible, it requires careful planning. A flexible production line could theoretically produce a standard module one day and a custom BIPV panel the next, but this demands excellent process control and supply chain management. Most specialized producers focus entirely on their niche to optimize for quality and efficiency within that segment.

Conclusion: Finding Your Niche in a Global Market

For the discerning entrepreneur, the path to success in solar manufacturing may not lie in chasing volume but in creating value. Specialized products like BIPV and Alpine Solar modules represent clear, growing markets where technical excellence, customization, and a deep understanding of customer needs are the keys to success.

These niches offer a strategic entry point to the industry, allowing a new business to build a defensible market position insulated from the price pressures of the commodity panel market. For those ready to explore this path, gaining a foundational understanding of the manufacturing process is the critical first step. Learning how to start a solar panel manufacturing business provides the framework needed to turn a specialized vision into a commercial reality.