At first glance, the idea of establishing a solar module factory in a high-cost country like Switzerland may seem counterintuitive. With some of the highest labor and energy costs in the world, the operational hurdles appear significant.

However, a deeper analysis reveals a compelling opportunity forged by a unique combination of national policy, brand prestige, and a market that values quality over cost. The key to unlocking this potential lies not in competing with mass-market producers, but in developing a sophisticated financial model that turns perceived disadvantages into strategic strengths.

A successful venture in this environment hinges on a business plan that meticulously balances high expenditures with premium revenue streams. It requires a shift in perspective—from a focus on cost-per-watt to an emphasis on long-term value, reliability, and the power of a trusted national brand.

Understanding the Swiss Solar Manufacturing Landscape

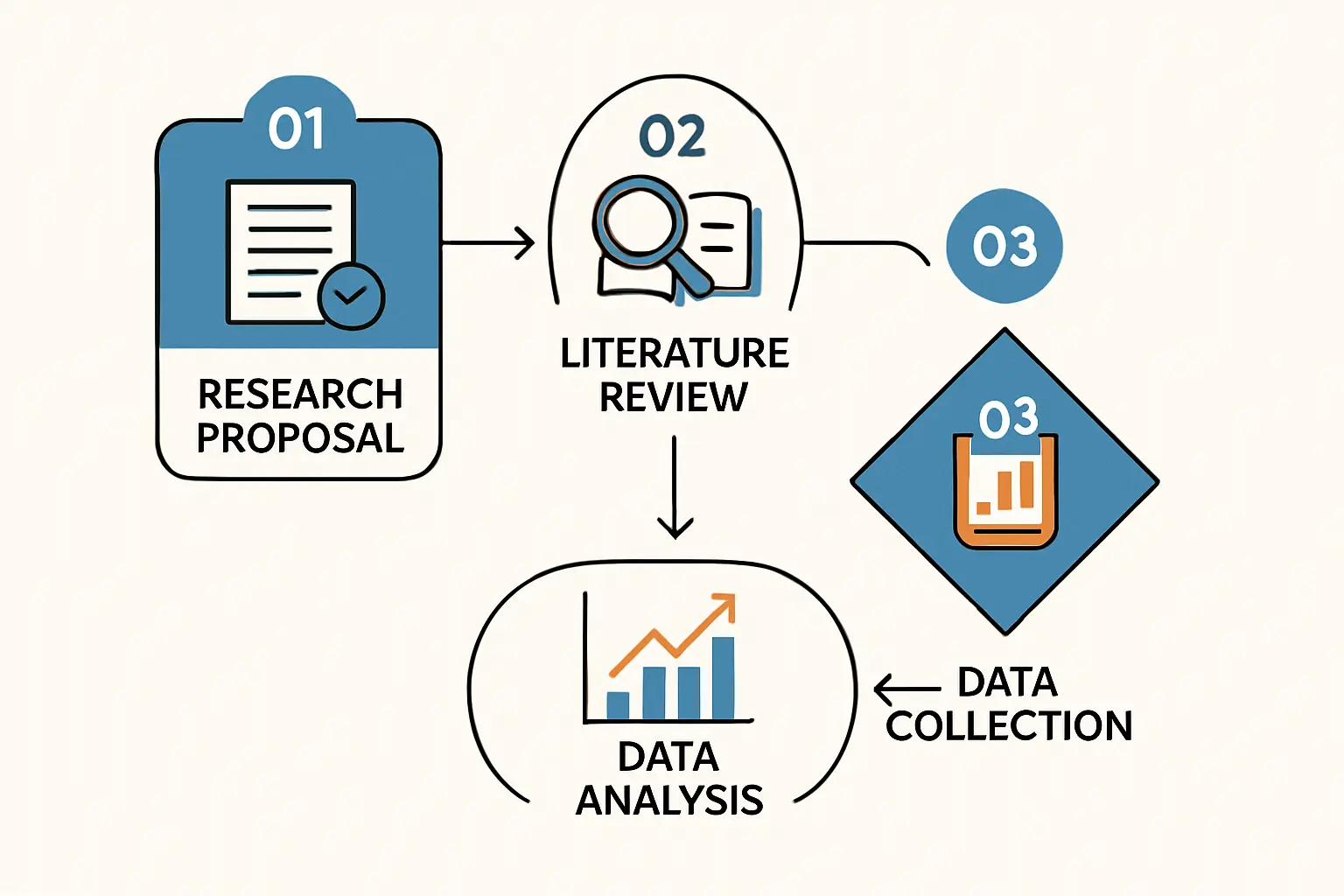

The foundation for this opportunity is Switzerland’s ambitious Energy Strategy 2050. The policy targets an increase in solar energy production to 34 TWh by 2050, a dramatic rise from the approximate 4.7 TWh generated today. This government-backed goal ensures substantial, long-term domestic demand for photovoltaic installations.

Any financial projection, however, must contend with two core realities:

-

High Operational Costs: Swiss manufacturing wages average between CHF 70,000 and CHF 90,000 annually. Industrial electricity prices are also among Europe’s highest, often ranging from €0.25 to €0.30 per kWh. These factors drive up the cost of producing each solar module.

-

The ‘Swiss Made’ Premium: The ‘Swiss Made’ label is globally recognized as a benchmark for quality, precision, and reliability. In the solar industry, this translates into a significant price premium, with modules often commanding prices 15-25% higher than their standard international counterparts. This brand equity is the primary lever for profitability.

The challenge, therefore, is not to ignore the high costs, but to build a model where the premium revenue more than compensates for them.

Key Components of a Viable Financial Model

A realistic financial forecast for a Swiss solar factory must be built on a detailed analysis of two opposing forces: high expenses and premium income.

Analyzing High Operational Expenditures (OPEX)

The success of the entire project hinges on managing costs without compromising the quality that justifies the premium price. The primary drivers of operational expenditures (OPEX) are labor, energy, and facilities.

Labor Costs and the Automation Imperative:

With high average salaries, minimizing the number of employees per megawatt (MW) of output is essential. The solution lies in a high degree of automation. While a conventional 500 MW factory in a lower-cost region might employ over 200 people, a state-of-the-art, highly automated Swiss facility could achieve the same output with a workforce of 100-120. The financial model must prioritize capital investment in automation to reduce long-term labor liabilities.

Energy Costs:

High electricity prices directly impact the cost of goods sold. A robust financial model must account for strategies to mitigate this, such as installing a large-scale solar PV system on the factory roof to generate its own power. This not only reduces costs but also reinforces the company’s commitment to sustainability—a key selling point for the ‘Swiss Made’ brand.

Land and Facility Costs:

Real estate and construction costs in Switzerland are also substantial. The model must account for these initial capital expenditures and their long-term depreciation, factoring them into the final module price.

Projecting Revenue Streams and Profitability

With a clear picture of the costs, the focus shifts to the revenue model, which is built almost entirely on the ‘Swiss Made’ value proposition.

Premium Pricing Strategy:

The model must be built around the 15-25% price premium. The target customer is not someone seeking the lowest possible price, but one who prioritizes performance, longevity, a low carbon footprint during manufacturing, and supply chain security. This includes residential, commercial, and agricultural clients who view their solar installation as a long-term asset.

Target Market Identification:

Revenue projections should be based on specific market segments. Key areas include public tenders, where government incentives and local content requirements can favor domestic producers, and architectural or BIPV (Building-Integrated Photovoltaics) projects, where aesthetic and quality standards justify a higher price point.

Leveraging Government Support:

Swiss energy policy, such as investment grants for large-scale PV, creates a stable domestic market. The financial model should factor in demand driven by these ongoing programs, which provide a reliable revenue base.

Building a Viable Business Case: A Scenario Analysis

To illustrate the balance, consider a hypothetical 200 MW factory. The financial model would project the higher initial investment for a turnkey solar module manufacturing line with advanced automation. It would then calculate the cost-per-watt produced, factoring in the high Swiss OPEX.

Simultaneously, the revenue side would model the selling price-per-watt, incorporating the established ‘Swiss Made’ premium. Profitability hinges on the comparison of these two figures. While the cost per watt will inevitably be higher than that of Asian competitors, the premium selling price is designed to create a healthy margin.

The business case holds up if the projected profit margin, multiplied by the annual production capacity, is sufficient to service debt, cover ongoing costs, and provide a return on investment within a reasonable timeframe (e.g., 5-7 years). Experience from J.v.G. turnkey projects shows that this level of detailed, data-driven forecasting is the most critical step in securing financing and ensuring long-term viability.

Frequently Asked Questions (FAQ)

Is it truly profitable to manufacture solar modules in a high-wage country like Switzerland?

Yes, provided the business model is strategically focused on the premium market segment. Profitability isn’t achieved by competing on cost but by leveraging the ‘Swiss Made’ brand, superior quality, high-efficiency technology, and advanced automation to justify a higher price point.

How much automation is required for such a factory?

A very high degree of automation is non-negotiable. The operational strategy must maximize output per employee. Modern production lines are designed for this, integrating robotics and process controls to run efficiently with a smaller, highly-skilled workforce.

What is the typical payback period for this type of investment?

The payback period can vary based on factors like the initial capital investment, the exact premium achieved on module sales, and operational efficiency. However, a well-structured project with a solid offtake strategy can realistically target a payback period of 5 to 7 years. A comprehensive business plan for your solar factory is essential to accurately forecast this.

Can a Swiss factory compete with large-scale Asian manufacturers?

It competes, but not on the same terms. The competition isn’t based on price. Instead, it’s based on a different set of values: superior product quality, a lower manufacturing carbon footprint, supply chain transparency and security, and the powerful ‘Swiss Made’ brand identity. The target customer is one who understands and is willing to pay for these advantages.

Conclusion: The Path Forward

Establishing a solar module factory in Switzerland is a venture built on strategic differentiation. This approach acknowledges that in certain markets, value propositions like quality, reliability, and local production can create more sustainable business models than a relentless focus on cost reduction.

Success requires meticulous financial modeling that embraces the high-cost environment and builds a revenue strategy around it. By investing in automation to manage labor costs and leveraging the immense brand power of ‘Swiss Made,’ a solar factory can not only be viable but can thrive by serving a growing market segment that looks beyond the price tag to the long-term value of its investment. Careful planning, backed by expert analysis, is the first and most critical step on this path.