For a business owner in Damascus or Aleppo, the sound of a diesel generator is the sound of survival—and of high operational costs, uncertain fuel availability, and constant maintenance. When the public grid offers only a few hours of electricity per day, this dependency becomes a critical vulnerability.

Yet this daily challenge also holds a significant and untapped business opportunity: local solar module manufacturing. A severe deficit defines Syria’s energy landscape. With a national grid operating at less than 50% of its pre-2011 capacity, the gap between available power (estimated at 2-2.5 GW) and peak demand (5-7 GW) forces industries, businesses, and households to seek alternative solutions. This article examines the compelling business case for establishing local solar module production in Syria to meet this urgent and growing demand.

Understanding Syria’s Acute Energy Deficit

The current state of Syria’s power infrastructure is the primary driver of the solar market. Years of conflict have left the national grid heavily damaged, resulting in chronic power outages that can last for more than 18-20 hours a day in many areas. The result is a parallel energy economy reliant on private diesel generators.

However, this solution is economically unsustainable. Fluctuating fuel prices, frequent shortages, and the logistical challenges of supply chains make diesel an expensive and unreliable power source.

For a factory owner, a farmer relying on irrigation pumps, or a hospital needing uninterrupted power, this volatility poses a direct threat to their operations and viability. This environment creates a clear and pressing need for a stable, cost-effective, and independent energy source.

Why Solar is the Logical Path Forward

Syria is blessed with some of the world’s most favorable conditions for solar power generation. With an average solar irradiation of approximately 5.5 kWh per square meter per day, the country has a vast, untapped natural resource that directly addresses its energy shortfall.

Recognizing this potential, the Syrian government has actively encouraged private investment in renewable energy. Official policy aims to add 2.5 GW of solar capacity by 2030, supported by incentives such as customs duty exemptions and tax breaks for renewable energy equipment. This government support offers a stable foundation for investors considering the market.

For an entrepreneur, the transition from expensive diesel to solar represents a clear value proposition. Solar offers long-term energy security with predictable costs, a stark contrast to the volatile diesel market.

The Strategic Advantage of Local Manufacturing

While importing solar modules is an option, establishing local production offers distinct competitive advantages, especially in the Syrian context. An effective solar module manufacturing business plan will highlight these key differentiators.

Customization for Local Conditions

Syria’s environment, characterized by high temperatures and dust, puts specific demands on solar module durability. A local manufacturer can design and produce panels optimized for these conditions, incorporating features like robust frames and specialized coatings. This focus on market-specific product quality can build a strong brand reputation and customer trust.

Reduced Reliance on Imports

Importing finished goods into Syria can be complex, involving logistical hurdles, currency fluctuations, and potential supply chain disruptions. Local assembly reduces these risks significantly. By importing raw materials and manufacturing the finished product in-country, a business can achieve greater control over its inventory, reduce lead times, and mitigate the impact of international shipping costs.

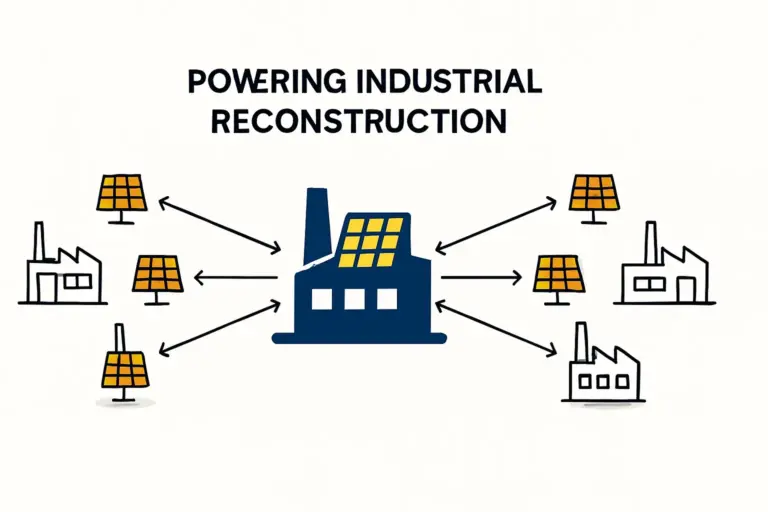

Economic and Social Impact

A local manufacturing facility contributes directly to the national economy by creating skilled jobs, fostering technical expertise, and supporting a domestic industrial base. For institutional investors or state-affiliated actors, this aspect is often as important as the financial return, making the enterprise a key contributor to national reconstruction and development.

Identifying Key Customer Segments

The demand for reliable power in Syria is universal, but it can be segmented into three primary markets, each with distinct needs.

1. Commercial and Industrial (C&I)

This segment includes factories, agricultural operations, workshops, and other commercial enterprises. For these businesses, energy is a primary production cost. Power outages mean lost revenue and idle machinery. They are the prime candidates for larger-scale hybrid solar systems that can power their operations during the day and charge batteries for nighttime or grid-outage use. A local producer can provide the customized solutions and technical support this sector requires.

2. Residential

Syrian households need electricity for fundamental needs like lighting, refrigeration, communication, and water pumping. Small-scale off-grid solar systems (1-5 kW) have become an essential household utility. The demand in this segment is for affordable, reliable, and easy-to-install solutions. A local factory can cater to this high-volume market with standardized, cost-effective modules.

3. Public and Critical Services

Hospitals, schools, water treatment facilities, and telecommunication towers require an uninterruptible power supply. Solar, combined with battery storage, offers the most reliable solution for ensuring these vital services remain operational. Contracts to supply these institutions can provide a stable revenue stream for a new manufacturing venture.

Navigating the Challenges with a Structured Approach

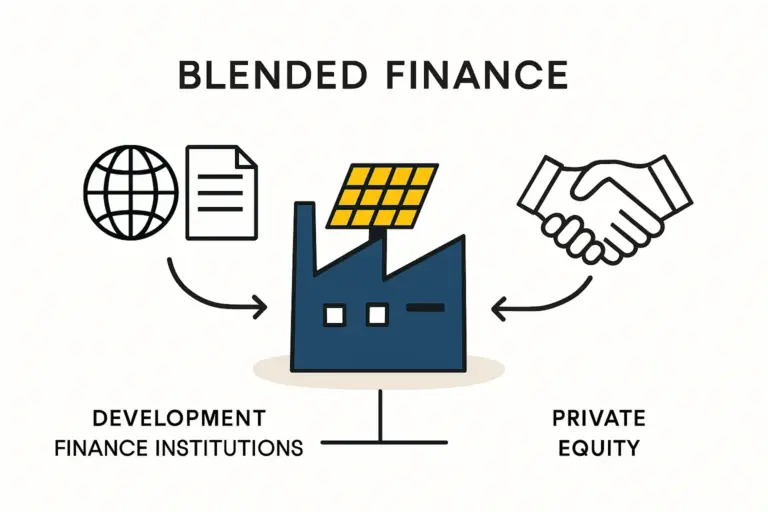

Establishing a manufacturing facility in any market presents challenges, and Syria has its unique complexities. Economic instability, international sanctions, and access to foreign currency for raw material procurement require careful planning. Building a skilled workforce and implementing rigorous quality control in solar panel manufacturing are also essential to compete with established international brands.

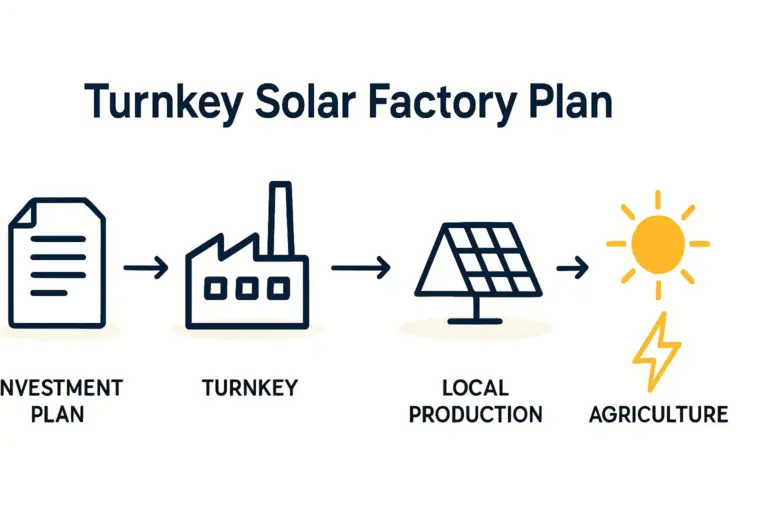

However, these are manageable obstacles. Entrepreneurs entering this field often find that the primary challenge is not the technology itself, but navigating the initial business planning. A structured approach, often starting with a semi-automated or turnkey solar production line, enables a new enterprise to become operational relatively quickly and scale up as the market matures.

The initial investment required can be optimized by focusing on an appropriate starting capacity, such as 20-50 MW, to serve immediate local demand. Based on experience from J.v.G. Technology GmbH turnkey projects in similar emerging markets, a phased approach allows investors to de-risk their entry while building operational expertise.

Frequently Asked Questions

What is the difference between an off-grid and a hybrid solar system?

An off-grid system operates completely independently of the public electricity grid, storing excess energy in batteries for use when the sun is not shining. A hybrid system is connected to the grid; it can use solar power, draw from the grid when needed, and send excess power to charge batteries. Given Syria’s unstable grid, both off-grid and hybrid systems are in high demand.

How much space is needed for a small-scale solar module factory?

A starter production line with an annual capacity of 20-50 MW typically requires a building of approximately 1,500 to 2,500 square meters. This space accommodates the assembly line, raw material storage, and finished goods warehousing.

Can locally produced modules compete on quality with imported ones?

Absolutely. Quality is a function of the raw materials used, the precision of the manufacturing equipment, and the strictness of the quality control processes. By sourcing certified materials and implementing international production standards, a local factory can produce modules that meet or exceed the quality of many imported brands.

What kind of skills are needed to operate a module assembly line?

A modern, semi-automated assembly line is designed for straightforward operation. A small team of 20-30 employees can manage a full production shift. Core roles include line operators, quality control technicians, and maintenance staff. Technical training is typically provided by the equipment supplier.

A Strategic Opportunity for Visionary Entrepreneurs

The Syrian energy crisis, born from necessity, has created a clear and defined market for solar power. For the discerning investor, this is more than just a commercial opportunity; it is a chance to build a foundational enterprise addressing one of the country’s most critical needs.

Local solar module production offers customers a path to energy independence and entrepreneurs a resilient business model. By focusing on quality, understanding local market needs, and adopting a structured approach to entry, entrepreneurs can establish a profitable and impactful business that will play a vital role in powering Syria’s future.